Dividends

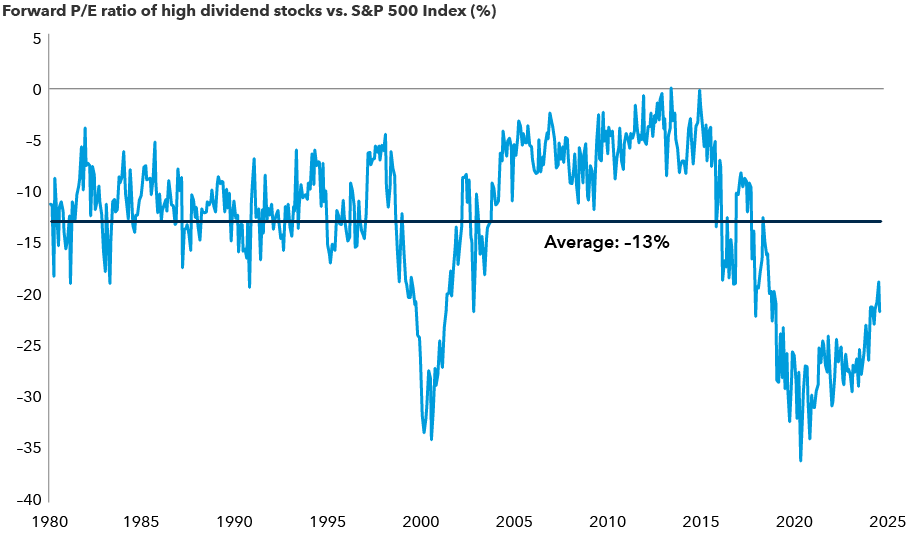

For the better part of the past 15 years, dividend stocks have lingered in the shadow of growth stocks that powered ahead. As the chart shows, the valuation gap across high-paying dividend stocks is now narrowing. Take utilities for example, often omitted from the conversation of growth stocks, many across the sector appear poised to benefit from increasing electricity demand, largely driven by the growth of data centers for artificial intelligence. The S&P 500 Utilities Sector Index, which yields 3%, is up 20% year-to-date as of September 5, outpacing the 16.5% gain of the S&P 500 Index.

Valuations for high dividend equities are climbing

Sources: Capital Group, Goldman Sachs. Data as of June 30, 2024. High dividend stocks refer to the cohort of stocks in the S&P 500 Index with the highest quintile dividend yield (sector-neutral) within the index. The line represents smoothed six-month average. P/E ratio = price-to-earnings ratio.

We’re keeping an eye on other market opportunities, especially semiconductor and aerospace companies that have introduced or increased dividends. Oil companies have exhibited better capital discipline by integrating dividends into their capital allocation plans. European and U.S. banks may also boost dividends at a faster pace, given stronger capital ratios and balance sheets. Overall, the S&P 500 is expected to post a 6% increase in dividend payments for 2024, versus a 5.1% rise in 2023, according to S&P Global. Free cash flow levels for S&P 500 equities are also in good standing, providing companies with the optionality for shareholder-friendly initiatives such as dividend payments.

As the Fed is poised for a rate cut, undervalued dividend-paying stocks could present an attractive opportunity. Market concentration in large technology stocks is a key issue for investors, and dividend-paying equities can benefit from longer term tailwinds, such as reshoring of supply chains.

With over $6 trillion sitting in money market accounts, according to the Investment Company Institute as of September 5, investors may seek alternative income sources if they begin to see the yields on those balances drop. Additionally, any moderation in economic growth could shift their focus on near-term cash flows and dividend-paying companies to boost returns.

The S&P 500 Index is a market-capitalization-weighted index based on the results of 500 widely-held common stocks.

The S&P 500 Utilities comprises those companies included in the S&P 500 that are classified as members of the Global Industry Classification Standard utilities sector.

Past results are not predictive of results in future periods.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

Global Equities

-

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Marc Nabi

Marc Nabi