Fixed Income

- A resilient U.S. economy underpins the bond market.

- Consider shifting into high-quality bonds to help offset equity market risk.

- Credit spreads reflect the benign economic outlook, but security selection is key.

The era of TINA or “there is no alternative” to stocks may be over. Bond income potential is at its highest level in decades, and investors now have more options to diversify their portfolio.

“The United States economy is solid going into 2025,” says fixed income portfolio manager Vince Gonzales. “Consumers continue to spend, corporate fundamentals are healthy, and interest rates are declining. That backdrop is supportive of fixed income and comes at a time when yields remain elevated, even as the U.S. Federal Reserve lowers rates.”

President-elect Donald Trump’s policy priorities of tax cuts, tariffs and deregulation could have implications for growth, inflation expectations and interest rates. For example, Capital Group economist Jared Franz notes that Trump policies could help sustain U.S. GDP in 2025 in a range of 3% to 3.5% but also cause inflation to settle above the Fed’s 2% target to a level of 2.5% to 3%. Bond markets could influence Trump’s economic policies since the 10-year U.S. Treasury underpins borrowing costs for governments and consumers. Investors have pushed U.S. Treasury yields toward the middle of 2024’s range, with the 10-year at 4.18% on December 3, 2024, compared to its level of 3.78% on September 30, 2024.

Investors shouldn’t lose the plot. After years of lagging, the yield on the Bloomberg U.S. Aggregate Bond Index was higher than the S&P 500 Index earnings yield as of November 30, 2024. Bonds have reclaimed their traditional role as providers of income and can also help lower overall risk in a portfolio.

Bond yields have surpassed the S&P 500 Index earnings yield

Sources: Bloomberg Index Services Ltd., FactSet, Standard & Poor’s. As of November 30, 2024.

With the Fed in cutting mode, short-term yields are expected to gradually decline over the next year, Gonzales says. However, potential inflationary impulses stemming from the prospect of higher fiscal deficits and tariffs may keep 10-year and 30-year U.S. Treasury yields elevated.

“In today’s rate environment, investors can capture a healthy level of income within high-quality bonds,” Gonzales explains. Moreover, bonds can again be viewed as a ballast when equity markets falter and can help investors navigate potential volatility.

Fundamentals remain healthy

Sustained consumer spending despite inflation and high interest rates has kept corporate earnings and credit fundamentals in good condition.

Companies broadly reported healthy earnings and operated their businesses conservatively over the past few years amid concerns of a recession, says fixed income portfolio manager David Daigle. “Although there are weak spots emerging, Fed rate cuts may help mitigate the pace of a potential economic slowdown.”

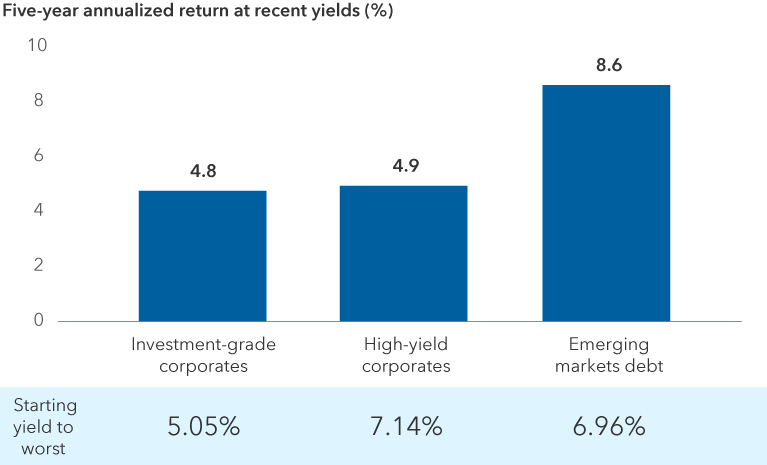

Current yields have typically led to attractive returns

Sources: Capital Group, Bloomberg, Bloomberg Index Services Ltd., J.P. Morgan, Rimes. Yields and monthly return data as of November 30, 2024, going back to January 2000 for all sectors except for emerging markets debt, which goes back to January 2003, and high-yield municipals, which go back to June 2003. Based on average monthly returns for each sector when in a +/- 0.30% range of yield to worst shown. Sector yields above include Bloomberg U.S. Investment Grade Corporate Index, Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index, 50% J.P. Morgan EMBI Global Diversified Index/50% J.P. Morgan GBI-EM Global Diversified Index blend.

