Market Volatility

Interest Rates

After a stellar 2020, the bond market is coming under pressure. Massive government stimulus measures and an improving economic outlook are combining to stoke one of fixed income investors’ biggest fears: higher inflation.

The selloff has been sharp. After rising more than 7% last year, the Bloomberg Barclays U.S. Aggregate Index is down more than 3% on a year-to-date basis. The key questions for investors: Is the selloff warranted, and are rates likely to continue rising significantly from here? Our answer to both is no.

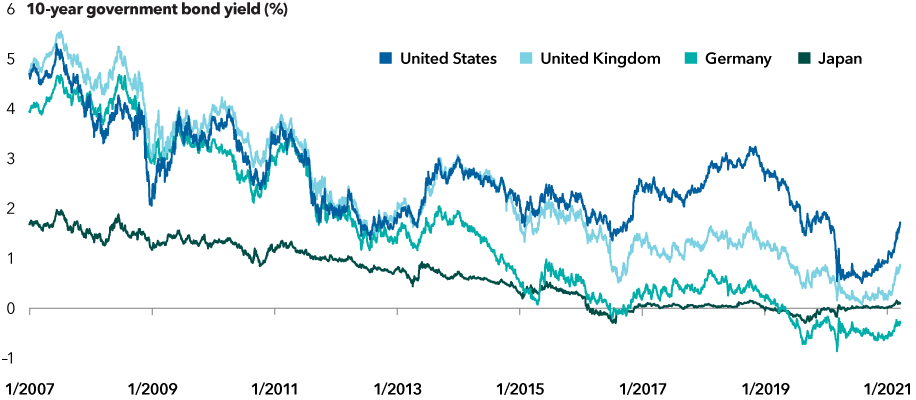

Long-term yields have risen but remain historically low

Source: Bloomberg. As of 3/19/21.

1. The market is overreacting

We believe the market is getting carried away with rate hike anxiety. Market expectations for a Federal Reserve rate hike in 2022 are earlier than we anticipate.

Our view is based on the Fed’s desire to get the U.S. back to full employment. On evaluating the labor market, the Fed has articulated a broad approach. That means no single employment measure will work as a rate hike trigger. Fed officials will consider a variety of measures of underemployment, labor participation and even employment trends within specific demographic and income groups. Some of those, such as a weak labor participation rate, suggest labor market slack and possibly some longer term scarring. This should lead to patience on the part of U.S. central bankers when considering when to tighten policy.

Additionally, the Fed has indicated that it is comfortable allowing inflation to run “hot” — above its 2% target — for a period of time if monetary policy is helping to hasten job creation amid elevated unemployment. This is evident by embracing policies such as average inflation targeting. This policy targets an average inflation rate over a period rather than having a rigid ceiling for all periods.

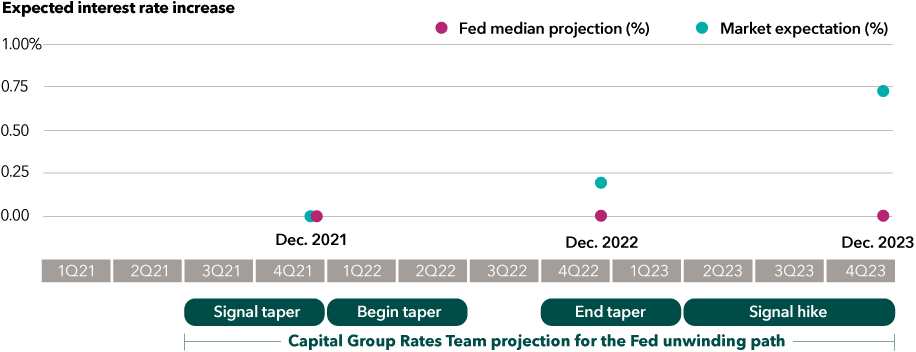

For these reasons, we believe that the Fed will remain broadly accommodative. It appears likely to encourage strengthening economic activity until late 2023 or even early 2024. Fed Chair Jerome Powell seems committed to projecting any action that could tighten policy well in advance of implementation. We believe the Fed will follow a structured unwinding path. This strategy is likely to be similar to its 2013–2015 signaling that led to its first hike after the financial crisis.

How will the first rate hike unfold?

Source: Capital Group, Federal Reserve. As of 3/22/21. Fed dots represent the median Federal Open Market Committee projections when rate increases will occur. The market dots represent investor expectations based on futures pricing. The lower timeline represents how Capital Group’s interest rates team believes the unwinding path could unfold. The Fed is likely to "taper," meaning to reduce its asset purchases, as an early step towards policy normalization prior to raising rates

Due in part to our view on the Fed, we find shorter term U.S. Treasuries attractive at present. If the market comes around to our view on monetary policy, these yields could decline and associated bond values rise. We are neutral on longer term Treasuries.

The combination of loose monetary policy and fiscal stimulus has led inflation expectations to rise over the past few quarters. That has helped boost values of Treasury Inflation-Protected Securities (TIPS). However, the Fed’s tolerance for moderate inflation could lead expectations to rise further. This may occur if the central bank’s policy remains stimulative for longer than the market currently anticipates. If those expectations rise, so too will the value of TIPS.

