Municipal Bonds

Energy

Is there more fuel in the tank for energy stocks?

That’s the question on many investors’ minds as the energy sector solidly outpaced all others over the past two years. Historically, the trajectory of oil prices has been a good gauge of prospects for the sector, as the price directly impacts many companies’ bottom lines. But thus far in 2023, there appear to be some deviations from this tried-and-true correlation. In fact, oil prices took a tumultuous ride last year, recently returning to near where they started in 2022. In contrast, energy stocks continue to mostly hold onto their gains.

1. Will the bull run for oil equities continue?

We believe we’re in the early stages of a multiyear bull run for oil stocks. That does not mean the energy sector — led by oil stocks — will move in a straight line. Amid long uptrends, there are also mini-cycles, some lasting months to a year or more, in which short-term factors outweigh longer term supply-demand trends. Nevertheless, we see investment opportunities over the next three to five years.

China’s reopening and lifting of COVID-19 restrictions is likely to push oil demand to new highs, with the International Energy Agency (IEA) forecasting an increase of nearly 2 million barrels per day. Meanwhile, there is a structural supply shortage due to many years of underinvestment in new capacity by oil companies, production cuts from the Organization of Petroleum Exporting Countries (OPEC+) with output undershooting supply targets, and declining U.S. shale inventories. It will take a number of years before we see supply catch up with demand. Together these factors should be supportive of oil prices above $70 per barrel.

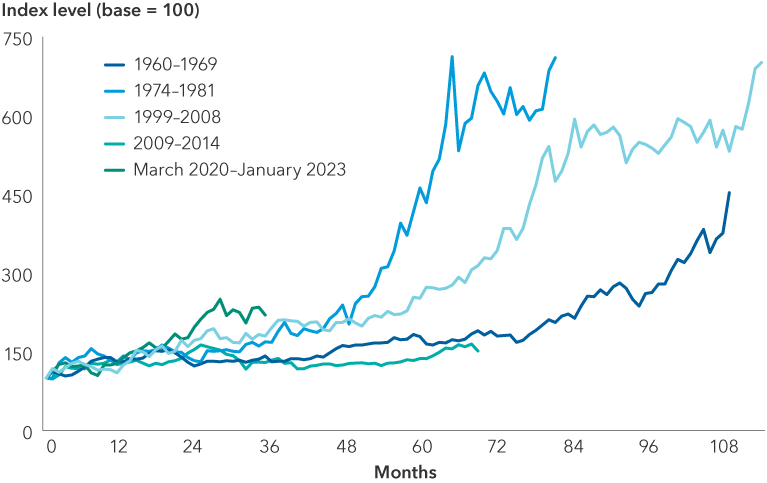

Analysis of prior energy equity bull markets (we show Canada, as an example, in the chart below) suggests we may still be in the early innings of a positive rerating for the sector. Supported by higher energy prices, companies in the sector generated a record-breaking estimated $1.4 trillion of free cash flow (FCF) in 2022. Valuations remain attractive across a number of metrics including price-to-earnings and price-to-book ratios. And the resilience of oil stocks in the face of falling oil prices over the last three months suggests investors are looking past any near-term weakness in the underlying commodity price.

Energy equity bull markets have often shown staying power

Sources: Bloomberg, Peters & Co. Limited, S&P/TSX (Canada) Composite Index performance. Data as of January 25, 2023.

2. What are top spending priorities for oil companies?

The industry business model has largely pivoted from a focus on high growth and reinvestment in production to a focus on higher dividend payouts and more capital discipline. This has been one of the most pronounced changes we’ve seen in our lifetime. And this trend looks set to continue. Record-breaking cash flow over the last 12 months has left oil producers with some of the strongest balance sheets in history. Nearly 40% of executives from the top 100 oil and gas companies in the U.S. indicated debt reduction and shareholder returns as their top capital allocation priorities, according to a 2022 study by Deloitte.

