The above hypothetical scenario considers the total recordkeeping costs of two hypothetical plans. The total costs of the plans are the same — 100 basis points. But looking at the total number alone doesn’t tell the full story. Plan sponsors should also look at the components of that cost to analyze how it relates to value.

In the example, costs are divided into three types: recordkeeping services, fund expenses and financial professional compensation. Although financial professional compensation is equal, Plan A charges four times as much for recordkeeping services. In contrast, Plan B charges four times as much for fund costs. While plan sponsors may initially have concerns over the level of fund costs in Plan B, choosing the cheapest fund isn’t necessarily best, nor is a plan obligated to do so to meet its fiduciary duty. The example highlights the importance of looking at each component of plan costs, not just the total.

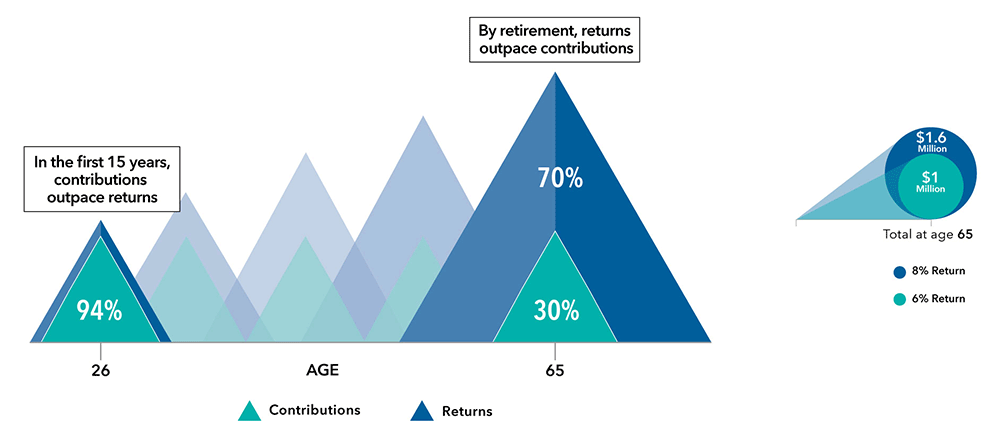

For fund expenses, consider the quality of the funds that are offered. Passive funds usually have lower fees and track the returns of indexes. Given how important investment returns are to retirement readiness, plan sponsors should consider whether typically more expensive actively managed funds could deliver stronger results than passive funds — either by outpacing during strong markets or suffering smaller losses in down markets. Passive funds are not striving to outpace their benchmarks; rather, they seek to track the benchmark’s return pattern.

Isolating recordkeeping costs can help reveal fees that could cost your clients more than they expect. Solutions that provide more transparent pricing can help them understand exactly what they’re paying and what services they’re getting. Emphasize to clients that, like target date funds, not all types of fees are created equal.

Service: This is where the right combination of technology and personal touch can really make a difference. When looking at the features of different recordkeeping solutions, focus on the true benefits and how they affect the user experience. Does the recordkeeper offer distinguishing service or technological capabilities that justify higher fees? The plan should help participants feel motivated to save for the future and empowered to make the most of their company retirement plan.

FP pro tip: You can help your clients balance the level of services needed with the cost they are comfortable paying. Furthermore, work with your providers to prepare a quote that clearly lays out what is included in their fee, broken out to show the specific amounts charged for recordkeeping services and investments. FPs can use this checklist to guide their efforts in finding the right recordkeeper for their plans.

Cost and service are two areas that can become pain points if not properly addressed. Deficiencies in either of these areas are often the reasons why a company switches retirement plan providers.