At Capital Group, we want to support you with your tax filing by providing answers to common questions on capital gain and dividend distributions, return of capital and cost basis reporting, including wash sales and covered and noncovered shares. If you have tax-filing questions on a specific type of account, we also provide tax FAQ for 529 accounts, IRAs and individual, joint and trust accounts.

Capital gains

When an investor sells a capital asset — such as a stock or a bond — for more than the amount paid for it, the investor makes a profit, or capital gain. For example, if a stock is bought for $100 and later sold for $120, the investor’s capital gain is $20.

When a fund sells securities at a profit, the sale also creates a capital gain. Our funds can realize two types of capital gains — short-term and long-term. Net short-term capital gains are distributed to investors as income dividends and are taxed at ordinary income tax rates. Long-term capital gain distributions are currently taxed at a maximum rate of 20%.*

* This rate does not include the 3.8% surtax applicable to net investment income for higher income taxpayers.

When mutual funds sell securities, they typically realize gains or losses. If gains exceed losses, most funds distribute their net gains to their investors before the end of the calendar year. These distributions made from the funds and paid to the investors typically occur once or twice a year.

Capital gains are paid when the overall holdings within a fund are sold and result in a realized profit. For some funds, profits from sales are offset by losses from other sales, causing the overall holdings within the funds to not pay a capital gain.

For additional information, refer to the Taxes and Distributions section in a fund's Statement of Additional Information (also known as Part B).

When a fund distribution (capital gain, dividend, etc.) occurs, profits are paid out to shareholders. On the calculation date, the money for the fund’s distribution leaves the fund, causing that day’s price per share to drop, which is reflected in an account’s value. On the payment date, generally the next business day, the profit is paid to shareholders.

Example: A fund share sells at the net asset value (NAV) of $10. Due to sales of the fund’s securities resulting in the fund making a capital gain distribution of $2 per share, $2 will be paid to the fund’s investors. The fund share price on the record date will decline to $8 because of the distribution.

No. Considering the answer to the previous question, when a fund distribution (capital gain, dividend, etc.) occurs, the price per share drops when the money leaves the fund on the calculation date, but it is paid to the investor. For fund distributions that are automatically reinvested into the account, the additional fund shares are purchased at the lower price per share. These additional shares compensate for the drop in the NAV, so the total value of their accounts doesn’t change. (Of course, if there is a decline in the market at the same time, they may still see a drop in the total value of their accounts.)

Example: Let’s say there are 100 shares in an investor’s account. At the NAV price of $10 per share, the account value is $1,000. If the fund pays a capital gain distribution of $2 per share, the NAV drops to $8, and the original 100 shares are now worth $800. However, if capital gain distributions are reinvested, they will automatically buy $200 worth of shares — at $8 per share. The investor can add 25 shares to his or her account, which now contains 125 shares worth $8 each. That’s a total of $1,000, which was the original account value before the capital gain distribution was paid.

The record date is the date when investors in a particular fund are entitled to receive a fund distribution.

For the American Funds, distributions are based on fund shares owned at the beginning of the record date.

For Capital Group exchange-traded funds (ETFs), distributions are based on fund shares owned at the end of the record date.

When the value of a fund holding increases, the fund has an unrealized gain until the security is sold. Once this security is sold, the fund realizes the gain and must pay a distribution unless the gain is offset by capital losses. Consequently, a fund’s capital gain distribution in a particular year is a result of the sale of securities that may have appreciated in value, perhaps during prior years when the fund’s returns were positive.

Capital Group is mindful of the taxes our investors pay on capital gain distributions. While taxes are an important consideration, meeting the funds’ investment objectives is our primary goal. Therefore, securities will typically be sold when it is deemed appropriate for investment reasons.

Capital gain distributions paid by a fund should not be confused with capital gains you may realize when you sell or exchange mutual fund shares. If you sold or exchanged fund shares, your capital gain or loss depends on your cost basis for those shares.

Capital gain distributions (shown in Box 2a of your Form 1099-DIV) are taxed as long-term capital gains. The tax rate for long-term capital gain distributions (assets held for more than one year) is determined by an individual’s taxable income and filing status. The applicable rates are 0%, 15%* and 20%.*

Short-term capital gain distributions (assets held for one year or less) are subject to tax at ordinary income rates.

For state taxation, the treatment of capital gain distributions varies from state to state and may not follow the federal income tax treatment. Consult your tax advisor or your state tax authority for more information about state income tax reporting of these distributions.

