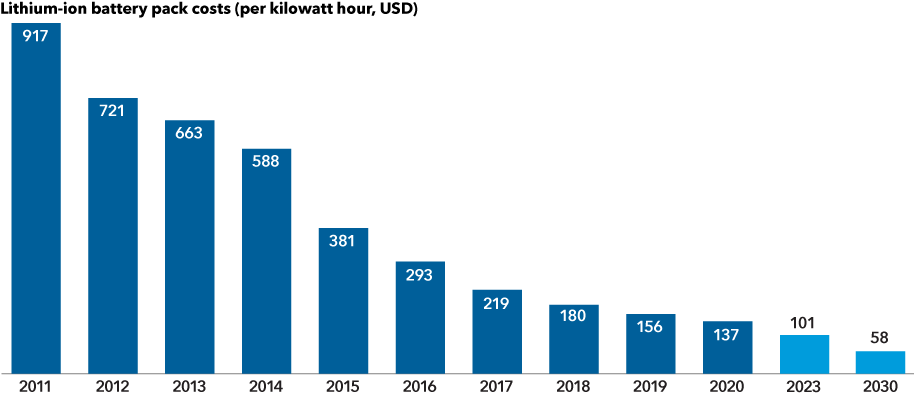

The International Energy Agency expects global EV sales to rise 28% a year over the next decade. But with emissions standards tightening worldwide and costs becoming increasingly attractive to consumers, those estimates may be too conservative, says equity investment analyst Kaitlyn Murphy.

“New developments will potentially make EVs cost competitive not only with new gas-burning cars but with the entire fleet of cars on the road, including used cars,” says Murphy, who covers U.S. automobile and components makers. “That’s about 270 or 280 million vehicles in the U.S. If you take a long-term view, that suggests there could be much stronger growth than the market expects.”

Indeed, the emergence of battery-powered cars is changing the economics of the global auto industry. As companies build out their EV fleets, they are also building a base of potential service revenues — from managing your battery to providing updatable software that can improve consumer experience as well as car safety.

“Whether they are legacy automakers or startups, companies that embrace structural change and introduce these advancements quickly have a better chance of winning over the long term,” Murphy adds.

Furthermore, broader adoption of lithium-ion batteries in autos could trigger price reductions that ultimately make the batteries affordable for other uses, like energy storage for public utilities, for example.