Dividends

The market pivot away from growth stocks over the past year has brought the dividend component of total stock returns back into focus. Dividend payers in the S&P 500 Index have outpaced the broader market by a significant margin over the past 12 months. With the U.S. Federal Reserve intent on tightening monetary policy to contain inflation, investors will likely continue to be less willing to pay up for high-multiple stocks, and dividends should remain in focus.

We asked two of our portfolio managers who have experience managing strategies with a focus on dividends and preservation of capital to share their thoughts. Alan Berro, principal investment officer (PIO) of Washington Mutual Investors FundSM, and Will Robbins, PIO of American Mutual Fund®, discuss how they are navigating the current investing environment and offer their medium-term outlook.

1. Looking for near-term visibility of cash flow and earnings

For now, we prefer companies where there is greater visibility on near-term cash flows and earnings, and sufficient pricing power to help blunt the impact of inflation. We see opportunities across industries within energy, industrials and health care.

So long as the cash flows and earnings are visible and can easily support the dividend, we prefer to continue to hold them in these portfolios. Johnson & Johnson is an example of a company that has spanned the value and growth spectrum. It has continued to deliver on its three business lines: pharmaceuticals, medical devices and consumer products. Its acquisition strategy has expanded its portfolio of innovative products, and it’s been a consistent dividend payer.

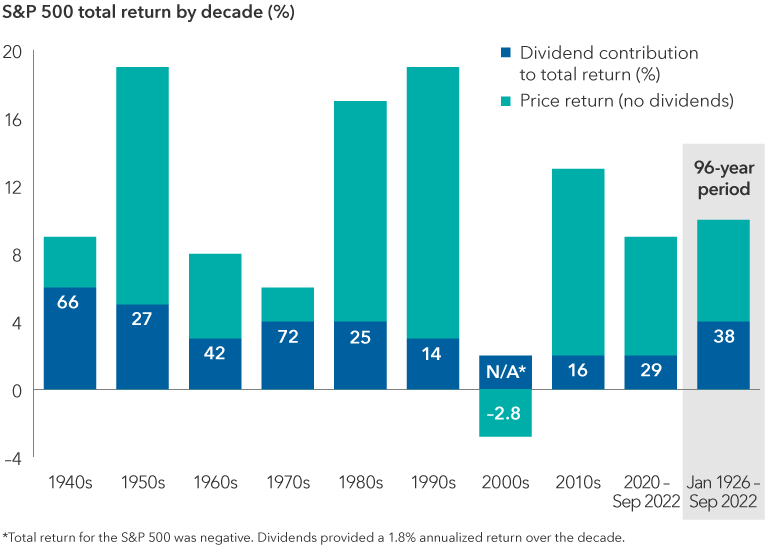

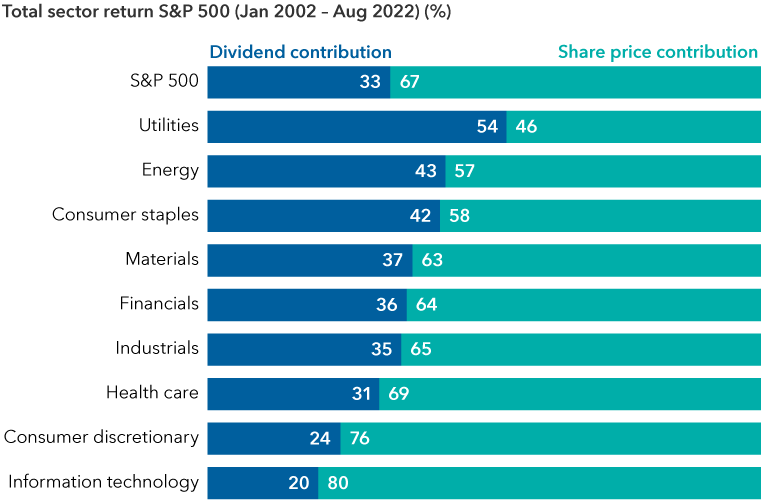

Dividends can be an important component of total return

Source: Standard and Poor’s. Data as of September 30, 2022.