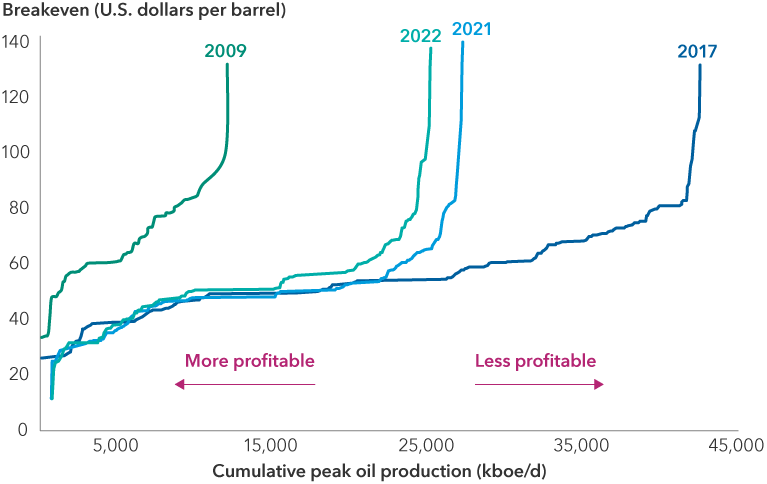

The shortening and steepening of the cost curve is benefiting oil producers

Sources: Capital Group, Bloomberg, Goldman Sachs. Data as of April 2022.

The cost curve indicates how much oil would be produced for a given price — a function of determining profitability for producers above the breakeven cost of drilling a new oil well. Short and steep cost curves generally enable producers to generate higher profits. Kboe/d = thousand barrels of oil equivalent per day

This renewed focus on shareholder returns has emerged because investors are demanding capital discipline. Investors who are willing to engage now are pressing for dividends and share buybacks rather than reinvestment at higher prices. It is likely going to be another 12 to 18 months before we see producers start to reinvest in their businesses while still maintaining a sharp focus on capital discipline and return on investment.

Supply-demand dynamics also support a higher oil price. It will take years for supply to catch up with demand as illustrated by widening OPEC+ production deficits and forecasted dwindling global spare capacity. Of the major oil-producing countries, Saudi Arabia could increase capacity by a million barrels per day and the United Arab Emirates by another million. But it would take years to build out that capacity, and U.S. production is slowing quite quickly. Taken together, there’s just not enough oil to bolster global supply.

Moreover, exploration costs are going up. Higher quality oil reserves have been used up, and further exploration is getting more expensive and requires greater expertise as drilling goes further afield. U.S. exploration and production companies lack the expertise for advanced exploration and will likely have to acquire companies that know how to tap into these oil fields to bring new supply to market. Additionally, oil services costs have risen with inflation. The higher cost structure is impacting the entire industry but will most acutely affect smaller companies with fewer resourcing options.

Taking demand and supply dynamics into consideration, in our view, $70 per barrel of oil is a floor that should hold under most scenarios, and our analysis shows this would allow the major oil companies to maintain profitability, even when factoring in inflation and higher costs of production.

3. What is the impact of the Inflation Reduction Act on energy companies?

The Inflation Reduction Act of 2022 is a landmark piece of legislation. The bill directs $369 billion in federal funding to clean energy tax incentives, loans, and consumer and commercial subsidies that have the potential to make the return profile more compelling for investments in areas such as carbon sequestration and the build-out of clean hydrogen infrastructure.

Over the next decade, the legislation could help to unleash a wave of capital expenditure. Oil and gas companies alongside chemicals and auto manufacturers are just a few potential beneficiaries. Only a handful of the U.S. supermajors have scalable low-carbon projects underway, but the subsidies in the Inflation Reduction Act are likely to move others off the sidelines.

Amid the optimism, it’s fair to say that some firms are proceeding cautiously, mindful that policy priorities could adjust with changes in the balance of political power. The Biden administration is supportive of investment in renewables; however, if there is a change in administration in the next election or if energy prices become too high, priorities could easily shift back in favor of fossil fuels to help lower costs.

