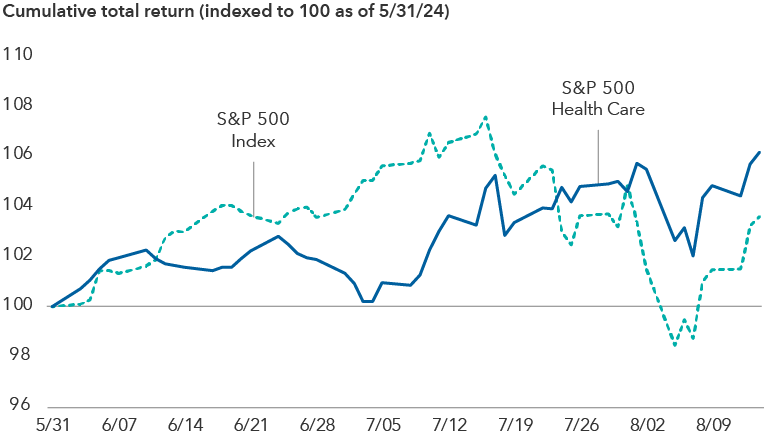

A spike in volatility following a lackluster jobs report in the United States and a rate hike in Japan masked a broadly solid second quarter earnings season.

“I’m a long-term investor, but the long term is the sum of all the short terms so every quarterly earnings report matters,” says Mark Casey, portfolio manager for CGGR — Capital Group Growth ETF and The Growth Fund of America®. “I’m interested in evidence that my long-term thesis is going as expected, better than expected, or possibly worse than expected.”

With that in mind, here are three investment ideas from the latest round of earnings reports.