INVESTMENTS

Know-your-product resource centre

Learn about our distinctive investment process and explore tools to assist with KYP due diligence

For advisor use only. Not for use with investors.

THE CAPITAL SYSTEM

A distinctive investment approach

The Capital SystemTM combines independent high-conviction decision-making with the diversity that comes from multiple perspectives. It is designed to provide continuity and help investors pursue long-term investment success.

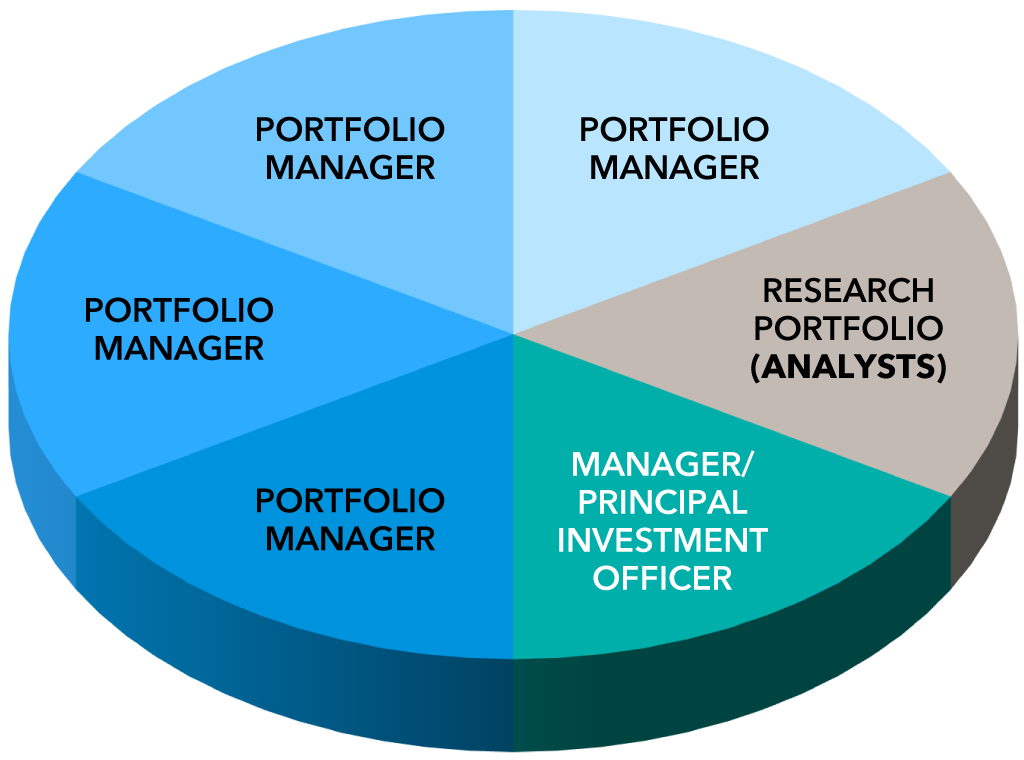

Each portfolio has multiple managers instead of one, with portfolios divided into segments to combine experienced managers’ best ideas in one portfolio. This creates the potential for superior long-term results while easing key-person risk and investment capacity concerns.

For illustrative purposes only.

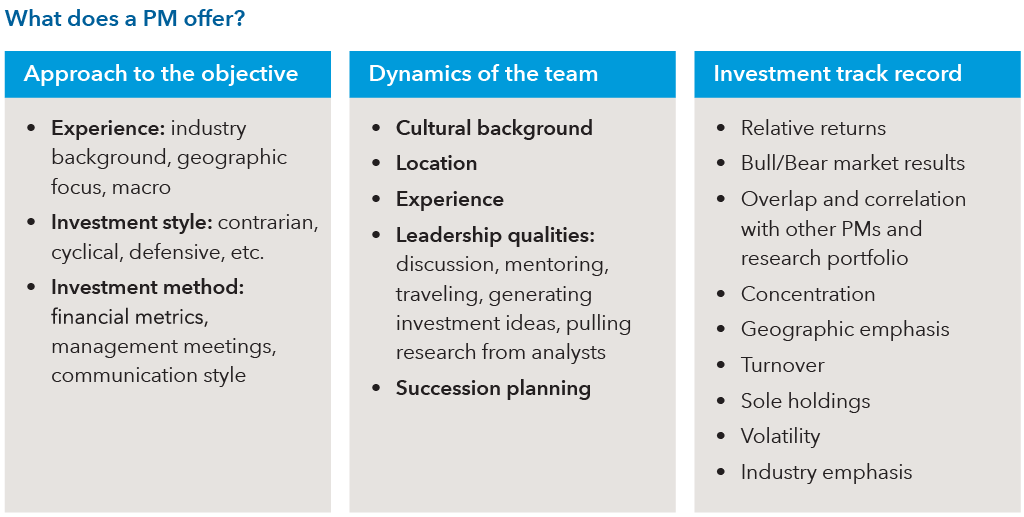

We construct portfolio manager teams on a combination of quantitative and qualitative factors. This helps teams meet portfolio objectives through complementary investment styles, which makes each portfolio style-agnostic.

Analysts have the opportunity to invest in their highest conviction ideas through the Research Portfolio, which is managed by a group of investment analysts, providing years of investing experience before they become portfolio managers.

For illustrative purposes only.

