Capital Group’s proprietary review of more than 1,400 advisor portfolios points to several key trends in early 2024, including the potential for concentration risk in equities, high exposure to low dividend-paying stocks and extended duration in fixed income. In a likely signal that investors lacked conviction in growth or value, industry fund flows show significant inflows into large blend equity strategies.

Published onJune 27, 2024

5 MIN ARTICLE

KEY TAKEAWAYS

- Capital Group analyzed fund flows and more than 1,400 advisor portfolios in early 2024

- Fund flows suggest a lack of conviction in growth or value in early 2024

- Key issues for advisors: equity concentration risk and high exposure to low dividend-paying stocks

Capital Group’s Portfolio Consulting and Analytics team reviews advisor portfolios in consultation with advisors, and from these consultations develops valuable, timely insights into the way advisors as a group are constructing portfolios.

“Our commitment to consulting with advisors on portfolio construction gives us real-time insight into how advisors are building portfolios, which is invaluable to us in our role as a thought partner to advisors,” said Jan Gundersen, Senior Investment Director on Portfolio Solutions and Services at Capital Group. “We believe our insights into these trends can help advisors evaluate their own approach to portfolio construction and any unintended risk exposures that may be present.”

In summary, as U.S. equity markets continued the 2023 rally into 2024, Capital Group identified these key trends in fund flows and advisor portfolios:

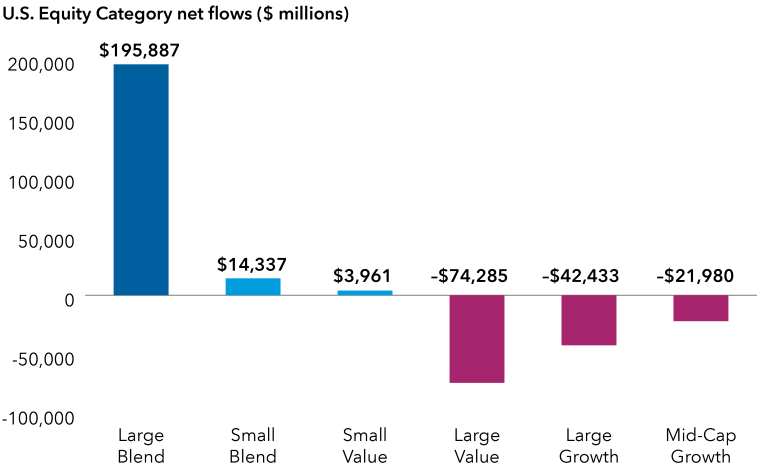

1. Industry flows favor large blend equities strategies

Based on trends in fund flows, asset allocators appear to favor blend strategies, a sign they lack conviction in growth or value going forward. In the 12 months ending March 31st, large blend equity funds attracted $195 billion in net inflows, while investors moved $74 billion out of large value funds and $42 billion out of large growth funds.

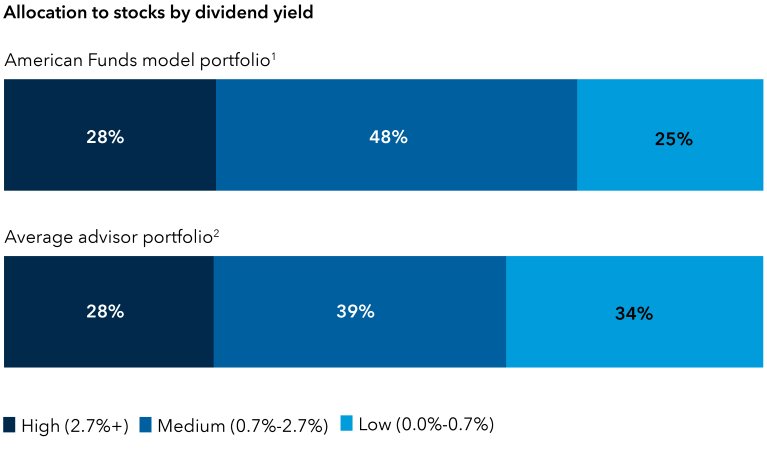

2. Elevated exposure to low dividend-paying stocks

Capital Group’s ability to analyze over 1,400 advisor portfolios gives us unique insight into how advisors are constructing portfolios, and where their decisions depart from ours, as expressed in Capital Group’s model portfolios. One trend that is clear is that advisors have greater exposure to low dividend payers, relative to Capital Group’s moderate growth and income model portfolio.

