Financial professionals are catching on to the potential of retirement plans to help grow their wealth management businesses. Once relegated to niche specialists, retirement plans are gaining attention among major financial intermediaries, who are asking wealth managers to cross-sell more plans.

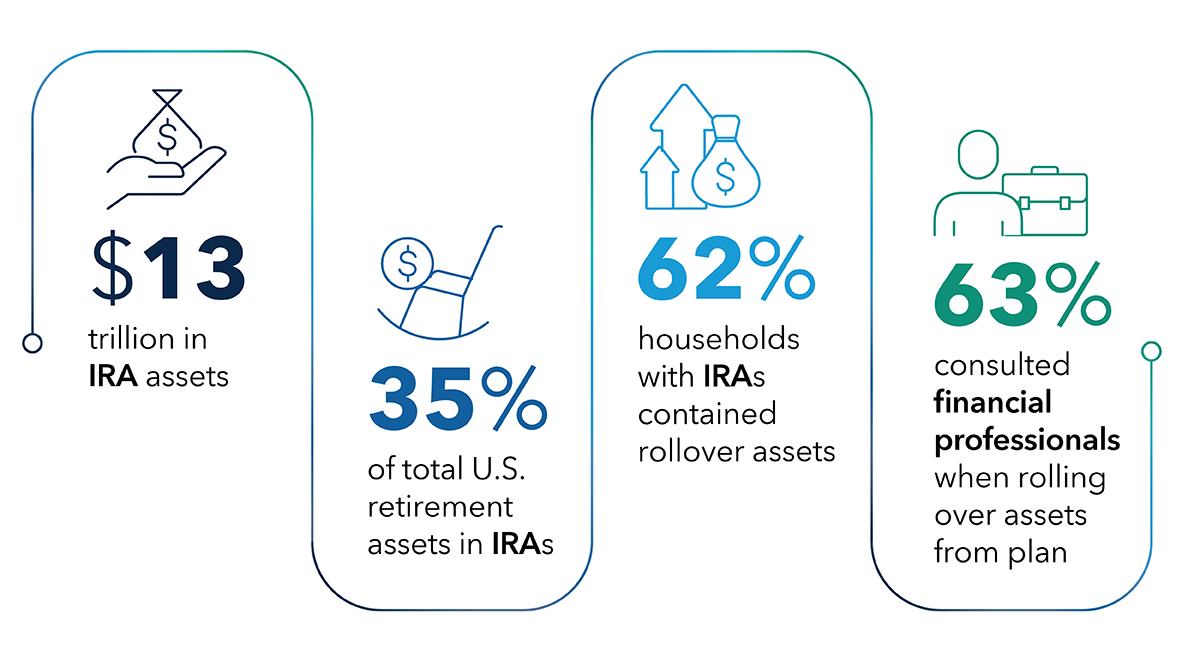

This increased focus on plan business may be due to factors such as rollover money in motion from plans to individual retirement accounts (IRAs) and the stabilizing and growth effect of plan assets.

