Markets & Economy

- Despite the vaccine announcements and U.S. election results, the economic recovery is likely to remain bumpy.

- Monetary policy will remain accommodative, helping to keep rates low and the yield curve flat and providing a cushion for risk assets.

- Our fixed income investment professionals continue to make the case for core bond portfolios that can provide diversification from equity risk.

- The outlook for credit assets remains positive, including U.S. high yield and select emerging markets debt.

The U.S. election results and announcements of a potential COVID-19 vaccine from Pfizer and Moderna have been pivotal events in markets, initially providing a substantial boost to risk assets. Mixed economic data and a rapidly rising rate of coronavirus infections have since tempered investor enthusiasm. We took stock of macroeconomic conditions and prospects for fixed income investors with three of our investment professionals: U.S. economist Jared Franz and fixed income portfolio managers Tom Hollenberg and Damien McCann.

Economic outlook: Jared Franz, U.S. economist

We are seeing a modest economic recovery. With fiscal support getting largely exhausted and prospects for a second fiscal stimulus package still uncertain, the pace of annualized GDP growth could slow in the fourth quarter toward 3% or lower. Stubbornly high levels of jobless claims near 709,000 also suggest the economic rebound is stalling. Nevertheless, Pfizer and Moderna’s recent announcements of an imminent vaccine improve the prospects for economic growth in the next couple of years.

Through the summer and fall of 2020, the U.S. economy has been experiencing subpar economic growth. Activity in several important sectors — airlines, hotels, entertainment and cruise lines — has been anywhere from 20% to 60% below the levels that prevailed before the outbreak of COVID-19. The prospect of an effective, safe and durable vaccine could short-circuit this negative feedback loop and release pent-up demand. Should some sort of herd immunity take hold in the second half of 2021 with the impact of a vaccination, it could create a step-up in the GDP growth outlook to 3% in 2021 and 3% to 4% in 2022.