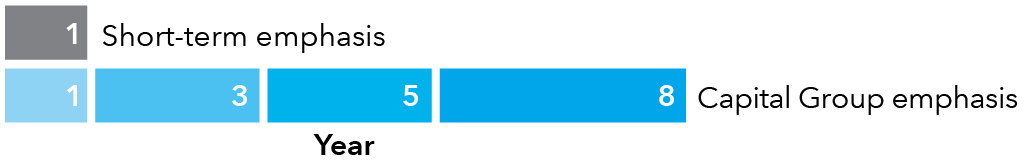

Source: Capital Group. Compensation paid to our investment professionals is heavily influenced by results over one-, three-, five- and eight-year periods, with increasing weight placed on each succeeding measurement period to encourage a long-term investment approach. Size and number of portfolio segments do not reflect actual asset allocations.

Portfolio managers’ compensation emphasizes results over longer periods with amounts heavily influenced by results over one-, three-, five- and eight-year periods. Increasing weight is placed on each succeeding measurement period to encourage a long-term investment approach.

INVESTMENT SOLUTIONS

Portfolios backed by deep fundamental research and driven by clients’ real-life goals

-

-

Equity

Canadian Focused Equity

Investment objective:

Long-term growth of capital and income through investments primarily in equity or equity-type securities with an emphasis on Canadian issuers.Fund category:

EquityGlobal Equity

Investment objective:

Long-term growth of capital through investments primarily in common stocks, including growth-oriented stocks, on a global basis. Future income is a secondary objective.Fund category:

EquityInternational Equity

Investment objective:

Long-term growth of capital through investments in a portfolio comprised primarily of securities of large-capitalization issuers located outside North America.Fund category:

EquityU.S. Equity

Investment objective:

Long-term growth of capital and income through investments primarily in common stocks of U.S. issuers.Fund category:

Equity -

Equity-income

Capital Income Builder

Investment objective:

The fund has two primary investment objectives. It seeks to provide (1) a level of current income that exceeds the average yield on U.S. stocks generally and (2) a growing stream of income over the years (in both cases, measured in U.S. dollars). The fund's secondary objective is to provide growth of capital. The fund invests primarily in a broad range of income-producing securities, including common stocks and bonds.Fund category:

Equity-income -

Multi-asset

Emerging Markets Total Opportunities

Investment objective:

Seeks long-term growth and preservation of capital by investing primarily in a broad range of equity and debt securities of emerging markets issuers. The fund seeks to achieve this objective with lower volatility of returns than emerging markets equities.Fund category:

Multi-assetGlobal Balanced

Investment objective:

Seeks the balanced accomplishment of three objectives: Long term growth of capital, conservation of principal, and current income through investments primarily in equity and debt securities issued by companies and governments around the world.Fund category:

Multi-assetMonthly Income Portfolio

Investment objective:

Seeks to generate income, along with conservation of capital and long-term growth of capital. The fund invests primarily in equity and debt securities issued by companies and governments around the world, primarily through investments in underlying funds.Fund category:

Multi-asset -

Fixed income

Canadian Money Market

Investment objective:

Generate current income and at the same time preserve capital and maintain liquidity by investing in money market instruments, generally maturing in one year or less.Fund category:

Canadian Money MarketCanadian Core Plus Fixed Income

Investment objective:

Steady income, capital preservation and long-term total return consistent with prudent management by investing mainly in a broad range of Canadian and global fixed-income securities.Fund category:

Fixed incomeMulti-Sector Income

Investment objective:

Seeks to provide a high level of current income through investments primarily in a broad range of bonds and other debt securities. The fund’s secondary objective is capital appreciation.Fund category:

Fixed incomeWorld Bond

Investment objective:

Seeks to provide, over the long term, a high level of total return consistent with prudent investment management through investments primarily in bonds and other debt securities of global issuers. Total return comprises the income generated by the fund and the changes in the market value of the fund’s investments.Fund category:

Fixed income

-

Portfolio analysis and results

Fund summaries

Overview of Capital Group mutual funds with investment objectives, distinguishing characteristics, risk ratings and series’ MERS.

How our portfolios have fared

View our mutual fund results.

Risk methodology

The methodology used to determine the volatility risk ratings of our funds.

Fund Facts / ETF Facts

View the potential benefits, risks and costs of investing in a fund.

Quarterly reviews and commentary

Including investment results, portfolio and market commentary, top holdings, and recent changes.

Expenses and compensation

Mutual fund management expense ratios, trailers and front-load commissions.

KYP BRIEFCASE

Resources to help you determine suitability for you and your clients

KYP ASSESSMENT

KYP assessment tools for due diligence quick reference. The first, pre-filled version contains a concise set of facts specific to Capital Group. The second is fillable for use with other firms.

Contact your dealer for KYP guidance.

REGULATORY DOCUMENTS

Connect with us

Our team is here to help.

This content is confidential and designed for the exclusive use of registered dealers and their representatives. Canadian securities legislation, including National Instrument 81-102, prohibits its distribution to investors, potential investors or the general public. It is not intended to be a sales communication, as defined in the Instrument, and has not been designed to comply with its requirements relating to sales communications.

Capital Group offers global investment services designed for investors in various jurisdictions. Certain investment services may not be available outside their intended countries or regions. Canadian residents' access to information about investment services offered in other jurisdictions is for informational purposes only and should not be construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any security under Canadian law.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California, in 1931. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.