Who benefits from reshoring?

With such a large undertaking, the investment implications are widespread across a number of sectors and geographies. Here are four areas expected to benefit from reshoring in the years ahead.

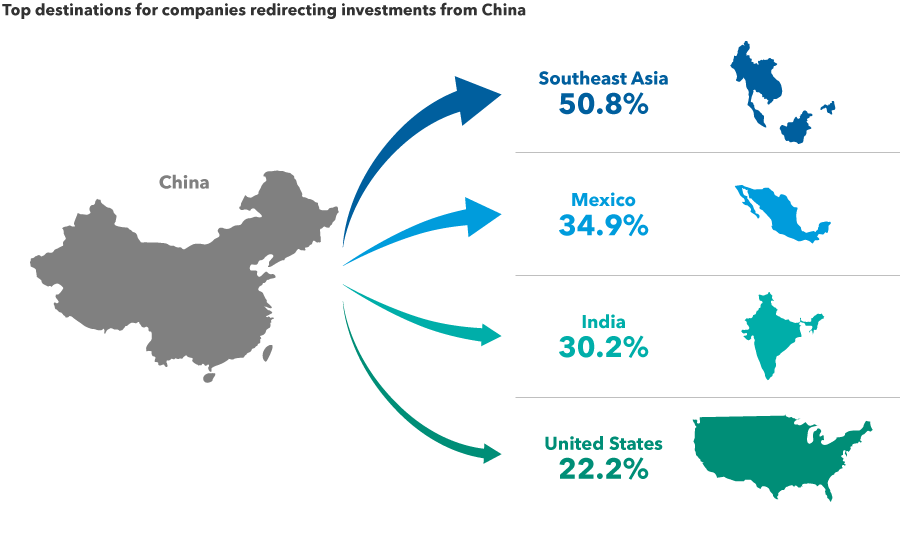

1. India Thanks to its proximity to China, a well-educated labor force, and a fast-growing, business-friendly economy, India may be the best-positioned country to capitalize on supply chain diversification. India’s government has taken bold steps to encourage the expansion of manufacturing operations, particularly in the smartphone space, where Apple works with contractors such as Foxconn to build the latest iPhones. The manufacturing sector is expected to accelerate over the next decade, driving growth in the Indian economy and boosting other industries such as banking, energy and telecommunications.

“India is arguably better positioned today than China was 20 years ago,” says Capital Group equity analyst Johnny Chan.

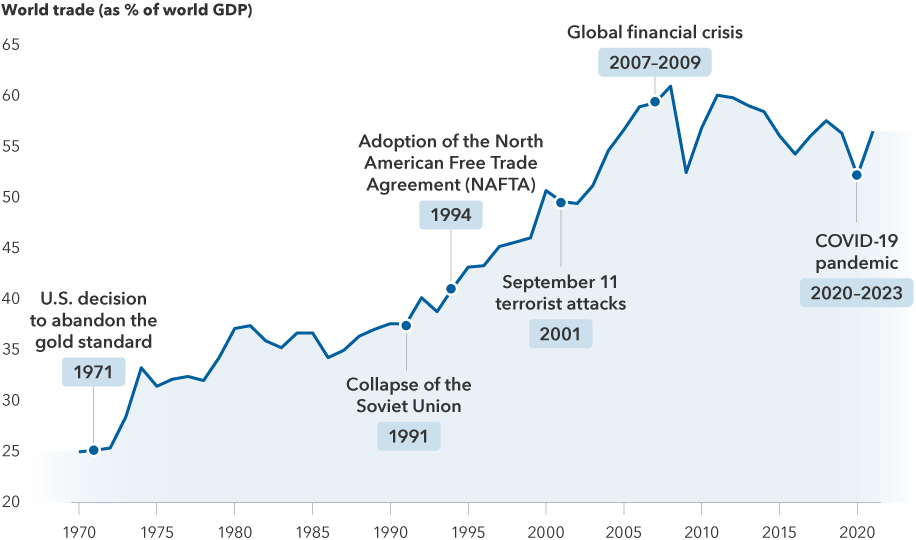

2. Mexico Similar to India, Mexico’s proximity to one of the world’s largest economies makes it an attractive base for expanded manufacturing and logistics operations. Many U.S. companies flocked there in the 1990s after the adoption of the North American Free Trade Agreement (NAFTA). That process has only accelerated under a revamped trade deal, the U.S./Mexico/Canada Agreement (USMCA), ratified in 2020.

Mexico’s annual exports to the U.S. have increased sharply in recent years. Although much of that is due to the influence of American companies, China is also ramping up in Mexico. For example, Hisense Group, one of China’s largest appliance makers, is currently building a $260 million industrial park in Monterrey, aiming to produce refrigerators, washing machines and air conditioners for the U.S. market. In the auto sector, BMW and Nissan have also recently expanded their capabilities south of the border.

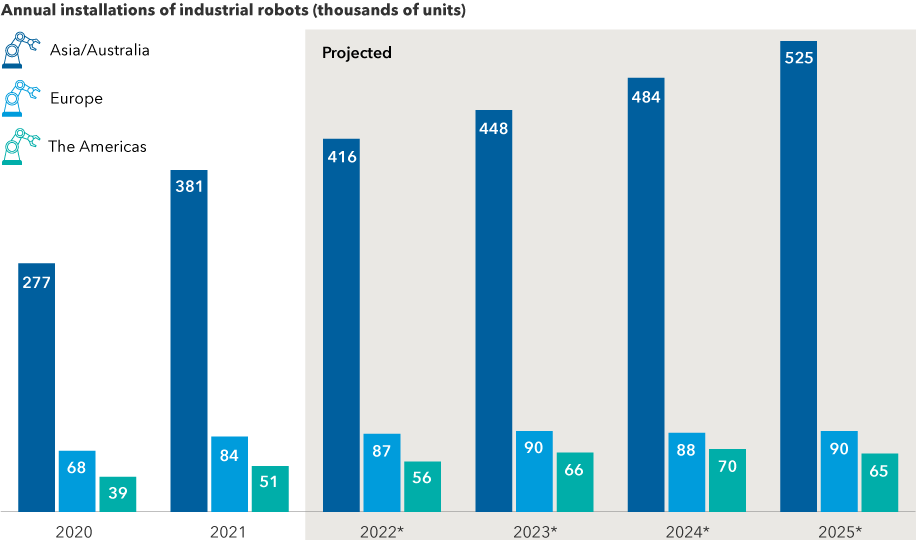

3. Automation providers One of the biggest hurdles to diversifying the world’s manufacturing capabilities is a chronic labor shortage, especially in developed economies. Automation powered by artificial intelligence (AI) is likely to provide an answer to this problem, says Mark Casey, a portfolio manager with The Growth Fund of America®. Many Asian countries are setting the trend with high rates of industrial automation, with the U.S. and Europe expected to follow. Both regions have room to grow, proving a bright outlook for top companies in the global robotics industry, including Japan’s Keyence, France’s Schneider Electric and Switzerland’s ABB Ltd. Amazon is also developing its own impressive AI-driven technology, Casey notes.

“Amazon has a new robotic picking-and-packing device called Sparrow that can grab more than 60 million different products and pack them into shipping boxes — completing each pick in a matter of seconds,” Casey says. “Just seven years ago Amazon’s experimental robots could handle only a small number of items, and each pick would take a couple minutes. I think this sort of technology is coming along sooner than we think, and I don’t see it accounted for in the stock prices of any major American or European company.”