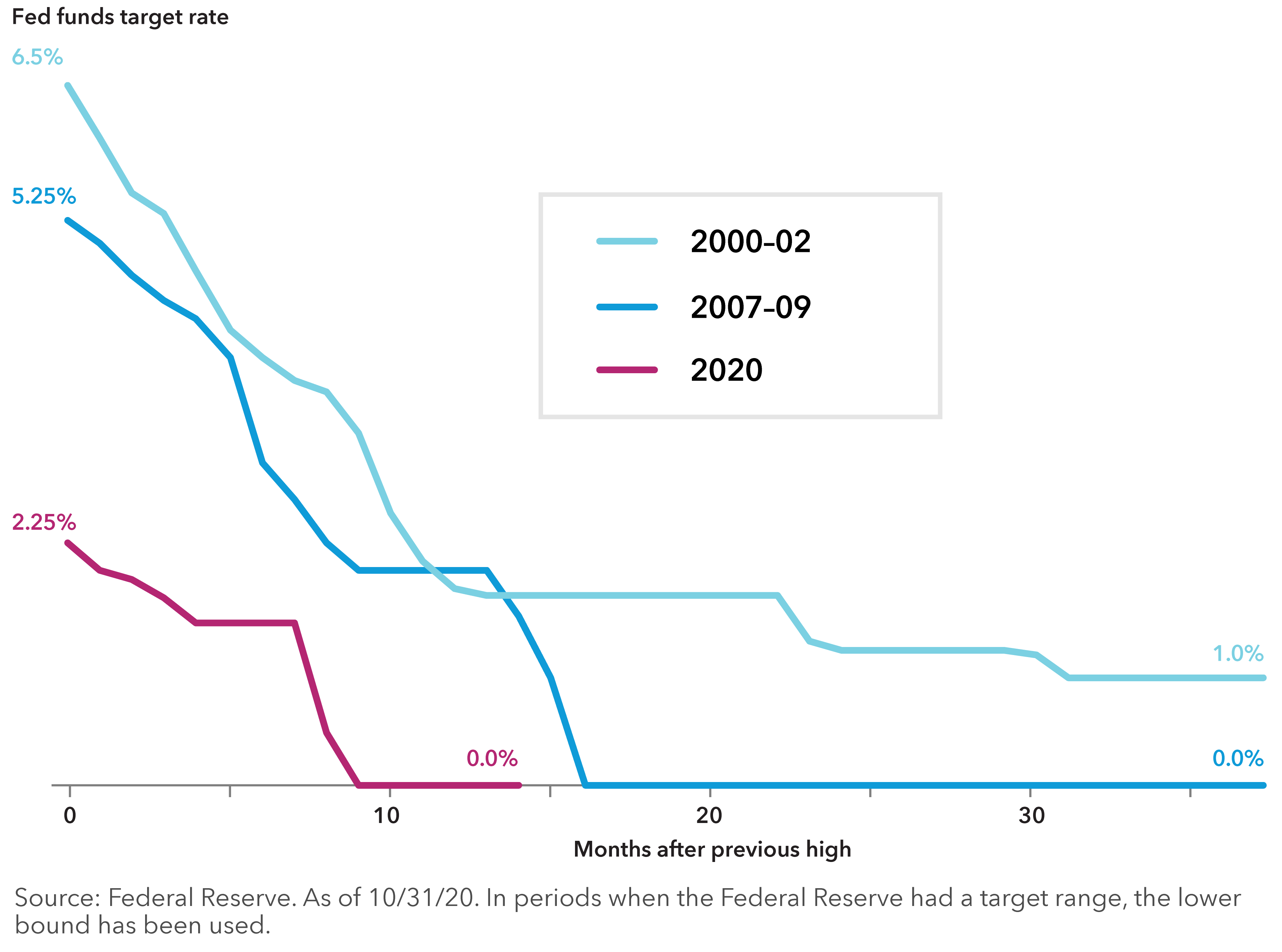

The challenge is that, despite the announcement, a vaccine could still be at least six to nine months away, and its efficacy has not yet been fully established. In the meantime, fiscal and monetary policy must fill the gap. If CARES 2.0 runs into a logjam, any near-term growth hiccup will have to be filled with a "whatever it takes" monetary policy easing by the Federal Reserve.

On the positive side, despite the COVID-19 flare-ups, consumer spending has shown resilience, especially in areas like autos. While we may see a softer holiday season, spending could pick up again in the spring once we are past the winter season, which tends to bring an upsurge in viruses.

A point I’d make as we try to calibrate the policy framework for 2021: There’s a big difference between the environment following the Great Financial Crisis of 2008 and the post-COVID economy. The latter has a clear human cost and the potential to cause extraordinary damage to some of the most vulnerable populations in our society, regardless of political affiliation. I believe that policymakers won’t be able to ignore that aspect, and there will be pressure to provide additional fiscal support.

Interest rate outlook: Tom Hollenberg, portfolio manager and member of the U.S. rates team

Interest rates rose modestly after Pfizer announced on November 9 that its COVID-19 vaccine has shown promising early results. However, the road to recovery could be bumpy with the winter months ahead and coronavirus infections spiking in the U.S. and Europe.

The Fed has indicated that it will maintain accommodative monetary policy until the economy has fully recovered. If interest rates rise significantly and financial conditions tighten enough to threaten the recovery, the central bank will likely pursue even looser monetary policy. With the federal funds target rate already near zero, quantitative easing will be the main tool at policymakers’ disposal. The Fed is most likely to buy longer duration Treasuries to have the greatest impact.

The Fed cut rates in record time in 2020

Central bankers want to push the personal consumption expenditures price index — their preferred measure of inflation — to their target of 2%, and they would like to see the unemployment rate return to pre-COVID levels. While unemployment has declined significantly since April, it remains well above the 50-year lows that prevailed before the pandemic.

Against this backdrop, we in the U.S. rates team expect range-bound interest rates and a flatter yield curve. Over the next few months, I expect the 10-year U.S. Treasury yield to hover between 0.70% and 1.00% and the 30-year yield to range between 1.40% and 1.80%. The Treasury yield curve has room to flatten between the 10-year and 30-year maturities.

From a technical standpoint, Treasuries remain supported by a diverse investor base. U.S. yields today are higher than in most developed market economies, including Japan, Germany and the U.K. With inflation likely to remain subdued at least through the next several months, Treasuries may also be attractive for investors looking to hedge riskier assets.

Credit outlook: Damien McCann, fixed income portfolio manager and principal investment officer, American Funds Multi-Sector Income Fund℠

I am modestly optimistic on credit and expect credit assets across the risk spectrum to do well over the next year. In the last two weeks, I've become a bit more confident in that view given the U.S. election outcome and very positive data on a vaccine. The likelihood of a divided Congress means we are unlikely to see significant changes in major policies such as taxation, which is positive for corporate earnings. Monetary and fiscal policy remain accommodative.

