Cloud software stocks — which soared to dizzying heights during the pandemic — have been in a painful downward spiral since November.

For the three months ended January 31, 2022, the BVP NASDAQ Emerging Cloud Index, a measure of cloud-based software companies, plummeted 28.5%. That compares with a decline of 2.0% for the Standard & Poor’s 500 Composite Index, which measures the broader U.S. stock market.

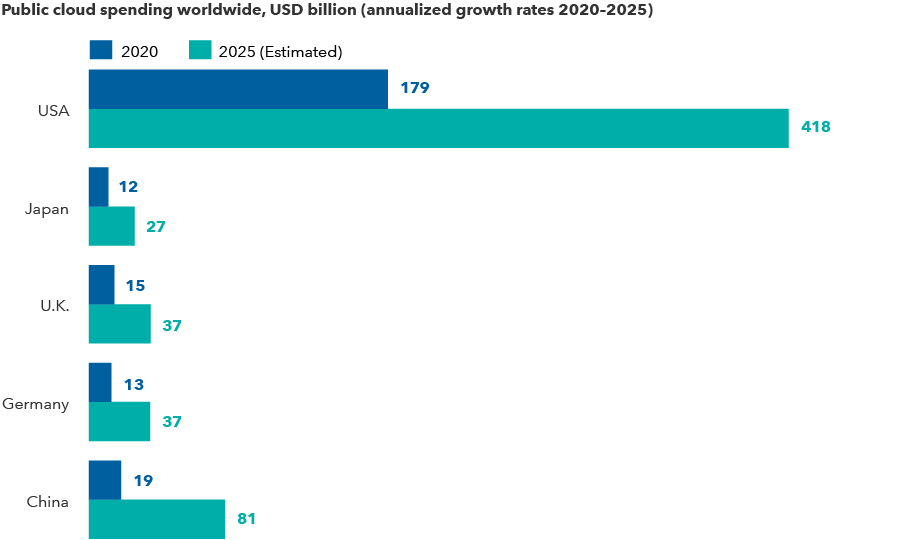

Why have these companies fallen so suddenly out of favor? In part, it’s due to expectations that the Federal Reserve will soon hike interest rates. Such hikes tend to have a more adverse impact on fast-growing businesses like cloud software, also known as software as a service (SaaS), than on the broader market. Higher interest rates reduce the current value of the much higher earnings such businesses expect to generate further into the future. In addition, valuations have ballooned over the past decade, with many software stocks reaching all-time highs in 2021.

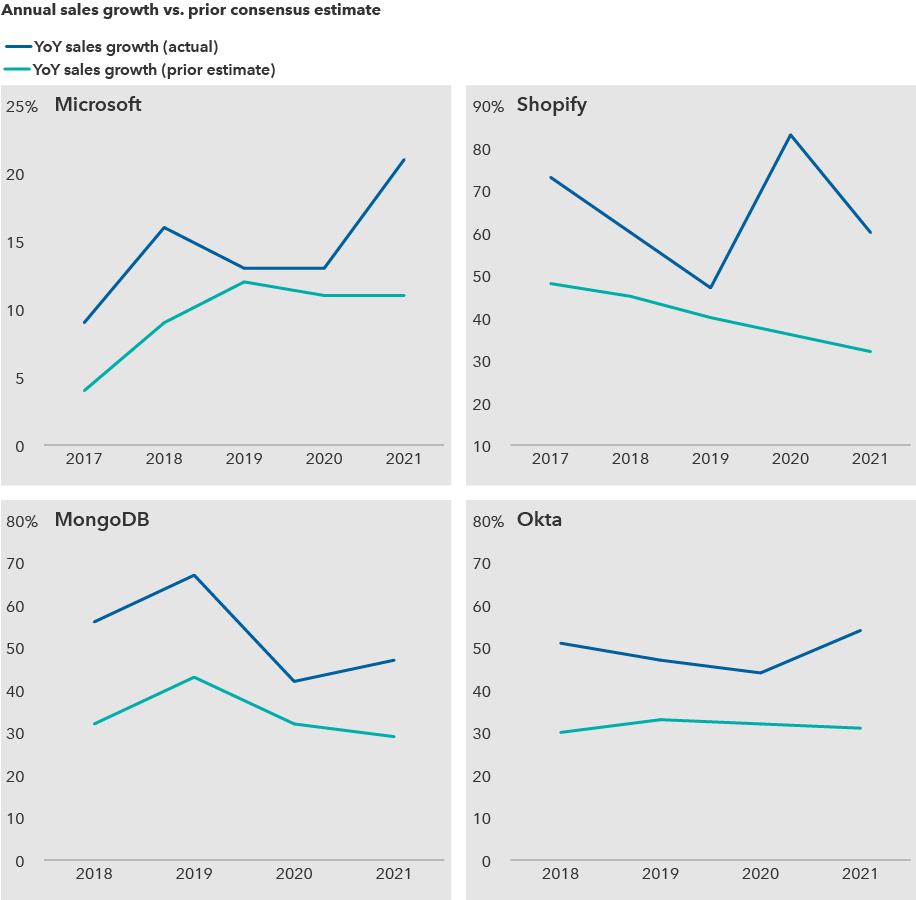

Investors might also wonder if many of these companies have grown too fast. After a decade-long sprint supercharged by the pandemic, has cloud software run into a wall?

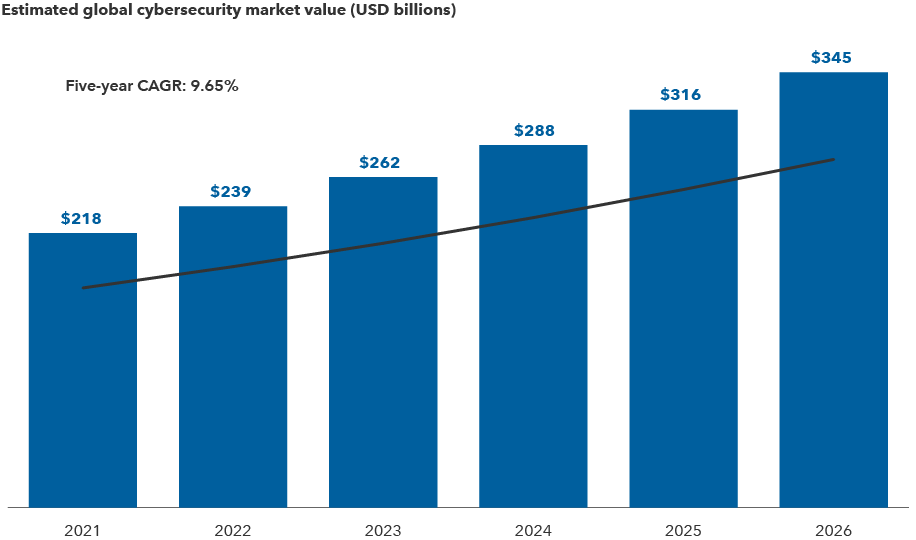

“It’s been a great 10 years for software, but I think we’re far from done,” says equity investment analyst Julien Gaertner, who covers U.S. software companies. “In my view, we are still in the early innings of this transition. I continue to be positive about the long-term outlook for the software industry.”