Emerging Markets

Dividends

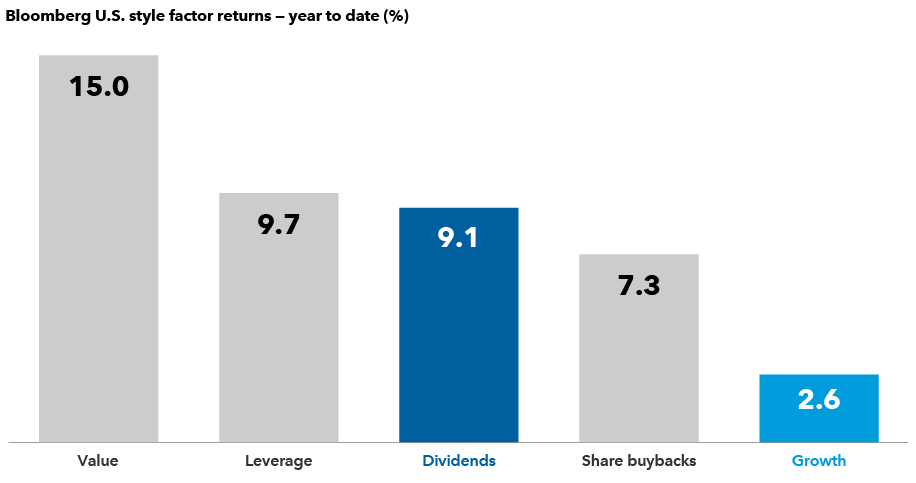

The recent volatility in growth stocks has brought dividend equities back into focus. Dividend-paying stocks have outpaced their growth counterparts by a substantial margin year-to-date, as fears of rising interest rates and worries about the pace of economic growth in the United States and China have raised concerns over the elevated valuations of many previously high-flying growth stocks.

We saw a similar market rotation in the first quarter of 2021, which fizzled out as growth stocks made a strong comeback. But this year the macro-economic backdrop is different. Inflation is at a multi-decade high, and the Federal Reserve plans to raise interest rates and wind down its quantitative easing program. Earnings reports from some of the larger growth companies, like Netflix and Meta, have disappointed versus expectations. And the value of the more distant cash flows of growth companies makes them more vulnerable to a rise in interest rates.

Dividend stocks have rebounded

Source: Bloomberg. Data as of February 15, 2022, and based on style factor strategies created by Bloomberg. Factor investing is an investment approach that involves targeting specific drivers of return across asset classes (including macroeconomic, fundamental and other statistical measures for building a strategy).

Amid rising bond yields and higher inflation, the market rotation into dividend stocks may still be in the early stages. Along those lines, dividend-income investment could well play a more important role in the total return of a portfolio. Against this backdrop, we explore four emerging trends in the dividend universe.

