Artificial Intelligence

Artificial intelligence (AI) is having an iPhone moment with the launch of ChatGPT, a chatbot technology that can simulate human-like understanding and produce well-crafted, conversational responses.

Racing to a million users in five days — and 100 million by January 2023 — ChatGPT has already been used to write short stories and academic papers as well as to create music and videos. Since the release of the chatbot, developed by OpenAI with a more than $10 billion investment from Microsoft, every day seems to bring news of incremental advances in natural language models, along with occasional apocalyptic warnings about the rise of robot overlords.

“As was true with the mainframe era in the 1950s, PCs in the 1980s and 90s and most recently the mobile and cloud era, AI has the potential to be the next technology platform that drives major productivity gains and changes the world,” says equity investment analyst Drew Macklis, who covers semiconductors, autos and mobility technology. “Each of these eras created investment opportunities, but it’s critical for investors to separate the reality from the hype and be sharp on where value can accrue in the chain.”

For starters, ChatGPT does not yet possess human logic per se, but can be better thought of as hyper-scale pattern recognition. Such chatbots built on large language models are one example of how AI is already being applied across the economy. The key question for investors is: Has AI finally reached a commercial tipping point?

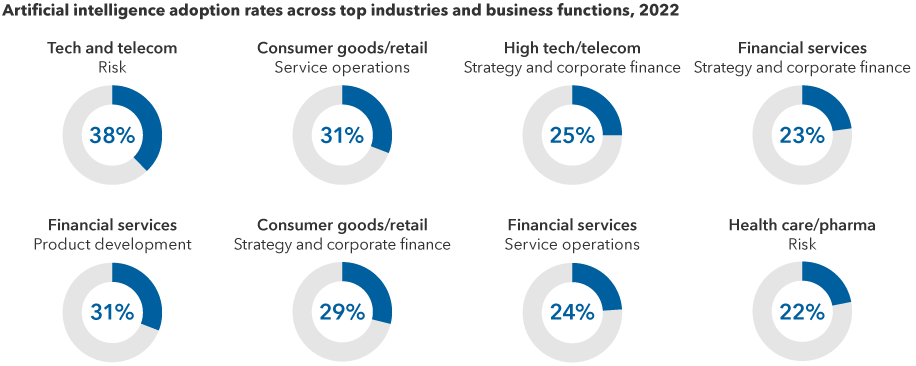

AI applications across industries and business functions

Sources: Capital Group, McKinsey, Stanford Institute for Human-Centered Artificial Intelligence (HAI). Figures reflect the percentage of firms that report utilizing artificial intelligence (AI) for the specific business functions listed above. Figures as of December 2022, as published in "Artificial Intelligence Index Report 2023."

”I believe AI can be one of the most profound investment trends of the next decade,” Macklis adds. “Years of deep AI research, breakthroughs in areas like transformer models and now a groundswell of interest in ChatGPT have set the stage for adoption to accelerate rapidly over the next five years.”

Here, Macklis, Mark Casey, an equity portfolio manager for The Growth Fund of America®, and Rich Wolf, an equity portfolio manager for The New Economy Fund®, share their views on how artificial intelligence is transforming industries and driving opportunity for companies and investors.

1. Robots are already here — and getting smarter

Mark Casey, 22 years of investment industry experience

As interesting as I find large language models like ChatGPT, it is possible AI-powered robots will have a bigger economic impact in the next handful of years. Consider these four examples.

Amazon has been deploying a robot called Sparrow, which picks up items and puts them in shipping boxes. In 2015, when Amazon held a competition to design a picking robot, the winner picked up 10 of 12 items at a rate of two minutes per successful pick. Seven years later, Sparrow can pick out roughly two-thirds of the more than 100 million items in an Amazon warehouse at a rate of just seconds per pick. Today, more than a million people work in Amazon fulfilment centers. This is obviously not great news for warehouse workers, but it might help Amazon address its current high operating costs.

Second, self-driving cars and trucks have been gaining real-world traction. Waymo One and Waymo Driver, the driverless car services of Google parent Alphabet and General Motors’ Cruise, are robo-taxiing passengers — without safety drivers — in Phoenix and San Francisco. Both companies have disclosed plans to launch taxis in more cities, including Austin and Los Angeles, as well as to add thousands of self-driving vehicles to their operations over the next several quarters.

A third example is the use of drones to make deliveries. Alphabet’s Wing has delivered more than 300,000 packages in test markets in Australia, Finland, Ireland and Texas. Amazon has also been testing drones in Texas and California. It is still early, but the company hopes to deliver 500 million packages annually utilizing the technology by the end of the decade.

