Energy

Long shunned, nuclear energy appears poised for a comeback. The world’s largest technology firms, including Microsoft and Amazon, are increasingly exploring nuclear energy as a solution for their enormous power needs. The growth of artificial intelligence (AI) and the vast electricity requirements of data centers have placed additional emphasis on electricity even as companies attempt to meet their emissions goals.

Big tech seeks nuclear power with AI push

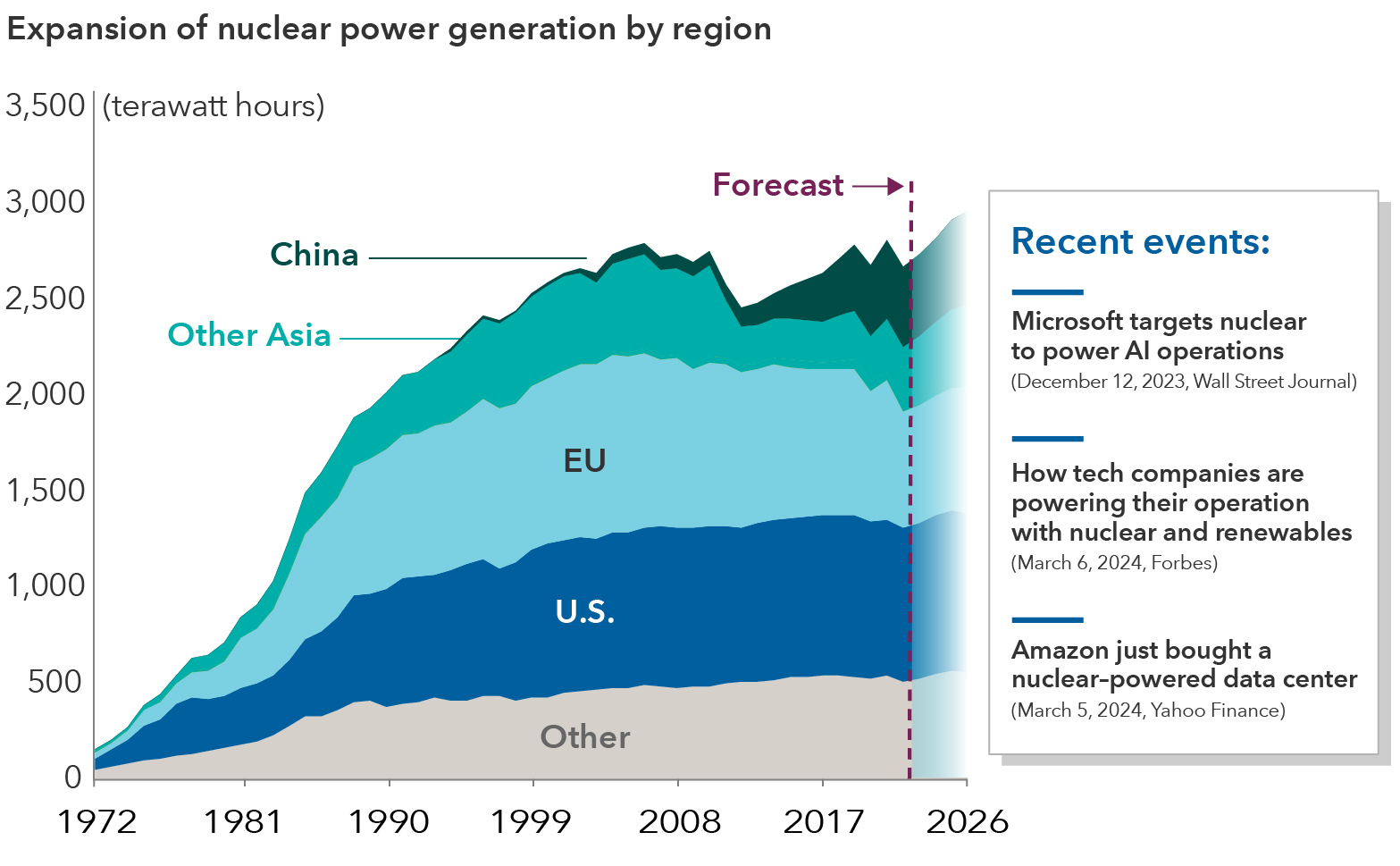

Sources: Capital Group, International Energy Agency (IEA). Evolution of nuclear power generation from 1972 until 2023 in terawatt hours and IEA projections from 2024–2026. Data as of January 17, 2024. Note: IEA’s forecast is based on projects currently under construction and expected to be operational by the end of 2026. EU refers to the European Union. India data was combined into “Other Asia.”

Last June, Microsoft struck a deal with Constellation Energy to supply one of its data centers in Virginia with nuclear power. More recently, Amazon purchased a data center in Pennsylvania from Talen Energy with a plan to utilize nuclear power from one of Talen’s nearby plants.

"Big tech companies will be a key driver of reigniting the nuclear power conversation, as their data centers require 24/7 power from reliable sources that curb carbon dioxide emissions," equity portfolio manager Mark Casey said.

For utility companies that own nuclear plants, they’re gaining a "new lease on life," where their lowest cost form of power is generating more revenue than was previously forecast, Casey added. Electricity usage from AI, cryptocurrencies and data centers could double by 2026, according to estimates from the International Energy Agency (IEA). Data centers gobbled up about 460 terawatt hours (TWh) of electricity in 2022 and could surpass 1,000 TWh in 2026.

Emerging markets countries also appear to be turning to nuclear power to address their growing needs, led by China and India, both of which are expected to add more nuclear capacity. With an added 29 gigawatts of nuclear capacity projected to be online by 2026, over 50% of that capacity will be built in China and India, according to the IEA. Nuclear power usage differs across the European Union. For example, France satisfies 70% of its energy consumption with nuclear power, whereas it makes up 3.3% of Germany’s energy mix.

Greater international acceptance of nuclear energy — along with broader governmental recognition that nuclear power can be used in addition to other forms of energy such as wind and solar — have shifted perspectives on nuclear power’s potential, says equity investment analyst Adam Ward.

“I’m coming to the conclusion that nuclear will achieve a meaningful price premium for its power, as it’s the only source that is both carbon free and the potential to be 100% reliable,” Ward said.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

Emerging Markets

-

Global Equities

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Mark Casey

Mark Casey

Adam Ward

Adam Ward