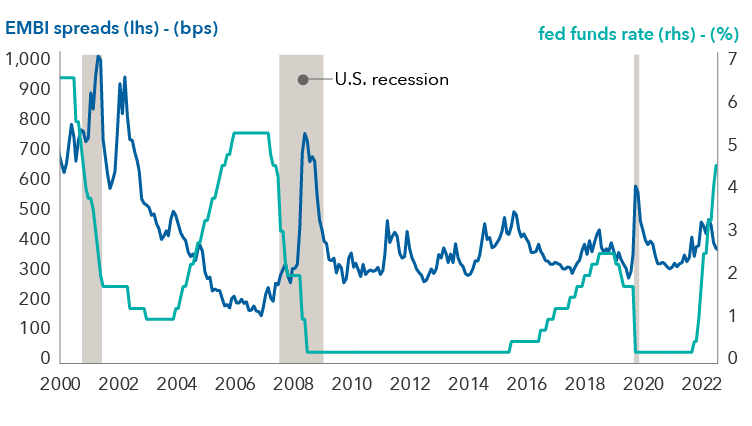

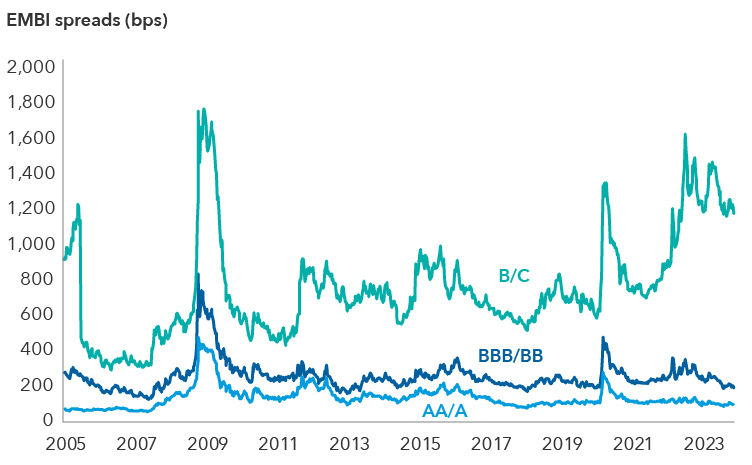

In 2024, numerous factors appear to be turning in favor of emerging markets (EM) debt despite the potential for weak global economic growth. A more dovish U.S. Federal Reserve (Fed) should support a rebound for EM economies. This is likely to benefit both higher-rated local currency debt — and to an extent, dollar-denominated debt — which spans a wide variety of economies and markets, extending all the way to the riskier and smaller economies often referred to as the frontier markets.

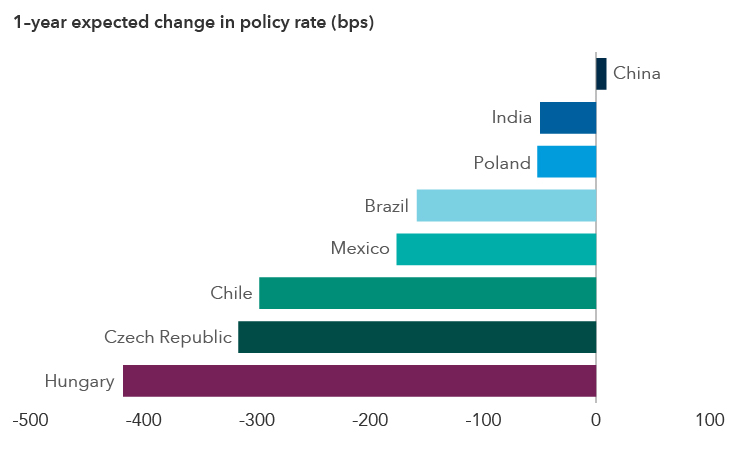

We see the largest opportunities within core (higher rated) local currency sovereign debt, along with select investment-grade (rated BBB/Baa and above) and high-yield dollar-denominated sovereign issuers. If incoming inflation data permits the Fed to cut rates, it should allow the central banks in EM countries to move in a direction that better reflects their domestic outlooks. Dollar-denominated issuers may also benefit from potentially lower funding costs. In most of the core economies, inflation is expected to decline throughout 2024. Falling interest rates should be positive for duration, especially for local currency debt holders.

While EM currencies recovered in 2023, the strength of the U.S. dollar could still pose a challenge, even though the dollar looks overvalued on most fundamental metrics. This could change with lower U.S. rates, although the process of unwinding dollar strength is likely to be gradual given the real rate level is still supportive of the dollar over other major currencies, and growth outside the U.S. remains relatively weak. Elections in several EM countries could also disrupt the status quo.

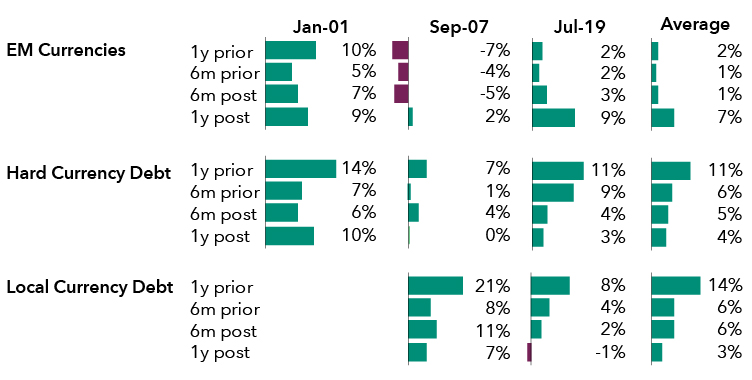

The table below shows how EM currencies and debt have performed before and after the Fed began cutting rates in previous cycles. Both local and hard currency (dollar-denominated) bonds have rallied the most prior to earlier rate cuts, while EM currencies have performed better after the rate cuts began.