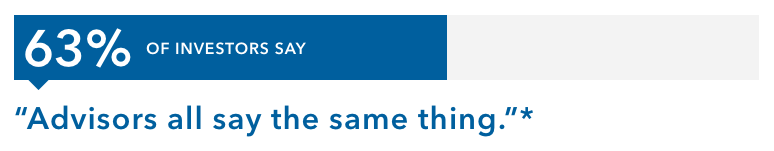

3. Demonstrate your distinctiveness

Apple is known for the friendly and intuitive interfaces of its devices. But the company doesn’t stop there. It reinforces the brand’s essence at every touchpoint — from its digital presence on the web and mobile, to physical spaces.

Consider the company’s stores. There is no zigzagging through queues, no moving from place to place, and no clumsy forms. In short, there are few difficulties to navigate before making a purchase. Instead, you’re typically met by a friendly associate who takes your name and finds you a place to sit. Thereafter, the service comes to you. What could be friendlier and more intuitive than that?

Your physical space: Advisors should also see all client touchpoints as opportunities to build and reinforce their brands. As with Apple, the experience and physical environment of your office is a good place to start. Are you meeting in a stodgy conference room, or around a more intimate setting, like a round sunlit table? Is your “why” on display in the form of family pictures or memorabilia that shows how you’ve helped your clients?

Commemorations of your charitable activities can signal your commitment to your community. Or you can display art from local artists, perhaps even with museum-style plaques to provide details on the work.

If you have a TV in your waiting area, what’s playing on it? A talking head barking out stock tips, or something more aspirational, like a channel focused on travel? That choice doesn’t just reinforce your brand, it can actually shift the client’s mindset away from money, markets and returns to longer term goals, like travel and retirement.

You can also use your office space to subtly remind clients of your qualifications. Displaying the degrees and certifications you’ve attained reminds clients that you have the skills and experience to help them reach their goals. Elsewhere, your technology projects a level of sophistication. You don’t need to be on the “bleeding edge,” but effective use of technology in your meetings and office environment suggests you take a similar approach to things like portfolio construction and risk management.

Your digital space: Increasingly, virtual meetings are another key touchpoint for projecting your brand. Firms that have been conducting virtual meetings for years may opt for a custom backdrop or slick digital filters to make a certain impression. But in today’s environment, home-office authenticity is allowed. What’s more important is conveying seriousness and professionalism in your focus, appearance and technical capabilities. A ring light, an uncluttered background and a camera angled slightly above eye level paint you in a flattering light and can all help make you feel more confident in your digital meetings. Find out more about the art and science of successful virtual meetings.

More importantly, how your brand is represented digitally can have an impact on business growth. Digital networking on social networking sites like LinkedIn and Facebook is increasingly a way to find and meet potential connections and prospective clients. But even investors referred to you through more traditional sources are bound to look you up online before meeting you. Does your website represent those words, phrases or associations that your brand is trying to achieve?

Think of ways to include your “why” in your firm’s About Us page, your professional bio and your LinkedIn profile. The emotional connections you wish to make are as important as the words and imagery you choose to reflect your brand. Simple concepts, written in a language that the average person can understand, are often the most powerful.