In 2009, when Michael Novak was building his RIA firm, Wellspring Financial Advisors, a client asked him a provocative question: “Do you have a lifestyle business, or do you have a real business?”

“I was taken aback,” says Novak, Wellspring’s president and CEO. He had a team of six and certainly believed he was running a real business. And he was seeking more of a challenge than simply running a practice to provide him with a nice lifestyle.

That’s when he picked up a book that helped him see the full potential of what his practice could be. Called “Traction,” it describes the Entrepreneurial Operating System (EOS) framework. Novak recalled that he immersed himself in the book during a flight, dog-earing pages and highlighting text. Inspired, he persuaded his partners to deploy EOS to help set priorities and align employees on reaching those goals.

You might think that business planning would take time and effort away from your top priority, which is serving clients. “But we’ve seen that advisors who do business planning are actually better able to offer the kind of more personalized client service emblematic of thriving practices,” says Paul Cieslik, advisor practice management consultant at Capital Group. “And the sooner you can bring business planning into your practice, the greater the multiplier effect can be in driving durable growth.”

In the decade-plus since the Cleveland-based Wellspring made the firmwide commitment to business planning, the RIA has grown from that team of six to 25 — including two partners who started at the firm as interns — with assets under management of more than $3 billion. “Business planning transformed our business,” says Novak.

“Traction” is just one of countless books, websites, assessment tools and other sources available on the market to help business owners professionalize their operations. A few are geared specifically to advisors, such as “one-page” business planning guides offered by financial planner Michael Kitces and consultant Jim Horan.

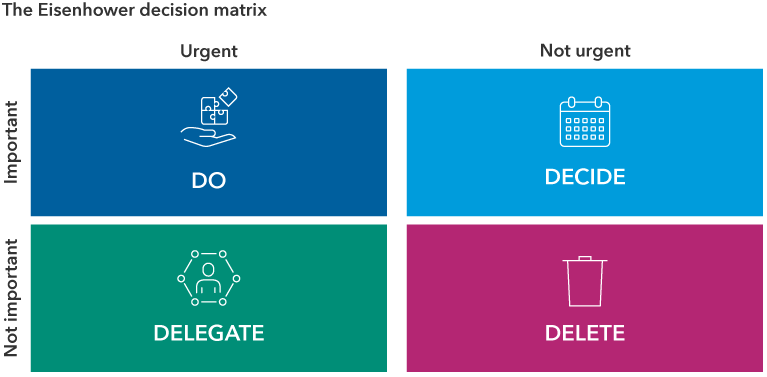

What most of these frameworks have in common are steps around setting achievable goals, monitoring results and aligning employees around a shared mission. Capital Group’s Business planning blueprint for financial advisors workbook provides details on five such steps and includes a 21-day playbook to help jump-start your efforts.

Pick a framework that feels right to you and get started.