Fourth, to see how robots for use at home are evolving, go online and watch a video of RT-1, a project Google recently disclosed. This one-armed robot has been trained on the same sorts of large language models powering ChatGPT and is able to perform more than 700 tasks with a high success rate.

Although it is too early to determine which companies will emerge as market leaders, one thing appears clear to me: The wider use of robots, along with the massive computing power required for broader uses of AI, will likely be a major tailwind for the semiconductor industry and cloud services. If you ask ChatGPT a question, it checks billions of data points to produce the desired content.

In fact, during its March earnings call semiconductor maker Broadcom reported that demand for some of its advanced chips surged in recent months as tech giants seek to integrate generative AI models like ChatGPT into their search platforms and other offerings. And chip maker Nvidia announced an initiative featuring its own AI tools.

Capital Ideas™ webinars

Insights for long-term success

2. AI in health care is helping doctors make better diagnoses

Richmond Wolf, 26 years of investment industry experience

Often we think about innovation within health care in terms of drug discovery. But tech and health care are coming together in interesting ways. AI is playing a growing role in helping medical professionals generate new treatments and better patient outcomes.

The simplest examples are within the use of AI-powered software to analyze X-rays, MRIs or CT scans to help radiologists improve the accuracy rate of their diagnoses.

German industrial conglomerate Siemens, a global leader in AI-related patents, has developed tools for its imaging machines that essentially apply inference modeling to better identify irregularities in a scan. While not replacing human radiologists, this enhances their ability to do their jobs.

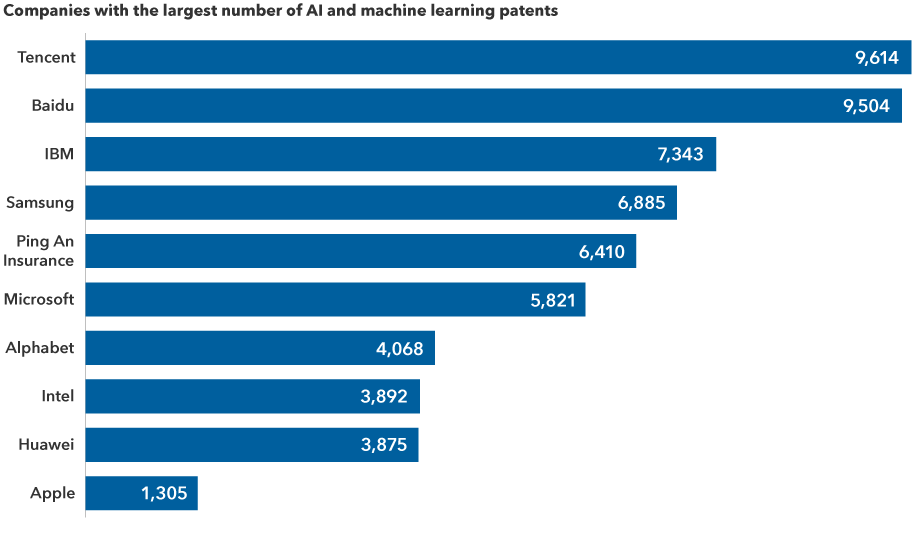

Tech and non-tech companies are racing to develop AI applications

Sources: Capital Group, LexisNexis. As of June 2022

Such AI-assisted analysis is also being integrated into the field of pathology, where significant advances are possible. Today, pathologists diagnose cancer by looking at tissue under a microscope, a time-consuming process that often requires consultation with other pathologists. Pathologists, with the help of AI-powered pattern recognition, can now improve their productivity and benefit from a larger knowledge base.

AI can also augment the ability to detect cancer by assisting researchers with genomic analysis. It has the potential to become a standard of care in many of these applications within the next decade.

Companies across the technology and health care sectors are also using AI to help develop drugs. For example, a team at Meta, parent company of Facebook, recently developed an AI algorithm that looks at amino acid sequence information and predicts how proteins will fold with a surprising degree of accuracy.

Why is that important? Going back to 10th grade biology classes, DNA is transcribed by RNA which translates the code and tells the body to produce a certain protein. Well, there are roughly 20,000 genes in the human genome, which translates to hundreds of thousands of proteins because an individual protein sequence can fold many different ways and have a great variety of combinations.

