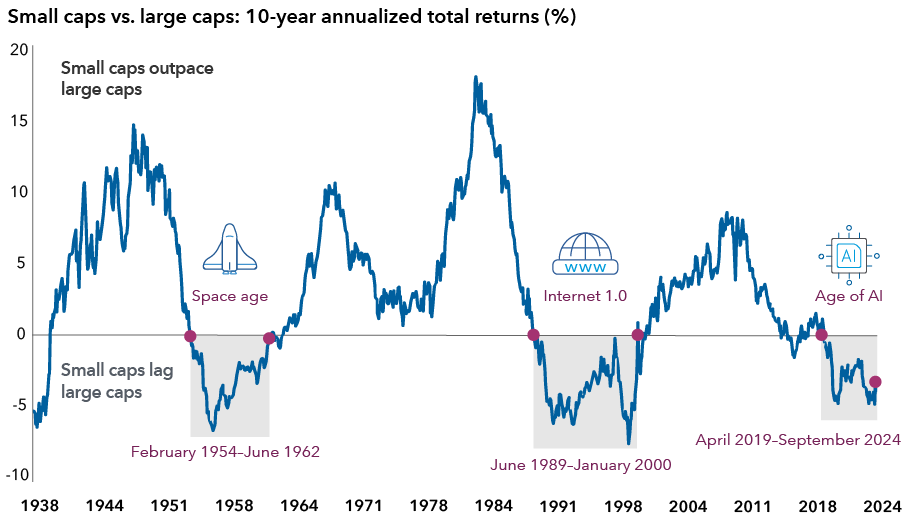

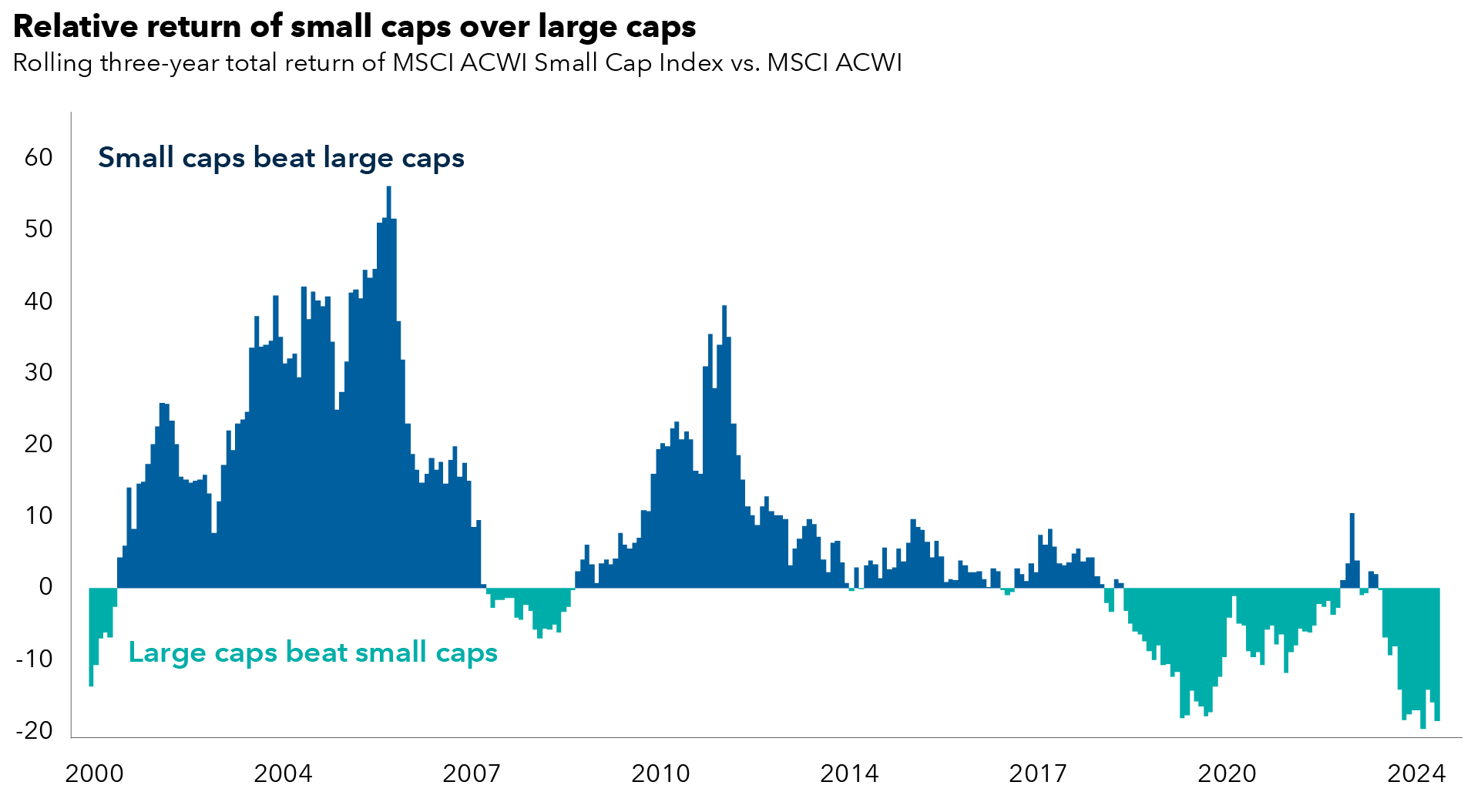

Small-cap stocks, long overlooked in favor of large caps, are staging a comeback and may be at an inflection point after years of lagging their larger peers. Small caps (as measured by the Russell 2000 Index) have surged to three-year highs, and we think the outlook is getting more constructive on several fronts.