*This rate does not include the 3.8% surtax applicable to net investment income for higher income taxpayers.

Capital gain distribution amounts can be found in Historical Prices and Historical Distributions, beginning with each fund’s record date.

Generally, withdrawals from retirement accounts and annuities are taxed at ordinary income tax rates. The lower rates that apply to long-term capital gains do not apply to withdrawals from these accounts.

Though the lower rates do not apply, retirement accounts and annuities remain attractive investment vehicles because earnings on these accounts can compound tax-free until withdrawn.

Investors are required to include these amounts on their annual federal and state (if applicable) income tax returns. This is true even if they reinvested their capital gain distributions or if the fund’s share price declined during the year.

Individuals will need Form 1040 and related schedules.

You can order IRS forms and schedules by calling (800) 829-3676 or downloading them from the Forms & Instructions section at irs.gov.

Qualified dividends

Qualified dividends are subject to special lower tax rates when paid to an individual taxpayer who meets a holding period requirement.

For a dividend to be a qualified dividend:

1. The dividend must be paid by one of the following:

- A U.S. corporation (including mutual funds)

- A corporation incorporated in a U.S. possession

- A foreign corporation located in a country that is eligible for benefits under a U.S. tax treaty that meets certain criteria

- A foreign corporation’s stock readily tradable on an established U.S. market (e.g., an American depositary receipt)

2. A specified holding period requirement must be met

Yes. A mutual fund generally can pass on the qualified dividends it receives.

Investors will receive this information on Form 1099-DIV, which is mailed in late January of every year.

You may also log in to your online account to view or download your Form 1099-DIV (if available) under Statements & Tax Forms.

Note: Tax forms are stored by tax year and not the calendar year they’re generated. To see when tax forms will be available, review the Tax form schedule.

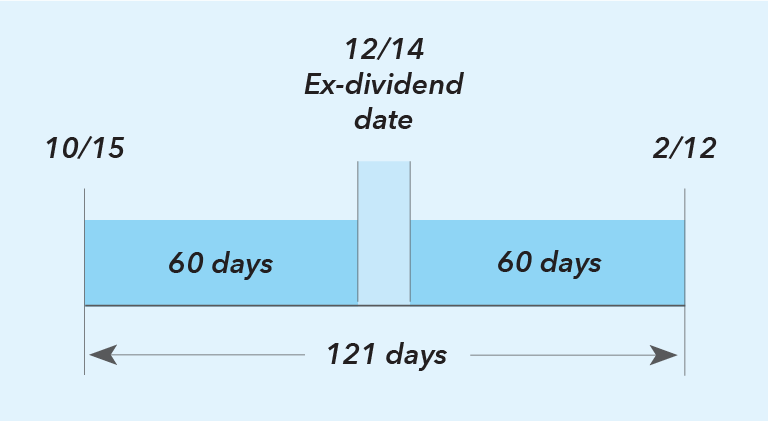

Yes. To be eligible to treat all or a portion of a fund’s dividend as qualified, an investor must have held the fund’s shares for at least 61 days during a 121-day period that begins 60 days before the fund’s ex-dividend date. You cannot count the day on which the shares were purchased or acquired by reinvesting dividends, but you can count the day the shares are sold when determining the holding period.

Example 1: Kate purchased shares of a mutual fund 60 days before its ex-dividend date. For a dividend to be qualified, she cannot sell her shares until the day after its ex-dividend date.

Example 2: Mark purchased shares of a mutual fund 2 days before its ex-dividend date. For the dividend to be qualified, he will have to hold his shares at least 59 days after the ex-dividend date.

Example 3: Karen purchased mutual fund shares on two separate occasions and subsequently sold all shares after the fund’s ex-dividend date. Karen’s first purchase met the holding period requirement, but her second purchase did not. Therefore, only the portion of the fund dividend attributable to the first purchase will be considered qualified.

No. A mutual fund may also pay income dividends that are not qualified, consisting of nonqualified corporate dividends (e.g., dividends paid by certain foreign corporations), interest income and net short-term capital gains.

The tax rate for qualified dividends is determined by an individual’s taxable income and filing status. The applicable rates are 0%, 15%* and 20%.*

Dividends that are not qualified dividends are taxed at the appropriate marginal tax rate for ordinary income.

* This rate does not include the 3.8% surtax applicable to net investment income for higher income taxpayers.

Generally, withdrawals from retirement accounts and annuities are taxed at ordinary income tax rates. The lower rates that apply to qualified dividends do not apply to withdrawals from these accounts.

