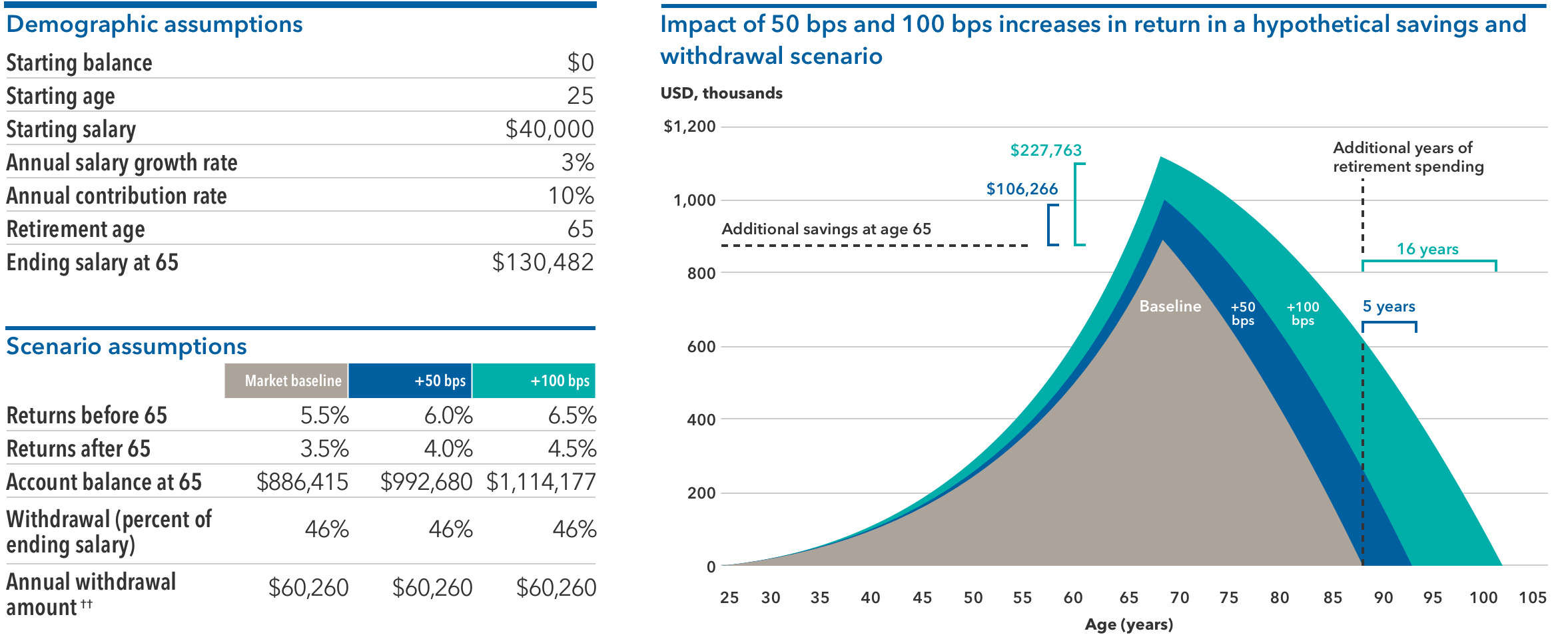

** Data as of March 31, 2024.

† Source: Capital Group. The demographic assumptions, returns and ending balances are hypothetical and provided for illustrative purposes only, and are not intended to provide any assurance or promise of actual returns and outcomes. Returns will be affected by the management of the investments and any adjustments to the assumed contribution rates, salary or other participant demographic information. Actual results may be higher or lower than those shown. Past results are not predictive of results in future periods. Based on an exhibit from Russell Investments. The additional years of retirement spending are intended to represent a conservative measure. Totals may not reconcile due to rounding.

†† Withdrawal that produces 20 years of income in the baseline scenario, which equates to an income replacement of 46% of the ending salary.

‡ Unlike semi- or non-transparent ETFs, transparent ETFs have the ability to invest in fixed income securities and non-U.S. securities. To invest in non-U.S. equities, semi- and non-transparent ETFs must use American Depository Receipts (ADRs), which may have less liquidity or could be subject to greater price fluctuations than the non-U.S. security itself.