Capital Group Sustainable Global Opportunities Fund (LUX)

Beleggen in de synergie van duurzaamheid en mogelijkheden

Meest recente aandeelhoudersberichten

Uw selectie is gewijzigd, klik op "GO" om te vernieuwen.

Een ogenblik geduld. De pagina wordt opnieuw geladen...

Resultaten

De informatie met betrekking tot de index is louter voor de context en puur ter illustratie. Het fonds is een actief beheerde UCITS. Het wordt niet beheerd onder verwijzing naar een benchmark.

Resultaten uit het verleden zijn niet indicatief voor de toekomst.

Koersen & Uitkeringen

Portfolio

Risico-aspecten

Risicofactoren waarmee u rekening dient te houden voordat u gaat beleggen:

- Dit materiaal is niet bedoeld om beleggingsadvies te verstrekken of om te worden opgevat als persoonlijke aanbeveling.

- De waarde van beleggingen kan zowel stijgen als dalen en het is mogelijk dat u uw inleg geheel of gedeeltelijk kwijtraakt.

- Als de valuta van het fonds waarin u belegt in waarde stijgt ten opzichte van de valuta waarin de onderliggende beleggingen van het fonds zijn genoteerd, daalt de waarde van uw belegging. Met valutahedging wordt geprobeerd dit te beperken, maar er is geen garantie dat hedging volledig succesvol is.

- Voor sommige fondsen kan voor beleggingsdoeleinden, voor hedgingdoeleinden en/of ten behoeve van efficiënt portefeuillebeheer worden belegd in financiële derivaten.

- Aan dit fonds zijn voorts tegenpartij-, opkomende-markt-, aandelen-, liquiditeits-, operationele en duurzaamheidsrisico's verbonden.

Aan het Fonds verbonden risico's

Tegenpartijrisico: Andere financiële instellingen verschaffen diensten aan het fonds, zoals bewaarneming van beleggingen, of kunnen optreden als tegenpartij voor financiële contracten in onder meer derivaten. Er is een risico dat de tegenpartij zijn verplichtingen niet nakomt.

Risico van opkomende markten: Beleggingen in opkomende markten zijn over het algemeen gevoeliger voor risicogebeurtenissen zoals een verandering in de economische, politieke, fiscale of juridische omstandigheden.

Aandelenrisico: De koers van aandelen kan dalen in reactie op bepaalde gebeurtenissen, waaronder gebeurtenissen die direct betrekking hebben op de ondernemingen waarin het fonds aandelen bezit, algemene marktveranderingen, lokale, regionale of wereldwijde politieke, maatschappelijke of economische instabiliteit en valutaschommelingen.

Liquiditeitsrisico: Bij gespannen marktomstandigheden is het mogelijk dat bepaalde effecten die worden aangehouden door het fonds niet voor de volledige waarde kunnen worden verkocht of helemaal niet kunnen worden verkocht. Het is mogelijk dat het fonds hierdoor de inkoop van haar aandelen moet uitstellen of opschorten, wat betekent dat beleggers mogelijk niet direct toegang hebben tot hun belegging.

Operationeel risico: Het risico van een potentieel verlies als gevolg van onvoldoende of falende interne processen, mensen en systemen of door externe gebeurtenissen.

Duurzaamheidsrisico: Een milieu-, maatschappij- of governance-gerelateerde gebeurtenis of omstandigheid die, wanneer deze zich voordoet, een daadwerkelijke of potentiële materiële negatieve impact kan hebben op de waarde van een belegging van het fonds.

Middelen

Informatieverschaffing over duurzaamheid

Samenvatting

Geen duurzame beleggingsdoelstelling

Dit fonds promoot ecologische of sociale kenmerken maar heeft geen duurzame beleggingsdoelstelling. CRMC (de 'Beleggingsadviseur') heeft echter toegezegd om ten minste 40% van de beleggingen van het Fonds te doen in ondernemingen die, naar het oordeel van de Beleggingsadviseur, maatschappelijke en/of milieugerelateerde uitdagingen aanpakken met hun actuele of toekomstige producten en/of diensten.