Though the lower rates do not apply, retirement accounts and annuities remain attractive investment vehicles because earnings on these accounts can compound tax-free until withdrawn.

Individuals will need Form 1040 and related schedules.

You can order IRS forms and schedules by calling (800) 829-3676 or you can download them from the Forms & Instructions section at irs.gov.

Return of capital

A return of capital is created when a fund pays more in dividend distributions to investors than it earned on a tax basis during the fund’s fiscal year. This amount will be reported in box 3 of Form 1099-DIV as a nondividend distribution. This amount is not taxable as income; however, it will reduce the investor’s cost basis. A return of capital that exceeds an investor’s cost basis must be reported as capital gains.

A fund may distribute return of capital in order to pay dividends consistent with its respective yields. Only a limited number of fixed income American Funds are likely to pay return of capital distributions.

Investors will receive this information on Form 1099-DIV, mailed in late January of every year. The return of capital information will also be disclosed on our website.

You may also log in to your online account to view or download your Form 1099-DIV (if available) under Statements & Tax Forms.

Note: Tax forms are stored by tax year and not by the calendar year in which they’re generated. To see when the current year’s forms will be available, review the Tax form schedule.

While a return of capital is not taxable as income, it will reduce the investor’s cost basis. A return of capital that exceeds an investor’s cost basis must be reported as capital gains.

Cost basis

The cost basis of your mutual fund shares is typically the purchase price, including any sales charges you paid when you purchased your shares. Activity such as reinvested dividends/capital gains and wash sale adjustments may increase your cost basis, while other activity, including nondividend distributions (i.e., return of capital), may reduce your cost basis.

The Internal Revenue Service (IRS) phased in regulatory changes related to cost basis in 2012. As a result, the IRS requires mutual fund companies to report cost basis information to both investors and the IRS on the sale or exchange of fund shares acquired on or after January 1, 2012 — called “covered” shares.

The IRS regulations apply only to taxable accounts. Tax-favored accounts, including 529 and retirement accounts, are not required to report cost basis.

No. Broadly speaking, the IRS regulations apply to taxable sales and exchanges.

Tax-favored accounts, such as retirement and 529 accounts, are not required to report cost basis. Money market accounts that maintain a constant net asset value are not subject to the cost basis regulations.

When available, cost basis information is included on the Form 1099-B mailed to you in late January.

You may also log in to your online account to view or download your Form 1099-B (if available) under Statements & Tax Forms.

Note: Tax forms are stored by tax year and not by the calendar year in which they’re generated. To see when the current year’s forms will be available, review the Tax form schedule.

Yes, reinvested dividends and capital gains are considered additional purchases made at the net asset value share price on the day the reinvestment occurred.

We generally cannot determine the average cost basis for:

- Accounts opened on or before December 31, 1983

- Accounts with noncovered shares acquired by transfers

If you selected the specific lot identification method for covered shares, Capital Group will not be able to provide average cost information for the noncovered shares.

We provide several IRS-approved methods for determining your cost basis on covered shares — each with different tax implications.

Please consult your tax advisor to determine which method should be selected for your individual tax situation.

Cost basis method |

Description |

|---|---|

Average Cost |

This method is provided unless another cost basis method is requested. Determined by dividing the total cost of the shares owned at the time of the sale/exchange by the total number of shares owned to produce an average cost per share. Shares acquired first are sold first to determine your holding period. This cost basis method is our default for covered shares. Note: Average cost is calculated separately for covered and noncovered shares. |

First In, First Out (FIFO) |

Shares acquired first are sold first. |

Last In, First Out (LIFO) |

Shares acquired last are sold first. |

High Cost, First Out (HIFO) |

Shares with the highest purchase price are sold first. |

Low Cost, First Out (LOFO) |

Shares with the lowest purchase price are sold first. |

Loss Gain Utilization |

Shares are sold by taking losses first (short-term, then long-term) and gains last (long-term, then short-term). |

Specific Lot Identification |

You identify the specific shares you want to sell or exchange at the time of each sale or exchange. The original purchase dates and prices of the shares you choose will determine your cost basis and holding period. Note: If you select Specific Lot Identification, Capital Group will no longer be able to provide Average Cost information for your noncovered shares. Therefore, if you currently do not maintain records adequate to determine basis information for all of your noncovered shares, please consider this limitation before selecting Specific Lot Identification. |

The IRS website has many cost basis resources, including:

Mutual Funds (Costs, Distributions, etc.)

