Have you ever wondered how some top-performing financial advisors are able to build their practices year after year and in all types of markets? Many advisors understand that deep engagement with clients is key to long-term loyalty, quality referrals and practice growth. But how to get there isn’t always so obvious.

“Through years of experience working with thousands of advisors, we’ve seen that the most successful practices take a deliberate, holistic approach to serving the increasingly complex needs of investors,” says Shaun Tucker, director of Advisor Practice Management. “To help advisors achieve the growth they are seeking, we help them prioritize client management and business management alongside investment management.”

Tucker and his team of advisor practice management consultants have developed a comprehensive, personalized practice management program to help more financial advisors benefit from the strategies and best practices they’ve seen lead to results. Known as Elite Engagement, it is designed around a set of capabilities that can help improve client engagement, increase acquisition and referrals, and boost practice growth:

- Turbocharge your brand

- Acquire the ideal client

- Deliver results, not performance

- Deliver priceless value

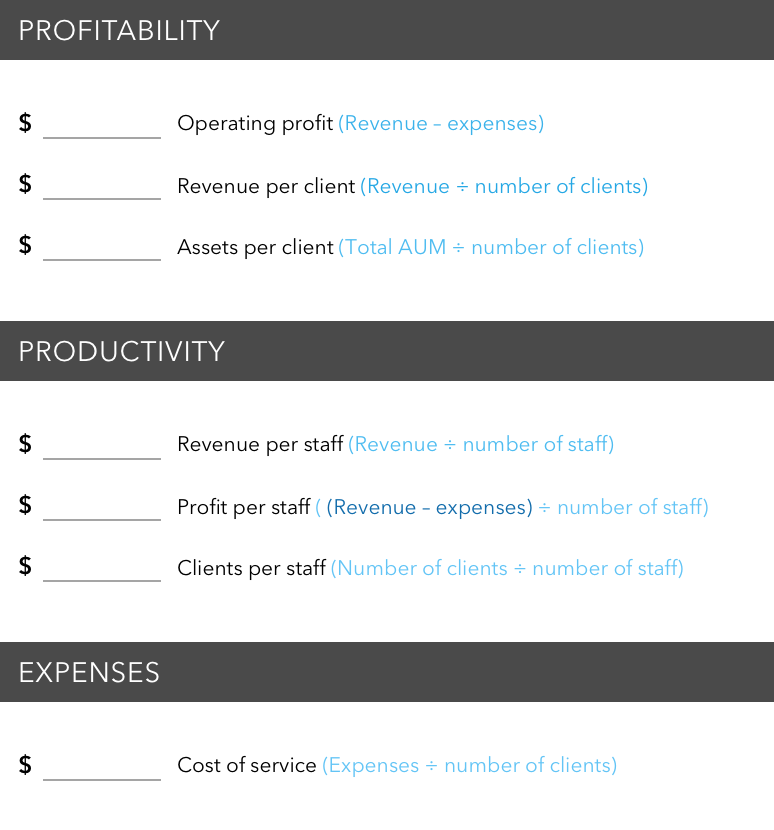

- Drive productivity and efficiency

- Fuel growth with a COI engagement strategy

- Prospect and grow in a digital world

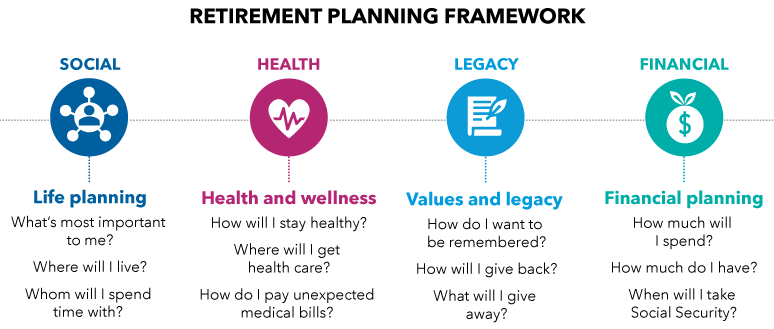

- Acquiring modern retirees

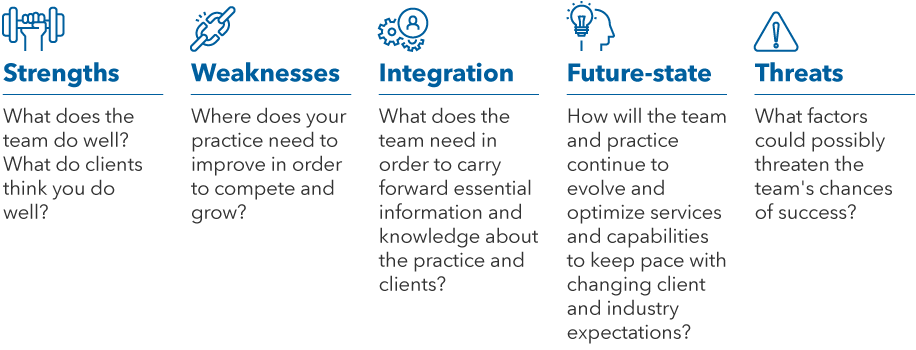

- Future-proof your practice

- A leader's guide to succession planning