Ecologische en/of sociale kenmerken van de financiële producten

Het Fonds promoot ecologische en sociale kenmerken via het beleggingsproces van de Beleggingsadviseur, die beoordeelt of een belegging in aanmerking komt en een Negatief Screeningbeleid toepast.

Beleggingsstrategie

Het Fonds belegt in bedrijven waarvan het merendeel van de producten en diensten zijn afgestemd op, of die overschakelen naar een grotere positieve afstemming op afzonderlijke duurzame beleggingsthema's of een combinatie daarvan, gericht op wereldwijde sociale en ecologische uitdagingen zoals die door de Beleggingsadviseur zijn geïdentificeerd. Die thema's stemmen overeen met de duurzame ontwikkelingsdoelstellingen van de Verenigde Naties (SDG's). Om in aanmerking komende bedrijven te identificeren, voert de Beleggingsadviseur een beoordeling uit die berust op eigen bottom-up onderzoek, uitgevoerd door de beleggings- en ESG-teams van de Beleggingsadviseur. Die beoordeling of bedrijven in aanmerking komen wordt ondersteund door de 'Kenmerken' (die beoordelen of producten en diensten bijdragen aan de SDG's) en 'Standaarden' (die onderzoeken hoe belangrijke ESG-risico's worden beheerd en of er goede bestuurspraktijken gehanteerd worden) van de Beleggingsadviseur op sectoraal niveau. Het Fonds belegt in 'Afgestemde' bedrijven waarvan momenteel minstens de helft van de activiteiten is afgestemd, en op bedrijven 'In transitie' die naar het oordeel van de Beleggingsadviseur hun activiteiten actief overschakelen naar een grotere positieve afstemming op duurzame beleggingsthema's zoals die door de Beleggingsadviseur zijn geïdentificeerd en op de SDG's, waarbij op korte tot middellange termijn aanzienlijke verandering wordt verwacht.

Daarnaast past de Beleggingsadviseur op ESG en op normen gebaseerde uitsluitingen toe om op het moment van de aankoop een Negatief Screeningbeleid toe te passen op de beleggingen van het Fonds.

Capital Group heeft een reeks criteria ontwikkeld om te beoordelen of een bedrijf ernstige afbreuk doet om te bepalen of de belegging een duurzame belegging is. Het Fonds neemt de verplichte belangrijkste ongunstige effecten (Principal Adverse Impacts of PAI's) in aanmerking die zijn opgenomen in Tabel 1 van Bijlage I van de Gedelegeerde Verordening (EU) 2022/1288 van de Commissie voor beleggingen uitgegeven door bedrijven, evenals andere ESG-risico's en controverses die de Beleggingsadviseur als potentieel materieel beschouwt, zoals beschreven in de hierboven vermelde Standaarden op sectorniveau, zoals gegevensbescherming of problemen in verband met censuur. Bij de beoordeling van praktijken op het gebied van goed bestuur neemt de Beleggingsadviseur minstens zaken in aanmerking die hij als relevant beschouwt voor de vier voorgeschreven pijlers van goed bestuur (nl. goede managementstructuren, betrekkingen met werknemers, beloning van het betrokken personeel en naleving van de belastingwetgeving).

