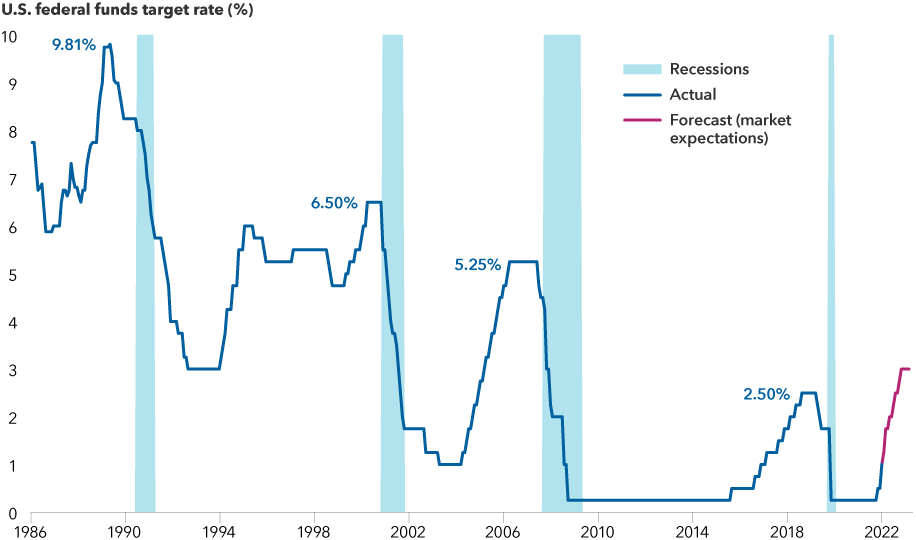

The U.S. Federal Reserve raised the federal funds target rate by 25 basis points to a range of 0.25% to 0.50%, marking the start of what is expected to be a forceful path of monetary tightening. The central bank faces the challenge of taming inflation even as a commodities shock in the wake of Russia’s invasion of Ukraine dampens the outlook for global growth.

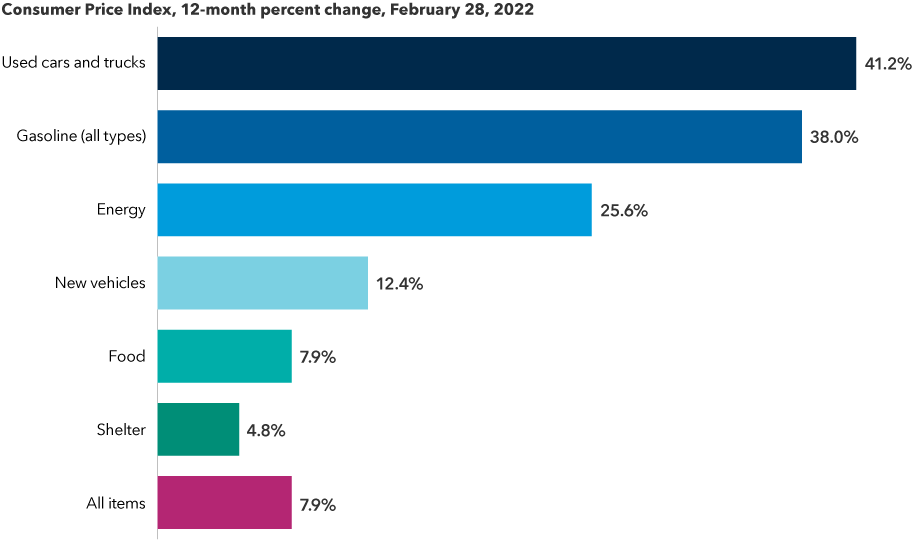

Fed chairman Jerome Powell reinforced in his comments that the central bank’s primary goal is to tamp down inflation — which is running at a 40-year high — and that it will do what it takes to bring it closer to target. The central bank chief also talked positively about growth and the labor market. “All signs are that this is a strong economy,” Powell said. “Indeed, one that will be able to flourish … in the face of less accommodative monetary policy.”

We maintain our view that inflation will remain elevated and that monetary policy is behind the curve. Markets are pricing in about seven 25-basis-point rate increases in 2022. Powell seems confident that the U.S. economy can withstand higher rates, and so barring a major fundamental shock, we expect the Fed will continue on its tightening path for the rest of 2022. He left open the possibility of a 50-basis-point hike but did not specify what might trigger such a move.

Powell emphasized that he wants to see the month-over-month inflation numbers come down. The Fed is increasingly concerned about inflation becoming unmanageable, and its latest projections indicate it may move rates above its estimated long-term neutral rate of 2.4% by next year. The neutral rate is a theoretical federal funds rate at which monetary policy is considered neither accommodative nor restrictive.

Consistent with this view, we favor positioning bond portfolios for tighter financial conditions by maintaining a short duration focused on two-year maturities. We expect the Treasury yield curve to flatten further, led by a rise in shorter maturities while long-term interest rates remain in a range.

We also anticipate quantitative tightening (QT) plans could be unveiled in May and begin in June following another rate increase at the Fed’s May meeting. The central bank will likely shrink its balance sheet by not replacing maturing bonds. While actively selling securities is a possibility, it is not its preferred path.