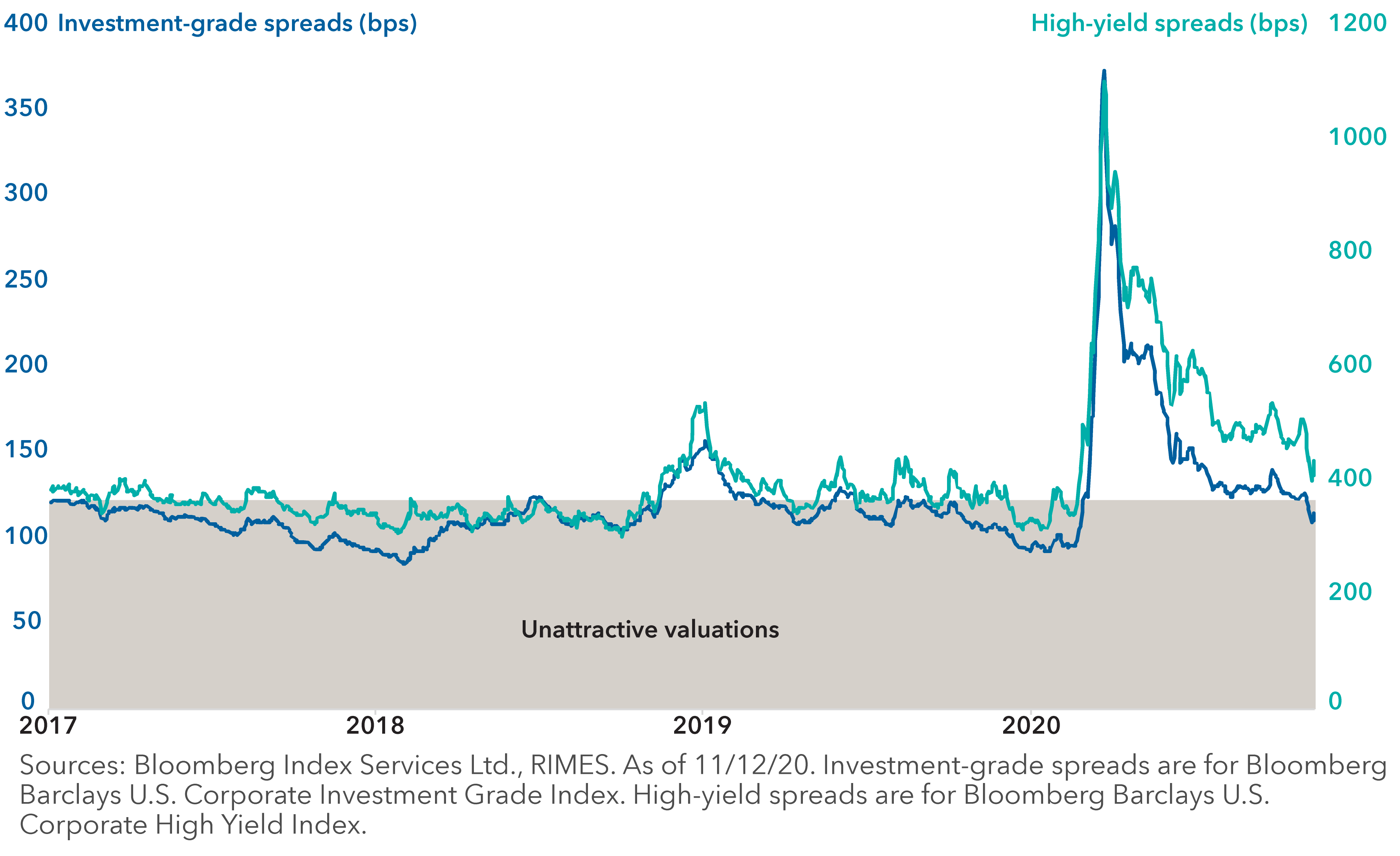

We have cautioned investors when high-yield credit becomes the largest portion of a fixed income allocation. Within a core bond portfolio, it may make sense to have a modest overweight allocation to investment-grade credit. Investors can seek a yield in the 2% range and probably get some capital appreciation via incremental tightening of spreads.

