A flexible approach to U.S. growth investing

The Growth Fund of America®

INCEPTION DATE

December 1, 1973

IMPLEMENTATION

Consider for a large-cap growth allocation

OBJECTIVE

Seeks to provide growth of capital

VEHICLE

The Growth Fund of America

Everything moves in cycles, and the markets are no different. The overall uncertain economic environment and challenges of inflation are very real concerns. These volatile periods can showcase the advantages of The Growth Fund of America's flexibility, multiple manager perspectives and long-term horizon.

The fund’s portfolio managers and investment analysts seek to identify innovative companies across a broad range of sectors.

For years, the emphasis has been on a flexible approach to growth investing. While conducting in-depth, bottom-up research in selecting US-based companies with attractive growth opportunities, we also keep an open mind in expanding our search abroad.

A FLEXIBLE APPROACH TO GROWTH

A flexible investment approach

For more than 50 years, The Growth Fund of America has invested across sectors and industries. Many of these investments are in the companies powering economic growth and developing new products and services. The strategy’s portfolio managers and analysts seek to identify companies with attractive prospects for appreciation, including those outside of traditional growth industries.

IDENTIFYING LONG-TERM LEADERS IN A BROAD RANGE OF SECTORS

Examples of top holdings in the portfolio*

Source: FactSet as of March 31, 2024.

A HISTORY OF RESEARCH AND RESOURCES

Investing in growth

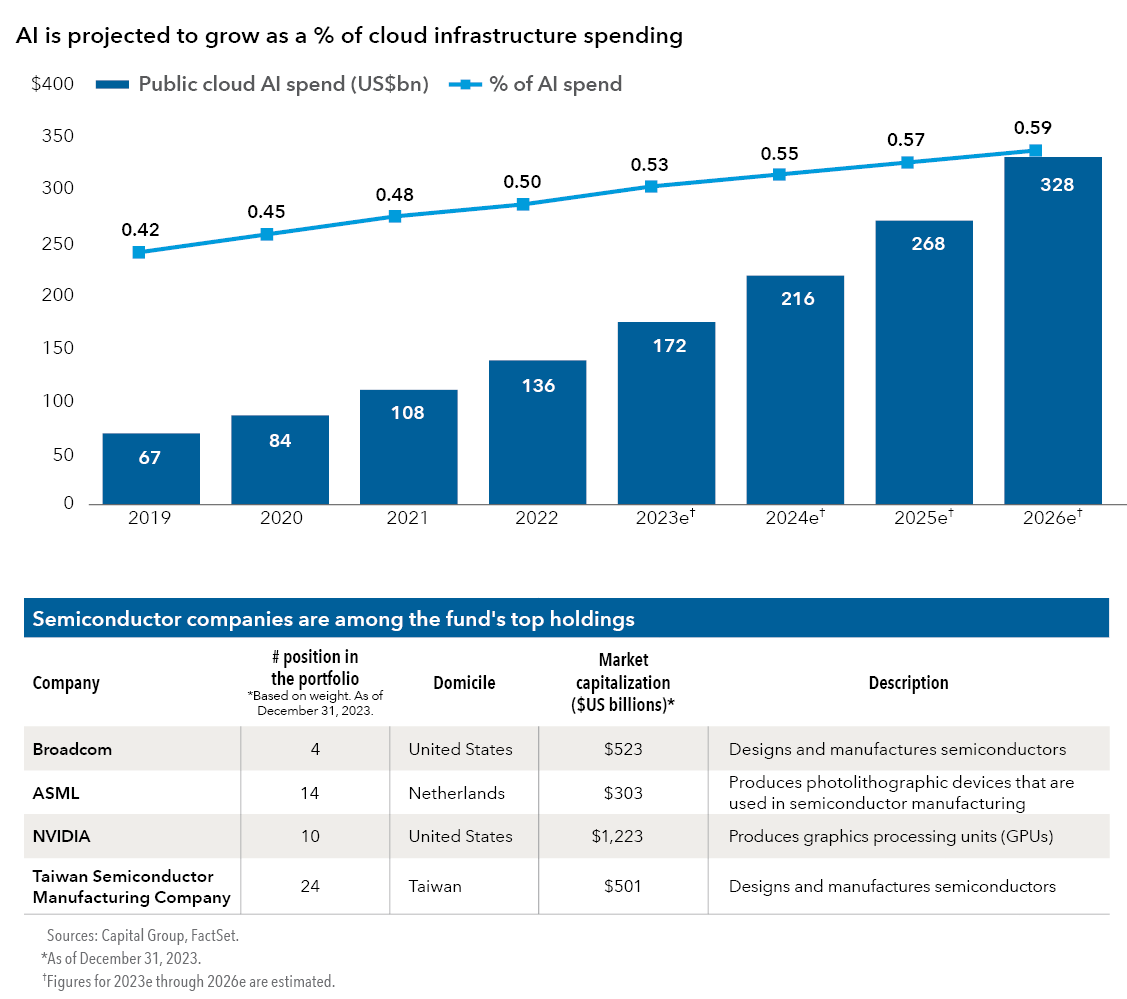

Generative artificial intelligence represents the next leg of growth opportunities for cloud computing and semiconductor demand. Portfolio managers in The Growth Fund of America view the opportunity for chips as an attractive long-term investment opportunity. The large data sets and immense need for computing power required for the technology have the potential to drive chip demand for years to come.

Research focus: AI growth is projected to boost investments in cloud infrastructure

Generative artificial intelligence represents the next leg of growth opportunities for cloud computing, but will require significant capital expenditure

The Growth Fund of America

The Growth Fund of America is offered in various share classes designed for retirement plans, nonprofits, and other institutional and individual investors.

*Companies shown are among the top 20 holdings by weight in The Growth Fund of America as of 12/31/23: (Microsoft, Meta Platforms, Alphabet, Broadcom, Amazon, Tesla Inc, UnitedHealth Group, Netflix, Eli Lilly, NVIDIA, Mastercard Inc, General Electric, Vertex Pharmaceuticals, ASML, Salesforce, TransDigm Group, Regeneron Pharmaceuticals, Uber, Royal Caribbean Cruises, Carrier Global).