The repricing that we are seeing in many traditional areas of growth — such as software, social media, digital payments and semiconductors — could create select opportunities for us, though valuations and fundamentals may not be there yet. We will need to see business models adjust to the new reality of higher interest rates, scarcer availability of capital, readjustment of supply chains and higher labor costs.

The sustainability of the dividend matters to us. In the past decade of a growth-led market, corporate management teams juggled between share buybacks and paying a dividend as a way to allocate excess cash. Where appropriate, we are encouraging companies to maintain or grow the dividend.

Once established, managements are reluctant to cut the dividend. Therefore, we find that dividends impose a level of discipline on management teams in how they manage their capital structure. Many investors know this, but it’s worth restating that over the past 96 years, about 38% of the total return for the S&P 500 Index has come from dividends.

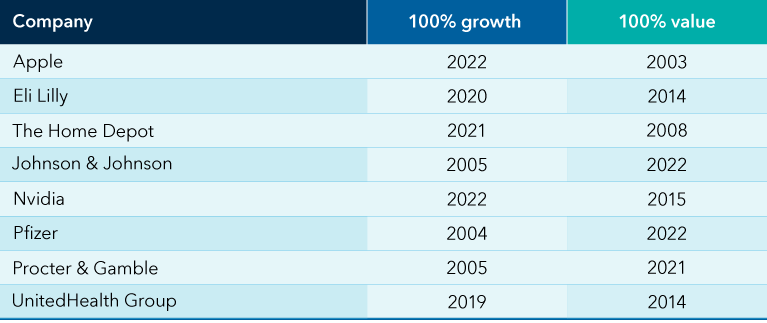

We are not dogmatic about the growth-value divide. Many well-known companies have swung between value and growth over the past two decades. Home Depot and UnitedHealth Group are two examples. Over the years, we have invested in select companies with lower price-to-earnings multiples and have held them in our dividend-oriented strategies even as valuation multiples expanded — if the combination of business fundamentals and the dividend continued to provide an attractive total return proposition.

Stocks can shift between value and growth classifications

Sources: Capital Group, FactSet. Graphic shows examples of companies that have been classified as either 100% growth or value at certain times in the Russell 1000 Index over the past 20 years. Companies were in the top 20 in terms of weighting in the benchmark. Data as of June 30, 2022.

2. Cyclicals are investible even in a recessionary economy

The traditional view that cyclicals should be avoided in a recessionary economy doesn't hold up as well today. Company managements have become more sophisticated in how they manage their inventory, supply chains and productivity, as well as their capital structure, to avoid boom-bust cycles. As a result, many of these companies — think energy, industrials and autos — could be better positioned to remain profitable even at the bottom of an economic cycle.

The energy sector in the S&P 500 has had the best returns for the 12-month period ended October 31. And we could see energy stocks continue to hold up even as the economy weakens. Even as the energy transition continues, it's going to take a long time to switch over the nation's vehicle fleet. Oil companies are not expanding capital expenditures aggressively, and in fact are reluctant to explore for new oil sources despite higher prices. Hence, supply is not increasing and energy resources are not being replenished.

