Technology & Innovation

Cloud software stocks — which soared to dizzying heights during the pandemic — have been in a painful downward spiral since November.

For the three months ended January 31, 2022, the BVP NASDAQ Emerging Cloud Index, a measure of cloud-based software companies, plummeted 28.5%. That compares with a decline of 2.0% for the Standard & Poor’s 500 Composite Index, which measures the broader U.S. stock market.

Why have these companies fallen so suddenly out of favor? In part, it’s due to expectations that the Federal Reserve will soon hike interest rates. Such hikes tend to have a more adverse impact on fast-growing businesses like cloud software, also known as software as a service (SaaS), than on the broader market. Higher interest rates reduce the current value of the much higher earnings such businesses expect to generate further into the future. In addition, valuations have ballooned over the past decade, with many software stocks reaching all-time highs in 2021.

Investors might also wonder if many of these companies have grown too fast. After a decade-long sprint supercharged by the pandemic, has cloud software run into a wall?

“It’s been a great 10 years for software, but I think we’re far from done,” says equity investment analyst Julien Gaertner, who covers U.S. software companies. “In my view, we are still in the early innings of this transition. I continue to be positive about the long-term outlook for the software industry.”

You've discovered one of Capital Group's 10 investment themes for 2022

Fasten your seatbelts for software volatility

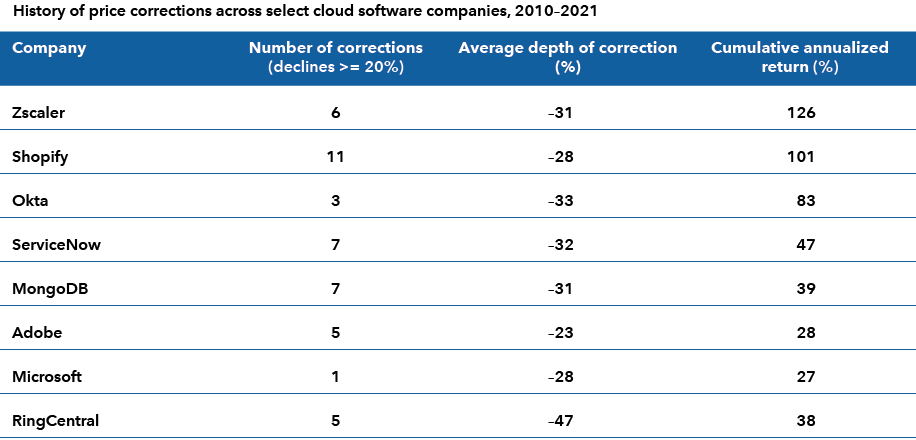

Bouts of intense volatility are nothing new for software stocks. In recent years, software companies as a group have sustained steep declines of 20% to 35% about every 18 months, so investors must have strong stomachs and no small amount of patience.

“My approach to these periods has been consistent,” Gaertner says. “I focus on long-term fundamentals and see if the market opens up opportunities to build positions at attractive prices. We may only see these prices for a short time or not at all, so the key is to be ready.”

Frequent corrections have been the norm for software stocks

Sources: Capital Group, Morningstar Direct. Corrections are defined by a share price decline of 20% or greater. The reference period for number of corrections, average depth of correction and cumulative return calculations begins in 2010, or date of company IPO, whichever is earlier. As of December 31, 2021.

