Market Volatility

- The health care sector includes a broad array of businesses, many of which offer opportunities to capitalize on demographic trends like an aging population and a growing middle class in emerging markets.

- Following a year of political rhetoric that exacerbated overall health care sector challenges, the global spread of the COVID-19 virus has resulted in a swift and significant rise in demand for health care services and products worldwide.

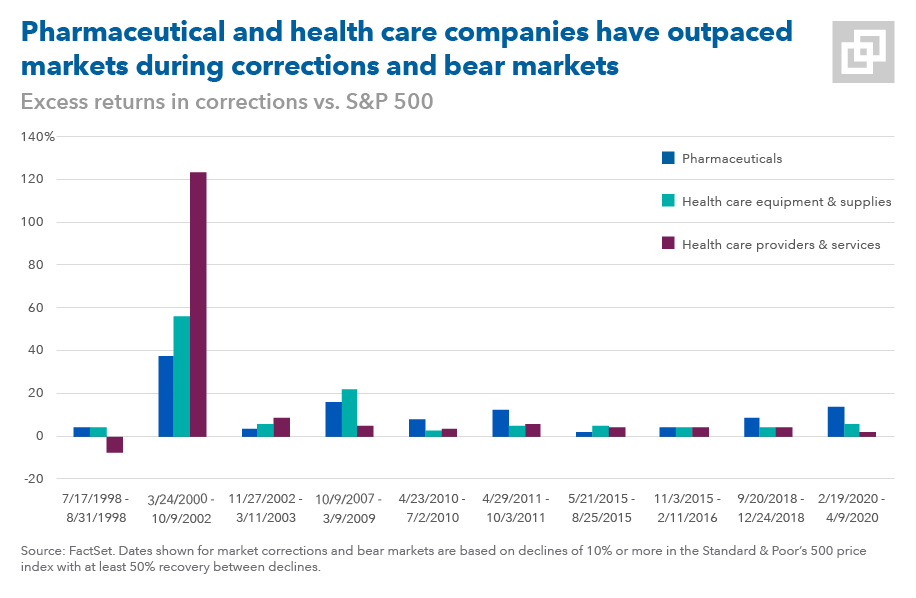

- Shining the spotlight on pharmaceuticals, medical device manufacturers, and health care providers and services reveals that revenues and stock prices of companies in these industries have been resilient in past market corrections and bear markets. This is holding true in the current volatility.

- While Capital Group does not have a house view on specific companies or sectors, our network of health care analysts is monitoring COVID-19’s potentially unprecedented disruption of the health care system and assessing opportunities for companies to play a role in leading the world out of the pandemic.

An aging global population and a growing middle class in emerging markets, both of which will demand more extensive drug treatments and medical care over time, are two primary drivers behind the longer term secular outlook for health care. Many companies also have sizable amounts of cash on their balance sheets, adding to the attractiveness of certain companies within the sector. At the same time, legislative reform risks remain and have historically been a focus in election years. However, some within our investment group believe that certain risks are already reflected in current stock prices.

The health care sector includes a broad array of business types, from those creating or delivering physical products to those providing different services. Among the former group are biotech and pharmaceutical companies, as well as medical device and other equipment and supply providers. Service-related businesses include managed care providers, hospital management companies and diagnostic networks.

As focus has shifted away from political rhetoric regarding the Medicare for All program and drug price reform to battling the global COVID-19 pandemic, the spotlight is on drug vaccines, therapies and medical technology that could help minimize the impact of the virus. Overall, the durability of health care companies’ earnings during economic downturns has tended to lead to solid results, including the current correction. Pharmaceutical and health care equipment & supplies companies, for example, have outpaced the broad market in all corrections and bear markets over the last 20 years, and the trend has so far held true in the current period of volatility.

On the front lines: Pharmaceuticals and health care equipment & supplies manufacturers

In the battle against the global pandemic, two U.S.-based businesses — pharmaceutical company Gilead Sciences and health care equipment & supplies manufacturer Abbott Laboratories — have been among the largest beneficiaries of the increased demand for health care products and services. While some within the investment group believe that positive developments for market leaders in these industries could see continued strength within the industry going forward, they also caution that risks remain. For example, disruption to other important clinical trials could be suspended or postponed, and drugs for less serious diseases could be most vulnerable.

Gilead Sciences (GILD)

Gilead Sciences has developed a combination of dominant therapies for HIV (Biktarvy) and Hepatitis C (Harvoni). Its response to COVID–19, Remdesivir, has shown positive signs of slowing the spread of the virus, which led to the FDA granting the drug emergency use authorization. The drug was previously a treatment candidate for the Ebola virus. Optimism surrounding Remdesivir, along with a strong drug pipeline, has helped support strong stock price movements this year.

Abbott Laboratories (ABT)

Several health care equipment & supplies manufacturers have also witnessed demand strength for ammunition in the battle against the global pandemic. Abbott Laboratories is one that has led the pack due to the recent FDA approval for its five-minute COVID-19 test. This development is considered a game changer and has helped boost the stock price significantly this year. Prior to this rapid and timely approval, some within our investment group believed ABT to have a geographically diverse set of strong businesses that have demonstrated economic resilience.

Providing the infrastructure: Health care providers and services companies

The managed care segment disappointed during the global financial crisis, as many analysts felt the industry should have exhibited much more resilience during the downturn. However, several Capital Group health care analysts believe this time is different. Industry leaders like UnitedHealth Group have margins that are much more stable, a greater mix of Medicare and Medicaid membership, and more profit coming from non-HMO businesses. As a result, divisions are more stable and diversified than they were in 2008. Additionally, the HMO industry is planning to price for some amount of COVID-19 costs in 2021, potentially helping to smooth out overall costs. However, risks from the global pandemic remain, as some 2020 costs will need to be realized this year, possibly reducing earnings in upcoming quarters.

The Capital System℠ and other health care investments

Capital Group’s analysts provide global coverage of the various types of health care companies described in this piece to seek what we believe are attractive long-term opportunities for our investors. Our investment groups, for example, have created multiple health care “clusters,” groups who regularly meet to discuss investment implications and recommendations in the space. Within the Capital System, portfolio managers and analysts (via our research portfolios) invest autonomously, and the investment needs of various strategies are based on objectives and geographic focus.

As of March 31, 2020, Capital Group–managed portfolios included a number of pharmaceutical and biotech companies around the world.

The Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. The S&P 500 is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

Chart in Focus

-

Manufacturing

-

Market Volatility

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.