While most people know exchange-traded funds (ETFs) offer tax advantages over mutual funds, they may not understand how and whether all ETFs share the same level of tax efficiency.

How ETFs offer tax advantages

ETFs provide tax advantages that stem from the way that they're structured, which allows for two main sources of tax efficiency:

- Externalization: ETFs trade in the secondary market, like a stock exchange, which largely insulates the fund from individual investors’ trading activity. In other words, if an ETF investor decides to sell shares of an ETF, a majority of the time, the transaction will occur in the secondary market, which does not involve any interaction with (or impact to) the fund.

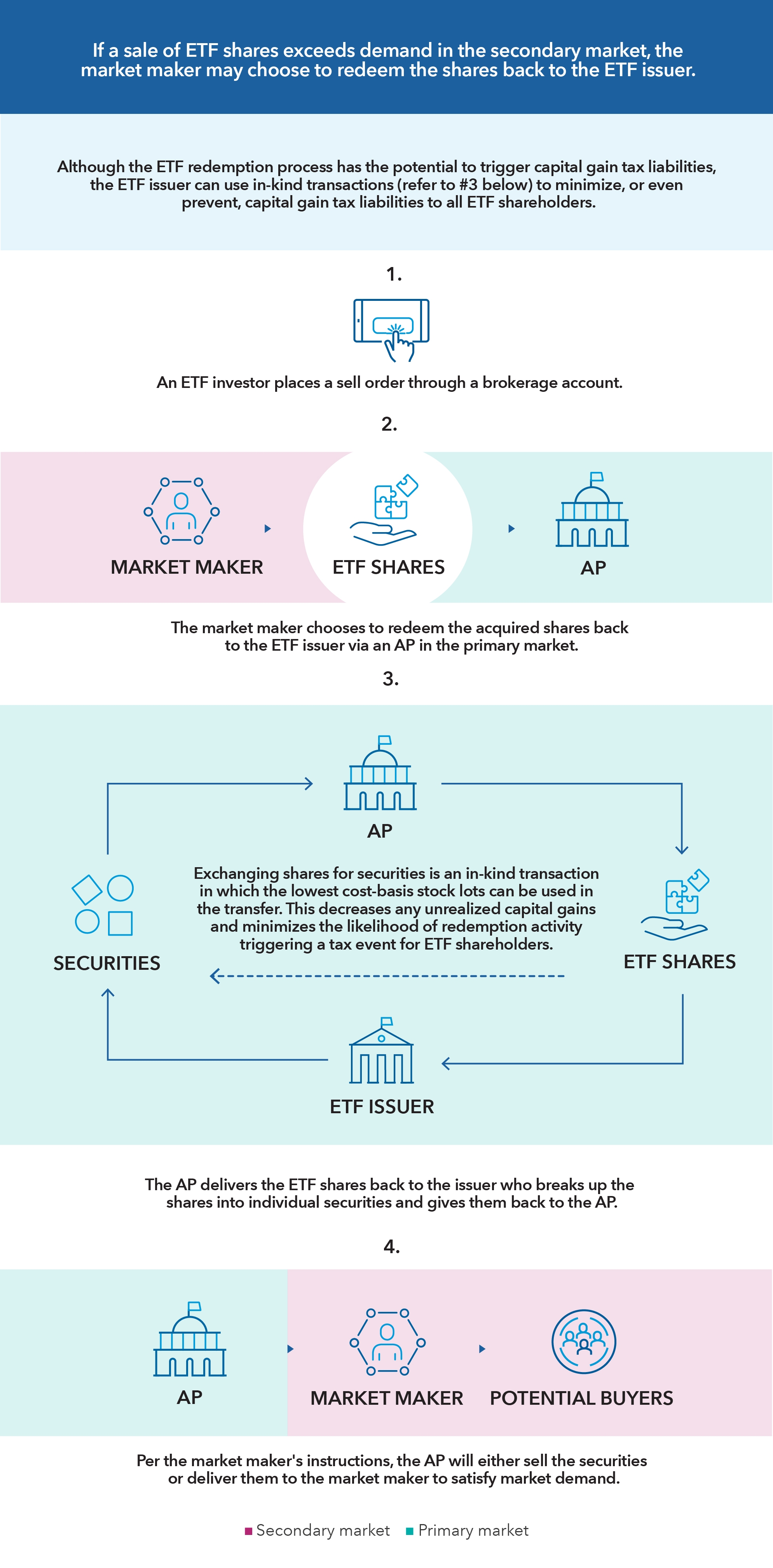

- In-kind redemptions: When selling activity on an exchange does result in a redemption from the fund, it is usually tax-free to remaining investors. ETFs generally satisfy redemption requests in the primary market through an in-kind delivery of securities to an intermediary (securities rather than cash), which means client redemptions from the fund do not generally create taxable events for remaining shareholders.

