Emerging Markets

India is known as the market that has confounded optimists and pessimists alike. Could this be its decade to shine?

India‘s significance as a rising global power came to light with Prime Minister Narendra Modi’s recent visit to the United States, where he addressed Congress, met with high-profile business leaders and dined at the White House. From our recent travels around the country, we believe indications are pointing in the right direction: Corporate confidence is high, the economy is expanding at a decent clip and technological innovation is leading to new areas of growth.

For a democracy of its size, the country has seen relative political stability over the past 10 years, allowing economic development to be a top priority. While political instability and market volatility may increase in advance of general elections next year, we believe that India is poised for a period of secular growth, fueled by significant expansion in direct and fixed asset investment. Here are some of the key aspects that make India appealing compared with other emerging markets.

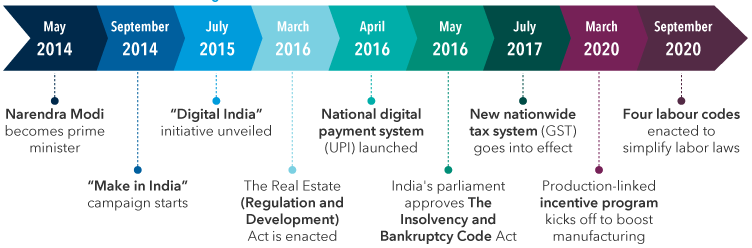

1. Reforms have set the stage for growth

Since Prime Minister Narendra Modi took office in 2014, he and his team have helped usher in pro-business reforms that have accelerated growth by facilitating the expansion of credit and bringing large swaths of the economy into the formal sector.

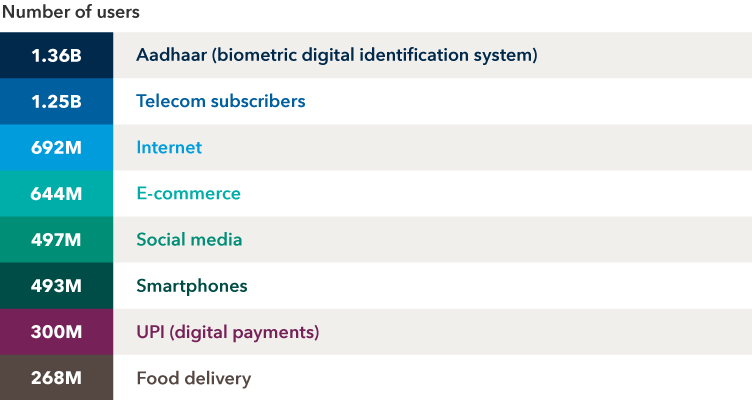

- Aadhaar — a voluntary biometric identification system similar to the social insurance number in Canada — has brought more than a billion people into a national database. The Aadhaar program, along with the development of credit rating agencies, has helped boost consumer lending.

- A national goods and services tax (GST) implemented in 2017 has replaced an inefficient web of state taxes. As a digitalized system that can also track goods and services at each point in the supply chain, GST has brought the manufacturing and industrial sectors into the formal economy.

- Launched in 2016, Unified Payments Interface (UPI) created an instant real-time payment system. UPI allows non-banks as well as banks to facilitate electronic transactions and provide credit.

Key reforms under Modi

Sources: Indian government, media reports.

Together, these reforms have revolutionized credit underwriting and sped up the lending process. This should boost the economy and meaningfully expand the market for banks and non-bank financial companies.

Production-linked incentive programs designed to elevate India’s domestic manufacturing base are gaining traction too. Modi, while still controversial on some social and human rights issues, has delivered in terms of governance, infrastructure and economic programs. India is projected to become the world’s third-largest economy behind the United States and China by 2027, according to the International Monetary Fund. It’s currently the fifth largest, after Japan and Germany.1

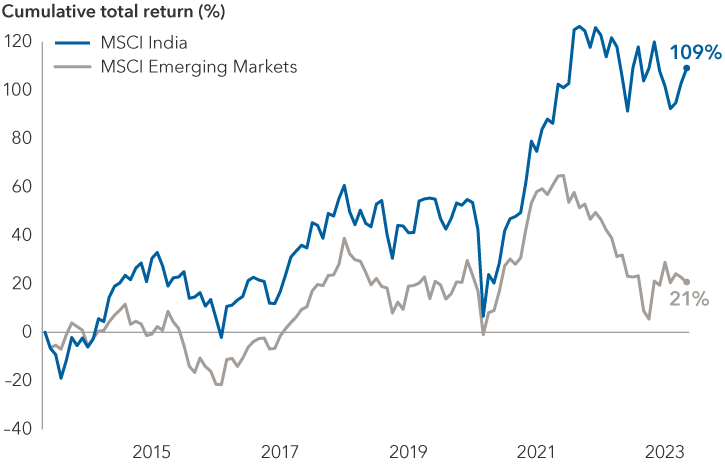

Reforms have helped bolster Indian stocks

Sources: MSCI, RIMES. Data as of May 31, 2023.