What if we are wrong and higher rates are rapidly approaching? Even then, there are strong reasons to stay invested in high-quality bonds.

2. Rates are rising for a good reason — a strong recovery

Growth and inflation expectations have picked up, as markets are seeing light at the end of the pandemic tunnel. Vaccines are steadily rolling out, and infections are on the decline: These are harbingers of stronger growth. They also underscore that the improving U.S. labor market trend will likely continue as COVID-19 restrictions lift.

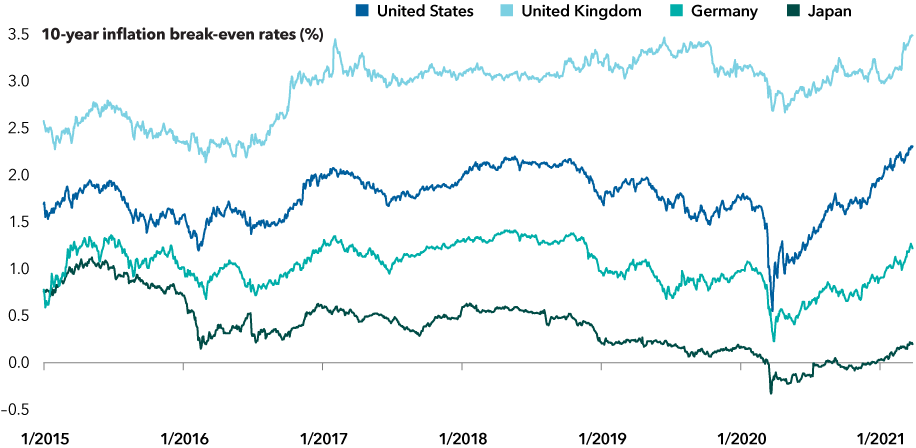

These positive factors have not prompted the Fed to signal rate hikes. However, their commitment to maintaining low rates amid more robust economic activity has helped boost inflation expectations. The Fed has pledged to endure moderate inflation to cut unemployment further. Yet the market believes rising inflation could mean higher rates are not that far off. An investor consensus projects an initial hike in 2022.

Inflation expectations are rising

Source: Bloomberg. As of 3/19/21. Break-even inflation rates convey the average inflation required over the life of an inflation-protected bond and similar nominal bond to generate the same total returns.

3. Core taxable bonds have shown resilience amid rate hikes

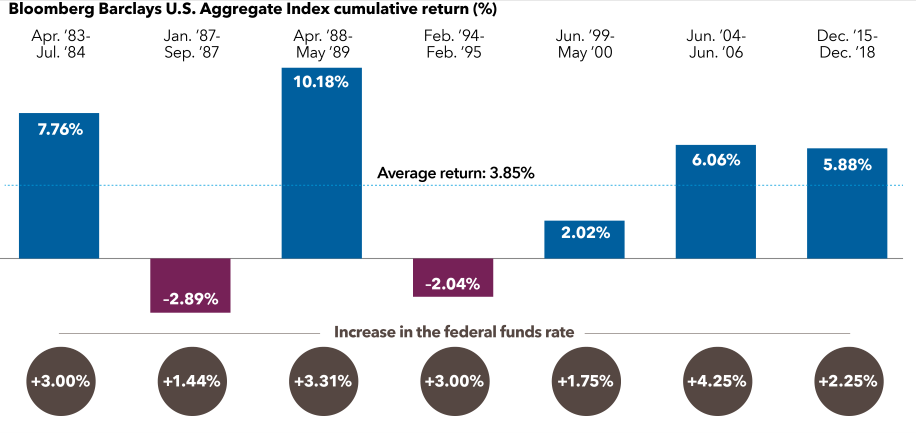

Bond values decline when rates rise. But history suggests that this isn’t the whole story. When rates rise, they historically haven’t done so quickly and sharply enough to cause significant losses over a hiking cycle for core bond investors.

The yield bonds offer investors and other factors that push up bond values can help provide a positive total return. The chart below shows rate hiking periods over the past several decades. In all those periods, only two have seen negative total returns for the core bond benchmark. Despite rising rates, the average return for these periods was nearly 4%.

Rising rates don’t always mean negative bond returns

Sources: Bloomberg Index Services Ltd., Federal Reserve. Data through 3/17/2021. Periods represented above include: 4/1/83-7/31/84, 1/1/87-9/30/87, 4/1/88-5/31/89, 2/4/94-2/1/95, 6/30/99-5/16/00, 6/30/04-6/29/06, 12/16/15-12/20/18. Note: Daily results for the index are not available prior to 1994. For those earlier periods, returns were calculated from the closest month-end to the day of the first hike through the closest month-end to the day of the final hike.

Recent history is probably more relevant to what we can expect from the Fed as well. When central bankers began raising rates in 2015, they did so gradually. They began with a 25-basis point hike in December 2015. The Fed then waited a full year for another. Over the next year it raised rates three more times, again by just 25-basis points per hike.