Aandeel beleggingen

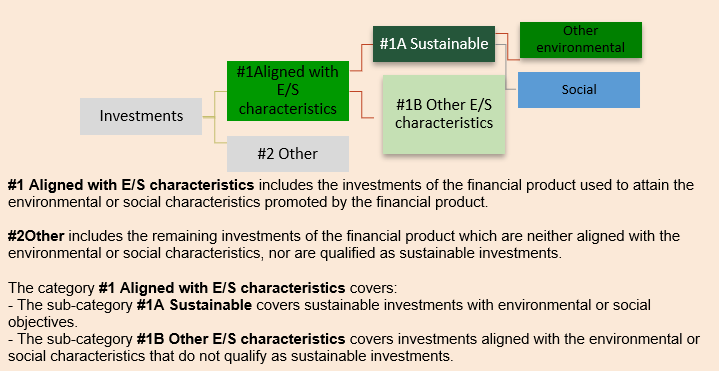

Ten minste 90% van de beleggingen van het Fonds wordt gebruikt om te voldoen aan de ecologische of sociale kenmerken die het Fonds promoot (#1 Afgestemd op E/S-kenmerken). Het Fonds zal een minimumaandeel hebben van 60% in de subcategorie '#1A Duurzaam', en maximaal 40% behoort tot de categorie '#1A Overige E/S-kenmerken'. Maximaal 10% van de beleggingen van het Fonds, met inbegrip van beleggingen die niet zijn afgestemd op de gepromote E/S kenmerken en/of derivaten behoort tot de categorie '#2 Overige'. Geldmiddelen en kasequivalenten zijn niet opgenomen in het hierboven vermelde % van activa. Ze kunnen worden aangehouden voor liquiditeitsdoeleinden.

Monitoring ecologische of sociale kenmerken

De duurzaamheidsindicatoren die door dit Fonds worden gebruikt om de verwezenlijking van elk van de door het Fonds gepromote ecologische of sociale kenmerken te meten zijn de volgende:

- in hoeverre emittenten voldoen aan de criteria uit het Negatieve-Screeningbeleid; percentage beleggingen waarvan minstens 50% van de omzet is afgestemd op de SDG's; en

- percentage beleggingen in bedrijven die worden beschouwd als bedrijven 'In transitie'.

Methodologieën

Het Fonds hanteert twee bindende ESG-gerelateerd criteria: emittenten worden uitgesloten op basis van screens op sectorniveau en op basis van normen en daarnaast heeft het zich ertoe verplicht duurzame beleggingen te doen.

Databronnen en -verwerking

Het Fonds gebruikt verschillende databronnen, met inbegrip van, maar niet beperkt tot MSCI ESG Business Involvement Screening Research ('MSCI ESG') en MSCI United Nations Global Compact Violators. Mogelijk bestrijken die gegevens echter niet het volledige universum van activiteiten van een emittent, en dergelijke gegevens kunnen plots veranderen, onjuist zijn, onnauwkeurig, onvolledig of verouderd, waardoor het Fonds belegt in een emittent waarvan een belegger zou verwachten dat hij zou worden uitgesloten. Capital Group voert een permanente due diligence uit op externe databronnen en levert inspanningen om te verzekeren dat data van derden betrouwbaar zijn. Indien de Beleggingsadviseur van oordeel is dat de gegevens en/of de beoordeling onvolledig of onnauwkeurig is, dan behoudt de Beleggingsadviseur zich het recht voor om zijn eigen beoordeling te gebruiken om de relevante activiteiten waarbij het bedrijf betrokken is, vast te stellen.

Methodologische en databeperkingen

De methodologie en bronnen die als grondslag dienen voor de uitsluitingen en de volledige ESG-integratie, hebben hun beperkingen. Om alle beursgenoteerde ondernemingen ter wereld in kaart te brengen die zijn betrokken bij activiteiten zoals de productie van controversiële producten en omzet genereren uit activiteiten die niet stroken met ESG-criteria en screenings op basis van normen, maakt het Fonds gebruik van ESG-criteria en uitsluitingen die hoofdzakelijk via externe aanbieders zijn geïdentificeerd.

Due diligence

Personeelsleden van de afdelingen Compliance, Risicobeheer en Interne audit van Capital Group voeren periodieke beoordelingen uit over de opzet en de operationele effectiviteit van de activiteiten van het bedrijf en essentiële controlemaatstaven. Dit omvat de naleving van interne processen en procedures en van de reglementering in de rechtsgebieden waar het bedrijf actief is.

Engagementbeleid

Een dialoog aangaan met bedrijven is een integraal onderdeel van de dienst voor beleggingsbeheer die de Beleggingsadviseur aan cliënten aanbiedt. Indien de beleggingsteams van Capital Group een kwestie identificeren die materieel is voor de langetermijnwaarde van een onderneming waarin is belegd of indien zij bezorgd zijn over relatieve ESG-prestaties, zullen de beleggingsprofessionals en governanceteams van Capital Group met het management een dialoog aangaan.

