FEATURED FUNDS

40+ years of experience managing municipal funds.

Focused on long-term results to help clients pursue their investment goals.

The Tax-Exempt Bond Fund of America®

Received a Morningstar Analyst RatingTM of Gold and Silver for F-3 and F-2 share classes, respectively.*

The Tax-Exempt Fund of California®

Received a Morningstar Analyst RatingTM of Gold for F-2 and F-3 share classes.*

Analyst-driven 100%

Data coverage 100%

The Tax-Exempt Bond Fund of America®

Received a Morningstar Medalist RatingTM of Gold for Class F-3 and F-2 shares as of 5/21/24.

Analyst-driven 100%

Data coverage 100%

The Tax-Exempt Fund of California®

Received a Morningstar Medalist RatingTM of Gold for Class F-3 and F-2 shares as of 5/23/24.

Analyst-driven 100%

Data coverage 100%

American High-Income Municipal Bond Fund®

Received a Morningstar Medalist RatingTM of Gold for Class F-3 and F-2 shares as of 5/20/24.

-

-

TEAFX

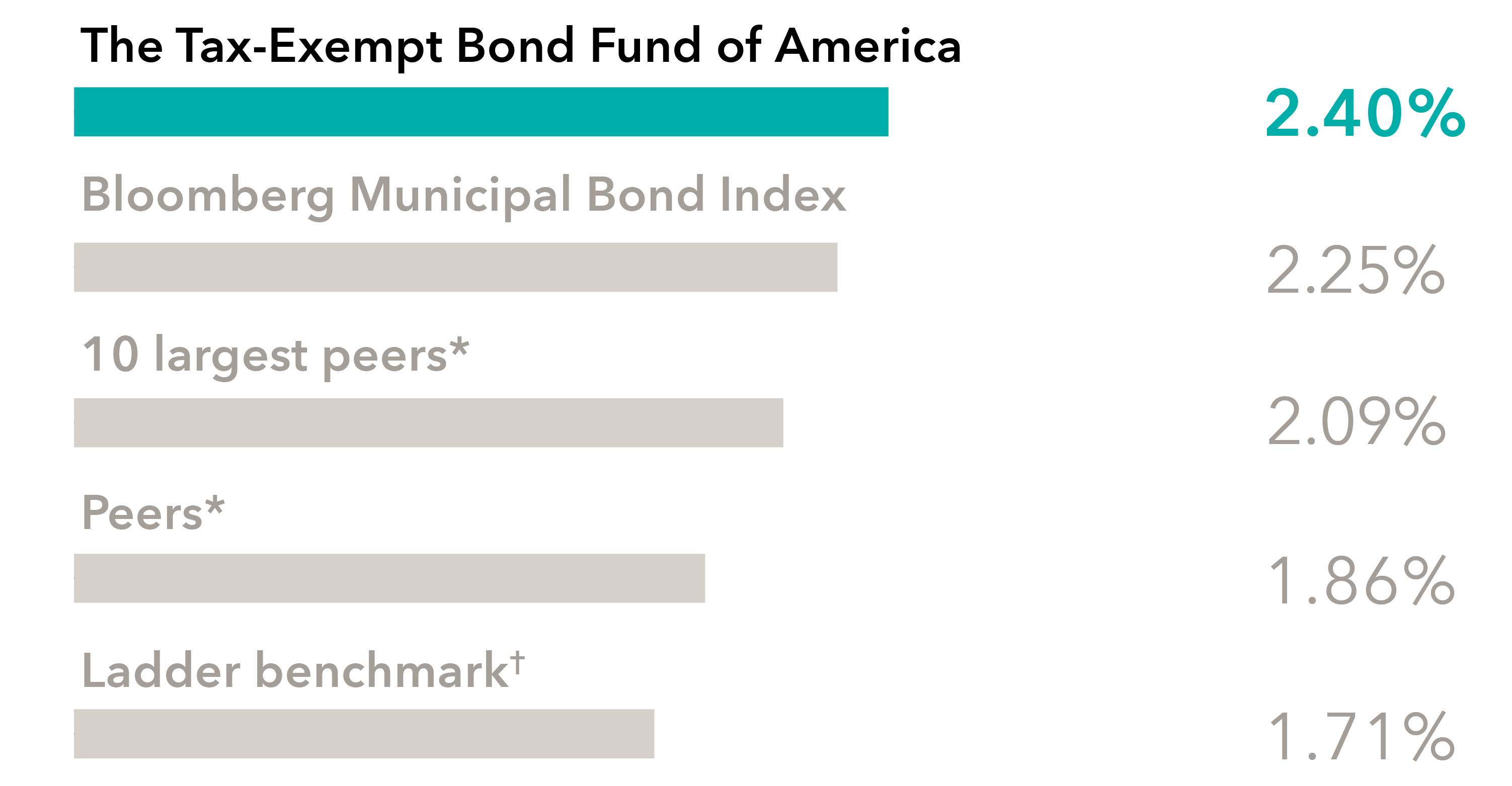

Over the last 10 years, The Tax-Exempt Bond Fund of America (TEAFX) led category peers and benchmarks.

Not only did The Tax-Exempt Bond Fund of America beat both the Bloomberg Municipal Bond Index and its peer average over 10 years, its return also surpassed the 10 largest peers in its Morningstar Category.

Annualized returns over a 10-year period

Class F-2 through December 31, 2024

Sources: Capital Group, Bloomberg Index Services Ltd., Morningstar. Indices do not include sales charges; investors cannot invest directly in an index.

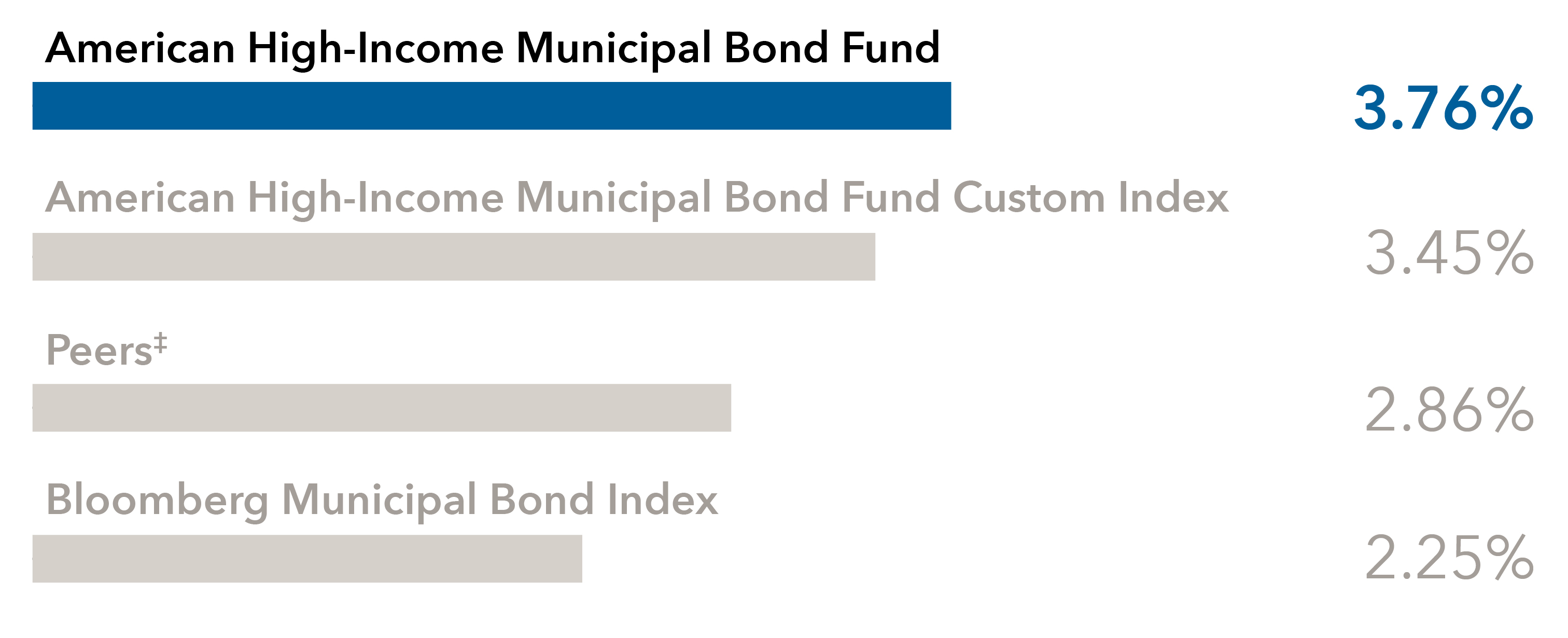

Annualized returns over 1- and 5-year periods, respectively: For Bloomberg Municipal Bond Index, 1.05%, 0.99%. For TEAFX, 2.49%, 1.30%. For 10 largest peers (Morningstar Muni National Interm category), 1.91%, 1.17%. For ladder benchmark (Bloomberg Municipal Managed Money 1–12 Year Laddered Maturity Index), -0.39%, 0.68%. For peers (Morningstar Muni National Interm category), 1.80%, 0.90%. For AHMFX, 6.48%, 2.40%. For American High-Income Municipal Bond Fund Custom Index, 4.97%, 2.00%. For Peers (Morningstar High Yield Muni category), 5.00%, 1.09%. -

AHMFX

-

Solutions designed to serve your clients.

Portfolio Series

Funds of funds designed for various investor objectives, including growth, growth and income, and preservation and income.

Tax-Aware Model Portfolios

Tax-aware models designed to focus on investor goals while reducing taxable distributions and short-term capital gains.

Looking for income exempt from state taxes in an SMA?

State specific portfolios are available with muni separately managed accounts (SMAs).

Your customized solution is a click away.

Access a team of specialists for a personalized experience.

Receive a complimentary portfolio analysis. This powerful report compares your client’s muni bond holdings to an SMA solution for a personalized plan.

Request your consultation and portfolio analysis today.

Request a consultation

This service is for registered financial professionals only.

OUR APPROACH

Want to learn how you and your clients can seek more from municipal bonds?

Get the lowdown on the market’s striking transformation, portfolio construction and how our tax-exempt bond funds strive to add value.

Capital Group did not compensate Morningstar for the ratings and comments contained in this material. However, the firm has paid Morningstar a licensing fee to access and publish its ratings data. The payment of this subscription fee does not give rise to a material conflict with Morningstar.

- Class F-2 shares were first offered on 8/1/2008.

Important note: Compared to managed ladders, fully actively managed funds seek to generate returns in additional ways. The risks entailed are, therefore, potentially broader than investors might be exposed to in a ladder. The Tax-Exempt Bond Fund of America has often shown a somewhat higher duration (sensitivity to prevailing interest rates) than many ladders. Favorable outcomes shown have often been accompanied by relatively higher rate risk. Investors should consult with their financial advisors about the potential tax and risk consequences of different investment vehicles.

Passive funds are not striving to outpace their benchmarks; rather, they seek to replicate the benchmark’s return pattern. Investors should consult with their financial advisor about the different pricing, cost structures and tax implications of mutual funds and ETFs. ETF share prices may significantly exceed the underlying NAV at times of volatility, unlike with mutual funds. And, unlike with ETFs, mutual funds may be subject to sales charges at purchase or redemption — which can detract from returns. Also, ETFs may offer certain tax efficiencies compared to mutual funds. Ladder benchmark is the Bloomberg Municipal Managed Money 1-12 Year Laddered Maturity Index.

*Peers include mutual funds and ETFs. Average of peers in category. Category shown is the Morningstar Muni National Interm category.

†A ladder involves buying several bonds with a specified range of (staggered) maturities, to offer regular income. When one bond in the ladder matures, proceeds can be used to buy a new bond at the ladder’s longest maturity.

‡Peers include mutual funds and ETFs. Average of peers in category. Category shown is the Morningstar High Yield Muni category.

The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index. There have been periods when the funds have lagged the indexes.

American High-Income Municipal Bond Fund Custom Index reflect results of the following indices: 50%/50% blend of the Bloomberg High Yield Municipal Bond Index and the Bloomberg Municipal Bond Index through December 31, 2015. From January 1, 2016, to current, 60%/20%/20% blend of the Bloomberg High Yield Municipal Bond Index (with 5% Tobacco Cap and 2% Issuer Cap), Bloomberg Municipal Bond BBB Index and the Bloomberg Municipal Bond Index, respectively. Results reflect dividends net of withholding taxes.

Bloomberg Municipal Bond Index is a market value-weighted index designed to represent the long-term investment-grade tax-exempt bond market.

Bloomberg Municipal Managed Money 1-12 Year Laddered Maturity Index is a component of the Managed Money index — a rules-based, market-value-weighted index of AA-rated tax-exempt bonds; this component is designed to represent a ladder strategy with the specified maturity profile.

Bloomberg High Yield Municipal Bond Index is a market-value-weighted index composed of municipal bonds rated below BBB/Baa.

Bloomberg Municipal BBB Index covers the USD-denominated long-term tax exempt BBB-rated bond market. The index has four main sectors: state and local general obligation bonds, revenue bonds, insured bonds and prerefunded bonds.

Morningstar Muni National Intermediate portfolios invest in bonds issued by various state and local governments to fund public projects. The income from these bonds is generally free from federal taxes. To lower risk, these portfolios spread their assets across many states and sectors. These portfolios have durations of 4.0 to 6.0 years (or average maturities of five to 12 years). Morningstar High-Yield Muni portfolios typically invest a substantial portion of assets in high-income municipal securities that are not rated or that are rated at the level of or below BBB (considered high-yield within the municipal-bond industry) by a major ratings agency such as Standard & Poor’s or Moody’s.