Despite generally stable corporate fundamentals, security selection remains an important driver of returns. “Inflation has been challenging for lower income consumers, so certain retailers and consumer cyclical businesses may run into trouble,” Daigle adds. “I think economic growth may slow a year from today, so it’s important to identify which businesses could be most impacted.”

Credit spreads largely reflect a benign economic outlook, but investors can still benefit from the higher yields offered by corporate investment-grade and high-yield bonds compared to Treasuries. The U.S. Federal Reserve’s historic campaign to combat inflation lifted rates and, by extension, yields across bond sectors. This indicates that strong income may finally persist after decades of low rates. The Bloomberg U.S. Investment Grade Index yielded 5.05% on November 30, 2024, while the Bloomberg U.S. High Yield Corporate Bond 2% Issuer Capped Index yielded 7.14%.

The total return of a bond consists of price changes and interest paid. The higher interest component compared to the post-global financial crisis period means that it may be easier to achieve a positive total return even amid modest volatility.

Historically, starting yields have been a good indicator of long-term return expectations. “Income potential remains strong relative to history, and exposure to these sectors should be considered as part of an overall diversified portfolio,” Daigle says.

In short, opportunities exist, and they exist across sectors — including beyond the U.S. market. Other fixed income markets such as emerging markets debt have weathered high interest rates and are considered well-equipped to handle potential volatility, says Kirstie Spence, portfolio manager for Capital Group Multi-Sector Income Fund™ (Canada).

Bonds should offer balance in the years ahead

The economy remains resilient, with underlying inflation easing and job markets healthy. Still, there is uncertainty ahead. “There are some weak spots that could turn into something more, so the range of outcomes is wide,” Gonzales says. For example, manufacturing and housing have struggled under high interest rates.

Moreover, the potential impacts of Trump 2.0 policy priorities have yet to play out. “Given the uncertainty, it’s important to remain flexible, which includes investing in bonds that can offer diversification benefits should growth stall and equity markets decline,” Gonzales adds. This means maintaining a core bond allocation that expresses a bias toward higher quality bonds in today’s environment where investors are not well compensated for taking incremental risk.

Diversification from equities appears to have returned for high-quality bonds

Sources: Capital Group, Morningstar. Periods of equity volatility from 2010 to 2023 are based on price declines of 10% or more (without dividends reinvested) in the S&P 500 with at least 75% recovery. The period of volatility during 2024 refers to July 15, 2024, through August 4, 2024. Returns are in USD.

“The U.S. Federal Reserve is focused on supporting labour markets now that inflation is near target,” says Capital Group Canadian Core Plus Fixed Income Fund™ (Canada) portfolio manager Tim Ng. “All else being equal, lower policy rates should be positive for risk assets and the economy.”

Nevertheless, investors are likely to appreciate bonds most for the relative stability they can provide when stocks decline.

“Bonds are in a position to offer diversification benefits again given higher yields and a supportive Fed,” Ng says. For example, when the S&P 500 plunged 7.9% from mid-July to early August 2024, the Bloomberg U.S. Aggregate Bond Index posted a 2.6% gain. While there are no guarantees that will happen again, it’s a good reminder of the importance of high-quality bonds as part of a diversified portfolio.

The Fed has ample room to cut rates aggressively — more than current market expectations — if a growth shock occurs or recession risk escalates. Those rate cuts can help lead bonds to appreciate and offer diversification from equity markets. Historically, periods of rate cuts have led to strong returns for high-quality core bonds since bond prices rise as yields fall.

