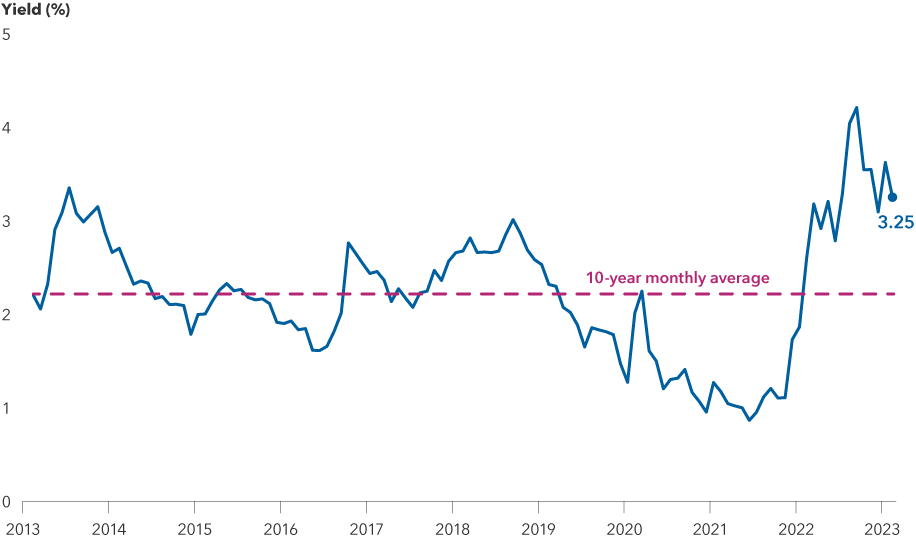

Investors are accustomed to volatility in stocks, but 2022 brought unprecedented challenges to the bond market as well. The U.S. Federal Reserve raised rates aggressively to fight inflation, battering both equity and fixed income investments. By year-end, those efforts helped to bring inflation from a peak of 9.1% in mid-2022 to 6.0% in February 2023, as measured by the Consumer Price Index.

For fixed income investors, the worst may be behind us. Fed funds futures — the market’s expectations of the federal funds rate — reflect a terminal (peak) rate around 5.0% by midyear. The federal funds rate is the interest rate at which depository institutions trade federal funds (balances held at Federal Reserve Banks) with each other overnight. While stocks remain volatile and the possibility of recession weighs on the minds of investors, that light at the end of the tunnel helped bonds to realize some positive returns for a few months in the wake of the turmoil. Following the collapse of SVB Financial, parent company of Silicon Valley Bank, and other banking sector pressures, lending has tightened. This may result in the Fed's monetary policy having a more meaningful impact on slowing economic growth.

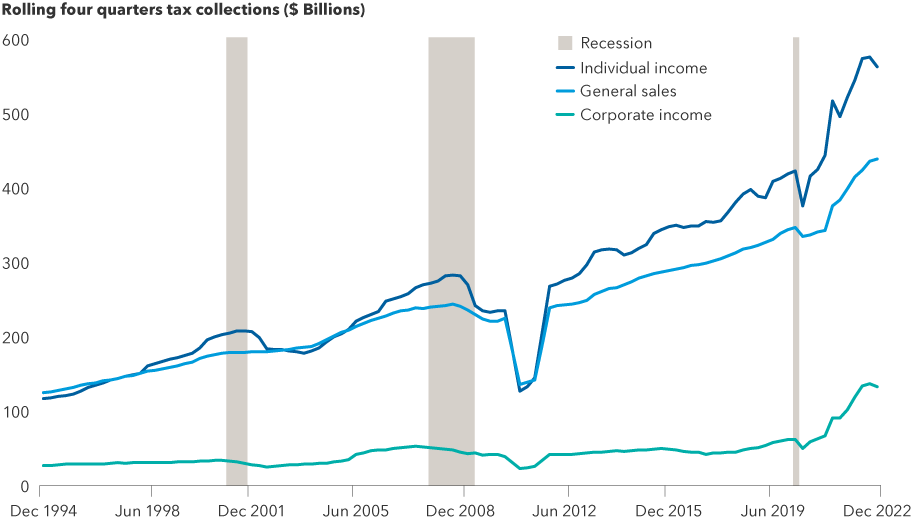

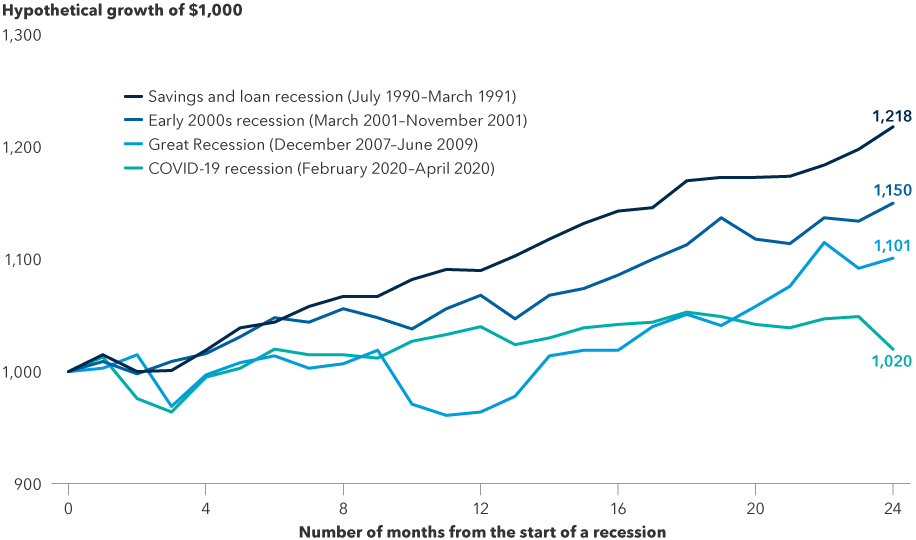

As the International Monetary Fund signals slowing growth and the economy potentially enters a period of market contraction, municipal bonds could be a relative bright spot. Munis offer strong fundamentals, have historically held up well versus other asset classes during periods of market difficulty and can now provide strong income to help cushion price volatility.