Aangewezen referentiebenchmark

Het Fonds heeft geen referentiebenchmark aangewezen om te voldoen aan de door het Fonds gepromote ecologische en/of sociale kenmerken.

The sustainability-related disclosures are meant to be revised as necessary from time to time to capture any changes or reviews. The capitalized terms are used in accordance with the definitions and references outlined in Capital International Fund Prospectus.

Capital International Fund - Capital Group Sustainable Global Opportunities Fund (LUX) (the “Fund”)

LEI: 549300SMK5QCHX6N2738

The below section “Summary” was prepared in English and is being translated to other official languages of the European Economic Area. In case of any inconsistency(ies) or conflict(s) between the different versions of this section “Summary”, the English language version shall prevail.

Summary

No sustainable investment objective

This Fund promotes environmental or social characteristics, but does not have as its objective sustainable investment. However, CRMC (the “Investment Adviser”) commits to maintain at least 40% of the Fund’s investments in companies that, in the Investment Adviser’s opinion, are addressing social and/or environmental challenges through their current or future products and/or services.

Environmental or social characteristics of the financial products

The Fund promotes environmental and social characteristics through the Investment Adviser’s investment process, which applies an eligibility assessment and a Negative Screening Policy.

Investment strategy

The Fund invests in companies whose products and services are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”). To identify eligible companies, the Investment Adviser performs an assessment that relies on bottom-up proprietary research conducted by the Investment Adviser’s investment and ESG teams. This eligibility assessment is underpinned by the Investment Adviser’s sector-level “Characteristics” (which assess whether products and services contribute to the SDGs) and “Standards” (which examine management of material ESG risks and good governance). The Fund invests in ‘Aligned’ companies that currently have at least half of their business aligned, as well as ‘Transitioning’ companies that the Investment Adviser believes are actively transitioning their business to higher positive alignment with sustainable investment themes as identified by the Investment Adviser and with the SDGs, with material near-to-medium term change expected.

In addition, the Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

Capital Group has developed a set of criteria to assess whether a company does significant harm to determine whether the investment constitutes a sustainable investment. The Fund considers the mandatory PAIs as set out in Table 1 of Annex I of Commission Delegated Regulation (EU) 2022/1288 for corporate investments, as well as other ESG risks and controversies that the Investment Adviser considers potentially material as outlined in the sector-level Standards described above, such as data privacy or censorship issues. When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance).

Proportion of investments

At least 90% of the Fund's investments are used to attain the environmental or social characteristics promoted by the Fund (#1 Aligned with E/S characteristics). The Fund will have a minimum proportion of 60% in the sub-category “#1A Sustainable”, and a maximum of 40% will be in category “#1B Other E/S characteristics”. A maximum of 10% of the Fund’s investments, including investments non-aligned with the E/S characteristics promoted and/or derivatives are in category “#2 Other”. Cash and cash-equivalents are not included in the % of assets set out above. They may be held for liquidity purposes.

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are the following:

- Adherence of issuers to the criteria set forth in the Negative Screening Policy Percentage of investments having at least 50% of their revenue aligned with the SDGs, and

- Percentage of investments in companies considered as “Transitioning”.

Methodologies

The Fund implements two binding ESG-related criteria: sector- and norms-based screens in the form of exclusions and a commitment to make sustainable investments.

Data sources and processing

The Fund uses several data sources including, but not limited to, MSCI ESG Business Involvement Screening Research (“MSCI ESG”) and MSCI United Nations Global Compact violators. However, such data might not capture the full universe of activities of an issuer, change suddenly, be flawed, inaccurate, incomplete, or outdated, resulting in a Fund’s investment in an issuer which an investor may expect to be excluded. Capital Group performs ongoing due diligence on third-party data sources and endeavours to ensure that third-party data is reliable. In the event that the Investment Adviser believes that data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify relevant business involvement activities through its own assessment.