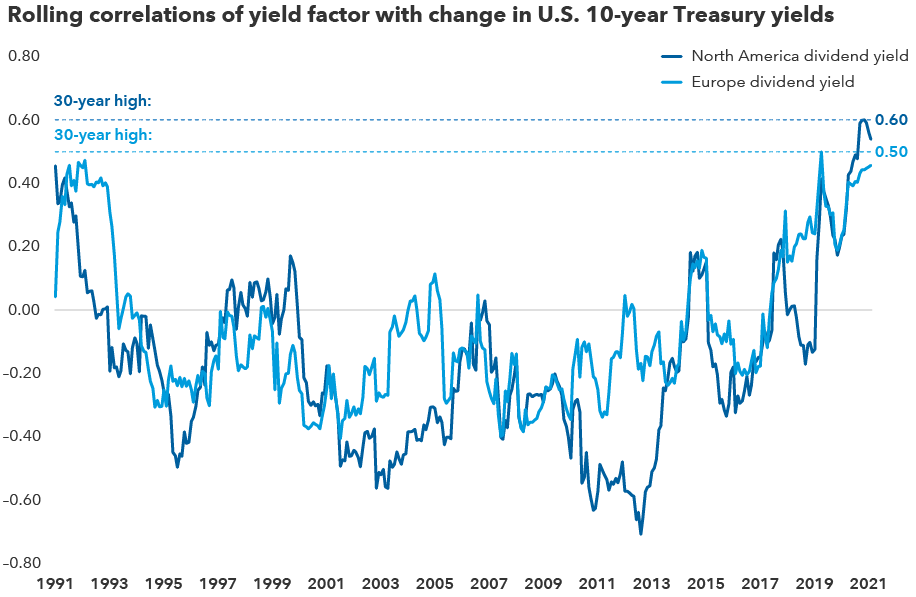

1. Positive correlation between dividend yields and bond yields

For most of the past 30 years, the relative returns of high dividend-yielding stocks and changes in U.S. Treasury yields had a negative relationship. That relationship reversed in the past two years and high-yielding stocks have exhibited a positive correlation to bond yields. If this trend continues, a rise in interest rates may not dampen prospects of dividend stocks as they have in the past.

Partly, it’s because interest rates are rising, but from a very low base. Even as the Fed begins to raise policy rates, our fixed income rates team expects the 10-year Treasury yield to remain within a range of 2% to 3% with a further flattening of the yield curve led by a rise in short-term rates. Against this backdrop, dividend-paying stocks provide a combination of income and potential for capital appreciation, especially since the valuations of many of these companies appear reasonable following a long bull market for growth stocks. That said, it’s important to identify companies with heavy debt loads or excessive leverage on their balance sheets in a rising rate environment.

Historical relationship between bond and dividend yields has turned positive

Sources: Capital Group, MSCI, Datastream. Data as of December 31, 2021. Yield factors are constructed by ranking dividend yields within a region and then breaking them into terciles, rebalanced monthly. The return reflects the average return of the high-yielding cohort minus the average return of the low-yielding cohort. Returns are market cap weighted. The change in the 10-year Treasury is measured as the monthly basis points change in the 10-year Treasury yield. The correlation is calculated over 24 months and rolled forward on a monthly basis.

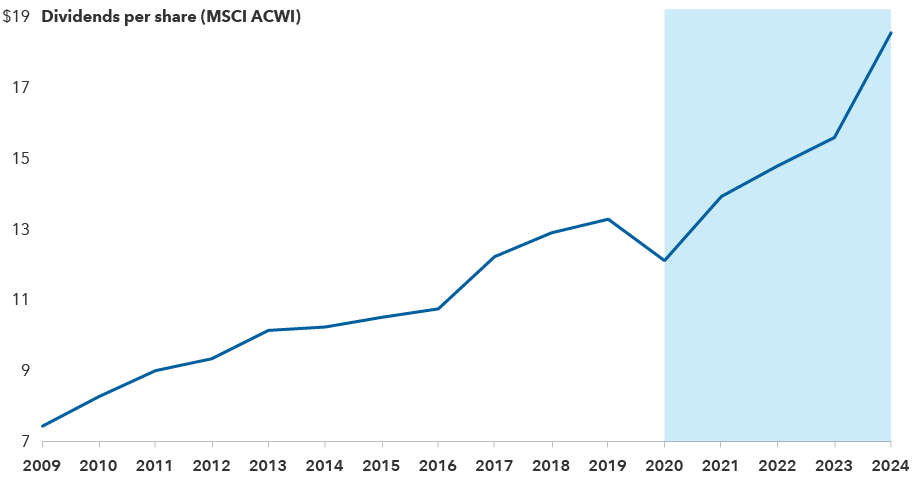

2. Dividends are making a comeback, but at a measured pace

We expect a steady increase in global dividends, but at a measured pace. Many companies are taking a more deliberate approach after their experience in the depths of the COVID-19 pandemic, when they were forced to substantially cut or eliminate their payouts. Now, amid a deceleration in global economic growth, some companies want to preserve cash in case of a greater-than-expected downturn.

