In observance of the Christmas Day federal holiday, the New York Stock Exchange and Capital Group’s U.S. offices will close early on Wednesday, December 24 and will be closed on Thursday, December 25. On December 24, the New York Stock Exchange (NYSE) will close at 1 p.m. (ET) and our service centers will close at 2 p.m. (ET)

401(k)s and other salary deferral plans

-

-

Why participate?

A salary deferral plan lets you shape your own retirement savings program so you can think beyond Social Security benefits. Below are three reasons to participate.

Everybody loves a tax break

Your employer’s 401(k) plan probably uses one or both of the following contribution methods. Each offers a tax benefit:

- Traditional contributions: You’re getting a tax break up front with traditional contributions because the money going into your account has not been taxed. By postponing taxes until you take withdrawals, you have more money working for you.

- Roth contributions: Money going into a Roth account is taxed before you invest it, but qualified withdrawals, including any earnings, won’t be taxed.*

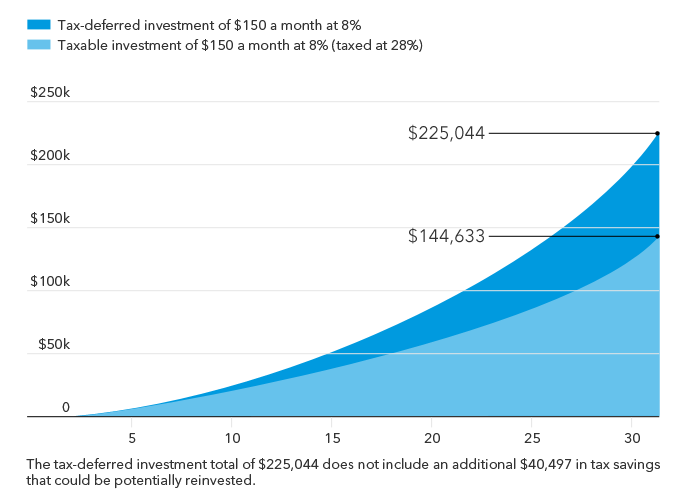

Check with your employer to find out which contribution types your plan offers.The chart below shows the hypothetical growth over 30 years of a traditional, tax-deferred investment compared with a taxable account.

- Traditional contributions: You’re getting a tax break up front with traditional contributions because the money going into your account has not been taxed. By postponing taxes until you take withdrawals, you have more money working for you.

This illustration compares investing before taxes are paid with investing the same amount after taxes are paid. Taxes are paid annually out of the taxable account. If a lump-sum withdrawal was taken at the end of the investment period, the full accumulation value of the tax-deferred savings would be subject to taxation as current income. This may or may not be to your advantage. Talk to your financial professional or tax advisor about withdrawal options. The value of a lump-sum withdrawal at the end of the period, assuming a 28% federal tax rate, would have been approximately $162,032. Exemptions and other taxes are not reflected. Assumes a hypothetical 8% return rate, compounded monthly, and a 28% federal tax bracket. While no further taxes are due on the taxable amount, any distribution from the tax-deferred account would be fully taxed, and, if applicable, subject to additional penalties for early withdrawal. Regular investing does not ensure a profit or protect against loss. Carefully consider your current and anticipated investment horizon and income tax bracket when making investment decisions, as this illustration may not reflect these factors.

You wouldn’t turn down free money

Many companies offer matching funds as an incentive to encourage employees to contribute to their salary deferral accounts. If your employer offers to match your retirement contribution, take it. It’s as if your employer is paying you a bonus — and all you have to do is save in the plan. Contribute at least enough to get the full match. If the match is in company stock, think about diversifying the rest of your account. The match is part of your benefits package. Don’t walk away from it.

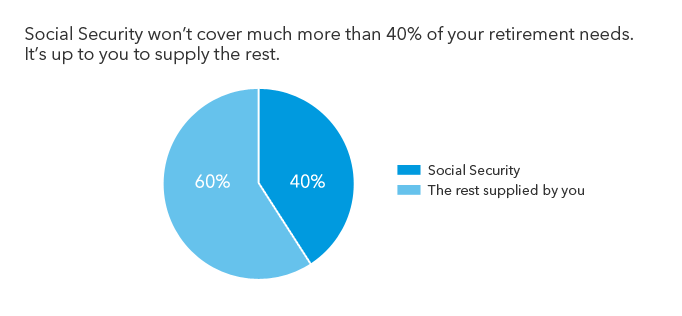

Social Security won’t be enough

If you plan to rely on Social Security to pay all your bills, your retirement dreams may need to be trimmed back. The rule of thumb is that Social Security probably represents only 40% of your retirement needs. In January 2022, the average monthly benefit for a retired worker was $1,660.90†. Even with cost-of-living increases, this won’t buy the kind of retirement most Americans dream about. When you participate in your retirement plan, you take control of supplementing Social Security.

Visit the Social Security Administration website for more information about the retirement benefit you can expect.

-

Plan types

Salary deferral plans include:

- 401(k)s — generally sponsored by public and private companies

- 403(b)s — sponsored by nonprofit organizations, such as hospitals, schools and religious organizations

- 457(b)s — for government employees

- SIMPLEs — for small businesses

-

Payroll deductions

If you contribute to an employer-sponsored salary deferral plan, money will be transferred directly from your paycheck to the investment options you’ve selected. Payroll deduction makes it easy to save.

If your 401(k) or 403(b) plan accepts Roth contributions, limits apply whether contributions are pretax, Roth after-tax or a combination of both. Your plan’s rules may vary.

-

Vesting

In a salary deferral plan, you are always 100% vested in your own contributions. However, you’re often required to work for your employer for a certain length of time to become vested in any employer contributions.

If you leave the company before becoming fully vested, you may forfeit part or all of the employer contribution. If you’re fully vested when you leave the company, the entire employer contribution is yours.

-

Rollover options

If you don’t need the money right away, consider transferring your assets into a rollover IRA or, possibly, into a new employer’s plan. This can allow you to delay applicable taxes, avoid possible penalties and continue benefiting from tax-advantaged growth potential. You may also be able to leave your assets in your former employer’s plan if your balance is large enough. Cashing out of your salary deferral plan is an option, but you’ll have to deal with the tax consequences. Check with your employer for more details.

-