Markets are on edge over soaring consumer prices, the war in Ukraine and recession fears in the U.S., Europe and China.

The Bloomberg U.S. Aggregate Index, a broad representation of the U.S. bond market, declined 5.9% in the first quarter, the worst quarterly loss since 1980. In April, it was down another 3.8%. With bond returns battered, investors may be wondering if there are any bargains in fixed income markets. Given the low prices, is now a good time to buy?

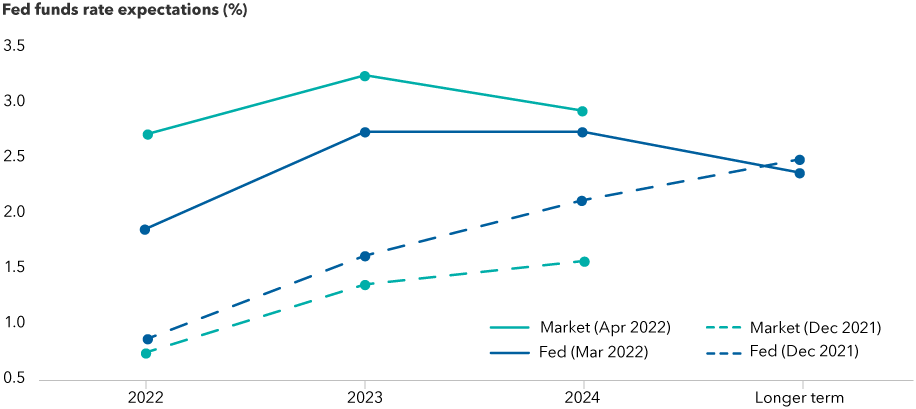

The risks are real. The U.S. Federal Reserve’s efforts to contain inflation are likely to pressure growth and employment. This week, the Fed raised its key policy rate 50 basis points to 0.75%–1.00%, the largest increase since May 2000.