Software’s potential underestimated by the market

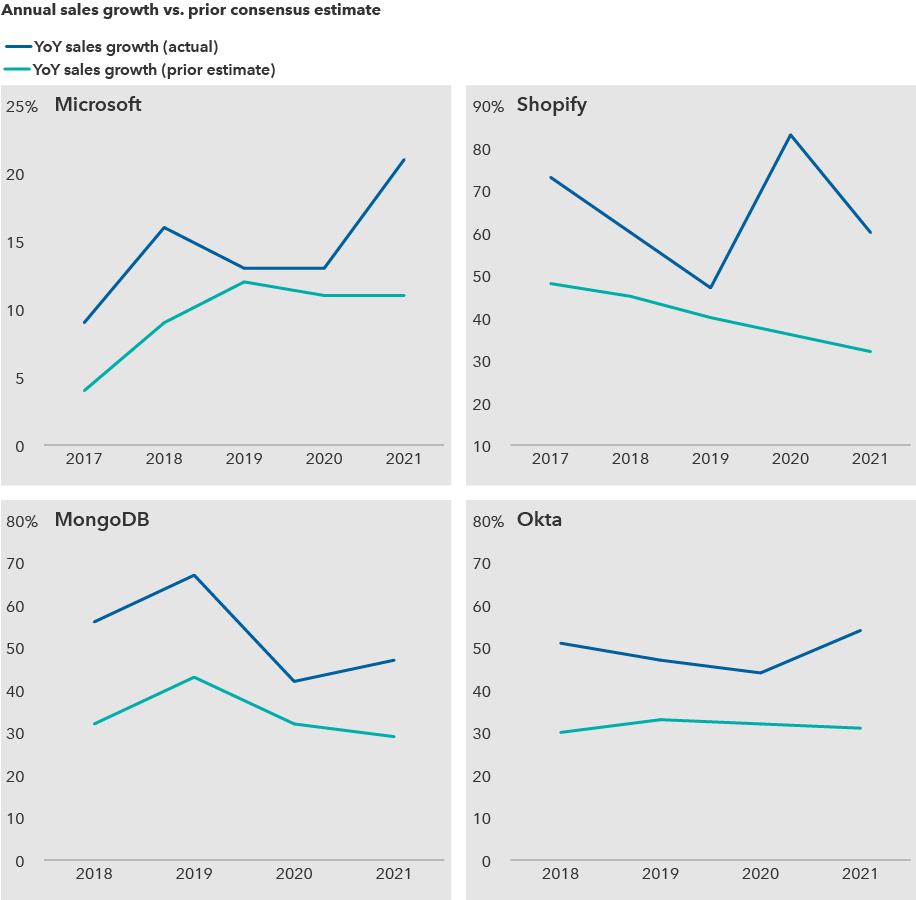

Many industries experience periods of innovation and rapid growth, but the software industry is unique for sustaining unusually high rates of growth for long periods.

“I cannot identify another industry that has the growth duration characteristics of the software industry. These companies have expanded scale and improved business models at a pace that is rare in any industry” Gaertner says. “Over time, the market has tended to underestimate just how long these companies can grow at elevated rates.”

Consider Workday, which offers HR management software as a subscription service through the cloud. When the company went public in 2012, it was adding roughly $100 million of recurring revenue a year. Today, best-in-class software companies can potentially add about $100 million in recurring revenue per quarter, Gaertner says. “And I expect that potential growth rate to double again over the next few years,” he adds.

Further adjustments to cloud software business models could drive further acceleration. “Today companies like Snowflake are using consumption-based business models, which could potentially quicken growth even more,” Gaertner says.

The duration of growth for leading cloud software makers has outpaced expectations

Sources: Capital Group, Refinitiv Datastream. Prior estimates are based on consensus analyst estimates as of one year prior to actual sales results.

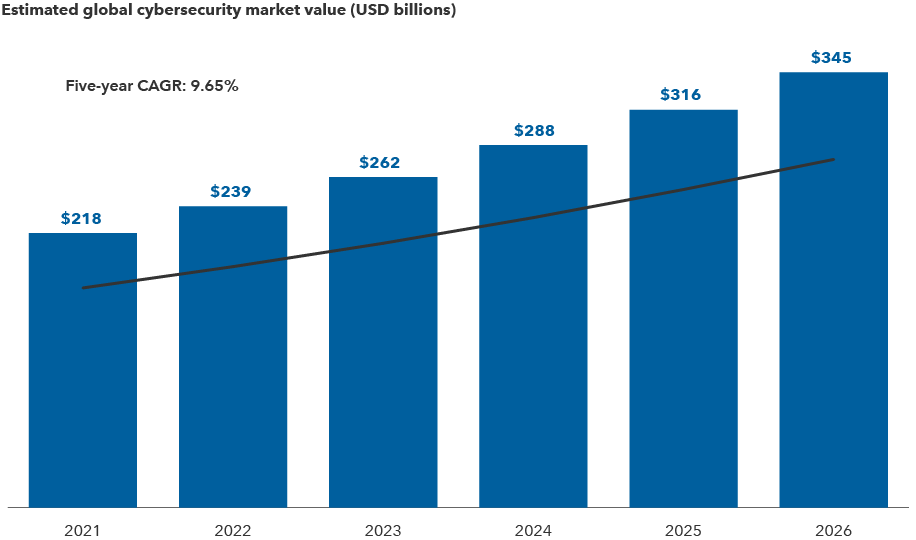

Cybersecurity and the next wave of growth

One trend driving software opportunity is the rapidly growing need for more and better cybersecurity. Shifting the world’s data and workloads to the cloud has expanded the potential for security threats. This trend was amplified by the pandemic rush to a digital future.

In 2021 alone, major cyberattacks included the REvil ransomware attack by Russian hackers in April and a breach of Colonial Pipeline’s systems in May, while in December a serious vulnerability in Log4j software reportedly exposed more than 89% of the world’s IT environments.

“It’s crazy what is happening today,” Gaertner says. “Major new threats seem to arise every couple of months. I believe we are all underestimating just how much cybersecurity will change the world over the next 10 years.”

The transition to the cloud has precipitated a shift toward a new approach to cybersecurity called zero trust architecture. This requires user authentication and management for each service and all information accessed.

“The legacy security providers have been slow to adapt to the zero trust model,” Gaertner explains. “And several innovative, smaller software companies have emerged to fill the void.”

For example, Zscaler, a cloud-based enterprise network security company founded in 2007, provides secure entry to both locally hosted and externally hosted applications. Okta, an identity and access management company, offers a system that allows a user to access several systems using a single sign-on process.

