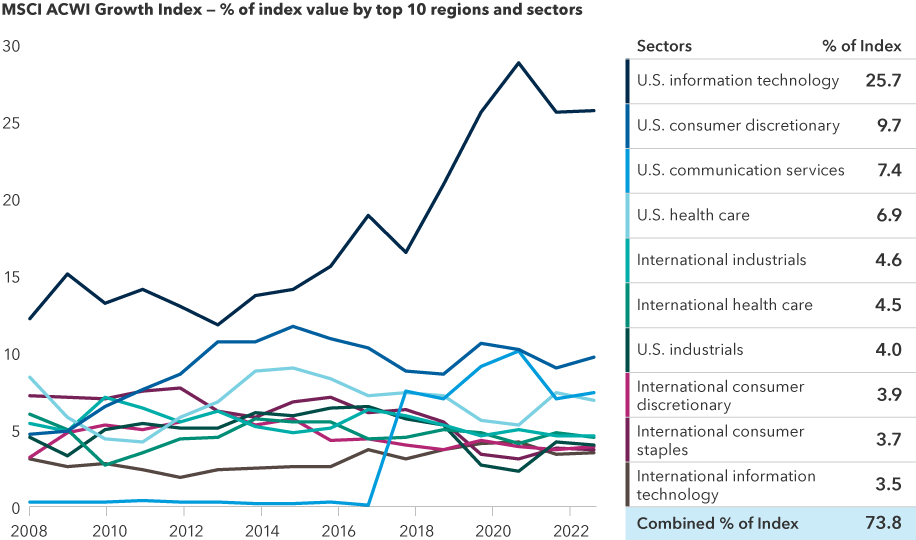

Last year, for the first time in almost a decade, U.S. stocks trailed markets in other major regions of the world. The odds that this trend can continue are reasonably good, in my view, simply because we've been in a long upcycle for U.S. stocks and the U.S. dollar.

For companies outside the U.S., dollar strength tends to be a headwind. At some point, I believe the Federal Reserve will have to cut rates. And when that happens, I think we may see further dollar weakness. So I'm optimistic about the prospects for international investing.

Regardless of whether economies in Europe or Asia do well, there will be great companies in those regions with solid business prospects. I often use a basketball analogy to help describe this dynamic. I'm struck by how international the NBA has become. In a sport that was first championed in the U.S., the NBA now features something like 120 international players from 40 countries, including some of the biggest superstars in the game.

Today I think there are select companies outside the U.S. that have been waking up to their opportunity globally. They are refocusing on generating value for shareholders during a time that is much more beneficial for their currency. In other words, like basketball, the world catches up, and some of the superstar companies are based in other countries.

Consider ASML, the world’s leading provider of manufacturing equipment for the most advanced semiconductors. It just happens to be based in the Netherlands. ASML has developed unique technology for making advanced chips. As its market share grew, it aggressively invested in developing its technological advantage. Right now, many chip stocks are down and the industry is struggling with oversupply. But taking a multi-year view, I think the industry is well positioned for a strong cyclical recovery.

Another example is in drug discovery. We are in the middle of a golden age of health care innovation. Many of the recent advances in treatments for cancer and pathogens like the COVID virus have been developed by U.S. companies. But there is also a Danish pharmaceutical company, Novo Nordisk, that has developed therapies to treat diabetes and obesity. Again, interest in this company has less to do with whether European markets can outpace U.S. markets and more to do with a worldwide increase in diabetes and obesity and the potential to improve patients’ lives.