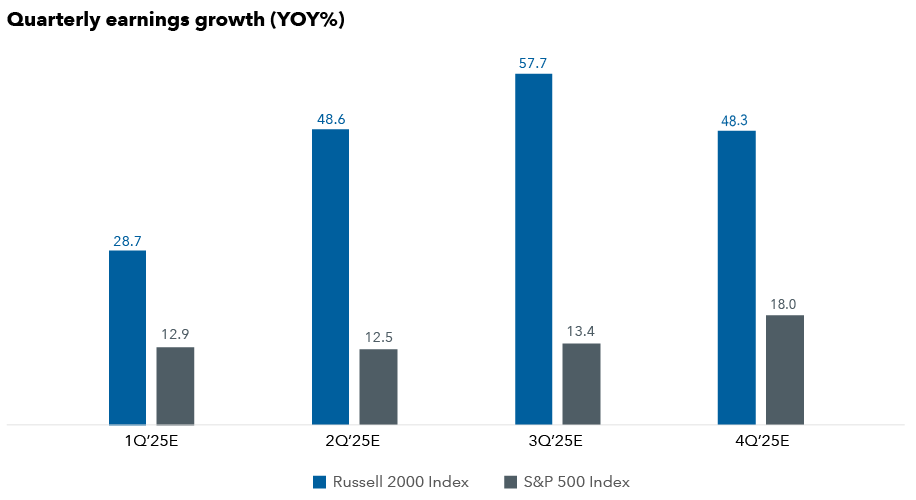

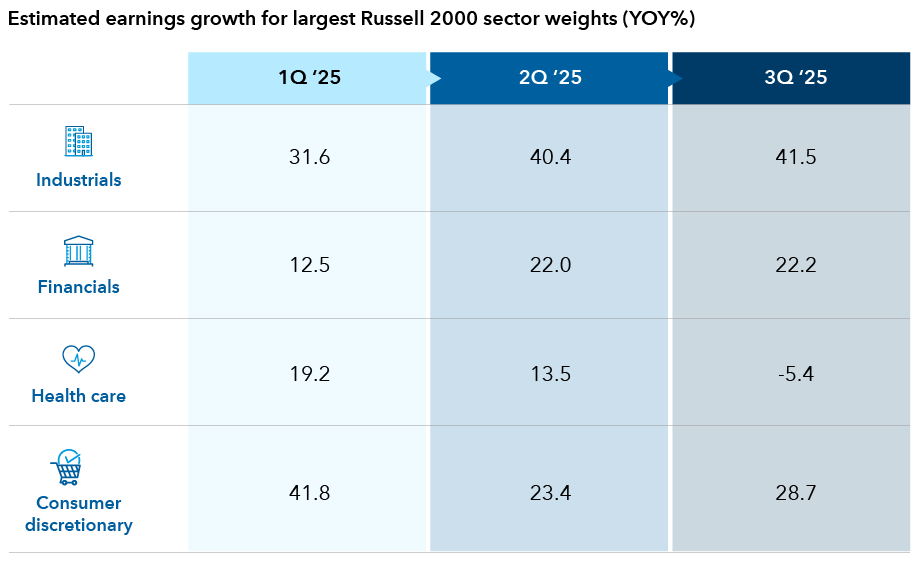

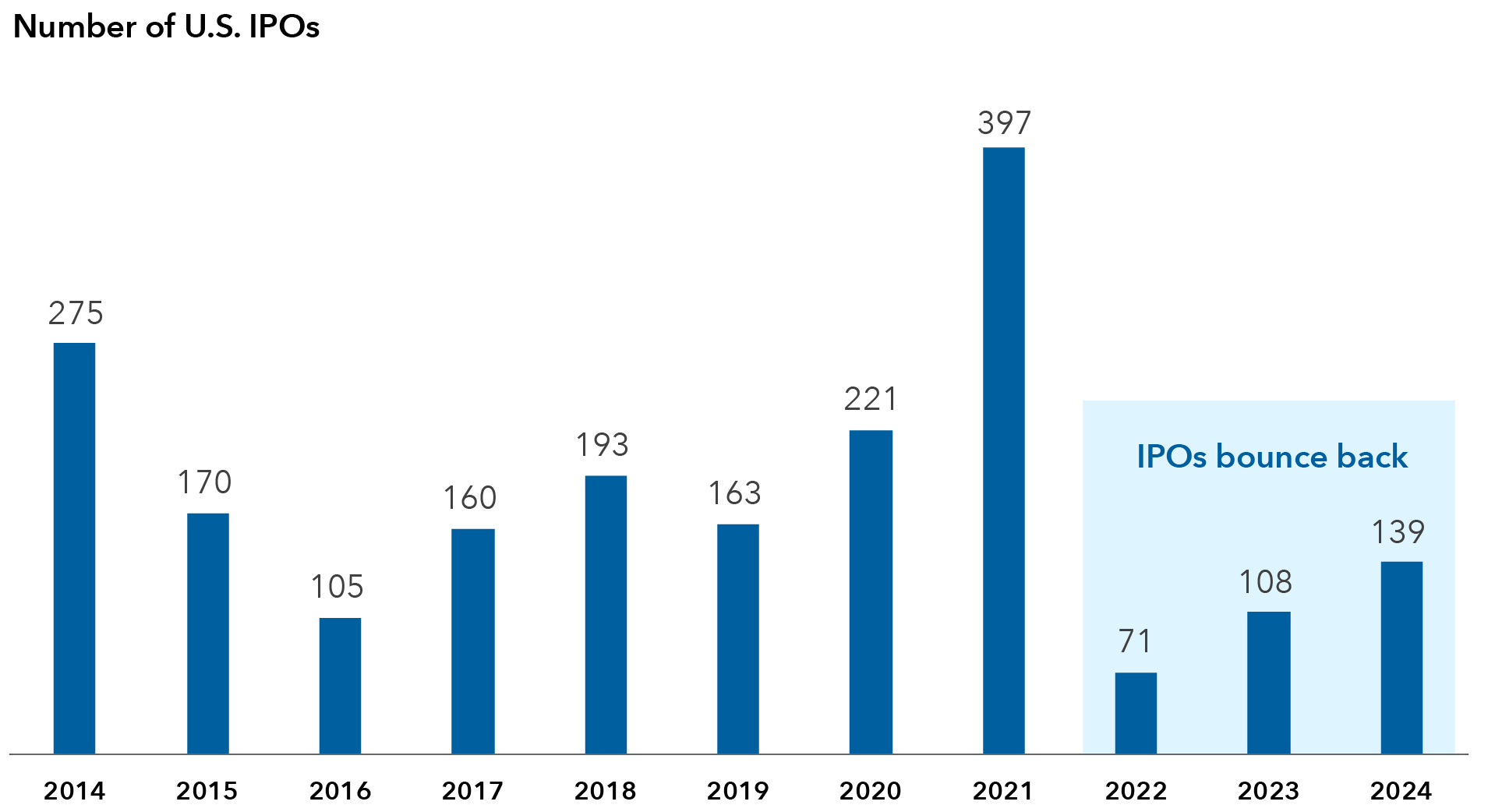

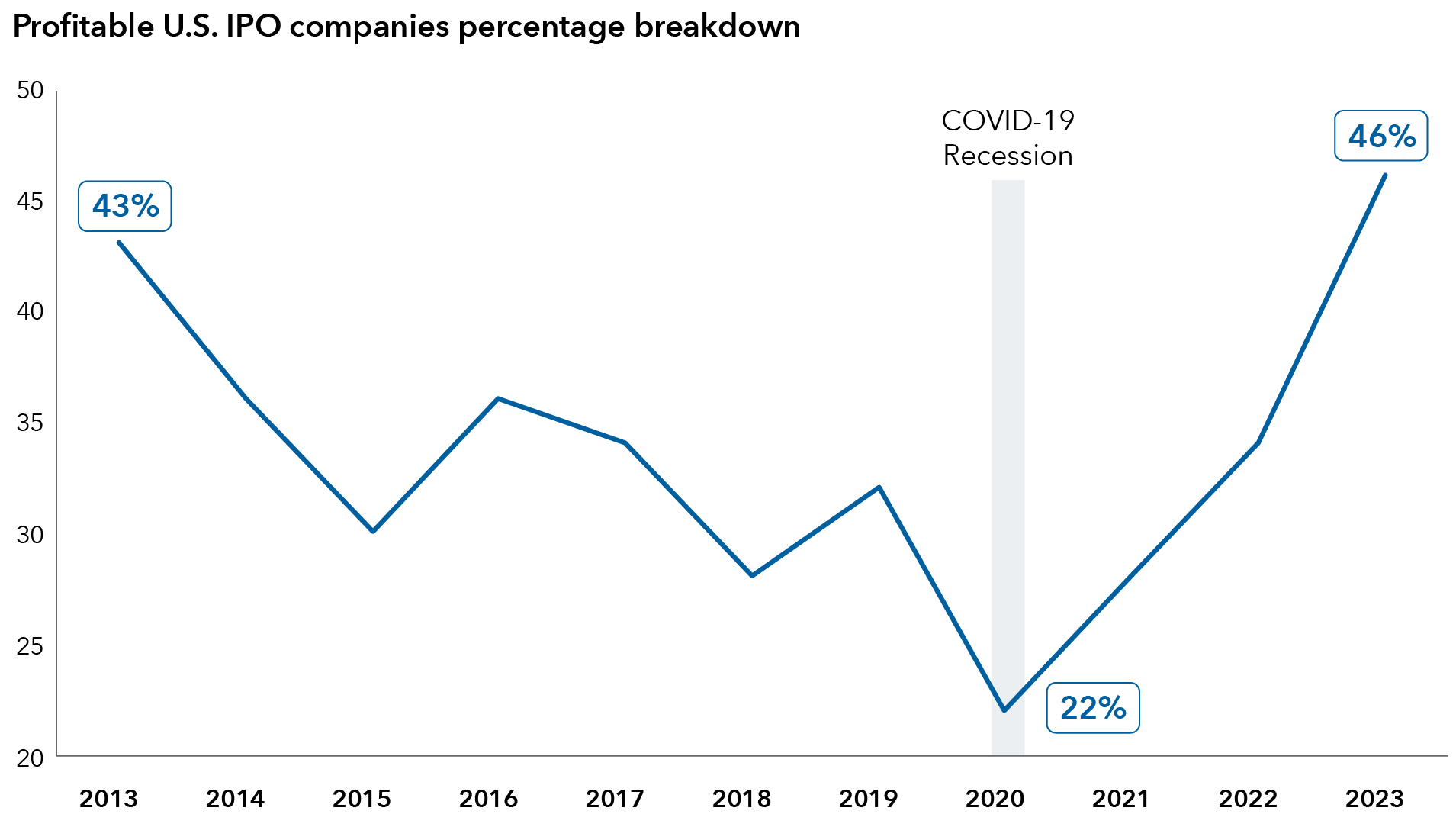

Here’s why: For one, the U.S. economy remains strong with the prospect of further interest rate cuts and a more deregulatory environment. On the earnings front, growth is poised to reaccelerate for smaller companies, following a rough patch in recent years. Also, initial public offering (IPO) activity is picking up, which could create new investment opportunities amid pent up demand from private equity investors to exit investments. Plus, there is a wide valuation gap with large caps.