History alone may seem a compelling enough reason not to abandon your core bond allocation when rates begin to rise. However, we would argue a core bond allocation is something a balanced portfolio needs in any market environment. Having a strong core bond allocation can help to provide a measure of stability when unexpected shocks hit. Indeed, today’s market makes an even stronger case for maintaining a solid core.

With riskier asset prices soaring, we believe investors should prioritize diversification from equities and capital preservation in fixed income. Markets are reflecting the likelihood of a post-pandemic economic upswing, but there could be bumps along the way. As the market crash in early 2020 illustrated, high-quality core fixed income can serve as ballast in portfolios during periods of equity stress.

What kind of core or core-plus funds should you consider? Those that do not take excessive credit risk. Their correlation to equities — how closely tied their returns are to those of stocks — should be relatively low. At Capital Group, we strive for this outcome with our core and core-plus funds The Bond Fund of America® and American Funds Strategic Bond Fund.℠

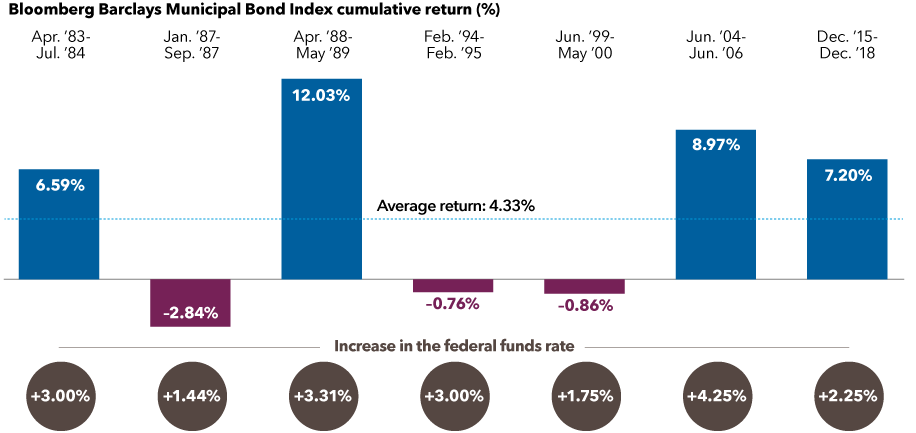

4. Core municipal bonds have also shown stability amid rising rates

Like taxable bonds, municipal bonds have also felt the impact of rising yields this year. While munis have become more credit driven in recent years, rates still have a major impact. Returns for the Bloomberg Barclays Municipal Bond Index are down 0.75%, year-to-date through March 18. But as with taxable bonds, a longer term perspective can be revealing. Consider those same periods of Fed rate hikes as shown earlier for the core taxable index.

Munis have held up well amid periods of rising rates

Sources: Bloomberg Index Services Ltd., Federal Reserve. Data through 3/17/2021. Periods represented above include: 4/1/83-7/31/84, 1/1/87-9/30/87, 4/1/88-5/31/89, 2/28/94-2/28/95, 6/30/99-5/31/00, 6/30/04-6/29/06, 12/16/15-12/20/18. Note: Daily results for the index are not available prior to 2006. For those earlier periods, returns were calculated from the closest month-end to the day of the first hike through the closest month-end to the day of the final hike.

For the municipal bond index, the results are similar. In most periods, the return was positive or close to flat. The average over all seven periods was a positive return of more than 4%.

“Rising rates may help our strategies increase tax-exempt yields,” says Fixed Income Product Manager Neil Amirtha. “Narrowing spreads, the premium investors are paid for credit risk over risk-free assets, would help us take advantage of dislocated subsectors. Those include bonds from hospitals, senior living facilities and transportation issues such as mass transit. For these sectors, spreads have yet to fully normalize to pre-pandemic levels.”

Today’s muni market has already been recovering from the onset of the pandemic, with better-than-expected revenue collections. But it has another tailwind: recent stimulus measures from Washington. The 2020 CARES Act, the stimulus passed in December and the American Rescue Plan Act passed this year will all help. Together, they provide about $1.2 trillion in muni-related aid provisions for subsectors such as state and local governments, health care and education. This should further improve muni bond fundamentals.

At first glance, prospects for rising rates may make fixed income investing seem unattractive. And yet, from a vantage point that is both long term and recognizes the roles of fixed income in a balanced portfolio, it’s clear that rising rates are no reason to abandon bonds.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds. Income from municipal bonds may be subject to state or local income taxes and/or the federal alternative minimum tax. Certain other income, as well as capital gain distributions, may be taxable. While not directly correlated to changes in interest rates, the values of inflation linked bonds generally fluctuate in response to changes in real interest rates and may experience greater losses than other debt securities with similar durations.

Bloomberg Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. Bloomberg Barclays Municipal Bond Index is a market value-weighted index designed to represent the long-term investment-grade tax-exempt bond market. Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Our latest insights

-

-

Market Volatility

-

Interest Rates

-

U.S. Equities

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Ritchie Tuazon

Ritchie Tuazon

Margaret Steinbach

Margaret Steinbach