Politics

- European stocks rally after first round of French presidential elections.

- My base case is that Macron wins the presidency but faces major legislative hurdles.

- Le Pen victory is a low-probability event, but comes with high market risk.

This article, originally published on April 12, 2017, has been updated to reflect the April 23 results of the first round of the French presidential elections.

Markets loudly cheered the results of Sunday’s presidential election in France. Although it was just the first round of a two-round contest, the rise of centrist Emmanuel Macron sparked a relief rally in European equities given that a major political event risk – the potential disintegration of the European Union – is now likely off the table.

Macron will face the far-right anti-EU candidate Marine Le Pen in a May 7 runoff, and while anything can happen, major polls show Macron leading Le Pen by a wide margin. In my view, Macron is now well-positioned to win the presidency. However, as we saw last year with Brexit and the U.S. presidential election, ultimately the voters will decide, and that can sometimes cause surprise outcomes.

As a pro-Europe candidate, Macron is likely to govern from the center. Questions remain about his ability to implement reform measures in France, as he may not have a legislative majority and he will almost certainly be in cohabitation with the center-right party. But that is an afterthought. What markets care most about is the removal of the tail risk represented by a second-round runoff between Le Pen and one of the other anti-EU candidates.

With a little bit of luck, we may have passed the Rubicon of key political risks this year in Europe. The probable re-election of German Chancellor Angela Merkel this fall could produce a reset in Franco-German relations, a partnership which lies at the heart of the European project. If Macron wins, the “narrative of disintegration” that has beset Europe in the post-Brexit era may soon be coming to an end.

Here is my full outlook, from April 12, outlining what is at stake in this election:

French voters will choose a new president next month in a pivotal election that has taken on global significance. With a rising wave of populism moving across Europe, the United States and elsewhere, investors are worried that France may be the next domino to fall, sweeping away the old-guard establishment and rejecting the geopolitical order that has dominated Western democracy since the end of World War II.

These fears were stoked by Donald Trump’s rise to the U.S. presidency and last summer’s Brexit referendum, which resulted in the U.K. moving to extricate itself from the European Union. One of the French presidential candidates, Marine Le Pen, has even been called the Donald Trump of France, which is not entirely accurate. Le Pen taps into similar sociocultural and economic anxieties as President Trump did with his voter base, but her party – the National Front – has a longstanding history in French politics and she is not a new voice on the political spectrum.

Thus, the political dynamics shaping the French elections have some parallels to what we have witnessed in the U.S. and the U.K., but it is a stretch to conclude that the outcome will also be similar. Yes, the French people are extremely disaffected with their country’s current direction, and they are demanding change. But that does not mean they are ready to reject the foundations of European cooperation and integration fostered over the past 70 years, and I don’t believe they will.

A binary choice

France’s presidential election will unfold in two rounds. The first round, featuring 11 candidates, is scheduled for April 23. The second round, a runoff between the top two vote-getters, is set for May 7. The winner will replace the current president, François Hollande, who chose not to seek reelection amid record-low approval ratings.

In recent weeks, two candidates have emerged as clear front-runners: centrist, pro-Europe Emmanuel Macron of the newly established En Marche party; and the far-right, anti-EU Marine Le Pen. Le Pen’s pledge to pull France out of the EU and end the use of the euro common currency has raised the level of political risk to new heights in France and across Europe.

Pre-election polls show that Macron is highly likely to defeat Le Pen in the May 7 runoff. But after Trump’s surprising win, and the shocking outcome of the Brexit vote, the populist Le Pen cannot be ruled out. In my assessment, a Le Pen victory is a low-probability, high-risk event that is causing many international investors to stay cautious until the outcome is known. That is not a bad approach given the substantial downside risk if Le Pen wins.

I will note that throughout the U.S. presidential campaign, as well as the Brexit campaign, the polling data was accurate within the margin of error, pointing toward a close race. In France, Le Pen is currently polling far outside the margin of error in the second-round runoff, making it highly unlikely that she could pull off a last-minute win.