Limitations to methodologies and data

The methodology and sources relating to the exclusions and the ESG integration approach as a whole have certain limitations. In order to identify all publicly traded companies globally which are involved in activities such as the production of controversial products and revenue derived from activities that are inconsistent with the ESG and norms-based screens, the Fund uses ESG criteria and exclusions that are primarily identified through third-party providers.

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s activities and key controls. This includes compliance with internal processes and procedures as well as with the regulatory landscape in the jurisdictions in which the company operates.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. Where Capital Group's investment teams identify an issue material to the long-term value of an investee company or they are concerned about relative ESG performance, Capital Group's investment professionals and governance teams will engage with management.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

No sustainable investment objective

This Fund promotes environmental or social characteristics but does not have as its objective sustainable investment. The Investment Adviser commits to maintain at least 60% of the Fund’s investments in companies that, in the Investment Adviser’s opinion, are addressing social and/or environmental challenges through their current or future products and/or services. This 60% minimum qualifies as “sustainable investments” under Regulation (EU) 2019/2088 on sustainability-related disclosures in the financial services sector.

How have the indicators for adverse impacts on sustainability factors been taken into account?

As mentioned above, the Investment Adviser considers all mandatory PAIs.

The Investment Adviser considers several PAIs within its Negative Screening Policy. In particular, the Negative Screening Policy addresses PAI 4 on exposure to companies active in the fossil fuel sector, PAI 10 on United Nations Global Compact violators and PAI 14 on controversial weapons.

Beyond the negative screening process, with respect to the remaining mandatory PAIs:

where the Investment Adviser considers sufficient and reliable quantitative data is available across the investment universe (for PAIs 1, 2, 3, 6, and 13), the Investment Adviser uses third-party data and prescribed thresholds to determine whether the adverse impact associated with the company’s activities is potentially significant based on the company’s relative ranking (on the specific adverse impact) to the overall investment universe and/or peer group; or

where data availability or quality is not sufficient across the investment universe to enable a quantitative analysis (for PAIs 5, 7, 8, 9, 10, 11, and 12), the Investment Adviser assesses significant harm on a qualitative basis, for example using proxies.

The Investment Adviser’s assessment will also include an overall qualitative assessment of how ESG risks are being managed.

Where third party data or the Investment Adviser’s qualitative assessment indicates that a company is potentially doing significant harm based on a PAI threshold, the Investment Adviser will do additional due diligence to better understand and assess negative impacts indicated by third party or proprietary data. If the Investment Adviser concludes that the company is not causing significant harm based on its analysis, it may proceed with the investment and the rationale for that decision will then be documented. For example, the Investment Adviser may conclude a company is not causing significant harm if (i) the Investment Adviser has reason to believe that third-party data is inaccurate and the Investment Adviser’s own research demonstrates that the company is not causing significant harm; or (ii) the company is taking steps to mitigate or remediate that harm through the adoption of timebound targets and there are meaningful signs of improvement and positive change.

How are the sustainable investments aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights? Details:

The sustainable investments are aligned with the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles on Business and Human Rights as follows: the Investment Adviser reviews companies involved in significant ESG controversies, with a focus on those that may conflict with existing global standards, including guidelines from the United Nations Global Compact. In accordance with the Negative Screening Policy applied to the Fund, the Investment Adviser will exclude companies violating the UN Global Compact principles. Although other incidents will not automatically result in exclusion from the Fund, the Investment Adviser ensures that appropriate action to remediate the concerns are taken.

Environmental or social characteristics of the financial product

The Fund promotes environmental and/or social characteristics through the Investment Adviser’s investment process, which applies an eligibility assessment and a Negative Screening Policy.

The Fund invests in companies whose products and services are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”).

To identify eligible companies, the Investment Adviser performs an assessment that relies on bottom-up proprietary research conducted by the Investment Adviser’s investment and ESG teams. This eligibility assessment is underpinned by the Investment Adviser’s sector-level “Characteristics” (which assess whether products and services contribute to the SDGs) and “Standards” (which examine management of ESG risks and good governance). The Fund invests in ‘Aligned’ companies that currently have at least half of their business aligned, as well as ‘Transitioning’ companies that the Investment Adviser believes are actively transitioning their business to higher positive alignment, with material near-to-medium term change expected.