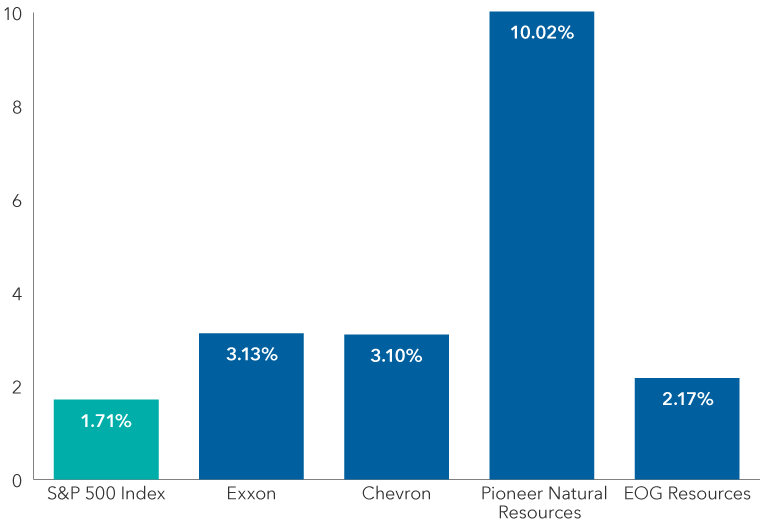

In any case, many of these oil giants can remain profitable even if oil retreats to around $50 a barrel. And oil multinationals, such as ExxonMobil and Chevron, are likely to maintain their substantial dividends, given their large income-oriented investor base.

Exploration and production (E&P) companies have become savvy at balancing capital-intensive business needs while paying a more sustainable dividend. Historically, E&P companies had not been high dividend payers, choosing instead to reinvest in the business to pursue more growth in production. In addition to their regular dividends, ConocoPhillips, Pioneer Natural Resources and EOG Resources are now supplementing with variable or special dividends, depending on commodities prices and the strength of cash flows.

Oil-related companies offer above-average dividend yields

Source: FactSet. Data as of October 31, 2022.

In the industrials sector, we are finding less cyclical businesses. One example is waste companies that haul and recycle trash for residential and commercial customers. They can be a good hedge against inflation since many municipal waste contracts in the United States are indexed to the Consumer Price Index (CPI), which was at a 40-year high of 8.2% at the end of September. These companies, which benefit from limited competition, are also fairly recession-resistant: Trash needs to be collected, no matter what kind of shape the economy is in.

Defense company revenues are influenced more by government budgetary cycles and less by the traditional economic cycle. Industry stalwarts, such as Northrop Grumman and Lockheed Martin, have been known for their steady dividends and cash flow strength.

Defense budgets are going up amid rising geopolitical tensions. In addition, both the U.S. and governments in European countries have been taking actions to bring supply chains closer to home on national security grounds after decades of globalization.

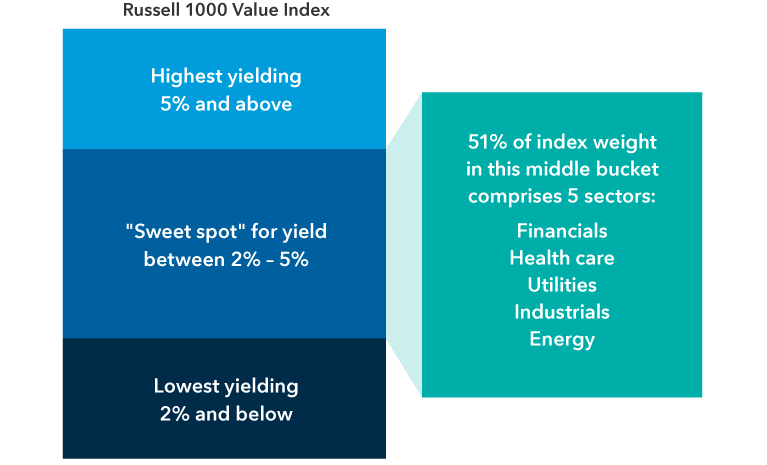

3. Opportunities in sweet spot of dividend universe

We find many more opportunities in the middle of the dividend yield stack. As is well-known, very high dividend yields can be a sign of risk. They can be a result of a price selloff, implying doubt in the sustainability of the dividend. At the other end of the spectrum, a low yield is often typical for higher growth stocks and may not provide sufficient cushion for stock price volatility.

In the past decade, we saw many companies with low dividend yields and middling growth rates offer a very small dividend to keep investors interested. That paradigm may not hold anymore with 10-year Treasury rates currently in the 4% range.

Today, we find the greatest opportunity in dividend stocks yielding between 2% and 5%. In addition to industrials and energy stocks, health care and financials are other sectors in this yield bucket.

