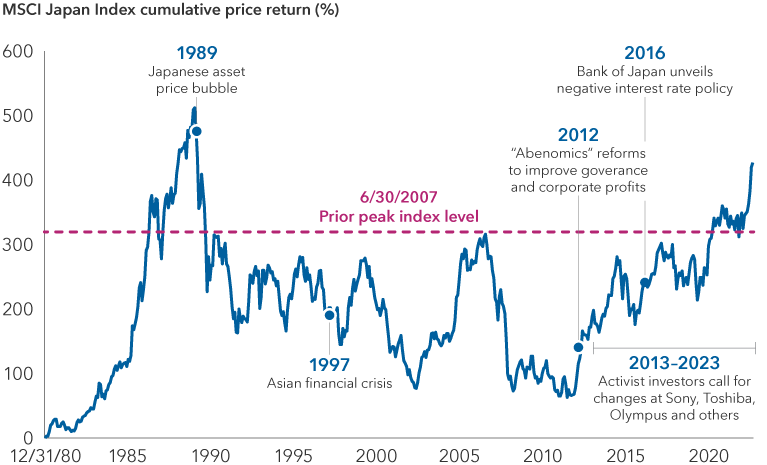

A significant shift is underway in Japan, and equity markets are taking notice. It may not have been obvious to U.S. dollar-based investors, but in local currency terms, Japanese equities as measured by the MSCI Japan Index have climbed 25% year to date (as of August 31, 2023).