In addition, the Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

There is no reference benchmark designated for the purpose of attaining the environmental or social characteristics promoted by the Fund.

Investment strategy

The Investment Adviser applies the following investment strategy to attain the environmental and/or social characteristics promoted and the sustainable investment objective as follows:

The Fund invests in companies whose products and services are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”). The themes map to the following key United Nations Sustainable Development Goals (“SDGs”):

| Themes | Key Associated UN SDGs |

|---|---|

| Health & Well-Being |

|

| Energy Transition |

|

| Sustainable Cities & Communities |

|

| Responsible Consumption |

|

| Education & Information Access |

|

| Financial Inclusion |

|

| Clean Water & Sanitation |

|

To identify such companies, the Investment Adviser performs an eligibility assessment that relies on bottom-up proprietary research conducted by the Investment Adviser’s investment and ESG teams. This eligibility assessment is underpinned by the Investment Adviser’s sector-level “Characteristics” and “Standards”:

- Characteristics: focus on whether products and services contribute to the SDGs; and

- Standards: focus on management of material ESG risks and good governance.

The Fund invests in ‘Aligned’ companies that currently have at least half of their business aligned, as well as ‘Transitioning’ companies that the Investment Adviser believes are actively transitioning their business to higher positive alignment with material near-to-medium term change expected. If a company is determined to be aligned or transitioning and purchased in the Fund, but fails to meet the aligned or transitioning requirements thereafter, such company would no longer be considered a sustainable investment anymore and would generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

In addition, the Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase.

This is supported by ongoing monitoring of the portfolio, performed by the Investment Adviser, against criteria set out in the Negative Screening Policy to identify any holdings that would be precluded. Any such company would no longer be considered a sustainable investment anymore and would generally be sold within six months from the date of such determination, subject to the best interests of investors in the Fund.

The activities and thresholds, from the Negative Screening Policy, applied to determine the list of companies to be excluded from the Funds’ investment universe consist of the following:

| Activities | Threshold |

|---|---|

| United Nations Global Compact (UNGC) | Companies that, in the Investment Adviser’s opinion, are violating the UNGC should be excluded. |

| Tobacco | Companies generating >5% of their revenue from the manufacture of tobacco products should be excluded. |

| Controversial Weapons | Companies with any ties to controversial weapons (cluster munitions, landmines, biological/chemical weapons, depleted uranium weapons, blinding laser weapons, incendiary weapons, and/or non-detectable fragments) should be excluded. |

| Nuclear Weapons | Companies generating any revenue from the production of nuclear weapons should be excluded. |

| Weapons | Companies generating >10% of their revenue from weapon systems, components and support systems and services should be excluded. |

| Oil & Gas Upstream Producers | Companies engaging in, or generating any revenue from, the exploration & production of oil and gas should be excluded. |

| Thermal Coal | Companies generating >10% of their revenue from the production and/or distribution of thermal coal should be excluded. |

When assessing potential investee companies, the Investment Adviser relies on third-party providers who identify a company’s participation in or the revenue which they derive from activities that are inconsistent with these screens. In the event that exclusions cannot be verified through third-party providers or if the Investment Adviser believes that data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

Companies that fail both the eligibility process and the Negative Screening Policy are considered not to contribute to the Fund’s environmental and/or social characteristics.

What is the policy to assess good governance practices of the investee companies?

When assessing good governance practices, the Investment Adviser will, as a minimum, have regard to matters it sees relevant to the four prescribed pillars of good governance (i.e., sound management structures, employee relations, remuneration of staff and tax compliance).

The Investment Adviser assesses the quality of corporate governance practices of companies as part of its eligibility assessment when examining ESG risks, and as part of its ESG integration process more broadly. The Investment Adviser’s fundamental analysis covers a range of governance metrics including among others, audit practices, board composition, tax paid, controversies and executive compensation. The Investment Adviser engages in regular dialogue with companies on corporate governance issues and exercises its proxy voting rights for the entities in which the Fund invests.