2. The infrastructure boom is real

The lack of infrastructure has been a major impediment to unlocking India‘s true growth potential. Over the past five years, the government has pumped billions into building out roads, railroads, airports and seaports. On our recent research trip to meet with companies, it was very clear that the construction of infrastructure as well as more affordable housing is finally happening. We traveled by car from Surat to Mumbai, a distance of 170 miles. Ten years ago, that trip would have taken 12 hours. We did it in six, driving on six-lane highways and stopping at several quality food establishments along the way. That was unheard of just a decade earlier.

In Mumbai, the skyline is unrecognizable from 15 years ago. Dozens of buildings reach 50 or more floors, and a subway system is under construction. Residential housing is fast expanding. As an example, the town of Palava, 20 miles from Mumbai’s central business district, is a master-planned community that reminds us of what we used to see in China. In 15 years, Palava has gone from a concept to a city of 120,000 residents.

3. Tailwinds for manufacturing are getting stronger

The playbook for the Indian government is twofold: ramp up capacity to serve the domestic population and over time become a larger player in export markets. Leaders also want to develop a supply chain ecosystem, as a wide array of product components are imported.

Manufacturing capacity is expanding for mobile phones, home appliances, computers and telecommunications equipment. Modi’s team has been aggressive in courting Japanese, Taiwanese and U.S. companies to invest in new capacity. Apple is producing its iPhone 14 line in India, while Japanese companies Daikin and Mitsubishi Electric are teeing up investments to make air conditioners and related parts.

Local firms have been investing heavily to scale up businesses and tap into the rapidly growing domestic market. These include Amber, a leading maker of air conditioners; Dixon, one of the largest electronics manufacturers; and Havells, an electrical equipment company.

Overall, manufacturing is getting easier. Securing government approvals for land is less onerous, labour is affordable and industrial parks are creating dedicated power sources (consistent power availability has historically been a big challenge).

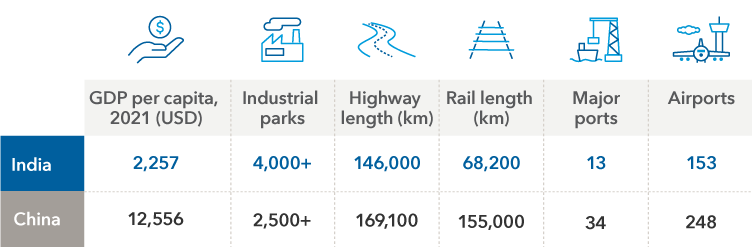

We anticipate India will become a desirable location for companies looking to diversify their supply chains outside of China, a strategy commonly known as China plus one. That said, it likely has many years to go before it can challenge China as a global manufacturing powerhouse. On the flip side, the upside looks promising.

India trails China in supply chain infrastructure

Sources: Capital Group, WorldData, World Bank, Statista, news articles. Data as of 2021.

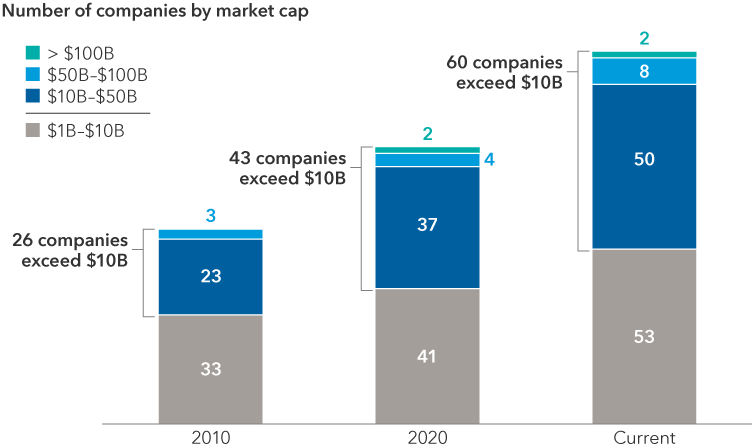

4. India‘s equity market has been growing and should evolve

Within the MSCI Emerging Markets Index, India represents 14% of the composite index, behind China at 29% and Taiwan at 16%.2 We expect potential investment opportunities to increase, especially in the small-cap space given India‘s economic trajectory.

The equity market is still relatively small compared with the size of the economy and its potential growth. The MSCI India Index had a market capitalization of close to US$1 trillion as of May 31, 2023. Smaller companies, or those with a market value between US$1 billion to US$10 billion, made up nearly half the index.