In building portfolios, advisors should bear in mind that dividend payers offer the potential to diversify portfolios and can mitigate risk.

Sources: Capital Group, FactSet, Morningstar. Totals may not reconcile due to rounding.

1The American Funds Model portfolio dividend payer exposure is represented by a monthly average exposure for the American Funds Moderate Growth and Income Model Portfolio from 12/31/2023-3/31/2024. This model aligns closely with the broad asset allocation of the average advisor allocation with 63% equity and 37% fixed income.

2The average advisor portfolio is representative of the aggregate exposure of 1,402 portfolios analyzed by Capital Group’s Portfolio Consulting and Analytics team from 1/1/2024 to 3/31/2024.

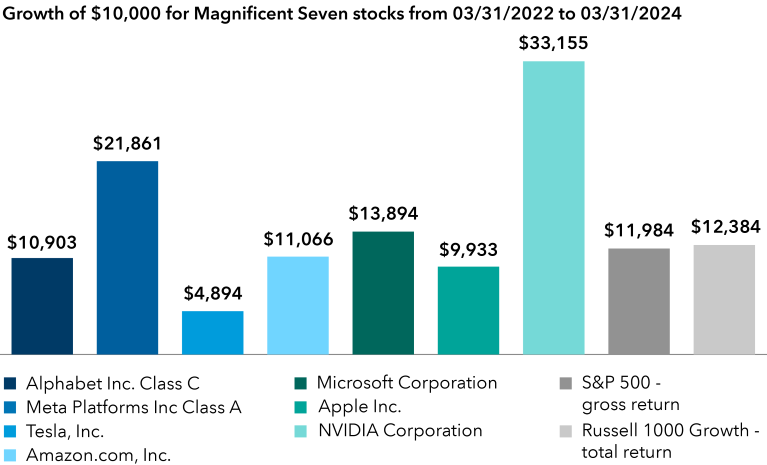

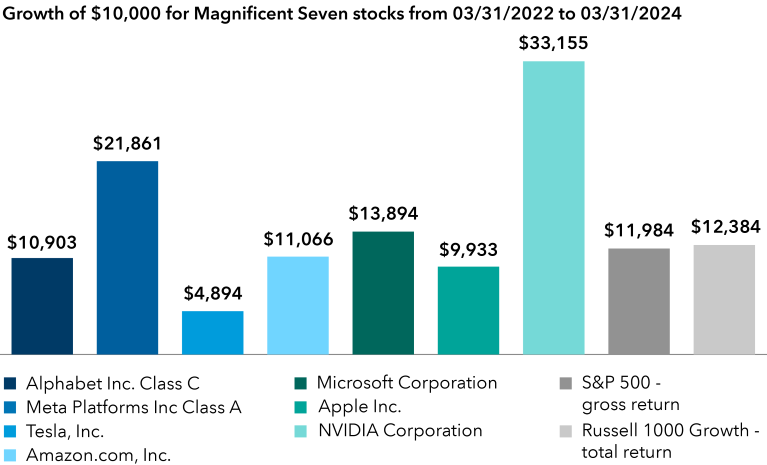

3. Advisor portfolios face potential for equity concentration risk

The “magnificent 7” stocks (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla) make up a significant portion of major U.S. equity indexes. For example, those seven stocks make up 29% of the S&P 500 index, but are producing only 24% of the S&P 500’s recurring earnings as of March 31, 2024. Total returns for the seven have been mixed in the recent market cycle, with four of the seven stocks returning less than the S&P 500. Accordingly, Capital Group encourages advisors to consider a more diversified approach to capital appreciation.

“One factor for advisors to consider as they assess equity concentration risks in this market cycle is exposure to passive investment vehicles,” Gundersen said. “One way to mitigate those risks is to consider active equity strategies where portfolio managers can carefully weigh and manage the pros and cons of holding large concentrated positions.”

