Economic Indicators

- U.S. economy is benefiting from a strong labour market and easing inflation.

- Europe and some emerging markets are struggling to boost growth.

- Monetary easing around the world is providing a favourable backdrop for stocks and bonds.

Economic outlook: Global growth dependent on a resilient U.S.

As inflation eases and central banks around the world cut interest rates, the outlook for the global economy remains decidedly mixed heading into the new year. Much like the past few years, the United States and India continue to lead the way, driving global economic activity, while weaker economies in Europe and China seek to stimulate growth.

With U.S. labour markets healthy, profit growth solid and business investment picking up, the International Monetary Fund (IMF) recently raised its forecast for U.S. economic growth in 2025 to 2.2%. That prediction offsets downward revisions for other advanced countries, including the largest economies in Europe. China, meanwhile, continues to struggle with a real estate downturn and worries about a broadening trade war following U.S. President-elect Donald Trump’s victory on November 5.

“I tend to think about the world in terms of tailwinds and headwinds,” says Rob Lovelace, equity portfolio manager. “The U.S. has plenty of tailwinds at the economic level, the industry level and the company level. Japan is picking up some tailwinds. And I think both Europe and China are dealing with some real headwinds at the moment.”

Healthy U.S. economy remains a cornerstone of global growth

Source: Capital Group. Country positions are forward-looking estimates by Capital Group economists as of November 2024 and include a mix of quantitative and qualitative characteristics (in USD). Long-term tailwinds and headwinds are based on structural factors such as debt, demographics and innovation. Near-term tailwinds and headwinds are based on cyclical factors such as labour, housing, spending, investment and financial stability. Circles represent individual economies. Circle sizes approximate the relative value of each economy and are used for illustrative purposes only.

Welcome to the Benjamin Button economy

Can U.S. strength lift up the global economy and financial markets along with it? The world’s largest economy is striving to do just that.

Odd as it may sound, the U.S. economy appears to be taking a page straight out of the 2008 movie The Curious Case of Benjamin Button. Film buffs will remember that the title character, played by Brad Pitt, ages in reverse, from old man to young child.

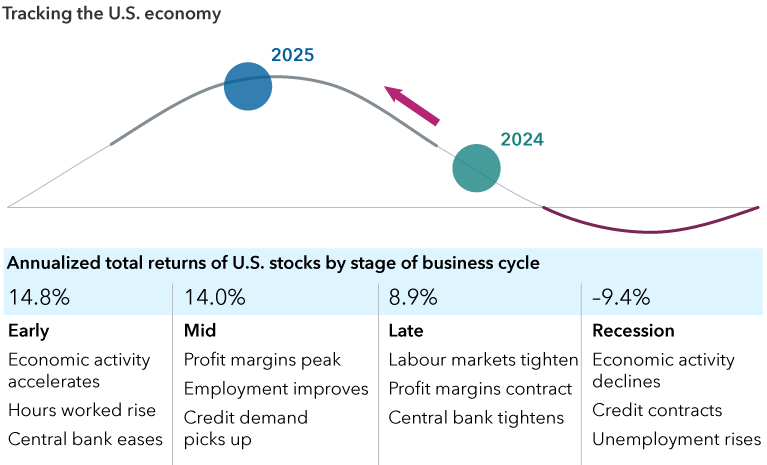

“The U.S. economy is going through a similar transition,” says Capital Group economist Jared Franz. “Instead of moving through the typical four-stage business cycle that has defined the post-World War II era, the economy appears to be shifting from late-cycle back to mid-cycle, conveniently avoiding a recession.”

A mid-cycle economy is generally characterized by rising corporate profits, accelerating credit demand, softening cost pressures and a shift toward neutral monetary policy. “We’ve seen all four of those in 2024,” Franz notes. “Going forward, I believe the U.S. is headed for a multi-year expansion period, perhaps fending off a recession until 2028.”

The U.S. business cycle appears to be aging in reverse

Sources: Capital Group, MSCI. Positions within the business cycle are forward-looking estimates by Capital Group economists as of December 2023 (2024 bubble) and September 2024 (2025 bubble). The views of individual portfolio managers and analysts may differ. Returns data is monthly from December 1973 to August 2024. Data is Datastream U.S. Total Market Index from December 31, 1973 through December 31, 1994, and MSCI USA Index data thereafter. Returns data reflects all completed cycle stages through October 31, 2024. Returns are in USD.

Historically speaking, mid-cycle periods have provided a favourable backdrop for U.S. equities, generating returns averaging 14% a year. That’s based on a Capital Group analysis of economic cycles and returns dating back to 1973.