India's equity market is expanding in the small- and mid-cap space

Sources: Capital Group, MSCI, RIMES. Data represents MSCI India Index. As of May 29, 2023. Dollar values in USD.

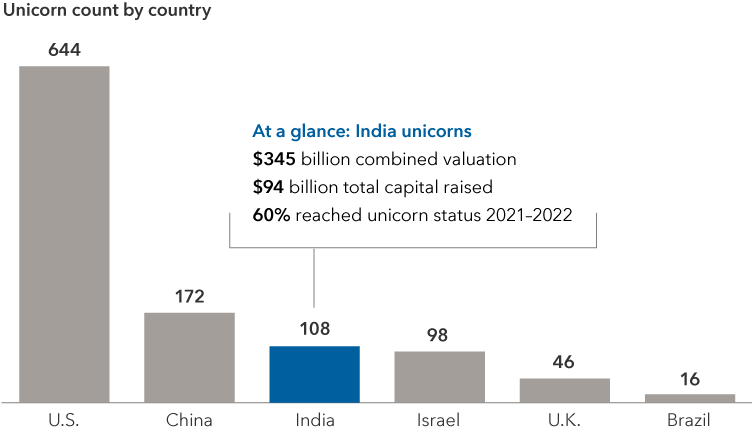

The country‘s capital markets have seen a proliferation of initial public offerings (IPOs) in recent years. The types of companies going public — and those in the IPO pipeline — reflect its ongoing transformation. These include online platforms such as Paytm (payments), Zomato (food delivery services) and Policybazaar (insurance quote aggregator). Venture capital has been pouring into the country. India is now behind only the U.S and China in terms of the number of “unicorns” (unlisted companies valued at US$1 billion) as of December 2022.

5. Investment opportunities span real estate, financials and industrials

Real estate: India, which the U.N. projected in April will overtake China as the world‘s most populous country this year, is a massively underhoused society. Housing is expected to be a key driver — and beneficiary — of the economy‘s growth. Real estate is projected to rise to nearly 15% of India‘s gross domestic product (GDP) by fiscal year 2031, up from 7% currently. With that will likely come demand for building materials, cable, refrigerators and air conditioners.

The sector is undergoing a dramatic structural shift, which should boost profits. Government policies have helped reform corrupt practices and build trust in the homebuying process among consumers. A liquidity crisis several years ago also wiped out many smaller developers. Taken together, a once highly fragmented market has become more organized and consolidated.

This should create opportunities for larger regional developers to take market share, especially those building homes and apartments for first-time buyers.

Banks: The overall environment looks positive. Loan growth remains solid in both the retail and corporate categories, and the credit environment remains benign. We could be entering a favorable cycle for banks given the trajectory of the economy and several rounds of consolidation among weaker state-owned banks in recent years.

Valuations for the largest private sector banks appear reasonable relative to history. For example, on a price-to-earnings basis, HDFC Bank is trading at 18 times earnings for the next 12 months, compared with its five-year average of 21 times. On a comparable basis, Kotak Mahindra Bank is trading at 29 times versus its five-year average of 40 times, according to FactSet (as of June 23).

Markets have been concerned that net interest margins3 — a key profit measure — have peaked, as monetary authorities are expected to cut benchmark interest rates. The flip side is that lower rates should spur the economy. We believe there is sufficient potential for loan growth to offset margin compression given the expansion of credit and robust economic growth.

A closer look at India's digital transformation

Source: Indian Council for Research on International Economic Relations, “State of India’s Digital Economy Report 2023.” Data as of February 2023.

Non-bank financial companies: As mentioned, the market has consolidated following a liquidity crisis several years ago, making it much more attractive from an investment perspective. Data gathering through the country‘s technology infrastructure has helped to improve underwriting standards. This has the potential to be a large market, especially in areas of affordable housing and vehicles.

Mobile communications: The telecommunications market has consolidated, effectively leaving conglomerate Reliance Industries and Bharti Airtel as the dominant players. We anticipate smartphone and data usage will continue to increase, especially as 5G and fibre-to-the-home technologies are rolled out in more cities.

Reliance, in particular, has witnessed rapid growth, underscoring the pace of India‘s digital revolution. Since its Jio telecom service was launched in 2016, it has amassed 439 million subscribers and handles 60% of the broadband data traffic.4 India is currently the world‘s second-largest telecom market by subscribers, making it an attractive proposition for global technology giants. In 2022, Google made a US$1 billion investment in Airtel to make smartphones more affordable.