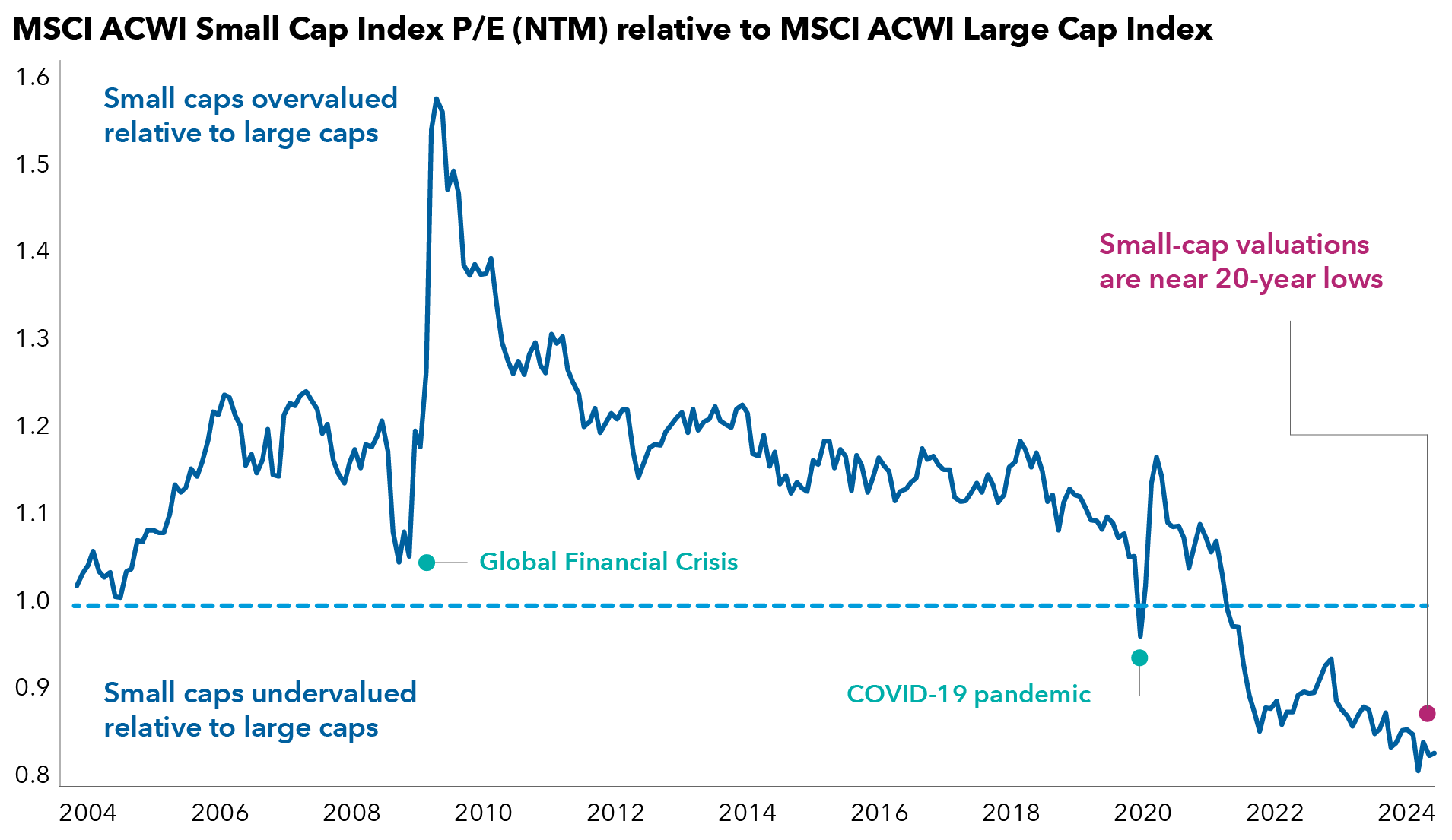

On a forward price-to-earnings basis, small-cap stocks globally trade at their lowest levels in nearly 20 years relative to large companies. Of course, quality varies in the small cap universe and returns have varied the past 12 months across the world, underscoring the eclectic nature of the asset class and idiosyncratic opportunities.