Market Volatility

Europe

- The European economy is struggling with global trade disruption and political turmoil.

- Central bank officials are responding with another substantial dose of monetary stimulus.

- Despite economic headwinds, company-specific investment opportunities remain.

It’s been another disappointing year for the European economy, even though 2019 is only two-thirds done.

The United Kingdom is beset with Brexit uncertainty. Germany is teetering on the verge of recession. Protests in the streets of Paris until recently threatened to destabilize the French government. On top of all that, global disruption from the U.S.-China trade war has weighed heavily on Europe’s export-dependent economy.

“I doubt many Europeans will be sad to see 2019 fade into history,” says Capital Group economist Robert Lind. “It’s been a tough year politically, economically and in the broader societal context.”

However, there is reason to think 2020 will be better, Lind explains. There are several important “ifs” in play: If a truce can be negotiated on the global trade front, if central bank stimulus measures do their job and if a Brexit resolution is finally achieved, those events could remove the large cloud of uncertainty that has hampered European economic growth in recent years.

Stimulus on the way

“Broadly speaking, I think the European economy should gradually start to show signs of improvement in 2020 as some political risks begin to diminish and as looser monetary and fiscal policy work their way through the system,” Lind says.

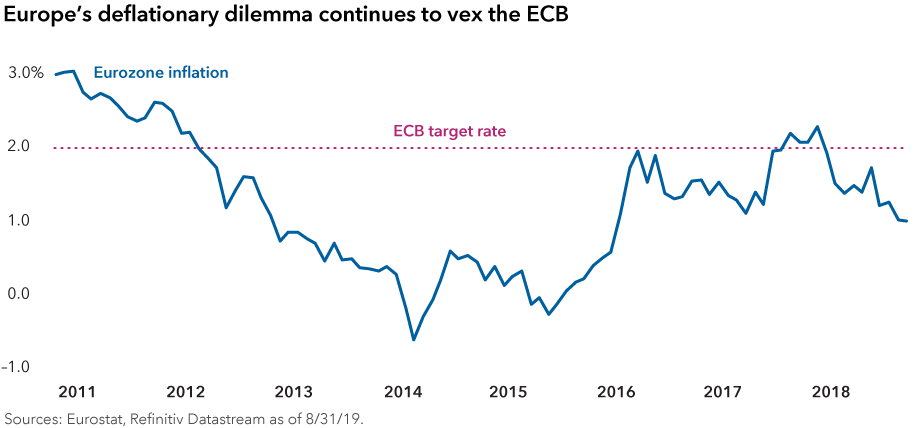

The European Central Bank last month cut its key policy rate further into negative territory, from –0.4% to –0.5%. ECB officials also said they would relaunch a €20 billion per month bond-buying program in a bid to spark inflation and jumpstart the European economy. Many eurozone governments also have been loosening fiscal policy to help the cause.

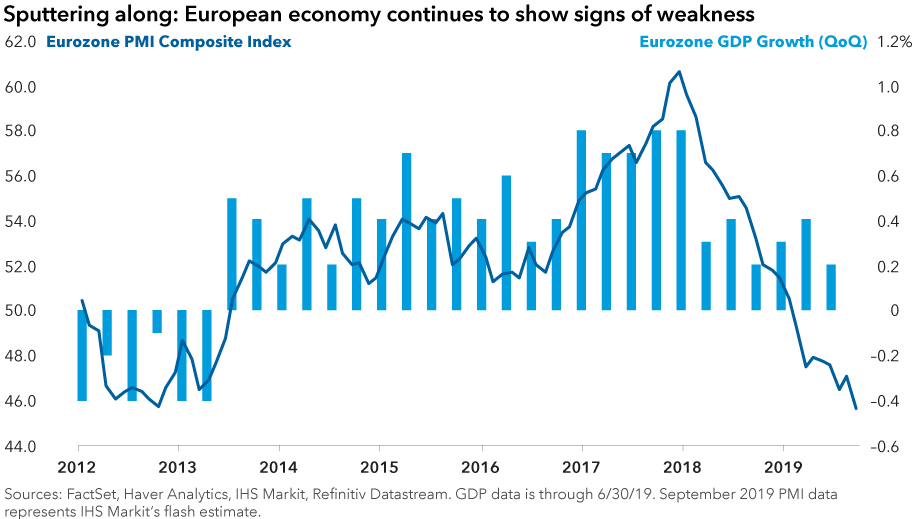

Inflation has been running far below the ECB’s target rate of roughly 2% a year, and GDP growth has hovered around 1% on an annualized basis. That’s about half the growth rate of the U.S. economy.

Outgoing ECB President Mario Draghi said aggressive stimulus measures are necessary to help offset the damaging effects of trade wars and slowing economic growth around the world. Draghi’s successor, former IMF chief Christine Lagarde, is expected to continue advocating for Draghi’s policies when she takes office November 1.

Another unique challenge to the European economy: the U.K.’s bid to leave the European Union. The U.K. faces an October 31 deadline to approve a hotly debated withdrawal agreement, although it now appears likely that British lawmakers will seek another extension in the long-running Brexit negotiations.

Meanwhile, Germany is nearing a recession as the U.S.-China trade dispute hammers the German manufacturing sector, particularly the auto industry. Germany’s economy shrank by 0.1% in the second quarter and is expected to fall further when third-quarter data is released. A recession is commonly defined as two consecutive quarters of negative growth.

Currency tailwind coming?