In multi-asset income portfolios where investors are willing to absorb a higher level of risk, I prefer U.S. high yield and some areas of higher yielding emerging markets debt. Overall, U.S. high-yield issuers are more exposed to the domestic economy, and their more leveraged balance sheets stand to benefit from a recovery. Spreads in the U.S. high-yield market remain at a notable discount to their historical valuations during periods outside a crisis or recession. With a positive fundamental picture, combined with extensive monetary support from the Fed, high yield should continue to offer value relative to investment-grade credit.

High-yield spreads remain somewhat attractive on a historical and relative basis

Corporate leverage may decline. We may be at the beginning of a deleveraging cycle, which has historically been supportive of credit assets. Corporate leverage rose meaningfully over the past year as earnings fell and companies issued debt to maintain liquidity and to take advantage of ultra-low interest rates. Now, as the economy recovers, we are likely to see corporate earnings start a gradual return to pre-pandemic levels and for companies to pay down some of the debt they raised during the crisis in March and April.

The pace of this deleveraging will vary by industry. For example, industries such as travel and retail that have seen a huge demand shock and a sharp decline in earnings will take longer to recover. These are the companies that raised large amounts of debt, and their leverage is quite elevated. For a hotel company such as Marriott, for example, it will take longer to get the balance sheet back in good shape — in the range of two to three years. But so long as they show a positive trajectory, I think the rating agencies will give them room.

I started investing in these hard-hit, consumer discretionary credits in areas such as travel and retail in March and April with small positions when valuations were discounting extremely negative scenarios. I believed that there would be a recovery eventually, even though the timing was unclear. With greater visibility to that recovery, valuations have improved but are still not at levels consistent with a normal economic environment. I’ll continue to add to these investments as and when appropriate.

Key sectors. The core of our investment-grade portfolios lies in the areas of utilities, energy, pharmaceuticals and chemicals. Within energy, we’ve invested in the large midstream companies whose fortunes are dependent less on the price of oil and more on pure business volume and take-or-pay contracts. Their cash flow streams are much more resilient than those of an oil producer, and their valuations are attractive.

In high yield, we also see value in industries with resilient credit fundamentals, including technology, pharmaceuticals and diversified manufacturing. In technology, examples of solid businesses include software companies that have sticky, subscription-based revenues. Their cash flows have remained steady regardless of where we are in the economic cycle. With stable cash flows, these companies can support greater balance sheet leverage. For investors, that translates into a potential for sustainable, higher yield in the portfolio. We also maintain exposure, albeit smaller, to more economically sensitive industries such as chemicals and gaming, where asset value, strong liquidity and improving economic activity provide support to valuations.

Opportunities in emerging markets. Within emerging markets, the riskier credits continue to trade at a significant discount to U.S. high yield. While there are some troubled credits in this sector, there are also many higher yielding, dollar-denominated bonds issued by sovereigns that have both the resources and the commitment to servicing their debt through economic cycles. They should benefit from a recovering global economy. These include countries such as the Dominican Republic, Ethiopia, Belarus, Ukraine and Egypt.

While I remain positive on credit in aggregate, it’s evident that it will take a few years for the global economy to address the challenges posed by COVID-19. Many weaker credits may not make it to the other side. In this environment, we remain highly selective in our investments and continue to err on the side of high-quality portfolios within their stipulated mandates.

Higher yielding, higher risk bonds can fluctuate in price more than investment-grade bonds, so investors should maintain a long-term perspective.

Unlike mutual fund shares, investments in U.S Treasuries are guaranteed by the U.S. government as to the payment of principal and interest. In addition, certificates of deposit (CDs) are FDIC-insured and, if held to maturity, offer a guaranteed return of principal.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness.

The return of principal for bond portfolios and for portfolios with significant underlying bond holdings is not guaranteed. Investments are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional cash securities, such as stocks and bonds.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Bloomberg Barclays U.S. Corporate Investment Grade Index represents the universe of investment grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements.

Bloomberg Barclays U.S. Corporate High Yield Index covers the universe of fixed-rate, non-investment-grade debt.

Our latest insights

RELATED INSIGHTS

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Jared Franz

Jared Franz

Tom Hollenberg

Tom Hollenberg

Damien McCann

Damien McCann