As a financial advisor, a big part of your job is focusing on goals and helping clients achieve them. But are you doing the same for your practice? In business, as in life, reaching a new goal requires setting it first. And the goals you set and how you plan to achieve them may make all the difference to your bottom line.

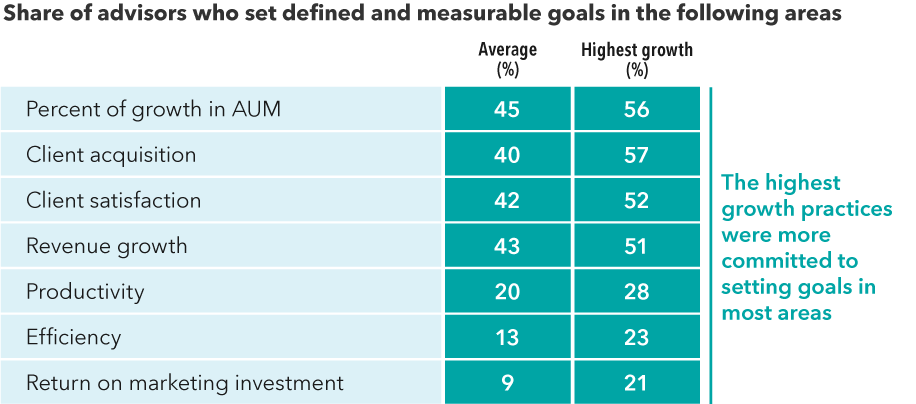

According to Capital Group’s Pathways to Growth: 2022 Advisor Benchmark Study, allocating more time to planning and goal setting can lead to enhanced growth. The highest growth advisors we surveyed were 42% more likely to do business planning, and were more intentional about goal setting in areas like efficiency, productivity, client satisfaction and growth in assets under management (AUM). The research findings also showed correlation between specific goals advisors track and measure to business growth. For example, while many of the advisors in our survey had goals for revenue, the highest growth segment also had goals for revenue growth, arguably a more sophisticated practice health measure.

“Advisors in today’s top teams are thinking like CEOs,” says Paul Cieslik, advisory practice management consultant at Capital Group. “These advisors are no longer running a practice — they are running a business.”

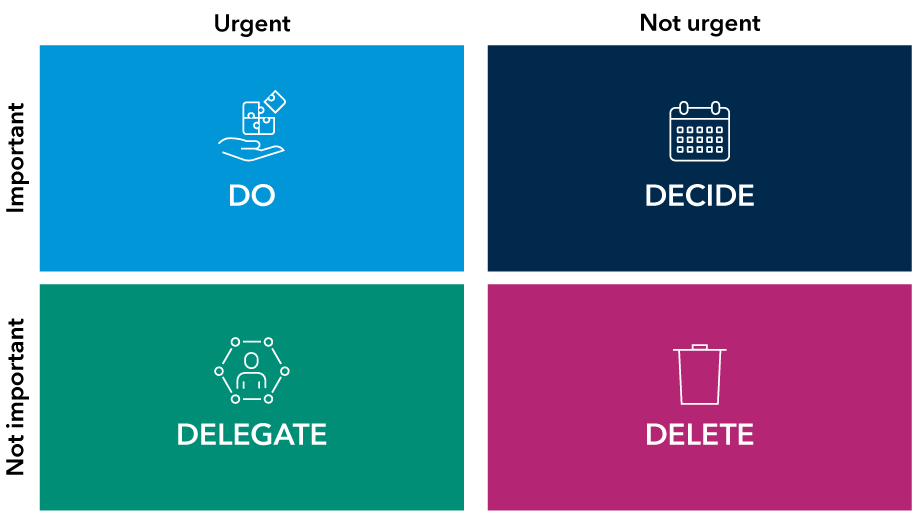

Successful business goal setting requires you to think big, but also to think intentionally based on the specific outcomes you want to see and the procedures you want to put in place. Here’s how you can start thinking like a CEO and get more strategic about goal setting and business planning.