The need for cybersecurity expected to soar as the cloud expands

Sources: Capital Group, Statista. "CAGR" represents the compound annual growth rate. As of August 2021.

Taking aim at the database Goliaths

Less visible than cybersecurity but no less ripe for disruption is the database software market. This is an enormous market opportunity, according to U.S. software analyst David Penner. “Every application created needs an underlying database on which to run,” Penner says. “So as the world of software expands, the database market expands.”

Capital Ideas™ webinars

Insights for long-term success

Customers tend to remain with a database provider for years, or even decades, because once the databases are integrated into business processes, they are hard to change. The database market is “sticky” — but also somewhat sleepy.

Legacy database providers have been slow to adapt, making them targets for new competitors. “The world has been running on Oracle databases for decades,” Penner explains, “but new providers like MongoDB are beginning to challenge Oracle and other database giants.” Founded in 2007, the cloud-oriented database provider achieved growth of 50% for its most recently reported quarter, higher than the 44% growth in the prior quarter. “This is a company that appears to be emerging as a next generation leader.”

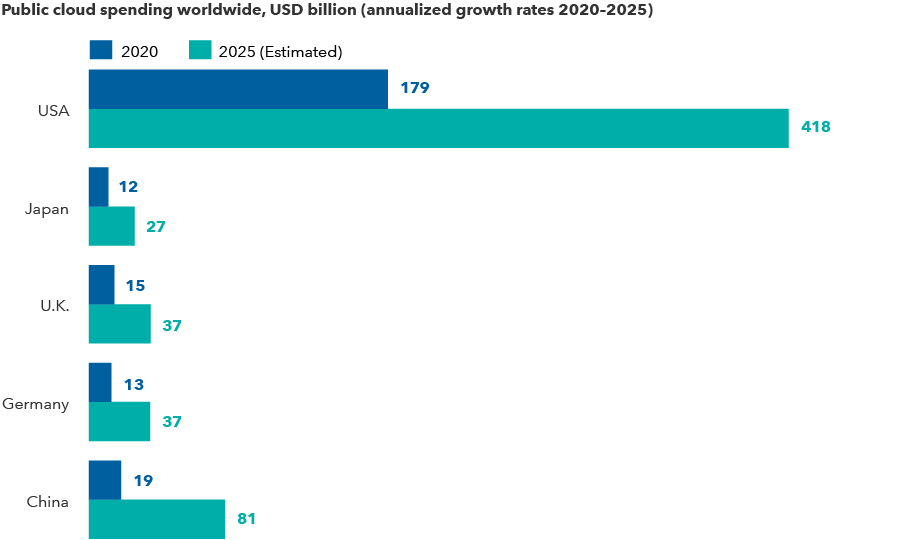

Cloud transition is going global

The rise of start-up cloud software makers doesn't always come at the expense of legacy giants. Microsoft, for example, has made the transformation to cloud with its Office software and its cloud infrastructure service Azure.

“Microsoft is unique in that they built their franchise during the PC revolution, then went through the desert for a while,” Penner says. The company was regarded as an aging dinosaur until Satya Nadella was named CEO in 2014. “Nadella and CFO Amy Hood drove a change in culture and strategy. Today you have a company transitioning its legacy products to the cloud and subscription services. And it's turning into the world's largest SaaS company.”

The cloud model is also expanding the software market into new territory: small businesses — a segment of the market that was historically uneconomical to serve. But now a new generation of companies are offering a broad range of services to small businesses. Examples include Shopify, the maker of e-commerce tools; HubSpot, a sales and marketing platform; and Paycom, a payroll and human resources provider.

“Customers can go to these companies’ websites and, with the swipe of a credit card, start operating on the software the same day,” Penner says. “Self-service software vendors like these didn’t really exist before the transition to the cloud model.”

Cloud adoption could gather steam as the world catches up with the U.S.

Source: IDC, Worldwide Public Cloud Services Spending Guide. Data as of June 2021.

The bottom line: Use pullbacks to build selective positions

With valuations for many software companies driven to all-time highs in 2021, investing in the industry comes with no small amount of risk. Even after the recent sell-off, the industry overall continues to be relatively expensive.

“Valuations are high when you look at average or index levels, and I wouldn’t be surprised to see valuations compress further,” Gaertner says. ”Software is an area that I believe will continue to grow rapidly thanks to the shift to the cloud. The key for investors is selectivity and patience.”

Penner agrees. “The cloud has been the next new thing for 10 years, but I believe it is still the next new thing. Nothing goes on forever, but as long as computing keeps getting cheaper and software keeps getting smarter, I see no reason for it to end anytime soon.”

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

BVP NASDAQ Emerging Cloud Index is designed to track the performance of companies providing cloud-based software and services.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

©2022 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Standard & Poor’s 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

-

Artificial Intelligence

-

U.S. Equities

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Julien Gaertner

Julien Gaertner

David Penner

David Penner