As described above, the Investment Adviser applies a Negative Screening Policy to the Fund. As part of this, the Investment Adviser excludes companies violating the United Nations Global Compact (UNGC) principles as well as those violating principle 10 on anti-corruption and principle 3 on employee relations.

Capital Group's ESG Policy Statement provides additional detail on the Investment Adviser's ESG integration approach and processes, including proxy voting procedures and principles, as well as views on specific ESG issues, including ethical conduct, disclosures and corporate governance. Information on the Investment Adviser’s corporate governance principles can be found in its Proxy Voting Procedures and Principles.

Further details can be found in the ESG Policy Statement on:

https://www.capitalgroup.com/content/dam/cgc/tenants/eacg/esg/files/esg-policy-statement(en).pdf

Proportion of investments

At least 90% of the Fund's investments are used to attain the environmental or social characteristics promoted by the Fund (#1 Aligned with E/S characteristics). The Fund will have a minimum proportion of 60% in the sub-category “#1A Sustainable”, and a maximum of 40% will be in category “#1B Other E/S characteristics”.

A maximum of 10% of the Fund’s investments, including investments non-aligned with the E/S characteristics promoted and/or derivatives are in category “#2 Other”.

Cash and cash-equivalents are not included in the % of assets set out above. They may be held for liquidity purposes.

Monitoring of environmental or social characteristics

The sustainability indicators used by this Fund to measure the attainment of each of the environmental or social characteristics it promotes are the following:

- Percentage of issuers falling under the sectors defined as part of the Negative Screening Policy

- Percentage of investments having at least 50% of their revenue aligned with the SDGs, and

- Percentage of investments in companies considered as “Transitioning”.

Methodologies

The methodologies used to measure how the environmental and/or social characteristics are met are as follows:

- Eligibility process: the Investment Adviser seeks to invest in companies whose products and services are majority-aligned, or transitioning towards higher positive alignment, with any single or combination of sustainable investment themes focused on global social and environmental challenges as identified by the Investment Adviser. These themes map to the United Nations Sustainable Development Goals (“SDGs”). ‘Aligned’ companies currently have at least half of their business aligned and ‘Transitioning’ are companies that the Investment Adviser believes are actively transitioning their business to higher positive alignment with sustainable investment themes as identified by the Investment Adviser and with the SDGs, with material near-to-medium term change expected. The Investment Advisor typically uses revenue to assess business alignment, however in some instances other metrics may be more relevant, for example, energy production mix for utilities. The business alignment is accompanied by a qualitative assessment of the company’s product and service contribution to the SDGs, as well as risk of misalignment. It will also consider how material ESG risks and opportunities are being addressed and managed by the company, such as the quality of corporate governance practices and any adverse environmental or social impacts. For Transitioning companies in particular, company development pathway and timeline to reach intended impact is also considered.

- Relevant KPIs and targets, as well as topics for engagement, are also identified at the time of eligibility and tracked over time. For Transitioning companies in particular, KPIs may include aligned revenue, as well as other transition metrics. Progress against these KPIs and targets is assessed periodically.

- Research is conducted by the Investment Advisor’s ESG analysts and investment analysts. Eligibility decisions are voted on by the strategy’s Principal Investment Officers, Portfolio Managers, and ESG leadership.

- Negative Screening Policy: the Investment Adviser applies ESG and norms-based exclusions to implement a Negative Screening Policy to the Fund’s investments at the time of purchase. The Investment Adviser relies on third-party providers who identify a company’s participation in or the revenue which they derive from activities that are inconsistent with these screens. In the event that exclusions cannot be verified through third-party providers or if the Investment Adviser believes that data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

- Engagement: Engagements are conducted by the ESG team in collaboration with our investment professionals. We engage management teams on topics that are informed by our research, ESG investment frameworks, voting and monitoring process.

- Proxy Voting: We have investment professional-led proxy voting, with our in-house Global Stewardship & Engagement (GSE)/Proxy team conducting analysis. Final proxy outcomes are decided by members of our investment units.

Data sources and processing

Data sources

The Fund uses several data sources as part of the investment process.