As always, it’s important to acknowledge that past results are not predictive of results in future periods. “But if the U.S. economy continues to grow at a healthy rate,” Franz says, “that could provide a healthy tailwind for markets.”

Franz’s estimate for U.S. economic growth is more optimistic than the IMF forecast. He expects the U.S. economy to grow at an annualized rate of 2.5% to 3% in 2025, potentially higher if Trump is able to quickly cut taxes and slash government regulations, as he promised during his presidential campaign. Trump’s election, combined with a Republican sweep of the House and Senate, will likely translate into generally higher economic growth, Franz notes, but also higher inflation and higher interest rates than previously expected.

Outlook is mixed outside the U.S.

In markets outside the United States, there is more divergence. Some bright spots, including India, are expected to lead the world, generating some of the fastest growth rates. India’s economy should enjoy 6.5% growth in 2025, according to IMF estimates, driven by a young and growing workforce. India also is benefiting from a post-pandemic shift in global supply chains, adding to its manufacturing base in mobile phones, home appliances and pharmaceuticals, among other products.

Europe’s economy continues to ride the edge between expansion and contraction, with expected growth around 1%, weighed down by the war in Ukraine, high energy prices and close ties to China’s sluggish economy. In response, the European Central Bank (ECB) started cutting interest rates this year ahead of the U.S. Federal Reserve, hoping to kickstart the eurozone economy.

In China, meanwhile, the government has launched a massive stimulus program designed to reverse chronic weakness in the country’s real estate market and slowing industrial production. China’s growth-oriented policies include interest rate cuts, mortgage rate reductions, and a recently announced US$1.4 trillion aid package to help local governments deal with growing debt burdens. Looking ahead, a cloud hangs over China’s role in international trade as the incoming Trump administration has vowed to raise tariffs on Chinese imports.

Where to invest in a rate-cutting cycle

Adding fuel to economic growth expectations, the world’s major central banks — the Fed, the ECB, the Bank of England and The People’s Bank of China — have all committed to monetary easing in the closing months of 2024.

The Fed, often considered the central bank to the world, has cut rates twice since September, setting the stage for what could be a favourable environment for financial markets in 2025. Rate cuts when the economy is growing have been a boon for investors in both stocks and bonds.

Of the Fed’s seven easing cycles since 1984, three occurred outside a recession. During those non-recessionary cycles, the S&P 500 Index averaged a 27.9% return from the first cut to the last, with most sectors posting double-digit gains.

Rate cuts have boosted stocks and bonds in a healthy economy

Sources: Capital Group, Bloomberg Index Services Ltd., Morningstar, Standard & Poor’s. Return calculations reflect annualized total returns over periods in which the U.S. Federal Reserve had stopped raising rates and began to actively cut rates, measured from the peak federal funds rate target to the lowest federal funds rate target for each cycle. Specific easing cycles included: August 1984 to August 1986 (non-recessionary), May 1989 to September 1992 (recessionary), February 1995 to January 1996 (non-recessionary), March 1997 to November 1998 (non-recessionary), May 2000 to June 2003 (recessionary), June 2006 to December 2008 (recessionary), and December 2018 to March 2020 (recessionary). Benchmarks used are the S&P 500 Index (U.S. stocks), MSCI World ex USA Index (international stocks), Bloomberg U.S. Aggregate Bond Index (U.S. bonds) and the average investment rate of 3-month U.S. Treasury Bills (cash). As of September 30, 2024. Returns are in USD.

During times when rate-cutting cycles have preceded a recession, stocks have not fared well. But U.S. bond returns have been strong in both non-recessionary and recessionary cutting cycles, significantly outpacing cash equivalent investments in non-recessionary periods.

Fixed income portfolio manager John Queen believes the economy will continue to improve heading into the new year and thinks the Fed is simply looking to normalize interest rates, reducing them to a level where they are no longer restrictive. That was the base case before the U.S. election, and it is even more so now.

“The Fed is cutting rates because it wants to,” Queen says, “not because it has to.”

Bloomberg U.S. Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market.

Datastream U.S. Total Market Index measures the results of the U.S. equity market, including large-, mid- and small-capitalization stocks.

MSCI USA Index is a free float-adjusted, market capitalization-weighted index designed to measure the U.S. portion of the world market.

MSCI World ex USA Index is a free float-adjusted, market capitalization-weighted that captures large- and mid-cap representations across 22 of 23 developed market countries, excluding the U.S. The index consists of more than 40 developed and emerging market country indexes.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

©2024 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Our latest insights

-

-

U.S. Equities

-

Global Equities

-

Emerging Markets

-

Long-Term Investing

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Rob Lovelace

Rob Lovelace

Jared Franz

Jared Franz

John Queen

John Queen