Market Volatility

International

There’s more innovation happening in Europe than meets the eye. One indication is the rising amount of venture capital flowing to the region and IPOs in e-commerce and online-related services. We’ll highlight these and other trends in our September 30 webinar, in which portfolio manager Gerald Du Manoir and investment analysts Laura Nelson Carney and Archana Basi will share their perspectives on growth opportunities in international markets.

According to Gerald, “in order to have a well-rounded and robust portfolio of stocks, I believe that investing in international markets is a must since there are a number of innovative and market-leading companies based in Europe and Asia that are often overshadowed by the market’s fascination with leading U.S. technology companies.”

Here’s a snapshot of thoughts from Gerald on renewable energy, Laura on biopharma and Archana on consumer staples.

Renewables

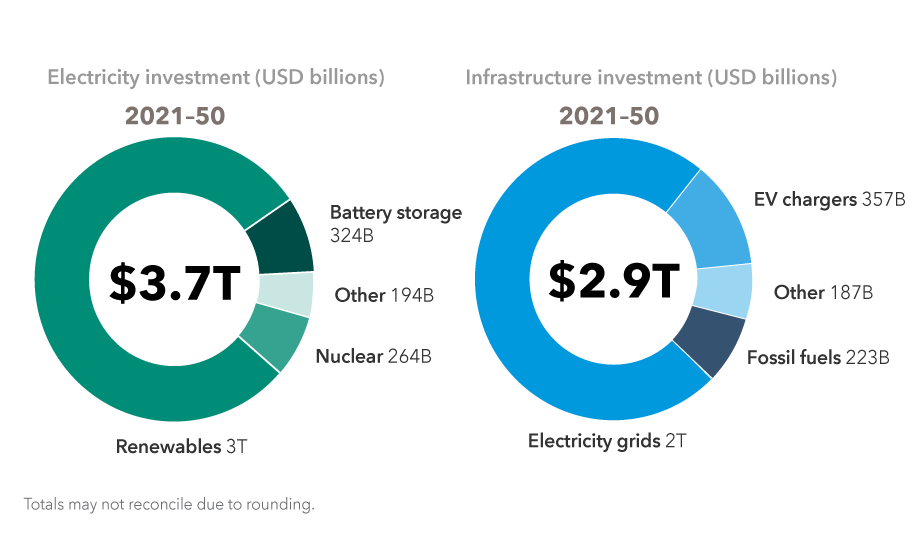

Gerald: The world’s transition to clean energy may be a transformative growth story for a number of European companies over the next decade. European policymakers and companies are already at the forefront of a growing global push to reach a net-zero carbon environment, ranging from utility companies to industrial firms to even the oil majors.

The European Union plans to source half of its energy from renewables by 2030, and its long-awaited “Green Deal” framework is expected to push that even further, as the bloc seeks to cut greenhouse gas emissions to net zero by 2050. The EU Green Deal will require a huge amount of investment ― as much as €7 trillion by 2050 ― which will come from a mix of private investment, public grants and subsidized lending.

Given this backdrop, the transfer from hydrocarbons to renewables will likely accelerate, and this could have an impact on the scope of potential investment opportunities.

Trillions in global investments expected for clean energy

Source: International Energy Agency, Net Zero by 2050 (May 2021).

Biopharma

Laura: The next major innovation in medicine is the use of cells and genes as medicines. We are at the very beginning. This holds the promise of both (a) functional cures of diseases that we couldn’t treat at all (or not very well) with chemicals or proteins and (b) one-time treatment rather than chronic therapy for the rest of a patient’s life.

Cell therapy is like a transplant with a gene-edited version of cancer-fighting T cells. So far, cell therapies are only used for blood cancers, but that may change in the future. The T cells are like assassins for hire for your immune system. They can be modified to better find and kill cancer cells. Gene therapy is a way to modify a person’s genes to treat a disease in one of a few ways. You can replace a disease-causing faulty gene with a healthy one or switch off a disease-causing gene that’s not functioning properly.

Overall, the development pipeline is growing, with more than 360 such therapies in development, targeting a range of diseases. There’s also a large pool of eligible patients who technically could receive these therapies.

However, cell and gene manufacturing are both relatively new and much more complex than protein or chemical manufacturing. This adds substantial risks. Larger companies that can afford to are increasingly preferring to bring manufacturing in-house to control all aspects of it (and to avoid inevitable delays because contract manufacturing capacity is very tight).

Consumer staples

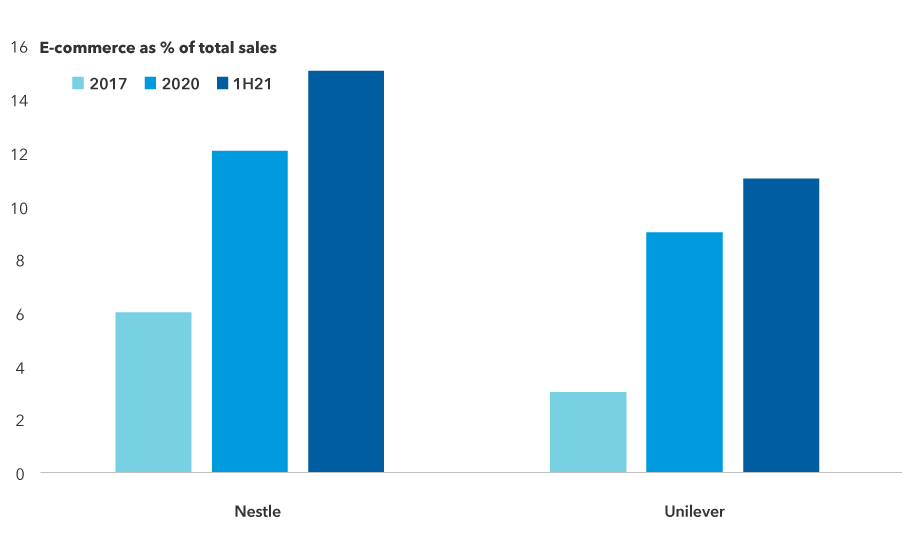

Archana: Consumer staples are undergoing some transformation. Spurred by changing consumer habits and going where the puck is, companies like Nestle and Unilever are investing heavily in e-commerce channels. As grocery shopping moved online in a big way during COVID-19-induced lockdowns, consumers gravitated to the familiarity of big brand names. As millennials starting cooking more at home, some of those habits appear to be sticking.

Retailers also sought to simplify their shelf space during COVID, resulting in a reduction in the number of items they stocked. Along with a surge in online orders during the lockdowns, this has helped larger consumer brands consolidate their market share over more niche product makers for certain food items and everyday household staples.

E-commerce sales have grown among consumer staples companies

Capital Group, based on company reports and media reports. Figures are approximations. 2021 data as of June 30.

We will cover these and other themes for investing in our webinar on growth opportunities in international equity markets on September 30. Save your seat.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

Our latest insights

RELATED INSIGHTS

-

5 charts that put market volatility in perspective

-

Market Volatility

How to handle market declines -

World Markets Review

Trade war fears jolt markets: Q1 roundup

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Gerald Du Manoir

Gerald Du Manoir

Laura Nelson Carney

Laura Nelson Carney

Archana Basi

Archana Basi