- Investors have a historic opportunity in strong-yielding, short-term investments.

- Short-term municipal bonds (munis) can benefit from price appreciation when interest rates fall.

- These bonds may also offer income exempt from federal, and sometimes state and local, taxes.

Just a few years ago, investors seeking strong levels of income had a very limited range of opportunities. Today, the opposite is true – income potential abounds. In the current economy, short-term yields are higher than long-term yields, in some cases. Investors have the opportunity to earn ample income with relatively high-quality investments. And tax-aware investors may benefit significantly with income exempt from federal, and sometimes state and local taxes, available with municipal (muni) bond investments. We believe one such area with a strong income opportunity to consider is short-term munis.

A unique historical period

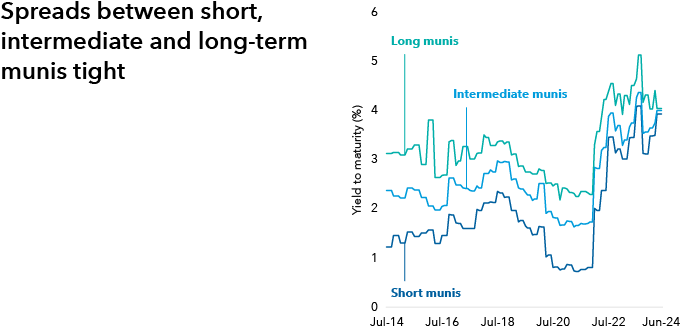

Investors have been experiencing an unusual time in history: short-term muni yields remain elevated when compared to the past decade. Because of the strong yield delivered by shorter-term investments, investors can pursue a historically high level of income even without introducing as much interest rate risk into a portfolio as they would have had to in the past. From a yield perspective, investors are not being “paid” to take additional duration risk as they have in the past. (Duration indicates a bond fund’s sensitivity to interest rates; generally, lower duration indicates less sensitivity.) Today’s spreads (i.e., the difference between yields) are extremely tight compared to historical levels.

Source: Morningstar. Data as of 6/30/24. Categories are Morningstar categories. Short munis represented by Muni National Short. Intermediate munis represented by Muni National Interm. Long munis represented by Muni National Long.

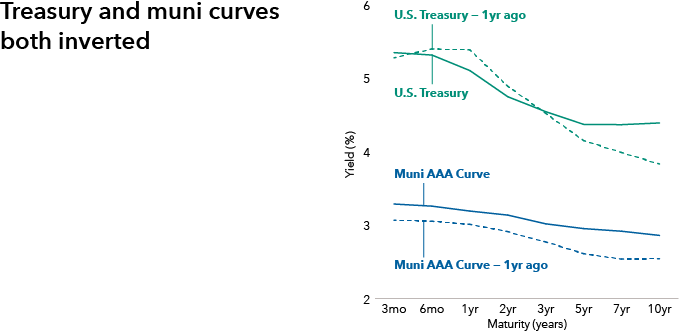

A tale of two inversions

Let’s take a brief look at why short-term yielding investments are currently enticing. Both the Treasury and muni yield curves are inverted (meaning short-term interest rates are higher than long-term rates). This is particularly unusual for the muni yield curve, but both have now been inverted for the longest time in history.

Source: Bloomberg. Data as of 6/30/24. Chart adjusted to reflect the tax-equivalent yield at the highest tax rate (37% plus 3.8% Medicare tax). U.S. Treasury represented by Bloomberg U.S. Treasury Index. Muni AAA Curve represented by BVAL (Bloomberg Valuation Service) Municipal AAA Yield Curve (Callable).

Does the Fed play a role?

At this point most investors are expecting rate cuts, not more rate hikes. U.S. monetary policymakers appear to be signaling a first cut in September. When this happens, there is no guarantee longer term yields will decrease initially, but the shorter term rates should be more directly impacted and begin to fall. That means shorter-term bonds would experience a positive impact with price appreciation.

Source: Capital Group. Duration measures a bond’s sensitivity to changes in interest rates. Figures show percentage increase of a bond’s price based on decline in yields. As an example, for a bond with a duration of 2 years, a 0.25% decline in interest rates would increase the bond’s price by 0.5%.

The potential upside for investors? They could benefit both from higher starting yield and price appreciation. Yields have already begun to drift lower, so investors holding excess cash could, depending on their investment objectives, consider moving into bonds to capture as much of that potential price appreciation as possible before the Fed moves.

As the Fed cuts rates, bonds may prove a balancing force again.

A primer for moving into short-term munis

Additionally, while cash-like investments (such as certificates of deposits [CDs]) may seem attractive, they deliver a tax hit. Muni bonds, on the other hand, deliver income exempt from federal taxes, and sometimes state and local taxes. Taxable investments would need to deliver higher yields to match the yield of a short-term tax-exempt muni investment. Typically referred to as tax-equivalent yield, this is the income a muni would provide if compared to a taxable bond yield with a given tax rate. Here’s an example of what a potential short-term muni could offer versus a CD, based on tax rates.

Sources: Capital Group, Bloomberg Index Services Ltd. Data as of 6/30/24. The 40.8% assumes the 3.8% Medicare tax and the top federal marginal tax rate for 2024 of 37%.

Exposure to short-term munis is available with mutual funds and exchange traded funds (ETFs). Mutual fund investors may want to consider the Limited Term Tax-Exempt Bond Fund of America® or American Funds Short-Term Tax-Exempt Bond Fund®. Their tax-equivalent yields could deliver a higher yield to investors than the yields illustrated in the below table. While not as low-risk as CDs, these funds aim for a higher credit quality than many stock or other bond investments. Some investors may want to own ETFs, which offer tax efficiency and other potential benefits. CGSM — Capital Group Short Duration Municipal Income ETF — is a fund that may serve as a nice step-out from cash while providing broad exposure across sectors and issuers. CGSM seeks a relatively high credit quality, low duration investment profile. There are differences between mutual funds and ETFs, including costs and expenses, liquidity, transparency of holdings and tax features.

| Fund/ETF | Effective duration* | Yield to worst (%) | Percentage investment grade (BBB/Baa and above) |

|---|---|---|---|

| Limited Term Tax-Exempt Bond Fund of America | 3.5 | 3.6 | 91.6 |

| American Funds Short-Term Tax-Exempt Bond Fund | 2.3 | 3.4 | 89.3 |

| CGSM — Capital Group Short Duration Municipal Income ETF | 2.4 | 4.0 | 76.9 |

The clock may be ticking

Investing after rate cuts could lead to missing out on capturing a higher yield and the price appreciation when those rates drop (prices and yields move inversely from each other). Investors can discuss with their financial advisors to determine the most appropriate vehicle, a mutual fund or ETF. Now may be the time to consider this opportunity.

* Effective duration is a duration calculation for bonds that takes into account that expected cash flows will fluctuate as interest rates change.