Market reaction

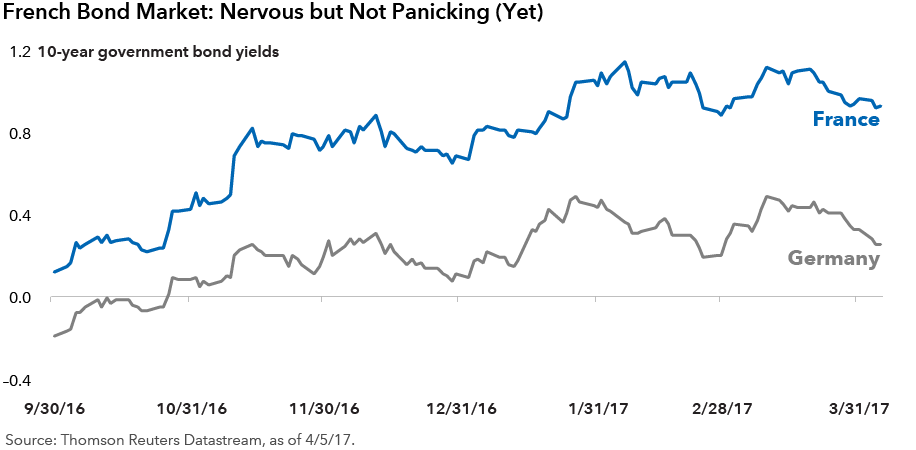

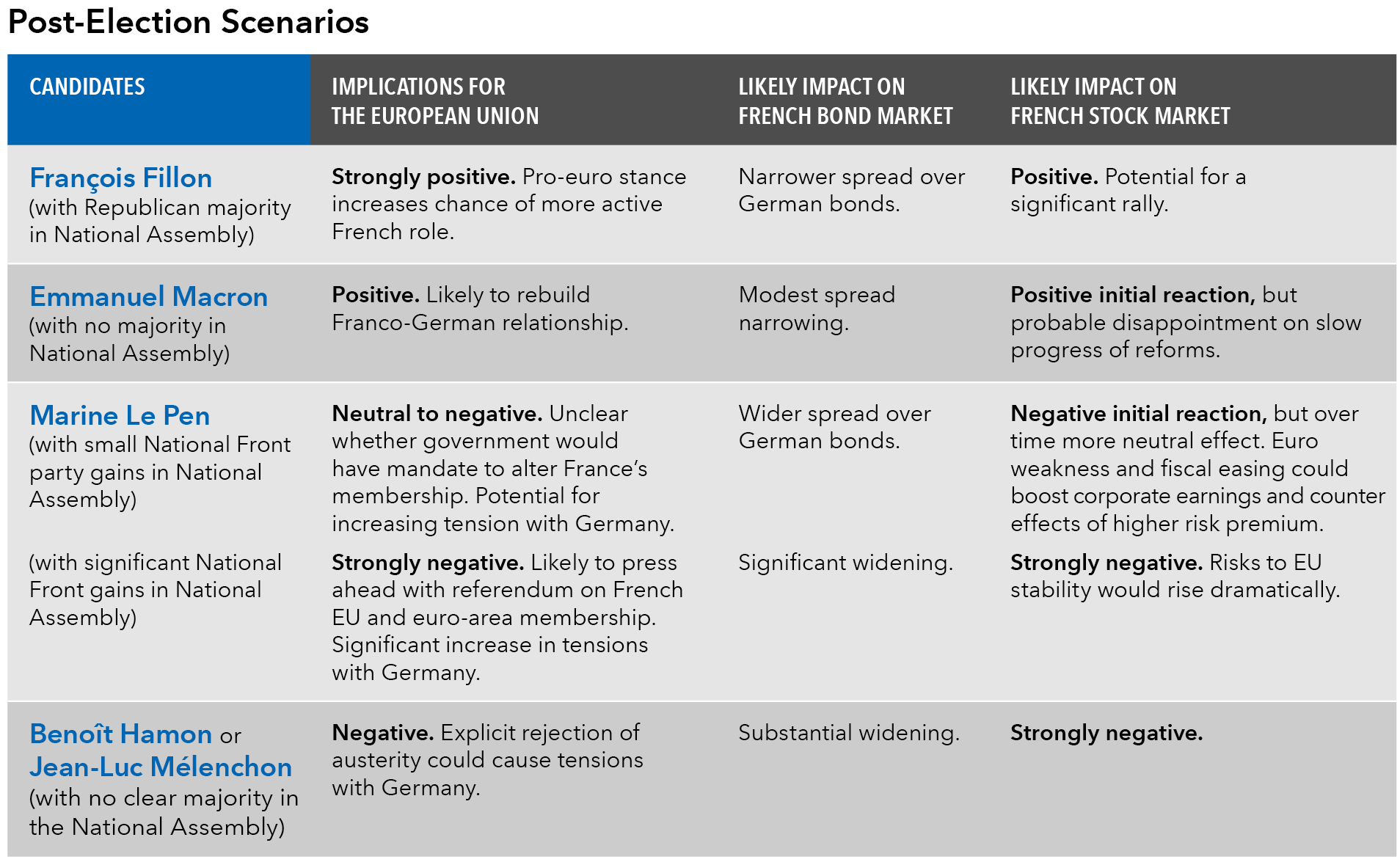

Investors in French financial assets are nervous about the upcoming elections, but they are not panicking. (Not yet, anyway.) Equity markets have remained relatively stable so far this year, rising roughly in line with global equity markets. The French bond market, where you can more clearly see the impact of political risk, is showing a bit more anxiety. In recent months, yield spreads have widened significantly between French government bonds and the perceived safe haven of German government bonds.

The divergent views of equity and fixed income investors are not surprising. Many of France’s largest publicly traded companies — Airbus, L’Oréal, LVMH, Sanofi, Total — are global enterprises that are not dependent on the French economy. In many cases, their earnings growth potential depends more on what happens in the U.S., Asia or other parts of Europe.

French bonds would be severely impacted by currency devaluation and large-scale capital flight if France were to abandon the euro and leave the EU. That impact would likely extend to peripheral bonds, as well (Italy, Spain, etc.), given their relatively weak profile amid the euro-zone breakup risk. In fact, such a serious threat to stability would probably result in a major financial crisis, given global linkages between the euro zone and other global equity and fixed income markets.

Looking ahead