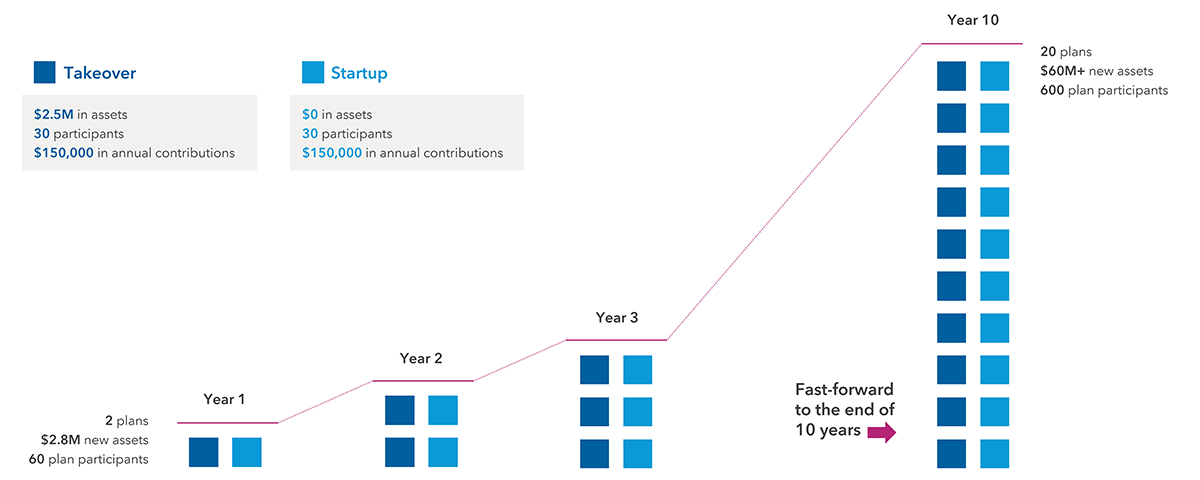

In Capital Group's 2024 financial professional benchmark study, the highest growth practices were more likely to service retirement plan clients with customized messaging and service, including a strategy for turning plan participants into prospects. They also had 25% or more of their assets under management in retirement plans.

What this data might suggest — and what financial intermediaries are recognizing — is that retirement plans can be a catalyst for growth. You can see this in firms’ efforts to create efficiencies and make plans more appealing to generalist wealth managers. Watch who’s adding retirement plan sales desks, fiduciary services and pooled plan solutions, and ask yourself why. What value are they seeing, and how can you capture some of it?

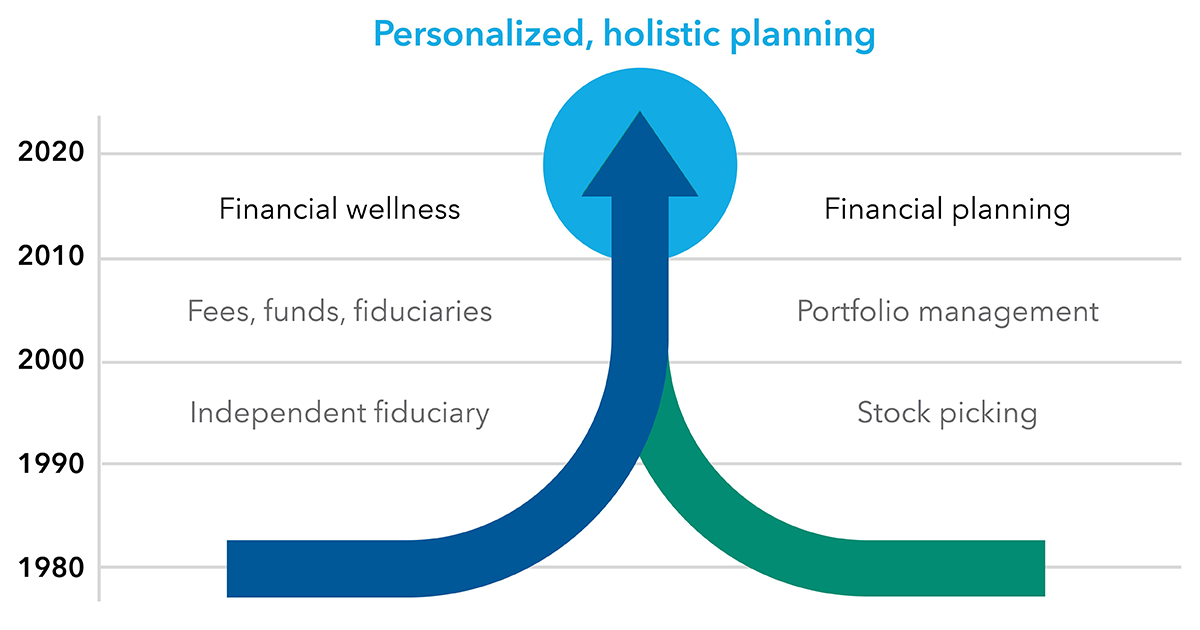

The evolution of retirement and wealth

Retirement plans and wealth management were once distinct practices, but they’ve since converged around clients’ broader financial planning needs. In fact, it’s an evolution decades in the making.

![Bar graph displaying the percentage of defined contribution participants who took any withdrawal or stopped contributing from each of the years from 2009 to 2023. Although precise values are not shown, it is apparent that for most years, both values are below 2%. In 2009, both percentages near 3%. Withdrawals tick up from 2020 to 2023, peaking between 3% and 4% in 2023. For those same years, the “stopped contributing” bars all remain below 2%.]](https://static.capitalgroup.com/content/dam/cgc/shared-content/images/banners4/chart-pursue-growth-03.png)