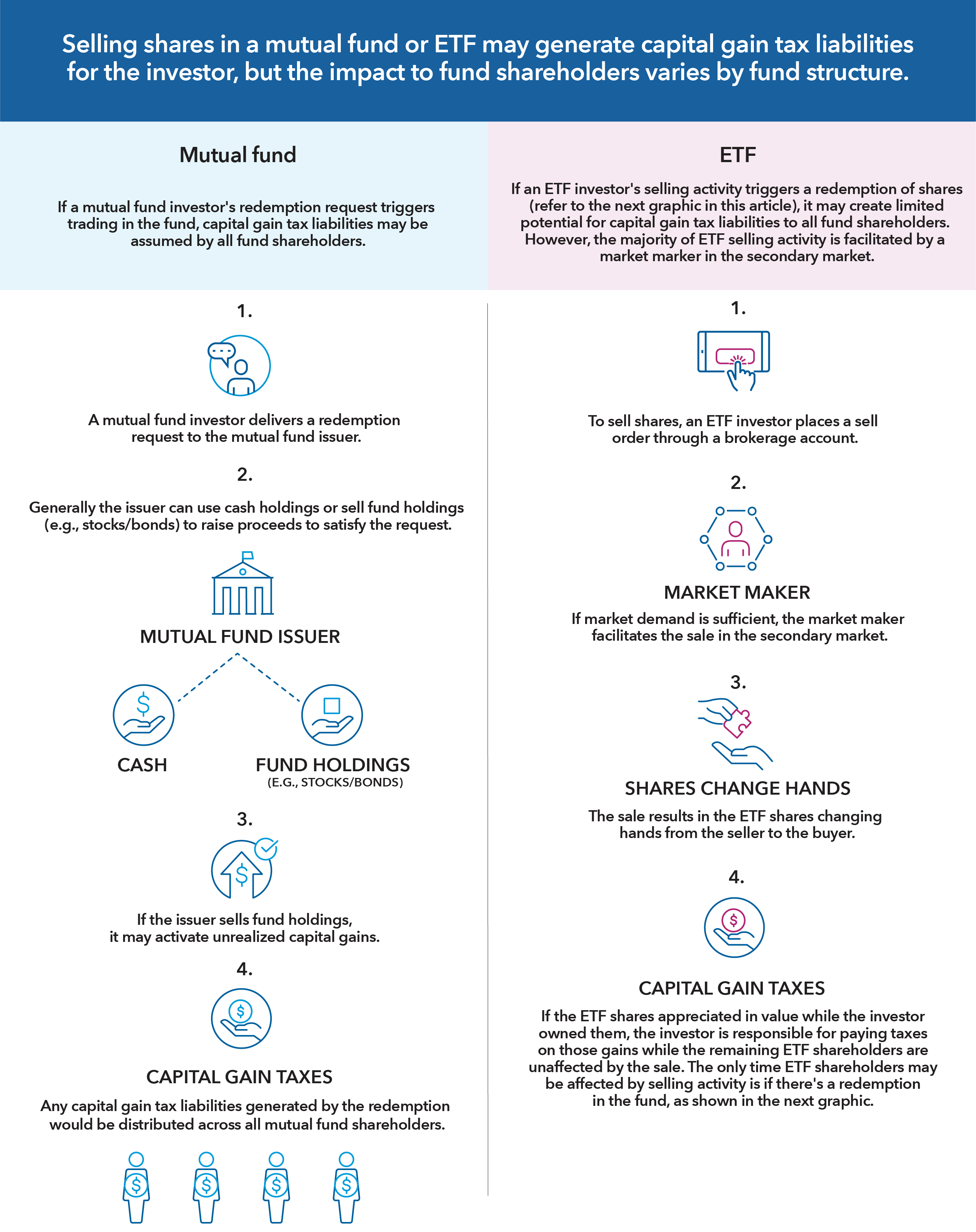

How different redemptions structures between mutual funds and ETFs affect tax efficiency

When a mutual fund issuer receives a redemption request, there are generally two ways to grant it:

- Use cash held in the fund.

- Sell fund holdings to raise enough cash to satisfy the request.

Fund issuers carefully consider these options with an eye toward maintaining sufficient cash holdings in the fund to meet redemption requests. If the issuer chooses to sell underlying securities, any unrealized gains crystalize, becoming capital gain distributions that impact all the mutual fund’s investors in taxable accounts. To the extent the fund has losses, it can use them to offset capital gains. (For investors in qualified accounts, reinvested distributions aren’t taxable.)

ETF shares trade in the secondary market, such as a stock exchange, which means ETF issuers don’t need to be involved for ETF investor sales activity. The seller places a sell order through a brokerage account and executes it at a market price respective to the fund’s intraday net asset value (NAV). This execution is provided by a market maker within the secondary market. Just as an investor selling a stock may incur capital gains if the share price has appreciated since the investor bought it, individual ETF sellers will be liable for their own realized capital gains on any ETF shares that have grown in value since their purchase price. Because the ETF investor sold shares in the secondary market, there was no impact to the underlying fund holdings. Therefore, the remaining fund holders were unaffected by the sale of shares. This can be a source of tax efficiency.

While most ETF transactions occur in the secondary market, occasionally, there may be a need to use the primary market. If an ETF investor sells shares in an amount that exceeds market demand, a market maker can redeem those shares in the primary market through an authorized participant (AP).

Issuers of most ETFs have another tax efficiency tool at their disposal called custom in-kind negotiated baskets. This feature allows ETF issuers to create non-representative baskets of securities (i.e., not a pro-rata slice) that can be transferred to an AP in the primary market. Custom baskets can be particularly useful for rebalancing because they may help reduce the tax impact of investment changes within the fund. In-kind mechanisms can also be used to maintain tax efficiency in certain years when capital gains may be distributed for various reasons, particularly within fixed income assets.

These are the most basic mechanisms that allow for ETFs’ tax efficiency and, when appropriate, can be leveraged in portfolio construction tools, such as tax-loss harvesting, to further enhance ETFs’ tax advantages.

What are the tax advantages of active ETFs?

In this video, Scott Davis, ETF director at Capital Group, examines the myth that active ETFs can’t be as tax efficient as index ETFs. He also discusses how Capital Group manages its ETFs to help investors pursue the tax advantages offered by the ETF vehicle.

For additional information about ETFs, contact your Capital Group representative.

Pursue greater tax efficiency with ETFs

See our five ideas for using ETFs to help reduce capital gain distributions.