My base case is that Macron wins the presidency and French financial markets enjoy a brief relief rally. However, if Le Pen wins, it may very well mark the end of the euro zone as we know it, since one of the principal architects of the monetary union would have elected a Euroskeptic leader. That will start a messy, high-stakes period of negotiations in Brussels and Berlin to see whether a compromise can be found on the way forward. In that scenario, it will take quite some time before it becomes clear which direction France (and Europe) will take, or if indeed there will be a French euro-zone exit referendum.

Unless the National Front can win the presidency and gain a majority in the National Assembly elections six weeks later (which is extremely unlikely), Le Pen will have a difficult time moving her nationalist anti-EU agenda through an uncooperative legislature. The National Front has little support outside its own membership; therefore, establishing a coalition government with other French parties would be nearly impossible.

In fact, if Macron wins, he will probably face a similar dynamic, given his recent break with the Socialist party and his lack of political experience. (Macron served as Economic Minister under Hollande, but he has never held elected office before.) He is a rising star, no doubt, but the rough-and-tumble world of French politics is a daunting environment for a relative newcomer.

As a result, it is entirely possible that no matter who wins this election, France will see a prolonged period of political and policy paralysis over the next five years, and a political system that is increasingly stretched and in crisis. C’est la vie.

Past results are not predictive of results in future periods.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Our latest insights

-

-

-

U.S. Equities

-

Artificial Intelligence

-

Interest Rates

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Talha Khan

Talha Khan