Some industries, such as travel, continue to face a high level of uncertainty. Boeing, one of the world’s largest makers of airplanes, and cruise line operator Carnival are still struggling with depressed travel and have not resumed dividend payouts. Overall, however, dividends continue to recover. Of the 242 companies that either suspended or cut their dividend in 2020, 98 have reinstated payments and only three companies cut their dividend in 2021, according to Wolfe Research data as of February 15.

Companies with pricing power are likely to be better positioned to increase dividends. Household products giant Procter & Gamble, for example, has already raised prices across some of its product lines to help hedge itself against inflation. Consumer staples makers are often hurt when inflation begins to move higher and input costs go up. However, after a period of three to six months, these companies often seek to reprice contracts with retailers and grocers. This ultimately puts them in a better position to recoup those raw material costs, grow their earnings and potentially increase their dividend at a commensurate rate.

Dividend acceleration is also anticipated in Europe, where governments have eased pressures on dividend payments. During the pandemic, governments and regulators had pressed some companies to refrain from making payments as part of a social solidarity movement.

Global dividends are projected to rise

Sources: Capital Group, FactSet, MSCI, RIMES. Data for 2022–2024 are estimates by FactSet as of February 2, 2022.

3. Highly cyclical firms take innovative approach with variable dividends

Some companies, especially those in cyclical industries, are adopting innovative approaches to balance their business needs and a commitment to dividend payouts. Take the mining sector, which in 2021 witnessed a boom in dividend payouts. Over the past few years, many large mining companies, such as Rio Tinto and Vale, have switched from progressive dividend policies to a payout ratio. In these arrangements, dividend payouts are determined by a formula tied to certain operating metrics. This shift results in a variable dividend yield over time. But it also gives these companies an enhanced ability to manage their balance sheet and cash flows in a sustainable manner through multiple commodities cycles.

In the past, miners often struggled to maintain a regular dividend during market downturns and would either cut the dividend or be forced to raise debt to cover the payout.

Exploration and production (E&P) companies are also pivoting their dividend strategies. Historically, E&P companies have not been dividend payers, choosing instead to reinvest in the business to pursue more growth in production. But growth backfired at times when fluctuating energy prices hurt investment returns on projects and led to financial troubles.

This is starting to change as firms have become more disciplined. Companies have begun to initiate a regular dividend at a low base, supplementing them with variable or special dividends depending on commodities prices and the strength of cash flows.

For instance, Pioneer Natural Resources last November declared a quarterly cash variable dividend of $3.02 per share, representing approximately $740 million of capital returned to shareholders. EOG Resources has increased its dividend over the past five years and announced a special dividend last July.

Companies hope this newer approach can lead investors to adopt a more benign valuation framework in which to view them and thus avoid excessive stock price volatility.

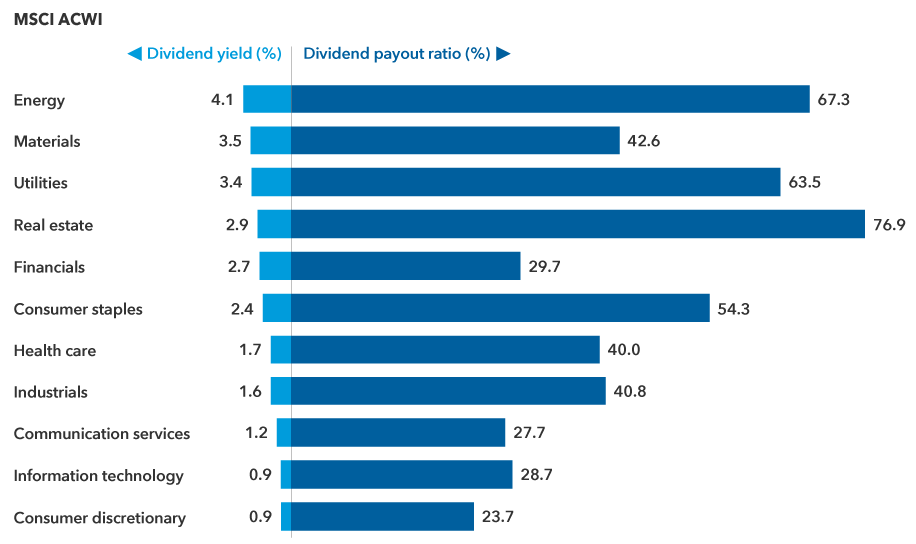

4. Financials, energy and health care are areas of dividend opportunity

Financials, energy and health care represent a substantial chunk of the dividend-paying universe, and a confluence of factors appear to support the case of rising dividends from each of these areas.