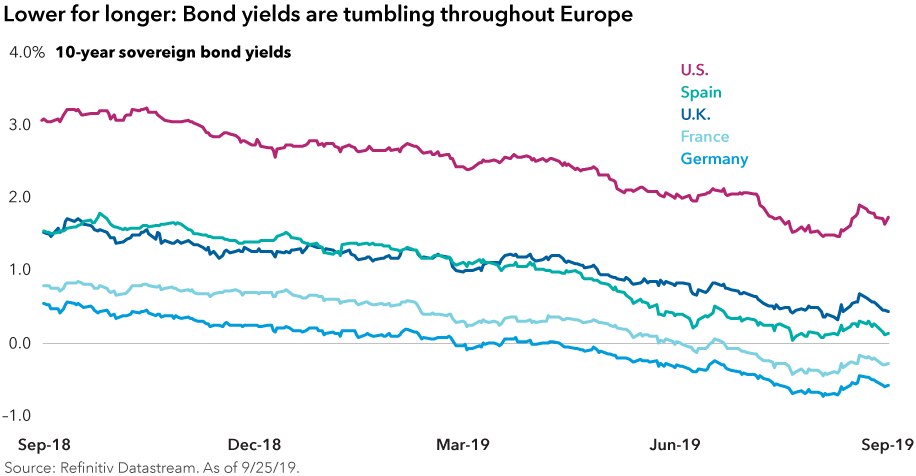

Since the ECB’s September rate cut, the euro has continued to weaken against the U.S. dollar, extending a strong dollar trend that has continued for years. On a year-to-date basis, the euro has declined more than 4% as negative interest rates in the eurozone (coupled with higher rates in the U.S.) have made dollar-based assets generally more attractive to investors.

The dollar is significantly overvalued against the euro, says Jens Sondergaard, a Capital Group currency analyst. Once that trend reverses course, he notes, it could provide a nice tailwind for euro-denominated assets.

Sondergaard expects the dollar to weaken in 2020–21 as U.S. economic growth softens, but he concedes that currency movements are notoriously difficult to predict. In the short term, the euro could fall further as the U.S. and European economies diverge.

“The relationship between interest rates and currencies has essentially broken down in a negative-rate world,” Sondergaard says. “We shouldn’t expect that correlation to return anytime soon. The more important drivers of currency movements today are relative bond flows and relative growth expectations.

“So, the big question is, can the euro rally when the U.S. economy starts to weaken?” Sondergaard asks. “That remains to be seen.”

Investment implications

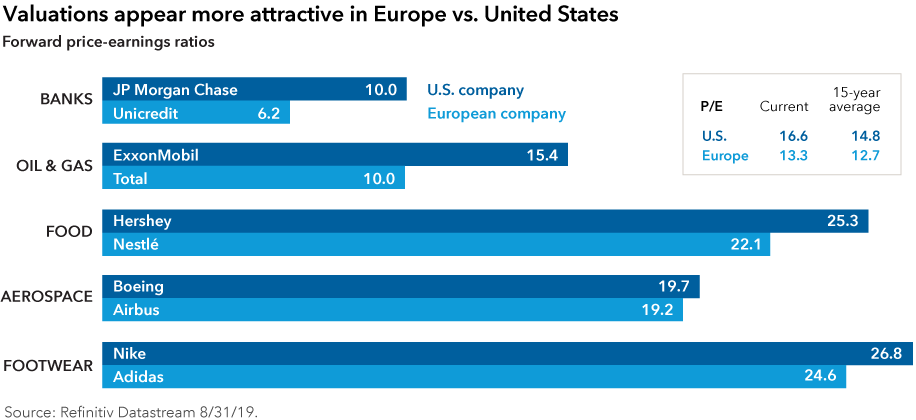

Despite the economic headwinds, or perhaps because of them, Europe is a classic stock-picker’s market, says Carl Kawaja, a portfolio manager with American Funds EuroPacific Growth Fund®. Investors can’t rely on robust economic growth to lift share prices, which places more emphasis on company fundamentals.

“Uncertainty creates opportunity,” Kawaja says. “We like it when things are a bit murky and difficult to figure out. In this type of environment, we are finding no shortage of compelling opportunities in Europe, both from a growth perspective and from a valuation perspective.”

On the growth side, Kawaja looks for fast-growing companies that are disrupting their respective industries. On the value side, he sees interesting opportunities in some hard-hit European auto companies.

It is important to note that although European stocks have continued to lag U.S. equity markets this year, European returns have still been solid on an absolute basis. As of September 27, the MSCI Europe Index is up 14% in U.S.-dollar terms and more than 18% in local currency. By comparison, U.S. stocks have gained nearly 20% so far this year, as measured by the S&P 500 Index.

Although European economic growth has been disappointing so far in 2019, investment returns have charted a decidedly different course — which serves as a timely reminder that the economy and the stock market aren’t always on the same page.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

The MSCI Europe Index is designed to measure developed equity market results across 15 developed countries in Europe. The MSCI World ex USA Index is designed to measure equity market results of developed markets. The index consists of more than 20 developed-market country indexes, excluding the United States. The MSCI Emerging Markets Index is designed to measure results of more than 20 emerging markets. MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

Standard & Poor’s 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Market Volatility

-

Market Volatility

-

Market Volatility

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Carl Kawaja

Carl Kawaja

Robert Lind

Robert Lind

Jens Søndergaard

Jens Søndergaard