Health care is an area that has grown to become a viable source of dividends and total return. The sector is becoming more diverse, drug discovery trends are accelerating, and productivity of research and development spending is improving. Plus, companies have demonstrated a focus on sustaining their dividends.

Greatest opportunities lie in sweet spot of yield universe

Source: FactSet. Data as of September 30, 2022.

While gene cell therapy and obesity drugs are well-known areas of growth, innovation is accelerating broadly in many areas after a decade of drugmaker reliance on modifications to patented drugs. We are at the start of what we think will be a decade of innovation. Valuations for large-cap pharmaceutical companies in the S&P 500 still look reasonable at an aggregate price-to-earnings multiple of 14 times forward earnings, even after strong relative share prices the past year, as we believe they have long runways ahead to grow earnings and dividends.

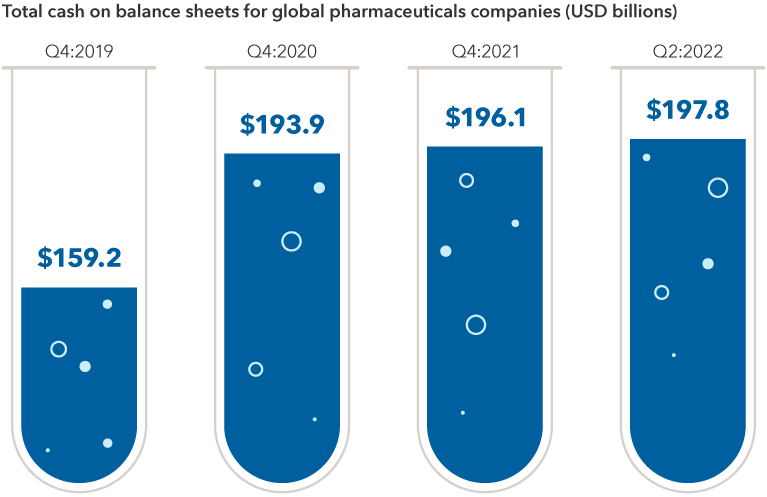

Many large pharmaceutical companies are also well-capitalized, with plenty of cash on their balance sheets to pay dividends or fund their own growth through acquisitions. This could help in a higher rate world where raising debt capital will be more expensive. There are also other areas of health care — including health-care service providers and insurance companies — where we are seeing an improvement in fundamentals and earnings.

Among financials, we are targeting banks and other companies that can expand their margins in a period of higher rates without being overly exposed to consumer credit risk should we enter in a prolonged recession.

Cash buffers are rising for pharmaceutical companies

Sources: Capital Group, FactSet, MSCI, Refinitiv Datastream, Refinitiv Eikon. Figures above represent the aggregated value in U.S. dollars of cash and short-term investments across constituents of the MSCI World Pharmaceuticals, Biotechnology and Life Sciences Index. Data as of June 30, 2022.

Large commercial insurance brokers could thrive in an environment of higher interest rates and inflation. These are highly cash-generative businesses that are less exposed to underwriting risks. They also generate a substantial amount of recurring revenue, which makes them more defensive than commercial banks. Lastly, the industry is highly consolidated, leading to attractive pricing opportunities.

4. It’s no longer the world of consumer staples, utilities and telecoms

Dividends were often associated with these “steady Eddies.” But these areas are not the primary focus of our attention today. Consumer staples have historically held up well in market downturns. Now, many of these companies face headwinds from continued cost inflation and potential difficulty in passing along price increases. A stronger dollar is also pressuring top-line growth. Procter & Gamble, for instance, has forecast that unfavorable currency movements are likely to depress its revenue growth by 6% this fiscal year.

Many consumer staples companies — including General Mills, Kellogg’s and Procter & Gamble — also may see their ability to raise prices in a slowing economy blunted by big-box stores like Walmart, one of their largest customers.

Investors traditionally bought utilities for their high yield, even though their businesses were lower growth. Today, many utilities are yielding 2% to 3% and are relatively less attractive to shorter term U.S. Treasury bills that offer investors a new source of potential income. Since utilities continue to trade at a premium to the S&P 500, we continue to be highly selective in this area.