Total returns for the “Magnificent Seven” stocks were mixed over a two-year market cycle

Source: FactSet. Data as of March 31, 2024. Magnificent Seven stocks are defined as Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla. Returns do not included taxes, fees or expenses. The indexes are unmanaged and have no expenses; investors cannot invest directly in an index. Past results are not predictive of results in future periods.

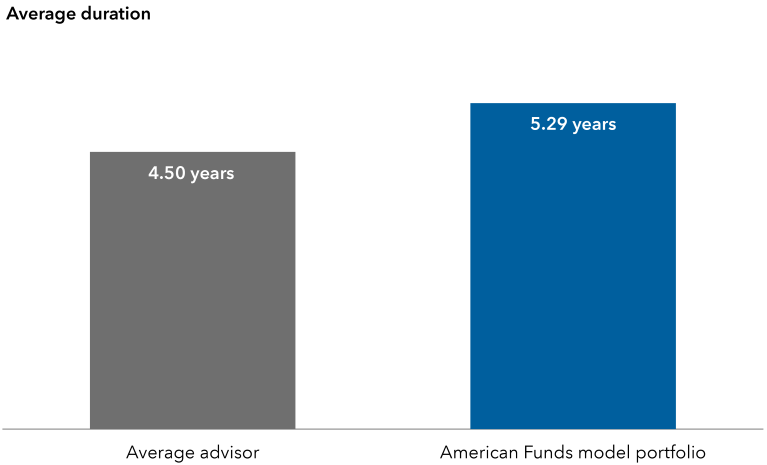

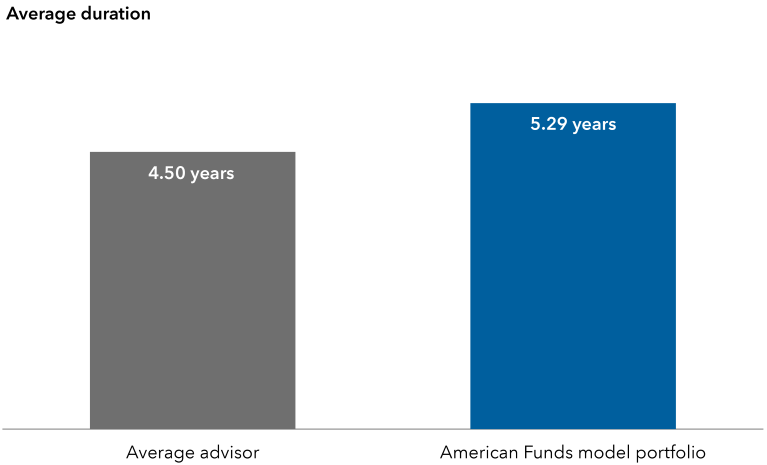

Extended duration in fixed income, unintentional credit exposure

We see two trends of note in advisors’ fixed income holdings. First, while advisors are extending duration in anticipation of lower interest rates, duration for the average advisor portfolio remains lower than the American Funds Moderate Growth and Income Model Portfolio.

Additionally, our review indicates many advisor portfolios may have unintentional exposure to lower-rated bonds that carry higher credit risk via intermediate core plus allocations. We encourage investors to guard against unintentional credit exposure and to consider extending duration further with a strong core and a dedicated credit exposure relative to client goals.

Extended duration in fixed income, unintentional credit exposure.

Source: Data from the Capital Group Portfolio Consulting and Analytics team based on analysis of 1,402 advisors’ portfolios from 1/1/24 to 3/31/24. American Funds model portfolio represents the most recent available data, as of 3/31/24, for the American Funds Moderate Growth and Income Model Portfolio. This model aligns closely to the broad asset allocation of the average advisor allocation with 63% equity and 37% fixed income. Spread sectors made up 44.5% of the fixed income portion of the average advisor portfolio, while non-spread sectors made up 55.5% as of March 31, 2024.

Want to learn more about your portfolio construction relative to your advisor peers?

Get an unbiased point of view on portfolios and talk through solutions with trusted partners. Connect to your Capital Group representative or sign up for an in-depth portfolio analysis and review

Jan Gundersen is a senior investment director on Capital Group’s Portfolios Solutions & Services team. He has 25 years of investment industry experience (as of 12/31/23). He holds a bachelor’s degree in geology from Colgate University and a masters degree in oceanography from Texas A&M University.