Financials: Rising rates should help the more rate-sensitive banks in the U.S. and Europe expand their net interest margins, which have been suppressed for many years by persistently low interest rates. This could result in stronger earnings, improved dividend streams and higher valuation multiples.

Banks have been building up excess capital on their balance sheets since the Great Financial Crisis and most are now well-capitalized, having undergone a number of regulatory stress tests. And some banks in the U.S. and Europe are poised to redeploy surplus capital in the form of regular and catch-up dividends after facing regulatory limitations during the pandemic.

For example, Dutch banking giant ING has committed to a minimum 50% dividend payout ratio (the proportion of earnings paid out as dividends to shareholders, typically expressed as a percentage) of earnings. CaixaBank, one of Spain’s largest banks, stated it would boost its payout ratio to as much as 60% from 50% previously. It’s possible that other European banks could follow a similar course of action as regulatory pressures ease, making this sector a potential source of more consistent dividend income.

Energy: Large integrated oil companies have long been good sources of consistent dividends for income-oriented investors. They’ve also become more disciplined on supply, having curtailed investment in existing reserves and pursuing new sources of oil.

U.S. oil giants Chevron and Exxon Mobil have demonstrated a steadfast commitment to paying dividends despite some dramatic swings in the price of oil over the past decade. Chevron recently increased its dividend for a 35th consecutive year.

But dividend policies have diverged in the oil sector and calibrating the dividend streams of oil companies has become more challenging. Over the past couple of years, European oil majors BP and Royal Dutch Shell have cut their dividends amid their transition to investing in renewable energies that are capital intensive and where the return on invested capital is still uncertain. Having reset their dividends to lower payout ratios, the European oil majors have left sufficient room to increase dividends over time.

Health care: Health care companies could be a source of both earnings and dividend growth in the current inflationary environment. Pharmaceutical companies historically have exhibited relatively strong pricing power. While the industry has faced political pressures on drug prices, the more innovative pharmaceutical companies will likely be positioned to raise prices at modest levels.

Like the energy companies, the major pharmaceutical companies recognize that a sizeable portion of their value proposition with the investor base is the dividend payout. That, combined with the potentially robust pipeline over the next several years at several major pharmaceutical companies across all geographies, gives us confidence that this will be another area that can be a well-diversified source of equity income.

Commodity companies offer some of the highest yields

Sources: MSCI, RIMES. Data as of January 31, 2022.

Bottom line

Over the past decade, many growth companies have been rewarded in an environment of modest global economic growth, very little inflation and ultra-low interest rates. We appear to be in the beginning stages of an equity market that is starting to show some breadth after a heavy focus placed on the technology-related growth stocks, especially those in the United States.

As market volatility increases due to monetary tightening and elevated levels of inflation, dividend-income investment could play a more important role in the total return of a portfolio. Investors are likely to pay greater attention to dividend payers as companies reinstate or continue to raise their dividends, albeit at a gradual pace. Furthermore, long-term investors have an opportunity to get in at the ground level amid this changing landscape; many companies currently trade at attractive valuations that may not be fully reflecting their upside potential as economies continue to normalize.

MSCI All Country World Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Institutional investors rely on our newsletter. Have you subscribed?

Our latest insights

-

-

Global Equities

-

Economic Indicators

-

-

Chart in Focus

RELATED INSIGHTS

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Hilda Applbaum

Hilda Applbaum

Alfonso Barroso

Alfonso Barroso

Marc Nabi

Marc Nabi