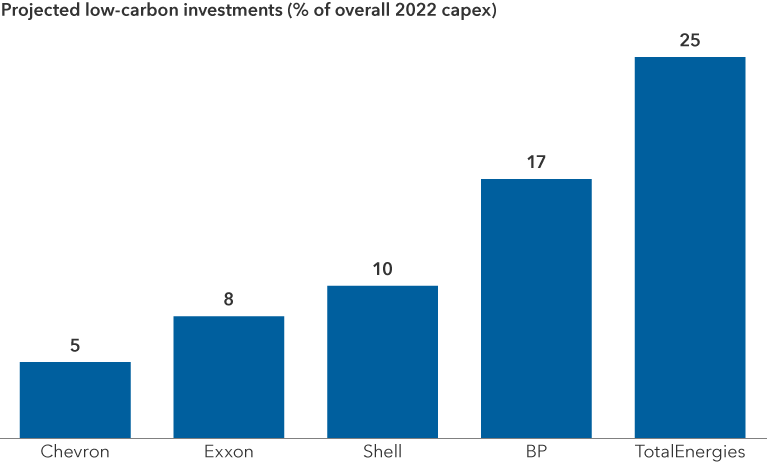

4. How do European and U.S. companies differ in their approaches to decarbonization?

Oil and gas companies, regardless of region, are seeking new ways to reduce emissions in their operations. One of the key drivers of this change in behavior has been the proliferation of net-zero targets, where the amount of human-produced greenhouse gas emissions is balanced by an equal reduction.

European oil and gas companies are proactively seeking replacements for their fossil fuel businesses, while U.S. companies are primarily focused on how to remove carbon from their existing businesses. They are leveraging tactics such as carbon sequestration — in which carbon dioxide is removed from the atmosphere and held in solid or liquid form — rather than looking to diversify their energy mix.

European supermajors are investing more capital into low-carbon investments

Source: InfluenceMap. Data as of September 2022.

Capital expenditure figures are taken from information disclosed directly by the company. It is noted that investments dedicated to transitioning away from fossil fuels are likely lower, as several companies include fossil gas-related activities in their “low-carbon” capex.

Like their U.S. counterparts, European firms are incentivized by new legislation. The REPowerEU plan, adopted by the European Commission in March 2022, directs nearly €210 billion in new investments toward clean energy in the European Union. The bill finances new energy partnerships with renewable and low-carbon gas suppliers, as well as clean hydrogen projects and solar and wind build-outs.

Failure to invest now in renewable infrastructure results in the risk of companies being disrupted later on. And it’s not just a matter of environmental, social and governance concerns. There’s a risk of market share loss as overall demand for renewables increases.