Misfolded proteins can lead to disease. So, researchers at Meta, using AI tools, created a database of more than 600 million protein combinations. This database can potentially help health care professionals better understand certain diseases and develop lifesaving treatments for them — and likely get the treatments to patients faster and cheaper. Other companies are now taking what Meta did to the next level. AI engines should drive faster drug discovery, which could lead to getting medicines to market faster to treat disease.

3. AI can drive productivity and disruption across industries

Drew Macklis, six years of investment industry experience

One of the most striking developments has been the pace of progress in the AI ecosystem since the release of ChatGPT. As with prior tech platforms, the tipping point often comes when a broad base of developers starts building useful tools on top of the underlying technology.

For the iPhone, this was the Apple app store, which is now home to millions of applications. ChatGPT seems to have sparked a similar explosion on top of AI foundation models, with developers now building a wide range of tools that unlock creative new use cases for AI — from drafting PowerPoint presentations, to booking travel, to ordering groceries, to online shopping.

Microsoft, which has already issued a limited test release of its Bing search engine that harnesses ChatGPT, has also disclosed plans to include the technology in its widely used Office software suite, its Teams platform and its GitHub code development service.

Moreover, while text-based models like ChatGPT have captured public interest, large advances are also being made in other areas, such as image-based AI models like Midjourney or coding models like Codex and AlphaCode. These further broaden the use cases of AI to larger swaths of the economy and over time can drive what can be thought of as a new version of Moore’s law for knowledge work.

As part of Capital Group’s investment research into AI, I recently organized meetings with 15 chief technology officers from leading companies across industries including banking, energy, telecom, consumer goods and others. These discussions helped us form early views on how AI tools might transform parts of the economy and set expectations for adoption curves over the coming years.

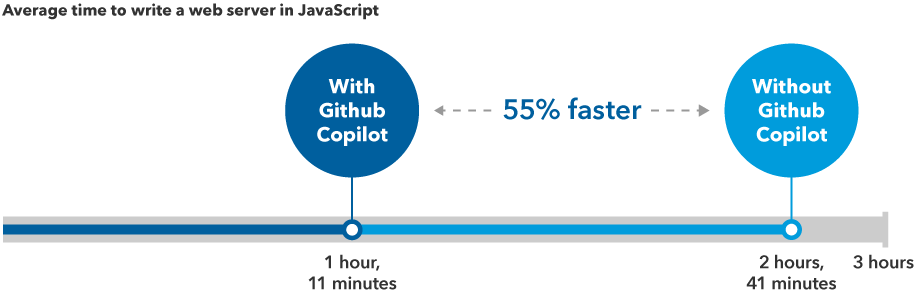

AI has the potential to be a transformative productivity tool

Sources: Capital Group, GitHub. GitHub Copilot is an artificial intelligence-powered developer tool that helps programmers by autocompleting comments and code. Figures reflect the results from a September 2022 GitHub study.

While it’s clear the impacts will take time, there are long-term opportunities for improved efficiency, new products and services, and business models — all with important implications for how we might invest over the long term.

What does the future of AI look like?

In a publication titled, “The Age of AI has begun,” Microsoft founder Bill Gates wrote: “The development of AI is as fundamental as the creation of the microprocessor, the personal computer, the Internet, and the mobile phone.” As with any leap in technological advancement, investors are prone to overestimate what is likely to happen over the next three to five years and underestimate what could happen over the next decade. But the recent developments in AI suggest we may be at the start of a cycle that could transform the technology landscape as well as the broader economy.

Because of the massive amounts of data required to train AI foundation models, cloud platform giants and makers of advanced semiconductors used in data centers may see demand for their offerings rise dramatically as businesses across the entire economic landscape develop new applications for AI.

Beyond obvious tech and ”knowledge” sectors, areas of potential AI application include supply chain management, insurance, oil and gas, utilities (for grid and load management) and autonomous farming. AI strategy may therefore become an increasingly important part of company analysis. What’s more, AI will also have implications for national security and the defense industry as defense companies develop autonomous planes and ships.

Of course, the technology presents risks. Cybersecurity will become more challenging when artificial intelligence can mimic a human voice, for example. Chatbots thus far have been prone to hallucination, providing irrational or incorrect answers. And in a world where prediction models can create novels, poems, photos and videos, questions of ownership issues will be challenging.

Just to be clear: This article was written by humans.

Go deeper:

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

Emerging Markets

-

Global Equities

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Mark Casey

Mark Casey

Richmond Wolf

Richmond Wolf

Drew Macklis

Drew Macklis