Municipal Bonds

Dividends

The Cold War was raging, Jimmy Carter became the first candidate from the Deep South elected President since the Civil War and Apple Computer was a newly established company the year Joyce Gordon began her career at Capital Group. She started as an assistant at age 19 – the youngest employee ever hired at the firm at that time.

It didn’t take Gordon long to recognize that the investment analyst role was the job to have at Capital. “For the first couple of years I was in a clerical role, but I decided pretty quickly that I wanted to work as an investment analyst,” she recalls. “Portfolio managers depend on the analysts to provide the information they need to make investment decisions. And I really liked the camaraderie and mutual respect among the investment professionals.”

With Capital’s backing, Gordon earned her degree and then an MBA at night. In 1987 she became an analyst covering savings and loans.

“Two years later, my responsibilities expanded to include the banking sector. That was in 1989, right before the commercial real estate crisis, when the average bank lost 67% of its value over 12 months,” she says. “It was about the only group of stocks that was declining because the crisis was centered around real estate. It was a lonely existence. I remember my research director saying, ‘Joyce, you are so lucky. You’re getting five years’ experience in one year.’”

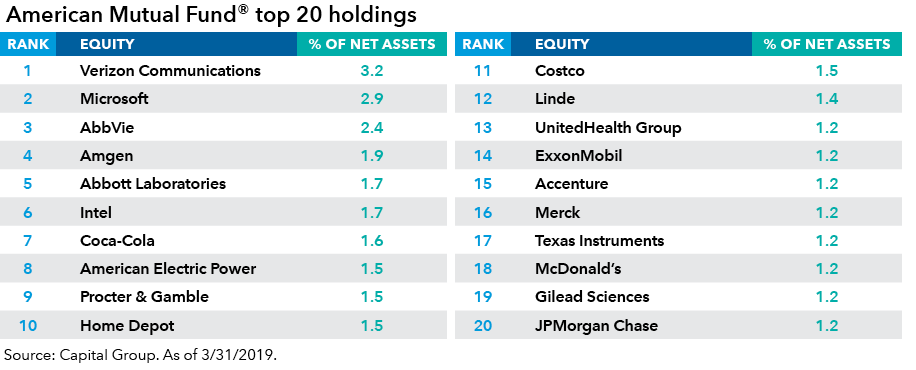

Today, Gordon is the principal investment officer and a portfolio manager for American Mutual Fund® (AMF). Since 1950, the fund has pursued three objectives — capital appreciation, current income and preservation of principal — by investing primarily in quality companies that pay dividends. Such value-oriented shares have lagged the broader market in recent years, behind a few fast-growing technology and consumer leaders. But with equity valuations elevated, market turbulence rising and the U.S. economy in late cycle, dividend-focused investing may start to attract more attention.

We sat down with Gordon to get her perspective on the current environment and lessons learned about investing through volatile markets.

The U.S. economy is firmly in late-cycle territory. How are you thinking about portfolio positioning today? Are you doing anything differently?

Now that the Federal Reserve has halted its interest rate hikes and taken a more dovish stance, I expect the decade-long U.S. expansion can continue, even though we are in the late stages of the cycle. I also feel that markets can continue to offer appreciation.

But equity markets tend to be more volatile during the late cycle. In part, that’s because order volumes start to come down — or at least level off — which increases the potential for companies to fall short of their earnings estimates. So I expect markets to be volatile going forward.

In this environment I am looking to be more defensive, focusing on established companies with a track record of generating steady revenue regardless of what is happening in the economy.

What type of companies are you looking at today that might have those qualities?

Utilities such as American Electric Power, with long-term contracts and a stable rate base, have tended to hold up well in troubled economic times. Indeed, in 2018 the utilities sector of Standard & Poor’s 500 Composite Index posted a 0.46% gain while the broader S&P 500 declined 6.24%.

I also look closely at defense contractors, food companies and health care companies such as AbbVie. Hormel [0.6% of the fund’s portfolio as of 3/31/19], for example, has held up better than the market during past declines, as have retailers like Costco.

These types of companies tend to have low debt levels; sometimes they are net cash. And many of them pay dividends. The longer this expansion continues, the more attention I pay to dividend sustainability. Should the company decide to cut its dividend, support for the stock price could collapse. That’s what happened with a lot of companies in the Great Recession of 2008 and 2009.

What lessons did you draw from the 2008 recession and other down markets over the course of your career?

One important lesson I learned is to avoid companies with a lot of debt. Companies with significant debt service are subject to a number of challenges. For example, they may feel pressure from credit rating agencies to cut their dividend so that they can maintain an investment-grade rating for their debt issuance.

Another thing I learned is to pay close attention to what company executives and boards are doing. Take Washington Mutual, which failed during the financial crisis in 2008. Going into the crisis, the bank issued a proxy proposal that would change its management bonus structure, removing the impact of any loan losses. In other words, management was being incentivized by volume, not quality. Looking back, that should have been a telltale sign that something horrible was coming.