No. Each taxpayer’s situation is unique, so we encourage you to consult your tax advisor, investment professional or the IRS to determine which cost basis method to select.

The Specific Lot Identification method requires that you identify the specific shares you want to sell or exchange each time you want to make a sale or exchange. We recognize, however, that there may be situations where investors don’t specify the shares they want to use. In such instances, we ask investors to designate a secondary method we can use to make the sale or exchange. If an investor has not set up a secondary method, we’ll use First In, First Out as the default secondary method.

For most accounts, we’ve traditionally used the Average Cost method for cost basis reporting, and we’ll continue to use that method for your noncovered shares. If you have been using a method other than Average Cost, you can continue to use that method for your noncovered shares. If, however, you have used Average Cost for your reporting to the IRS in the past, it is our understanding that the IRS requires you to continue using Average Cost for noncovered shares going forward unless you received permission from the IRS to use another cost basis method. Please consult your tax advisor if you have questions about your individual situation.

When shares are sold or exchanged, the capital gain or loss is the difference between the proceeds from the sale or exchange and the cost basis of the shares.

Even though we will report cost basis for the sale or exchange of covered shares to you and to the IRS, you will be responsible for reporting any capital gain or loss information for both covered and noncovered shares to the IRS.

Whether you purchased your shares directly or through reinvestment, the length of time you owned the shares — their holding period — determines whether their gain or loss is considered long- or short-term:

- Long-term: shares held for more than one year

- Short-term: shares held for one year or less

Special rules apply to losses from the sale of shares held six months or less if you received capital gain distributions on those shares. Please consult your tax advisor for more information.

No, we do not report cost basis information for noncovered shares to the IRS.

Cost basis information for covered shares is provided on your quarterly statements and reported on Form 1099-B.

If cost basis information is available for noncovered shares, it is also provided on your quarterly statements and on Form 1099-B.

To view your cost basis information or change your cost basis method, log in to your account and go to Profile & Settings.

The cost basis information for covered shares generally transfers. The cost basis information for noncovered shares, however, is not required to be transferred with shares.

Yes, assuming we maintained a cost basis for the noncovered shares when originally acquired and we receive cost basis information on the transferred noncovered shares.

The IRS rules require us to track and report to the IRS cost basis for covered shares that are gifted or inherited. When noncovered shares are transferred, they remain noncovered. When covered shares are transferred, they remain covered if we receive the information required to calculate the cost basis.

Wash sales and covered and noncovered shares

IRS regulations make the distinction between covered and noncovered shares in a taxable account.

Covered shares are any shares acquired on or after January 1, 2012. The IRS phased in regulatory changes related to cost basis in 2012. As a result, we are required to report the cost basis for any sales or exchanges of covered shares to you and the IRS.

Noncovered shares are any shares acquired before January 1, 2012, and any shares for which cost basis is unknown. We are not required to report cost basis for these shares to the IRS.

In general, a wash sale occurs if you sell or exchange fund shares at a loss and, during the 61-day period beginning 30 days before the sale or exchange, you purchase the same fund shares, regardless of the account. The loss is not allowed for tax purposes and must be added to the cost basis of the repurchased shares. The regulations require us to track wash sales separately for covered and noncovered shares and within the same fund and share class. As was the case prior to the regulations, investors must apply the wash sales rules across all of their accounts in the same fund.

If within 90 days of redeeming shares you purchase shares in the same fund or another one of the American Funds (except American Funds U.S. Government Money Market Fund), and you notify us that you're using the right of reinvestment, the purchase may be made without a sales charge. Any sales charge on the shares initially purchased may not be included in the basis of the shares redeemed if the subsequent purchase occurs before February 1 of the following year. Such sales charge must be added to the cost basis of the newly acquired shares.

IRS regulations require us to apply the load deferral rules only within the same fund and share class. As was the rule prior to the regulations, you must apply the load deferral rules across all American Funds.

For example, assume an investor purchases The Growth Fund of America® on March 5 with a sales charge and sells The Growth Fund of America on April 12. Further assume that the investor uses the right of reinvestment to acquire shares in The Income Fund of America® on July 6 without a sales charge. Although we’re not required to apply the load deferral rules because the later purchase was in a different fund, the investor is required to apply the load deferral rules. The sales charge paid for The Growth Fund of America shares may not be included in the basis of The Growth Fund of America shares sold on April 12. Instead, the sales charge is added to the basis of The Income Fund of America shares acquired on July 6.

Noncovered shares will be redeemed before covered shares unless you select the Specific Lot Identification method and identify covered shares to be redeemed.