“Now is a good time for investors to evaluate their portfolios for unintended risks, which includes potentially holding excessive exposure to stocks or lower quality bonds,” Gonzales says. “Bonds are back to their basic but essential roles of providing income, return potential and diversification from equities should the market become volatile.”

Earnings yield is equal to the forward expected earnings-per-share divided by the share price.

Yield to worst is the lowest yield that can be realized by either calling or putting on one of the available call/put dates or holding a bond to maturity.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

Bloomberg U.S. Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market.

Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%.

Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity and quality requirements.

J.P. Morgan Emerging Markets Bond Index (EMBI) Global Diversified is a uniquely weighted emerging market debt benchmark that tracks total returns for U.S. dollar-denominated bonds issued by emerging market sovereign and quasi-sovereign entities.

J.P. Morgan Government Bond Index (GBI) — Emerging Markets Global Diversified covers the universe of regularly traded, liquid fixed-rate, domestic currency emerging market government bonds to which international investors can gain exposure.

This report, and any product, index or fund referred to herein, is not sponsored, endorsed or promoted in any way by J.P. Morgan or any of its affiliates who provide no warranties whatsoever, express or implied, and shall have no liability to any prospective investor, in connection with this report.

Our latest insights

-

-

Currencies

-

Market Volatility

-

Market Volatility

-

Markets & Economy

RELATED INSIGHTS

Commissions, trailing commissions, management fees and expenses all may be associated with investments in investment funds. Please read the prospectus before investing. Investment funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by any other government deposit insurer. For investment funds other than money market funds, their values change frequently. For money market funds, there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you. Past performance may not be repeated.

Unless otherwise indicated, the investment professionals featured do not manage Capital Group‘s Canadian investment funds.

References to particular companies or securities, if any, are included for informational or illustrative purposes only and should not be considered as an endorsement by Capital Group. Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any investment funds or current holdings of any investment funds. These views should not be considered as investment advice nor should they be considered a recommendation to buy or sell.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and not be comprehensive or to provide advice. For informational purposes only; not intended to provide tax, legal or financial advice. Capital Group funds are available in Canada through registered dealers. For more information, please consult your financial and tax advisors for your individual situation.

Forward-looking statements are not guarantees of future performance, and actual events and results could differ materially from those expressed or implied in any forward-looking statements made herein. We encourage you to consider these and other factors carefully before making any investment decisions and we urge you to avoid placing undue reliance on forward-looking statements.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

FTSE source: London Stock Exchange Group plc and its group undertakings (collectively, the "LSE Group"). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. "FTSE®" is a trade mark of the relevant LSE Group companies and is used by any other LSE Group company under licence. All rights in the FTSE Russell indices or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indices or data and no party may rely on any indices or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company's express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication. The index is unmanaged and cannot be invested in directly.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

The MSCI information may only be used for your internal use, may not be reproduced or redisseminated in any form and may not be used as a basis for or a component of any financial instruments or products or indices. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each other person involved in or related to compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose) with respect to this information. Without limiting any of the foregoing, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages. (www.msci.com)

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Indices are unmanaged and cannot be invested in directly. Returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment.

All Capital Group trademarks are owned by The Capital Group Companies, Inc. or an affiliated company in Canada, the U.S. and other countries. All other company names mentioned are the property of their respective companies.

Capital Group funds are offered in Canada by Capital International Asset Management (Canada), Inc., part of Capital Group, a global investment management firm originating in Los Angeles, California in 1931. Capital Group manages equity assets through three investment groups. These groups make investment and proxy voting decisions independently. Fixed income investment professionals provide fixed income research and investment management across the Capital organization; however, for securities with equity characteristics, they act solely on behalf of one of the three equity investment groups.

The Capital Group funds offered on this website are available only to Canadian residents.

Vince Gonzales

Vince Gonzales

David Daigle

David Daigle

Jerry Solomon

Jerry Solomon