5. Where do you see areas of relative value?

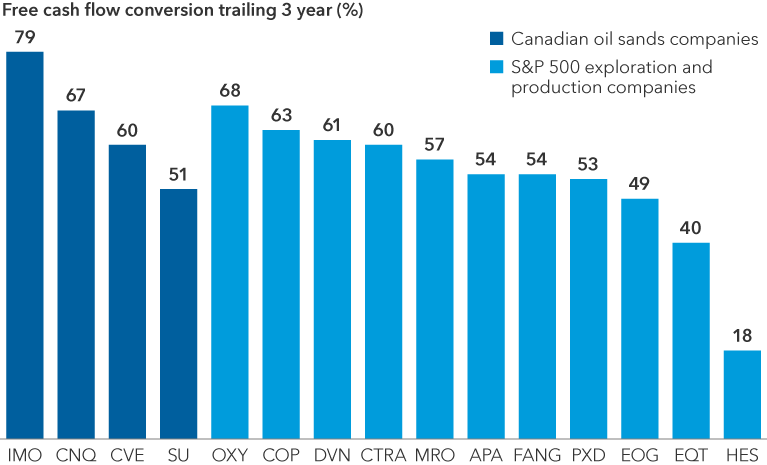

There’s a fairly widespread view that production costs in the Canadian oil sands, located in the Alberta region, are high. But the facts on the ground are changing. The cost of oil production there has declined over the last two decades. The long-life, low-decline nature of these assets means the capital intensity required to maintain operations is comparatively low versus U.S. peers, and it enables high free cash flow generation, which is cash flow in excess of the company’s operating and capital expenses. In addition, the Canadian oil sands stocks often trade at valuation discounts to the U.S. exploration and production peer group, and that is due in part to environmental concerns and the high carbon intensity of production per barrel.

Lower capital intensity for the Canadian oil sands supports high free cash flow conversion

Sources: Company filings and Capital Group analysis. Free cash flow conversion is a ratio that indicates how much cash is available to a company after covering its operating and capital expenses, an indication of its capital intensity. Defined here as free cash flow divided by cash flow from operations.

Companies highlighted: Canadian oils sands (IMO = Imperial Oil; CNQ = Canadian Natural Resources Limited; CVE = Cenovus Energy; SU = Suncor Energy). S&P 500 exploration and production (OXY = Occidental Petroleum Corporation; COP = ConocoPhillips; DVN = Devon Energy Corporation; CTRA = Coterra Energy; MRO = Marathon Oil Corporation; APA = APA Corporation; FANG = Diamondback Energy; PXD = Pioneer Natural Resources Company; EOG = EOG Resources; EQT = EQT Corporation; HES = Hess Corporation).

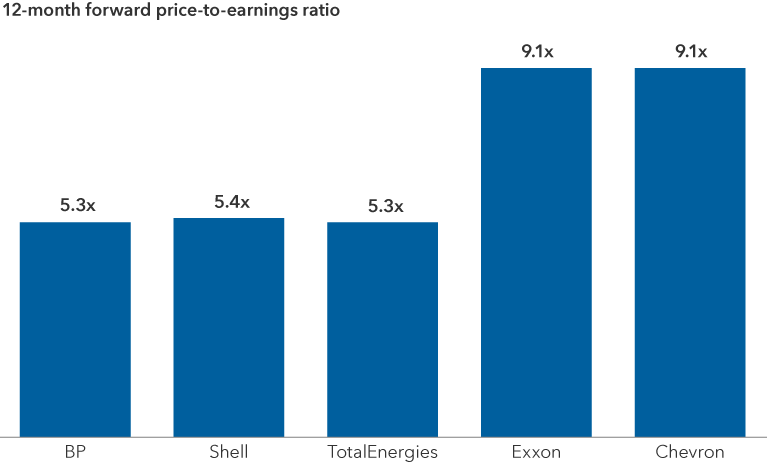

The management teams of select U.S. and European oil giants are operating with the strongest capital discipline seen in decades, and dividends offer some cushion for investors even if oil prices soften from here. The supermajors may benefit from higher-for-longer oil and gas prices supporting upstream exploration and production companies — in addition to record high downstream refining margins that purely upstream companies do not have exposure to. On a valuation basis, the European supermajors trade at a wider-than-usual discount versus their U.S. peers on price-to-earnings multiples, despite very similar business characteristics.

European supermajors trade at a significant discount to their American rivals

Source: Bloomberg. Data as of January 25, 2023.

Bloomberg® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The S&P/TSX Composite is the headline index for the Canadian equity market. It is the broadest in the S&P/TSX family and is the basis for multiple sub-indices including but not limited to equity indices, Income Trust Indices, Capped Indices, GICS Indices and market cap based indices. The Toronto Stock Exchange (TSX) serves as the distributor of both real-time and historical data for this index.

The S&P/TSX Composite Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

RELATED INSIGHTS

-

-

Global Equities

-

Market Volatility

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Craig Beacock

Craig Beacock

Darren Peers

Darren Peers