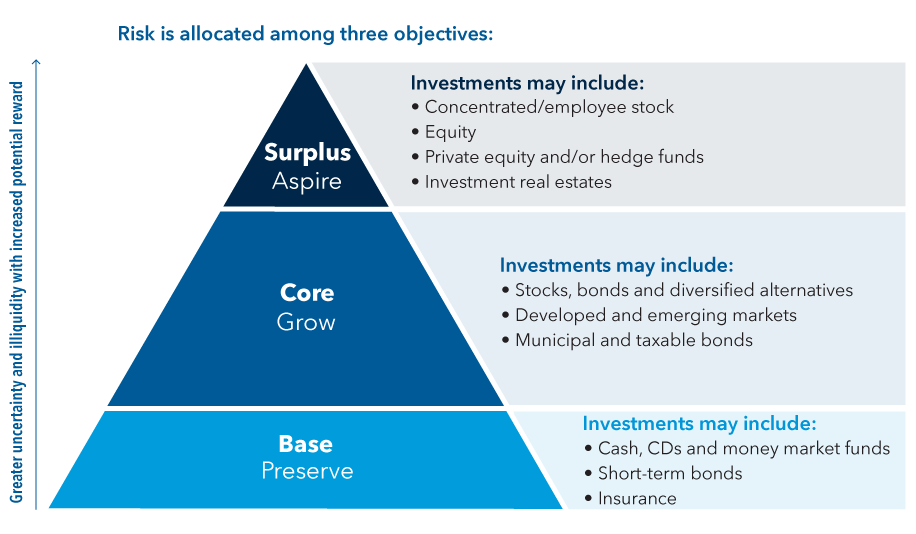

The HNW pyramid

Even very wealthy investors who are unlikely to run out of funds respond to mental accounting and the retirement bucket strategy. “A lot of distribution strategies are designed to help manage the emotional concerns of clients, not necessarily maximize wealth,” says Aaron Petersen, CFP and senior wealth advisory manager with Capital Group’s Private Client Services. “The emotional fear of markets declining impacts everyone.”

Petersen and his team have developed an objective-based approach that’s similar to bucketing but tailored to the needs of high net worth (HNW) clients. The team uses a slightly different metaphor: the pyramid. Assets are separated into three segments, including a base, core and surplus:

The base – Designed for preservation, the base may contain cash, short-term bonds or insurance — assets pulled out of the market that don’t have a lot of volatility risk. “Based on our research, we typically suggest considering one to two years of living expenses in the base,” Petersen says. But for some clients, that feels like too much to have sitting on the sidelines, especially when markets are going up. “Portfolio declines have lasted less than a year for some investors, with the average recovery period being about 12 months,” says Petersen. “It’s not until investors get into the depths of a down market that they really need that emergency cash reserve. For that reason, many of our clients feel pretty comfortable with one year of living expenses set outside the market,” he says.

The core – The core is the amount of money you need to meet all of your living expenses for the rest of your life with a high level of certainty that it will last, says Petersen. This varies from client to client, but it represents the bulk of the portfolio and has the potential to generate long-term growth. Investments may include stocks, bonds (munis and taxable) and diversified alternatives, in both developed and emerging markets.

The surplus – The aspirational portion of the pyramid, also known as the surplus, holds everything else, says Petersen. “Some clients have it, some don’t. This can be more of an HNW problem. For those who have more than they will need, you can open up a discussion about what to do with it,” he says. The alternative could be more spending, or not taking as much risk in the rest of the portfolio, because you don’t need to. Maybe it could be used for philanthropic giving or gifted to the family.

Petersen says his clients often have options outside of the portfolio that can be used to generate cash if necessary. “HNW clients tend to own real estate with plenty of equity. And if they needed to, they could use it to generate some short-term cash flow. Others have credit lines backed by their portfolios they can look to for their short-term cash needs,” he says.

Still, the pyramid seems to resonate with them. “They understand why we are setting aside this cash.” Sometimes, he says, the structure provides a helpful way to consider riskier investment allocations with clients. “If you don’t have a core that’s fully funded, you probably don’t want to be investing in things that are more speculative. Consider reserving that for when you have a surplus,” he says.