6. China plus one: The chemicals industry sets a good example

The chemicals industry exemplifies how both governments and multinationals are turning to India to diversify manufacturing beyond China. Many chemical companies have come up over the past decade as the West sought to diversify its sourcing of both specialty and generic chemicals.

India‘s competitive advantage has been its large pool of trained scientists and chemical engineers, which has enabled it to establish expertise in specialty and commoditized chemicals. This includes those being used in semiconductors, electric vehicle batteries and solar panels, where additional capacity is being built.

That said, India’s chemicals industry is a fraction of that of China, the world's largest producer. But if 10% of demand sourced from China came to India, it would be meaningful. To make a broader point, India is a US$3.5 trillion economy, compared with an annual gross domestic product output of US$18.1 trillion for China,5 leaving a long runway for growth ahead.

7. The energy transition could be transformational

Indian corporations are seeking to compete with China all along the value chain of clean energy, especially with green hydrogen. So far, the companies looking to capitalize on this effort include Reliance Industries, Larsen & Toubro and Tata Power, based on our conversations with government and industry sources.

The energy transition is potentially transformational for India. If done right, the payoff could be massive: The country is a large importer of oil and gas, so more renewable power would make it more energy independent. It would also significantly boost its manufacturing base.

India‘s ambition in this area is in the early stages. Specifically, India must build its renewables supply chain from scratch, establish global cost competitiveness, continue to push policy forward and attract a lot of capital. While this will take time, both government and the private sector seem highly motivated.

8. Demographics are the biggest advantage

While India will very likely benefit from Western countries exploring China-plus sourcing strategies, the bulk of economic growth will come from domestic consumption and investment. With a median age of 29 years, India in our view has one of the most attractive demographic profiles among the world’s largest economies and can reap benefits from its productive capacity, provided the right policies are in place.

We have already seen that technological innovation combined with an improving regulatory and legal framework has put the nation‘s economy on a path of 5% to 6% annualized growth, among the fastest of the world‘s large economies. With a general election due in 2024, political risk will rise. The consensus view in markets today is that the pro-business Modi government will retain power, possibly with a reduced majority in parliament.

Should that change, market volatility will no doubt increase. But the imperative of economic growth and job creation is well-understood by political parties across the ideological spectrum.

India has emerged on the global unicorn stage

Sources: Inc42 (for Indian unicorns), TechAviv (for Israeli unicorns) and CB Insights (for all others). Unicorn refers to a startup valued at or above US$1 billion. Data as of December 2022. Dollar values in USD.

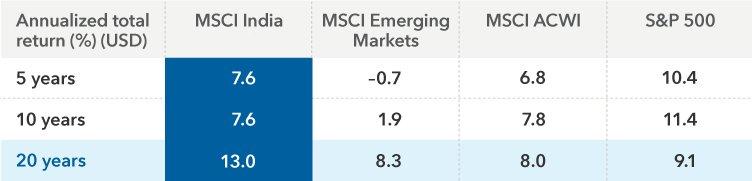

9. Valuations are stretched but not insurmountable

When it comes to investing in emerging markets, India has historically traded at a premium on a relative price-to-earnings basis. Currently, the market looks a little expensive by historical standards. The MSCI India Index trades at 20 times forward earnings versus its 10-year average of 18 times.6

That said, we believe the fundamental outlook for India is arguably better than ever. The market has a lot going for it: It‘s one of the world‘s fastest growing economies, inflation is under control, the government has been fiscally responsible, and corruption is lower than it was a decade ago. If Indian companies can deliver on earnings and cash flows, we think it‘s possible the market can grow into these valuations.

The path of India‘s equities has never been a straight line, but over longer periods, the stock market has delivered some of the best returns among emerging and developed markets.

India‘s equity benchmark has delivered over the past 20 years

Sources: MSCI, RIMES. Data as of May 31, 2023.

MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.

The MSCI India Index is designed to measure the performance of the large and mid-cap segments of the Indian market. With 114 constituents, the index covers approximately 85% of the Indian equity universe.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global emerging markets, consisting of more than 20 emerging market country indexes.

S&P 500 Index is a market-capitalization-weighted index based on the results of 500 widely held common stocks.

Our latest insights

1 All figures as of April 2023. Source: IMF.

2 As of May 31, 2023. Source: MSCI.

3 Net interest margin reveals how much the bank is earning in interest on its loans compared to how much it is paying out in interest on deposits.

4 As of March 31, 2023. Source: Reliance Industries.

5 As of April 2023. Source: IMF.

6 As of May 31, 2023. Sources: MSCI, RIMES.

RELATED INSIGHTS

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Brad Freer

Brad Freer

Shlok Melwani

Shlok Melwani

Anirudha Dutta

Anirudha Dutta

Rahul Sadiwala

Rahul Sadiwala