Read important investment disclosures

In the years since the Global Financial Crisis, the U.S. market has far outpaced its non-U.S. counterparts with a similar imbalance in growth stocks outpacing value, driven by innovation and a period of declining rates.

While innovation is still with us, the cost of money has risen appreciably in most markets as central banks hiked rates in the aftermath of the pandemic to combat inflation. Many central banks have signaled that this is not temporary, fueling expectations of “higher for longer.”

In the U.S.- and growth-led environment that has prevailed over recent years, Capital World Growth and Income Fund has shown resilience despite unfavorable conditions for its global- and dividend-investing mandate. The fund has a history of reduced volatility (16.96 vs. 17.37 for 5-year standard deviation, and 14.28 vs. 14.78 for 10-year standard deviation). This reduced volatility, paired with signs of shifting market sentiments, has positioned Capital World Growth and Income Fund well in multiple market environments.

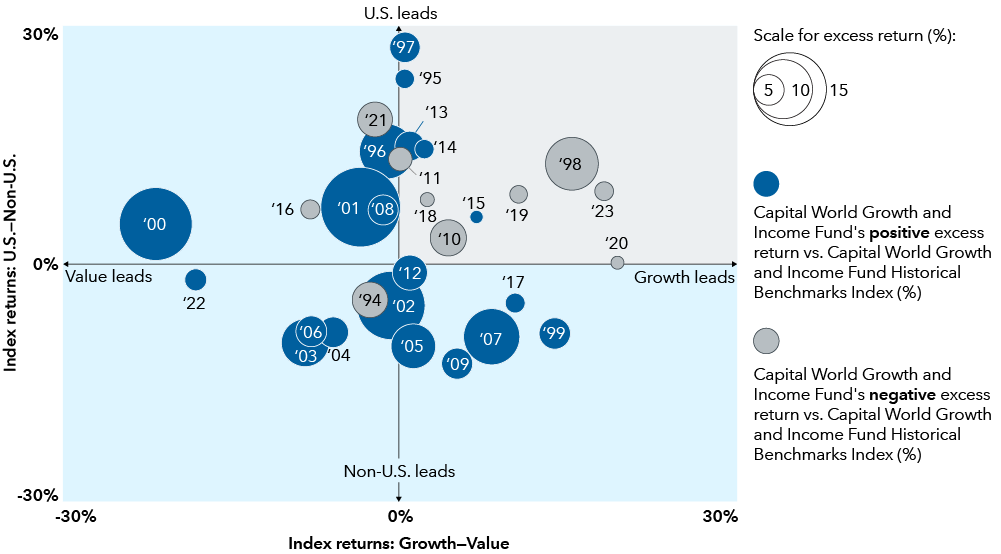

When looking at the results in the chart below dating back to the fund’s first full year in 1994, the fund (R-6 shares) has beaten the benchmark Capital World Growth and Income Fund Historical Benchmarks Index nearly every time that non-U.S. markets outpaced U.S. markets and/or value was stronger than growth.*

Capital World Growth and Income Fund returns in different market environments

The fund has been stronger in markets where U.S. and growth are not dominant but has also been able to cushion losses despite headwinds

Source: Capital Group. As of 12/31/23. The quadrants in this chart refer to the dominant market, measured on the x-axis by the MSCI ACWI Growth Index’s excess returns over the MSCI ACWI Value Index’s excess returns from 2001 to 2023, and by the MSCI World Growth Index over MSCI World Value Index from 1994 to 2000. On the y-axis, the dominant market is measured by the S&P 500 Index’s excess returns over the MSCI ACWI ex USA Index. Within these various market environments, the bubbles correspond to the size of Capital World Growth and Income Fund’s excess returns over its benchmark (Capital World Growth and Income Fund Historical Benchmarks Index) for each full calendar year since fund inception, with gray showing the benchmark outpacing the fund, and blue showing the fund outpacing the benchmark. Past results are not predictive of results in future periods.

Even amid the headwinds of a U.S.- and growth-dominant market, there have been periods of occasional strength. Perhaps more importantly, the fund has shown an ability to minimize losses in down years and capture gains when on stronger footing, as illustrated in the chart above.

Capital Group has previously shared expectations that market breadth and dividends could make a comeback after a long run of top-heavy returns, exemplified by the Magnificent 7. That type of environment could be a source of tailwinds for the fund after an extended period of headwinds.

As of June 30, 2024, the S&P 500 Index has had an average annual return of 14.82% over the past 15 years, more than double that of the MSCI All Country World Index (ACWI) ex USA’s 6.21% over the same time period. Similarly, the MSCI ACWI Growth Index has an average annual return of 12.34% over the past 15 years as compared with 8.11% for the MSCI ACWI Value Index.

If higher interest rates are here to stay, that would end a period of rates outside historical norms that has fueled this phenomenon of U.S. and growth dominance.

Sources: U.S. Federal Reserve, Robert Shiller. Data for 1871–1961 represents average monthly U.S. long-term government bond yields compiled by Robert Shiller. Data for 1962–2022 represents 10-year Treasury yields, as of December 31 each year within the period. Data for 2023 is as of November 30, 2023.

In this anomalous environment, valuations for dividend-paying stocks have drifted toward multidecade lows compared with the broader market, as represented by the S&P 500 Index and its highest paying dividend quintile (see below chart). However, with economic growth expected to moderate in 2024 along with a prolonged period of higher rates, dividends may take a more prominent role in driving total returns for investors, especially with some of the mega tech companies, which are paying dividends for the first time, changing the face of dividend payers, traditionally associated with older, more value-oriented companies.

Sources: Capital Group, Goldman Sachs. As of November 28, 2023. High dividend stocks refer to cohort of stocks in the S&P 500 Index with the highest quintile dividend yield (sector-neutral) relative to the broad S&P 500 Index. Line represents smoothed six-month average P/E (price-to-earnings) ratio. Past results are not predictive of results in future periods.

Zooming out, it is important to not give in to one of the easiest traps for investors: recency bias. While simply investing in U.S. growth stocks has panned out for the better part of a decade, market trends do not last forever.

*Growth markets are represented by when the MSCI ACWI Growth Index outpaces the MSCI ACWI Value Index, and value markets are represented by when the MSCI ACWI Value Index outpaces the MSCI ACWI Growth Index. U.S. markets are represented by when the S&P 500 Index outpaces the MSCI ACWI ex USA Index, and non-U.S. markets are represented by when the MSCI ACWI ex USA Index outpaces the S&P 500 Index.

†Capital World Growth and Income Fund Historical Benchmarks Index returns reflect the results of the MSCI World Index through 11/30/2011 and the MSCI All Country World Index, the fund's current primary benchmark, thereafter. MSCI World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results of developed markets. The index consists of more than 20 developed market country indexes, including the United States. MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global developed and emerging markets. The index consists of more than 40 developed and emerging market country indexes. Results reflect dividends net of withholding taxes. These indexes are unmanaged, and their results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes.