- As fixed income investors continuously seek to limit costs or to reliably achieve the specific risk profile of a given market index, some may prefer passive ETFs—even if these funds ultimately produce below-benchmark returns after fees.

- In our view, the unique characteristics of fixed income indexes and markets give actively managed funds structural advantages that can potentially produce excess returns with lower risk over time.

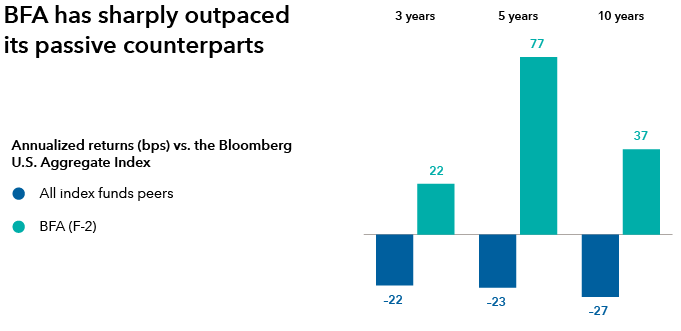

- Comparing The Bond Fund of America (BFA) to its passive peers highlights the positive impact that active management—including fundamental research, valuation assessment, and risk management in portfolio construction—may have on long-term total returns.

The growth of fixed income ETFs

Since their inception more than 20 years ago, fixed income exchange-traded funds (ETFs) have steadily gained market share in assets under management (AUM). In some Morningstar categories, ETFs represented a majority of core fixed income AUM as of June 30, 20241. Meanwhile, in Morningstar’s Intermediate Core Bond category, ETFs accounted for 29% of total AUM as of June 10, 2024.

1Source: Morningstar. As of 6/30/24. These categories include Emerging Markets Local-Currency Bond, Intermediate Government, Long Government, and Ultrashort Bond.

Source: Morningstar. As of 6/10/24.

As with the growth of ETFs more broadly, the growth of fixed income ETFs is likely due to several factors. These include potential tax benefits, such as the fact that ETFs tend to generate fewer taxable capital gains than mutual funds with similar investment objectives. While most fixed income mutual funds are actively managed, a majority of core fixed income ETFs are passive2. Active fixed income ETFs have become more prevalent in recent years, offering investors who prefer the ETF structure a greater range of options. Still, the availability of active ETFs remains very modest compared to passive ETFs, and as a result, some investors may not be aware that active fixed income ETFs exist. Consequently, some investors may default to passive ETFs in search of market liquidity, such as the potential for intraday trading. In addition, some investors may not have a deep understanding of active ETF structure or the potential long-term advantages that these funds can offer.

An additional factor in the growth of passive fixed income ETF AUM is that passive vehicles tend to charge lower fees than active strategies. For example, the two largest passive fixed income ETFs—iShares’ Core U.S. Aggregate Bond ETF (AGG) and Vanguard’s Total Bond Market ETF (BND), each of which had more than $100 billion in AUM as of June 30, 2024— both have a gross expense ratio of 0.03%3, a tiny fraction of an investor’s original investment.

Even so, what often gets lost in cost-focused discussions is the value that actively managed funds may deliver, including the potential for higher after-fee risk-adjusted returns. The critical question is: Do the lower fees that passive funds charge ultimately result in stronger long-term results?

2Source: Morningstar. As of 6/30/24.

3Source: iShares and Vanguard. As of 7/24/24.

Investors can’t buy a fixed income index

If fixed income investors consider fees alone, or if they’re so focused on achieving a specific risk profile that they’re willing to accept below-index returns (since the goal for most passive funds is index returns minus fees), then the dramatic increase in passive ETF AUM is certainly understandable. (Broadly speaking, passive funds do not strive to outpace their benchmarks; rather, they seek to replicate their benchmark’s return pattern). Nevertheless, we believe that passive fixed income funds entail disadvantages versus their active counterparts.

While in theory passive funds aim to replicate the holdings of a particular index, in practice it can be very difficult for them to do so precisely. If nothing else, the sheer number of securities in many fixed income indexes makes exact replication virtually impossible. In the Bloomberg U.S. Aggregate Index, for example, there are more than 13,0004 individual securities, many of which investors cannot purchase on a given day due to lack of availability and liquidity constraints.

As a result, passive fixed income funds must often use statistical techniques or otherwise buy bonds that only approximate the characteristics of those in their respective indexes. Many passive funds cite sampling as a primary feature of their portfolio construction process and use a subset of bonds from their respective index to try to replicate the index’s sector, maturity, and credit quality characteristics, among other factors. This often results in greater portfolio concentration as compared to the index, leading to greater risk contribution from the subset of bonds that passive funds utilize. For example, AGG holds about 11,6005 bonds —or about 86% of the number of bonds in its benchmark. While AGG is certainly diversified on an absolute basis, over time, its greater concentration compared to its index can produce unintended risks for investors, such as increased volatility or tracking error6.

Compared to many of their equity counterparts, passive fixed income funds face additional challenges in that fixed income markets trade “over the counter” through a specific number of intermediaries, each of which has limited market depth. This means that beyond buying the same bonds—which can already be challenging for some of the reasons noted above—passive funds would have to buy them at the exact same price to truly replicate an index. In practice, there is no guarantee that such funds will be able to do so, and they could pay more or less than the original price of the bonds in the index.

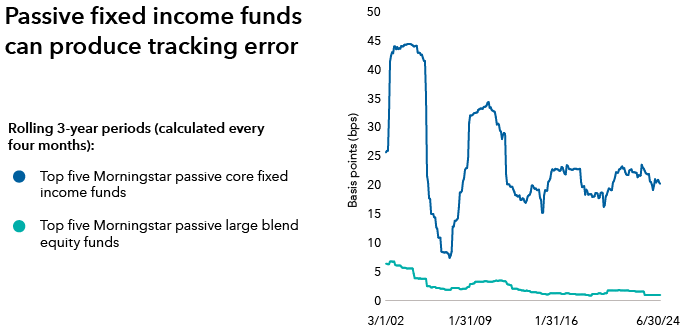

Given these constraints, passive funds inevitably incur some degree of tracking error, or variance in a fund’s daily returns as compared to its index. When compared to their equity counterparts—such as the top five Morningstar large blend equity funds (as measured by AUM) referenced in the chart below—two disadvantages stand out for passive fixed income. First, tracking error has been higher on average. And second, that tracking error is not stable, and it has been meaningfully higher during periods of market stress.

4Source: Bloomberg. As of 7/24/24.

5Source: BlackRock/iShares. As of 7/24/24.

6Mathematically, tracking error is defined as the annualized standard deviation of daily return differences between the total returns of a fund and the total returns of the fund's respective index. Standard deviation is a statistical calculation that measures how far individual points in a dataset are dispersed from the mean of that set.

Source: Morningstar. Funds selected by total AUM as of 6/30/24.

Ultimately, we believe that the unique nature of fixed income markets leaves passive fixed income funds at a disadvantage in trying to replicate their respective indexes, with greater variability than most investors may expect. Fortunately, these issues are not as relevant for active funds, which seek to outpace (rather than replicate) the return pattern of a given index.

Passive funds often trail their indexes

The challenges that passive funds face in replicating fixed income indexes often result in lower returns than their respective benchmarks over time. Passive ETFs in Morningstar’s Intermediate Core Bond category, for example, trailed their respective benchmarks after fees by about 13 basis points (bps) over the annualized rolling five-year period ended June 30, 20247. (The one-year return was -16 bps as of the same date, while the annualized rolling 3- and 10-year returns were -12 bps and -11 bps, respectively). These results may not be entirely surprising since, over time, passive fixed income funds have often produced below-index returns (i.e., index return minus fees).

Given the challenges that passive funds face in seeking to replicate fixed income indexes, they may also need to emphasize purchasing bonds that are from larger issuers and that have greater liquidity, depending on the fund's objectives. In some cases, these companies may have already issued a great deal of debt, meaning that passive funds are essentially purchasing bonds of issuers that are overrepresented in the market. This in turn may detract from the diversification and capital preservation that many fixed income investors seek. In addition, these issues can trade at a premium to similar bonds as a result of elevated demand, meaning that passive fixed income investors may pay a liquidity premium in the form of lower returns and higher volatility over time.

Beyond the issue of purchasing overrepresented bonds, fixed income trading can reflect transaction costs that increase depending on the liquidity of the sector. Corporate bonds, for example, can have higher transaction costs than U.S. Treasuries. These transaction costs are not captured by indexes but are real costs with which both active and passive funds contend. On a relative basis, active fixed income managers may generally have more flexibility in their trading decisions than passive managers given that passive managers seek to replicate the return pattern of a specific index, while active managers do not.

Ultimately, while some fixed income investors may believe that passive funds will consistently replicate the returns of their respective indexes, this has often not been the case. And while passive fixed income funds may outpace their indexes over short periods of time, over 10 years or more, these funds will likely produce index-like returns—minus fees (if applicable) and with greater variability (i.e., higher tracking error)—than passive equity funds.

7Source: Morningstar. As of 6/30/24.

Potential active advantages

In our view, actively managed fixed income funds have several structural advantages that can potentially allow them to produce excess returns with lower risk over time. For example, actively managed funds can utilize fundamental research and valuation analysis to assess the relative value of each bond in a portfolio, rather than buying bonds with the intent of replicating an index. As a result, factors such as fundamental analysis, valuations and supply/demand dynamics drive active security selection, as opposed to passive sampling techniques that focus on assessing the broader composition and concentration of a portfolio. On that basis, actively managed funds can potentially respond more effectively to changing market conditions such as higher volatility, shifting monetary policy and elevated inflation.

For example, active managers may be in a better position to mitigate the effects of rising interest rates by adjusting their interest rate exposure across the Treasury yield curve and reinvesting capital into higher-yielding securities. The corollary is also true: In a falling-rate environment, active managers may be better able to invest in securities that may benefit from lower interest rates. Similarly, shifting inflationary environments can enable active managers to emphasize reflationary sectors or add inflation-protected bonds.

Importantly, active managers can assess the amount of compensation they’re receiving for taking on risk from a specific issuer. In fact, this assessment becomes a critical aspect of determining the degree to which an active manager should include a specific issuer within a portfolio—rather than simply the prevalence of that issuer’s debt within an index.

Active managers can also benefit from structural inefficiencies in fixed income markets. For example, most fixed income indexes determine their composition based on the market value of debt. As a result, passive funds may tend to invest more in issuers that are already highly indebted. Unfortunately, this may occur regardless of the types of assets that back these issuers’ bonds, the issuers’ fundamental economic strength, the strength of their sector or the compensation that investors will receive for taking on these risks. In our view, this is a less effective approach to investing that has often led to suboptimal outcomes. In contrast, active managers may be better able to avoid such highly indebted issuers and instead purchase securities that offer investors a potentially more beneficial risk/reward profile.

In addition to these factors, actively managed portfolios may have trading advantages that allow them to gain appropriate market exposure at lower costs to the investor. Since actively managed mutual funds and ETFs don’t seek to replicate an index, they can leverage the expertise of experienced traders and portfolio managers to potentially buy and sell bonds at attractive prices, rather than buying or selling certain bonds at wide bid/ask spreads. This is particularly important in markets where a single fund may consist of thousands of individual bonds. As one would expect, this flexibility may be most advantageous during periods of heightened market volatility when prices often deviate significantly from their historical norms. In these cases, active managers can become buyers—effectively earning liquidity premiums rather than paying them.

Of course, there is no guarantee that active managers will be able to use the potential advantages discussed above to produce long-term excess returns. At times, active managers may make investment decisions that will detract from overall returns and that may increase a fund’s volatility. In this sense, active investing may involve a greater degree of risk than passive investing. In order to produce excess returns, active managers must exceed the returns of their respective indexes net of fees. This may involve, among other things, frequent trading, portfolio rebalancing and active security selection, all of which can deviate from an index based on an active manager’s research and investment conviction. Activities such as trading and portfolio rebalancing will incur costs for the investor. Given that passive funds do not seek to produce excess returns, they often charge lower management fees than active funds.

A case study in active advantage: The Bond Fund of America

As an example of the structural advantages that active fixed income managers may have, Capital Group’s Bond Fund of America® (BFA) has produced consistent excess returns over the past five years with similar or lower risk than the passive mutual funds and ETFs in Morningstar’s Intermediate Core Bond category8. These funds seek to replicate the returns of the Bloomberg U.S. Aggregate Index. For example, over the five-year period ended June 30, 2024, BFA’s F-2 share class9 returns exceeded the Aggregate Index by 77 bps on an annualized basis, whereas passive ETFs with the same benchmark trailed the index by an annualized average of 23 bps over the same timeframe10.

Source: Morningstar. As of 6/30/24. Returns shown are as compared to the Bloomberg U.S. Aggregate Index over the same time periods.

BFA’s F-2 returns thus exceeded those of its passive counterparts by an annualized average of 100 bps over the period described11. Additionally, over the 10-year period ended June 30, 2024, BFA’s F-2 shares exceeded comparable passive ETFs by 64 bps per year on average, highlighting the fund’s ability to benefit from active security selection, duration positioning and yield curve positioning, among other factors.

BFA’s F-2 shares also produced strong excess returns versus the Bloomberg U.S. Aggregate Index and the average of all passive funds in Morningstar’s Core Bond category over the five-year period ended June 30, 2024, with lower risk.

8Source: Morningstar. As of 6/30/24.

9Chosen for illustrative purposes as this share class is commonly used by financial professionals.

10Source: Morningstar. As of 6/30/24.

11Source: Morningstar. As of 6/30/24.

Source: Morningstar. As of 6/30/24.

These results are due in part to the fact that BFA emphasizes producing attractive excess returns over a market cycle while maintaining a risk profile similar to that of its benchmark. They’re also a reflection of BFA’s ability to benefit from Capital Group’s extensive fixed income resources, which include 173 dedicated fixed income professionals across research, portfolio management, trading and other specializations12. Working together, these professionals help BFA maintain a robust and repeatable investment process.

Capital Group has built its fixed income capabilities to seek compelling, consistent excess returns within a risk profile that aligns with our funds’ investment objectives. One hallmark of this process is to structurally embed a team approach that allows multiple portfolio managers to contribute to a single fund. Within this framework, the firm has designed BFA to take moderately sized positions across a wide variety of risk factors, thereby creating a more balanced portfolio throughout various market cycles. Ultimately, the fund seeks to pursue its investment objective of providing a high level of current income that is consistent with capital preservation. This balanced approach can in turn help to generate diverse sources of returns, which can potentially lead to consistent excess and risk-adjusted returns over time.

Together, Capital Group’s professionals represent arguably one of the most experienced and highly skilled fixed income teams in the financial industry. In addition, the firm’s fixed income team benefits from collaboration with its equity research colleagues, who often bring a unique perspective to potential investment decisions. For example, equity professionals can offer comprehensive insights on potential market trends, such as inflationary pressures on supply chain companies or decreasing bank demand for agency mortgages. Over time, the combination of equity and fixed income perspectives on broad markets—or even a single issuer—may allow BFA’s investment team to maintain information and trading advantages that can ultimately translate to long-term success and consistency in the fund’s return pattern.

For reference, ETFs and mutual funds are both considered liquid investments. However, like individual stocks, ETFs can be bought and sold intraday, while mutual funds can only be purchased at the end of each trading day at NAV.

Actively managed mutual funds and ETFs tend to have higher fees and higher expense ratios than passive mutual funds and ETFs due to their higher operational and trading costs. ETFs do not require a minimum initial investment and are purchased at “market price.” Mutual funds have minimum initial investment amounts and can be purchased in fractional shares or fixed dollar amounts.

12Source: Capital Group. As of 6/30/24.

A potential solution for ETF fans: Active ETFs

Investors who prefer the ETF structure may appreciate CGCB – Capital Group Core Bond ETF. Like The Bond Fund of America, CGCB is designed to offer diversification from equities by investing in high quality bonds. In addition, the fund can potentially provide a measure of capital preservation while pursuing attractive income and total returns.

Built on Capital Group’s five decades of dedicated fixed income investing, the fund leverages the combined experience of specialized portfolio managers, analysts and traders. This experience allows the fund to offer the benefits of Capital Group’s core approach in a vehicle that can have potential tax benefits by transferring out capital gains on some appreciated securities through the custom basket process. This process can also alleviate some of the costs associated with buying and selling certain fixed income securities, such as corporate bonds. In short, CGCB provides ETF investors with direct access to Capital Group’s core fixed income approach at a lower cost than some of its mutual fund peers. For example, as of 7/31/24, CGCB’s gross expense ratio was 0.27%, less than half of the average gross expense ratio for the Morningstar Intermediate Core Bond Category, which was 0.88%13.

13Source: Morningstar.

A holistic view

Despite their potential risks, some investors will undoubtedly continue to favor passive fixed income funds. Still, we urge these investors to look beyond low expense ratios (if applicable) and consider the potential that actively managed funds have to produce better total returns net of fees. As noted, the unique characteristic of fixed income indices and markets are such that, in our view, passive fixed income funds are at a disadvantage when seeking to replicate the returns of various fixed income indices. Ultimately, we believe that actively managed funds offer significant advantages that can enable them to seek meaningful excess returns with lower risk over time.