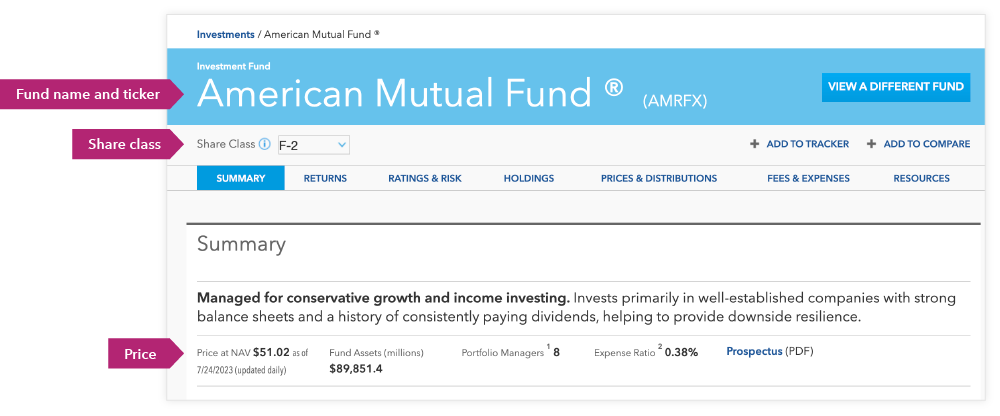

Fund name and ticker

The ticker symbol (the letters after the name) is the most accurate way to search for a fund. It’s unique to the fund and share class and is used by third parties, like Morningstar® and brokerage firms. It’s also useful to refer to when you’re comparing two funds with similar names.