Municipal Bonds

Chart in Focus

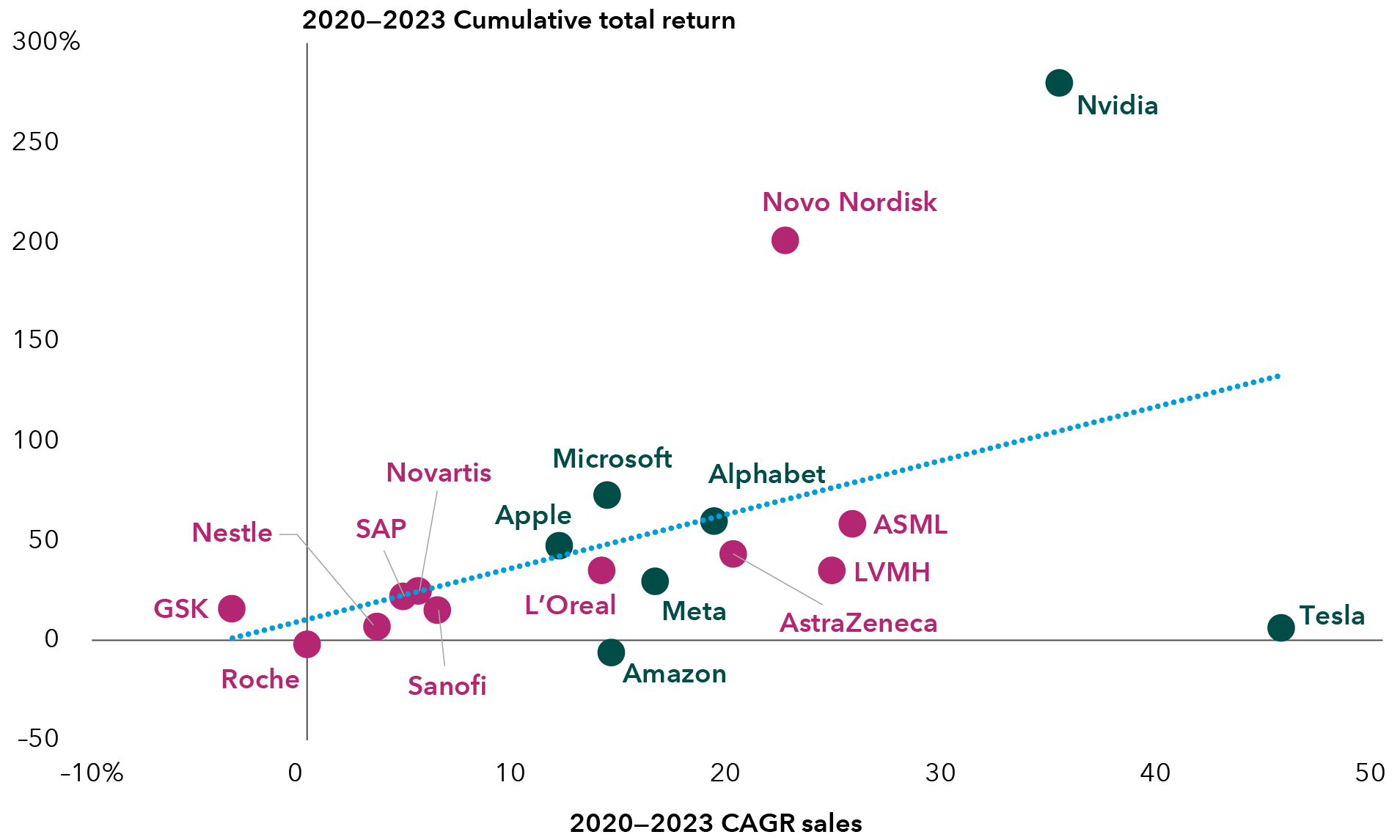

Europe has developed its own dominant stocks in the market. While the U.S. has the Magnificent 7, Europe's largest companies have come to be known as the Granolas (GSK, Roche, ASML, Nestlé, Novartis, Novo Nordisk, L’Oreal, LVMH, AstraZeneca, SAP and Sanofi).

Large European stocks are a broader group

Source: FactSet. CAGR = compound annual growth rate. Granolas is an acronym coined by Goldman Sachs to represent the 11 largest European companies by market cap in 2020. The Magnificent Seven refers to the seven largest contributors to the S&P 500 in 2023. Data from January 1, 2020, through December 31, 2023. Past results are not predictive of results in future periods.

Many of these companies share attributes with the Magnificent Seven, such as strong balance sheets and promising earnings growth, although not all to the magnitude of the dominant U.S. technology companies. The Granolas are a diverse group of companies, from pharmaceutical giants to luxury goods maker LVMH, food and beverage behemoth Nestlé.

"We have found a lot of investment opportunities in Europe. The Granolas are global, so many of them can shift where they sell their products,” said Noriko Chen, an equity portfolio manager at Capital Group.

These companies derive a majority of their revenue outside Europe and can adjust their businesses across countries and regions, depending on political or economic shifts. For example, LVMH generates over 50% of its revenue from Asia and the U.S. combined, while biotech firm Roche earns about 70% of its revenue from North America and Asia. Then there’s ASML, a global leader in specialized semiconductor equipment. The Netherlands-based company derives almost all its revenue outside Europe, mostly from Asia and the U.S. Overall, companies in the MSCI Europe Index make 57% of their revenue outside of the region, underscoring the substantial influence of the U.S. and Asia on European earnings.

Market concentration is growing across regions. The Granolas represent 20% of the MSCI Europe, while the Magnificent Seven comprise 31% of the S&P 500.1

1 FactSet. Data as of July 25, 2024.

The S&P 500 Index is a market-capitalization-weighted index based on the results of 500 widely held common stocks.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

The MSCI Europe Index captures large and mid-cap representation across 15 Developed Markets (DM) countries in Europe. With 418 constituents, the index covers approximately 85% of the free float-adjusted market capitalization across the European Developed Markets equity universe.

MSCI is a registered trademark owned by Morgan Stanley Capital International, Inc.

Granolas is an acronym coined by Goldman Sachs to represent the 11 largest European companies by market cap in 2020.

The Magnificent Seven refers to the seven largest contributors to the S&P 500 in 2023. The companies are Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla.

Our latest insights

-

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

RELATED INSIGHTS

-

Global Equities

-

Economic Indicators

-

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Noriko Chen

Noriko Chen