In relation to the SDGs alignment, the Investment Adviser typically uses revenue to assess business alignment, but will leverage other metrics if there are more sector-relevant financial metrics for a company and its industry.

The data sources used as part of the Negative Screening Policy are as follows:

| Activities | Datasource |

|---|---|

| United Nations Global Compact (UNGC) | Companies are identified through MSCI’s UNGC violators. |

| Tobacco | Companies are identified through MSCI’s Tobacco Producer – Maximum Percentage of Revenue factor name. |

| Controversial Weapons | Companies are identified through MSCI’s Controversial Weapons – Any Tie factor name. |

| Nuclear Weapons | Companies are identified through MSCI’s Weapons – Nuclear Maximum Percentage of Revenue factor name. |

| Weapons | Companies are identified through MSCI’s Weapons – Maximum Percentage of Revenue factor name. |

| Oil & Gas Upstream Producers | Equity: Companies are identified through Global Industry Classification Standard (GICS) “Integrated Oil & Gas” and “Oil & Gas Exploration & Production” sub-sector classifications. Fixed Income: Companies are identified through Barclays Global Sector Classification (BCLASS) “Independent” and “Integrated” sectors. |

| Thermal Coal | Companies are identified through MSCI’s Thermal Coal – Maximum Percentage of Revenue factor name. |

In the event that exclusions cannot be verified through third-party data or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

Data quality and processing

Capital Group periodically reviews the performance quality of provider organizations and conducts ongoing monitoring and due diligence activities commensurate with the significance of the services provided.

Data are regularly updated in Capital Group’s internal platforms and made available to relevant teams. When issues are identified in third-party data, they are reported back to the provider(s). The Investment Adviser also applies systematic data quality checks to catch discrepancies and validate with the provider when issues arise.

Proportion of data that is estimated

Third-party providers may estimate data. While reported data are prioritized, Capital Group uses estimated data when reported data are unavailable. The proportion of estimated data varies depending on the data point due to inconsistencies in reporting by investee companies.

Limitations to methodologies and data

The Investment Adviser may be reliant on third-party data or a combination of third-party data and Capital Group’s proprietary research and analysis. However, such data might not capture the full universe of activities of an issuer, change suddenly, be flawed, inaccurate, incomplete or outdated, resulting in a Fund’s investment in an issuer which an investor may expect to be excluded from the portfolio. Capital Group performs ongoing due diligence on third-party data sources and endeavours to ensure that third-party data is reliable.

In addition, in the event that data cannot be obtained through third-party providers or if the Investment Adviser believes that third-party data and/or assessment is incomplete or inaccurate, the Investment Adviser reserves the right to identify business involvement activities through its own assessment (including by using other third-party data sources).

Due diligence

Members of Capital Group's compliance, risk management and internal audit staff conduct periodic assessments on the design and operating effectiveness of the firm’s activities and key controls. This includes compliance with internal processes and procedures as well as with the regulatory landscape in the jurisdictions in which the company operates. Capital Group meets regularly with the third-party data providers to review the quality of the services provided.

Pre-trade and post-trade checks are also in place as further explained in section “Monitoring of environmental or social characteristics” above.

Engagement policies

Establishing dialogue with companies is an integral part of the Investment Adviser’s investment management service to clients. Capital Group’s investment teams meet on a regular basis with company management, including executive and non-executive directors, chairs and finance directors. This enables the company to engage and generate dialogue on any issues that could affect the company’s long-term prospects, including exposures to sustainability issues.

Where Capital Group's investment teams identify an issue material to the long-term value of a company or they are concerned about relative ESG performance, Capital Group's investment professionals and governance teams will engage with management. Management’s response and the steps they take to minimise any associated risks, forms an important part of Capital Group's assessment of management quality, which itself is a key factor in the stock selection decisions.

Designated reference benchmark

The Fund has not designated a reference benchmark to meet the environmental and/or social characteristics it promotes.

Where can more product-specific information be found?

https://docs.publifund.com/1_PROSP/LU1577354035/en_LU

More product-specific information can be found in the periodic reports: