Municipal Bonds

U.S. Equities

A spike in volatility following a lackluster jobs report in the United States and a rate hike in Japan masked a broadly solid second quarter earnings season.

“I’m a long-term investor, but the long term is the sum of all the short terms so every quarterly earnings report matters,” says Mark Casey, portfolio manager for CGGR — Capital Group Growth ETF and The Growth Fund of America®. “I’m interested in evidence that my long-term thesis is going as expected, better than expected, or possibly worse than expected.”

With that in mind, here are three investment ideas from the latest round of earnings reports.

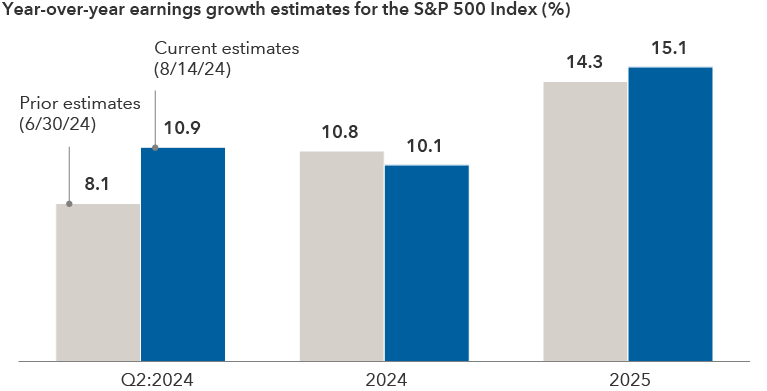

Earnings outlook softens for 2024, but remains solid

Sources: Capital Group, FactSet. Earnings growth refers to annual change in earnings per share. As of August 14, 2024.

1. AI is generating value, but spending is a concern

Executives at large technology companies emphasized during their earnings calls how investments in artificial intelligence have already contributed to business growth. These statements may have been made to address investor concerns about increased capital expenditure to support AI.

“Every AI-driven company seems to have a good story about how AI is showing some positive impact to revenue, which is one reason their stocks aren’t too far off from their all-time highs,” Casey says.

Meta CEO Mark Zuckerberg noted that “advances in AI continue to improve the quality of recommendations and drive engagement.” One of the company’s long-term goals is to provide marketers the ability to automate the processes of creating and testing advertising content.

Still, investors are nervous about increased spending. “In some cases the check sizes are getting so large it’s hard to imagine the investment return can be there,” Casey says.

If a recession hits, lower spending from customers could crimp profits, but the impacts to long-term stock prices are harder to predict.

“My simplifying approach to investing is to think four to eight years out and assume there is a recession between now and then. Then I try to determine which companies are likely to be larger and more profitable at that point in the future than their stock prices currently assume,” Casey says. The exercise helps him work through near-term volatility and avoid rash decisions.

2. Companies with weight loss drugs widen their lead

The duopoly for weight loss and diabetes drugs from Eli Lilly and Novo Nordisk is likely to continue for some time, says equity analyst Christopher Lee, who covers U.S. pharmaceuticals and biotechnology companies.

Eli Lilly, which sells Mounjaro and Zepbound, aggressively invested in manufacturing capacity as high demand landed those products on the Food and Drug Administration’s shortage list. In early August, the government’s database indicated they are now available.

“Competitors are coming around to the idea that they need to have a product that differs from or is complementary to obesity drugs currently on the market,” Lee says. For example, some companies are working on drugs that will preserve muscle mass as people lose weight.

The moat has widened because Eli Lilly and Novo Nordisk, maker of Ozempic and Wegovy, have invested billions into their franchises over the past 20 years. “By the time a competitor has a product, Eli Lilly and Novo Nordisk will have built a strong wall with commercial insurers. Often referred to as a rebate wall, the practice makes it difficult for competitors to gain traction for their drugs,” Lee notes.

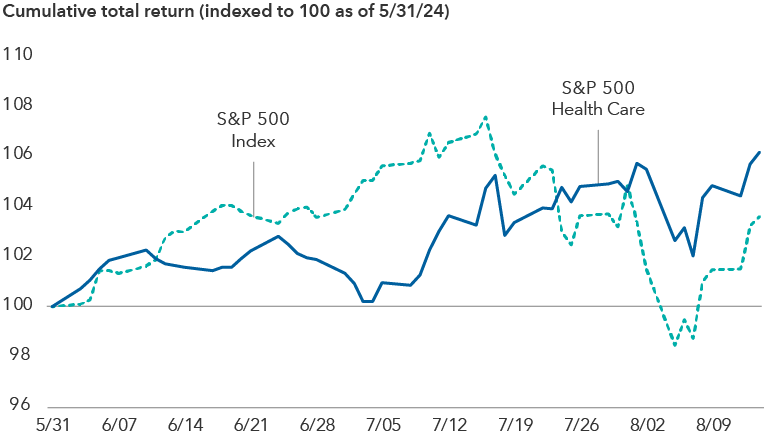

Meanwhile, investors concerned about a slowdown in the economy could take the opportunity to review their health care exposure overall, Lee adds. The sector has tended to hold up well compared to the S&P 500 in a downturn as opting out of life-saving medication is usually not a choice for most consumers.

Health care stocks have recently held up

Sources: Capital Group, FactSet, Standard & Poor's. Cumulative total return figures are indexed to 100 as of May 31, 2024, and current through August 14, 2024.

3. America still runs on fast food

After raising prices considerably in the wake of the pandemic, McDonald’s and other fast-food companies are offering more affordable options to win back unhappy customers, says equity investment analyst Betsy Lind.

“McDonald’s has traditionally done well in an environment where consumers pull back on spending, but it pushed its pricing so much higher over the last few years that it lost traffic among lower income consumers,” Lind says.

Fast-food companies are now launching national value meals and actively competing for customers. “They can’t raise prices, so they need to grow volume.”

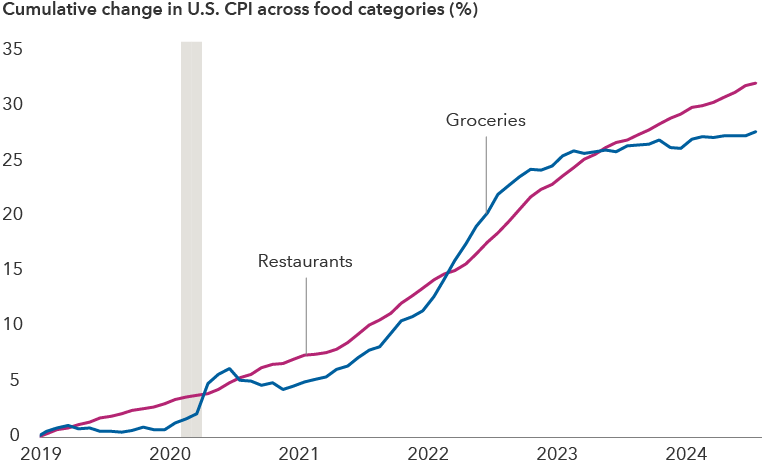

Meanwhile, growth continues for restaurant and food delivery companies such as DoorDash, in part because they’ve expanded their services to include grocery deliveries. Inflation for food sold in grocery stores has declined faster than restaurant inflation, Lind notes, adding that the gap is expected to narrow.

Consumers dined at home as restaurant inflation remains high

Sources: Capital Group, Bureau of Labor Statistics, National Bureau of Economic Research (NBER). Shaded region indicates period defined as a recessionary period by the NBER. Cumulative change shown is for the U.S. Consumer Price Index (CPI) for All Urban Consumers: Food At Home (groceries) and U.S. CPI for All Urban Consumers: Food Away From Home (restaurants) between December 2018 and July 2024.

Lind thinks McDonald’s could regain customers because the company’s speed of service and uncomplicated menu haven’t changed. McDonald’s same store sales in the U.S. declined 0.7% in the second quarter compared to last year. The company’s stock has declined roughly 7.5% this year as of August 15.

In contrast, companies like Sweetgreen, Chipotle and Cava Group that cater to higher income, health-conscious consumers continue to show strong growth. “There is a long-term theme of people shifting to these options, but they’re not the reason fast-food companies are hurting,” Lind says.

Surviving a selloff

Recent market volatility showed how impulsive investors can be as concerns of a looming recession took hold. And just as quickly, equity markets staged a comeback. Overall, quarterly earnings have generally been strong, with some signs that lower income consumers continue to moderate their spending.

Markets will likely continue to have bouts of volatility in the short term as sentiment shifts and markets move on emotions. “In the long term, however, a company’s stock price tends to accurately reflect what the company is economically worth,” Casey concludes.

Watch Mark Casey’s conversation with Capital Group CEO Mike Gitlin:

Past results are not predictive of results in future periods.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

S&P 500 Health Care comprises those companies included in the S&P 500 that are classified as members of the GICS Health Care sectors.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

RELATED INSIGHTS

-

Global Equities

-

-

U.S. Equities

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Mark Casey

Mark Casey

Christopher Lee

Christopher Lee

Betsy Lind

Betsy Lind