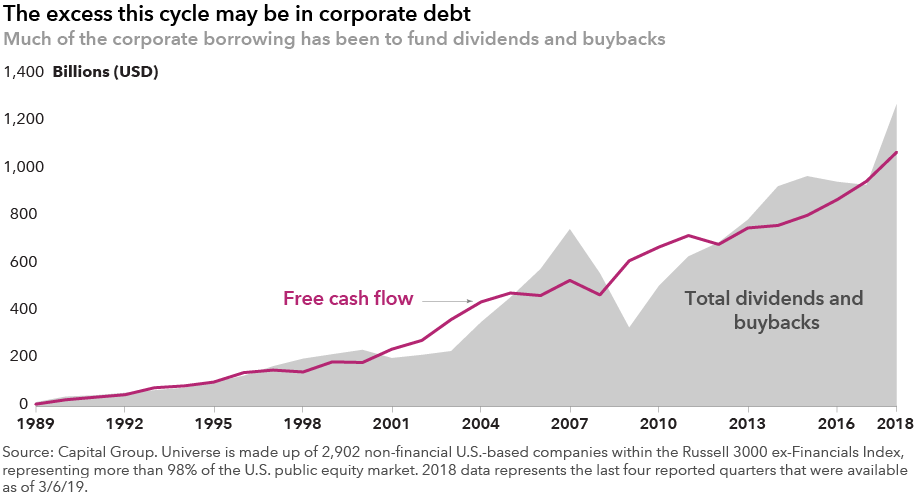

I don't see a lot of those types of things going on today. But some companies are issuing debt to buy back shares and pay their dividends, rather than using free cash flow. It’s tempting for companies to do this because rates are so low, but it can be a warning sign.

I have also seen some companies that have typically increased their dividend every year that have yet to do so over the past year. And in many cases these have been the companies with a lot of leverage who are becoming concerned about paying down debt. We have seen that with some of the food companies. This suggests that sales growth is tougher in this late-cycle environment.

Are you and the other AMF managers taking a more defensive approach?

Because preservation of principal is one of the fund’s primary objectives, I am always thinking about steps I can take to help protect on the downside. Today I am holding more cash than usual; it's partly because we are so late in the economic cycle and partly because I'm getting a little nervous about valuations. While I do give up some of the market return potential, holding cash can help mitigate market volatility and, if the market corrects I have the dry powder to invest in good companies at relatively attractive valuations.

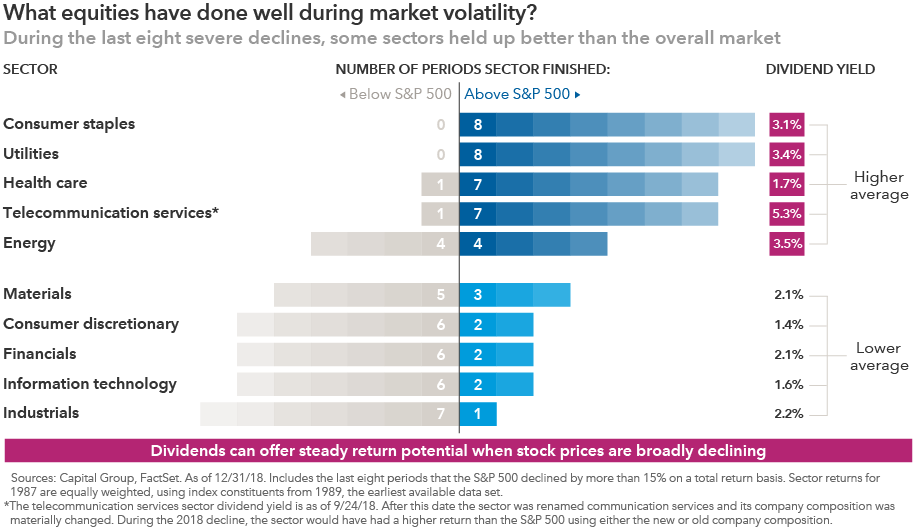

In addition, all the portfolio managers in the fund are looking through their portfolios with a fine-tooth comb. We are studying how companies have fared in previous downturns to identify a whole array of stocks that typically do well versus those that don't tend to fare so well.

It comes down to doing the fundamental research on individual companies. Over time we have constructed a backdrop of what has typically happened during recessions and the types of companies that have fared better than the broader market.

We go through all the scenarios and try to make sure that we are protecting on the downside while still participating in the market. The goal is to help our investors stay the course through difficult periods by reducing the amount of volatility in the fund.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. Investors cannot invest directly in an index. Standard & Poor’s 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Capital believes the software and information from FactSet to be reliable. However, Capital cannot be responsible for inaccuracies, incomplete information or updating of the information furnished by FactSet. The information provided in this report is meant to give you an approximate account of the fund/manager's characteristics for the specified date. This information is not indicative of future Capital investment decisions and is not used as part of our investment decision-making process.

Our latest insights

-

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

related insights

-

Market Volatility

-

-

Interest Rates

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Joyce Gordon

Joyce Gordon