Dividend contribution by sector over past two decades

Sources: Capital Group, Refinitiv Datastream, Standard & Poor’s. Data as of August 31, 2022.

5. Finding resilience in volatile markets

Dividend growth has rebounded from the depths of the COVID-19 pandemic when many companies were forced to substantially cut or eliminate their payments. We do not expect a rash of dividend cuts in a global economic slowdown, but we do anticipate that dividends will grow at a more measured pace.

Many companies are taking a more deliberate approach to management of their capital structure, balancing business needs, capital expenditure plans and their dividend policies. Management teams today want to maintain a steady and sustainable dividend policy that they can support for extended periods, and we think that’s a positive development.

Even in the midst of a very challenging economic and market environment, we are finding attractive opportunities. In an equity market where growth is slowing and fears of a global recession are mounting, we believe it is important to focus on companies with stronger balance sheets and cash flows. Sustainable dividends don’t lie, and dividends could become a much bigger part of the total return equation compared to the past 20 years.

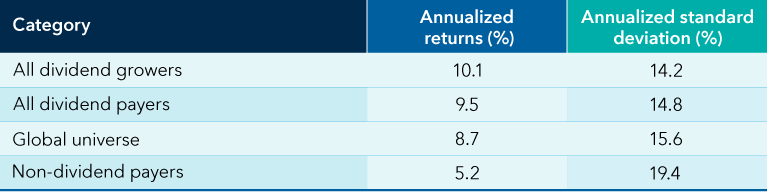

Dividend growers have offered stronger returns, lower volatility over past 30 years

Sources: Capital Group, FactSet, Compustat, Worldscope, MSCI. Data reflects December 31, 1989, through December 31, 2021. Results are based on the weighted average of total returns in USD (with gross dividends reinvested) of a global universe of companies. The global universe consists of the 1,000 largest companies for North America (50% weight), Europe (25%) and Japan (10%), and the 500 largest companies for Emerging Markets (10%) and Pacific ex. Japan (5%), in the S&P Global Broad Market Index (BMI) series from December 1989 to December 2004, and in the MSCI Investable Market Indexes (IMI) at the same regional weighting thereafter. Data going back to December 1989 for the MSCI IMI is not available and, as a result, part of the analysis relies on the S&P Global BMI. These indexes were used to provide a full sampling of stocks in the small-, mid- and large-capitalization universes. The universe constituents were balanced quarterly. All companies in the global universe are split into dividend payers and non-dividend payers. A company was classified as a "dividend payer" if it currently pays a dividend. A company was classified as a "dividend grower" (a subset of payers) if its trailing 12-month dividend per share increased relative to one year earlier. Annualized standard deviation (based on monthly returns) is a common measure of absolute volatility that tells how returns over time have varied from the mean. A lower number signifies lower volatility.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services.

The Russell 1000 Index is a market capitalization-weighted index that represents the top 1,000 stocks in the U.S. equity market by market capitalization. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.

The Russell 1000 Value Index, a subindex of the Russell 1000 Index, tracks large-cap value stocks.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

S&P Global Broad Market Index (BMI) is a market capitalization-weighted index maintained by Standard and Poor's (S&P) providing a broad measure of global equities markets. The index includes approximately 11,000 companies in more than 50 countries covering both developed and emerging markets, including U.S. stocks.

The MSCI Investable Market Indexes (IMI) cover all investable large-, mid- and small-cap securities across the Developed, Emerging and Frontier Markets, targeting approximately 99% of each market’s free-float adjusted market capitalization.

The MSCI World Pharmaceuticals, Biotechnology and Life Sciences Index is composed of large- and mid-cap stocks across 23 Developed Markets countries. All securities in the index are classified in the Pharmaceuticals, Biotechnology and Life Sciences industry group (within the Health Care sector), according to the Global Industry Classification Standard (GICS®).

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

-

Emerging Markets

-

Global Equities

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Alan Berro

Alan Berro

Will Robbins

Will Robbins