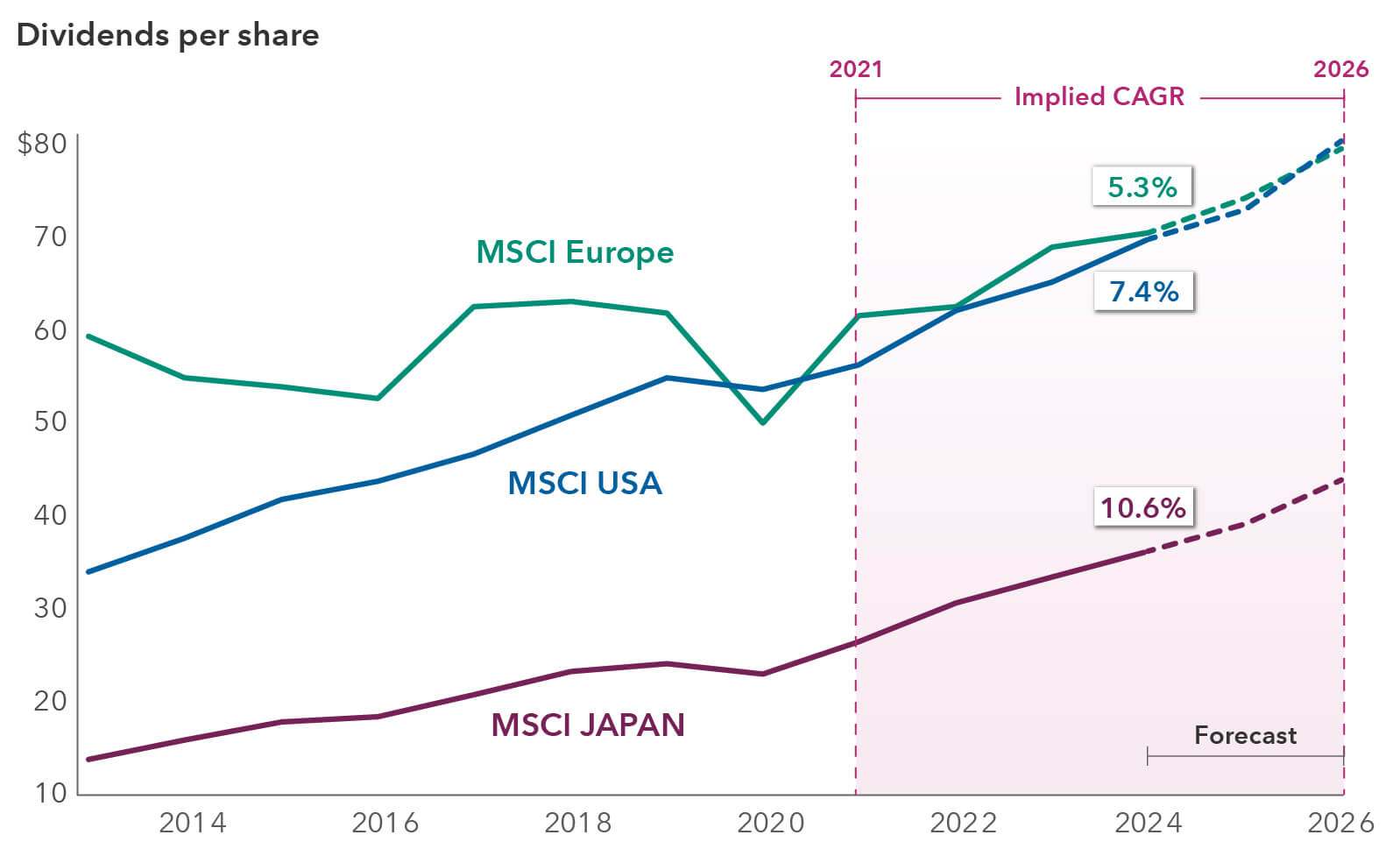

The wave of optimism has been driven by two key factors: inflation and reforms. While inflation has been challenging for many developed economies, it’s a welcome sign in Japan, which has been battling deflation for three decades. Sustained and healthy inflation could change the mindset in Japan from saving to investing.

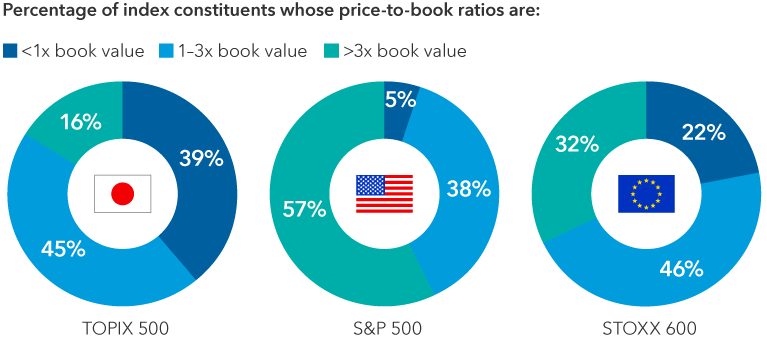

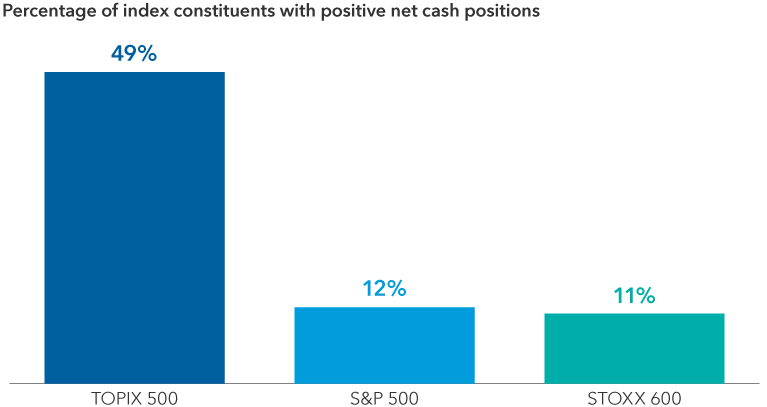

In terms of reforms, there is tremendous emphasis on improving corporate governance, and companies are focusing more on shareholder returns. In a recent move, the Tokyo Stock Exchange asked all listed companies to enact policies to improve profitability, long-term returns and valuations. About 39% of companies in the TOPIX (an index comprising Japanese stocks) trade below book value, compared to just 5% for companies in the S&P 500 Index.